Ways to pay at the point of sale both physically and online just keep on multiplying, but in spite of all the innovation, the dominant choice for Americans when they buy is the workaday debit card.

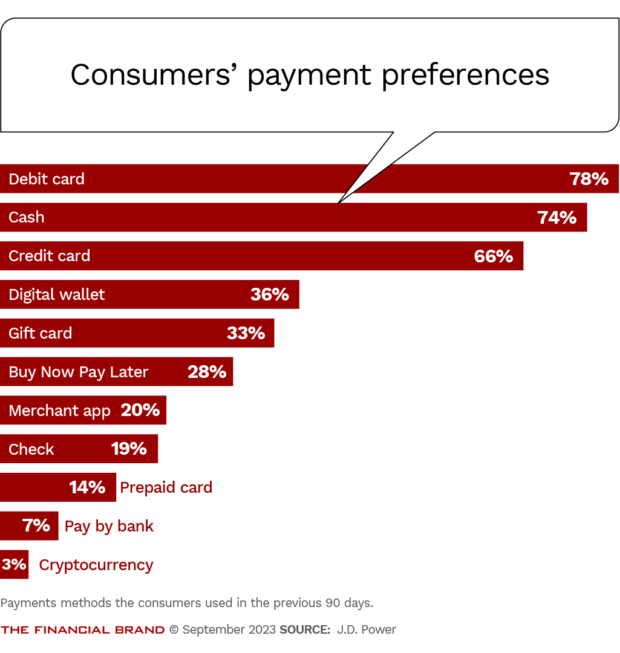

J.D. Power research finds that 78% of consumers say they have used debit cards for purchases in the last 90 days. This is followed very closely by cash, at 74%.

The research also shows that the heaviest debit card users aren’t all alike. They don’t fall neatly into demographic segments either. But by understanding these consumers better, banks and credit unions could make their debit cards even more appealing, says Miles Tullo, managing director, banking and payments, for J.D. Power.

Following debit and cash in usage preference are credit cards, 66%; digital wallets, 36%; gift cards, 33%; buy now, pay later, 28%; merchants’ payment apps, 20%; checks, 19%; prepaid cards, 14%; pay by bank, 7%; and cryptocurrency, 3%. (An example of merchant apps is the Starbucks app that handles both payments and buyer incentives, such as earned free beverages.)

These figures total much more than 100% because most consumers use multiple payment methods. J.D. Power reports that Americans on average use 4.1 different forms of payment in a typical quarter. Just over half of those surveyed — 55% — have used newer payment forms. The most frequent choices among those new forms are digital wallets (36%) and buy now, pay later (28%).

This data and more below come from a battery of four new J.D. Power studies, covering point-of-sale payment choices, debit card satisfaction, digital wallet satisfaction, and buy now, pay later satisfaction. Because the studies are in their first round, the company did not publicly issue its usual rankings of providers.

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Why Debit’s at the Forefront of Point-of-Sale Payments

Familiarity played a strong role in the dominance of the debit card. Among banking companies, they are pre-dated by credit cards, but branded debit cards have been around for decades. Visa, in the mid-1970s, and Mastercard in the early 1980s, offered debit cards that drew on consumers’ bank accounts, with machines at the point of sale that physically imprinted card information on a purchase receipt using the card’s embossed numbers. Electronic networks put an end to that long ago.

Today, debit cards represent the usual starting point for fintechs offering transaction capabilities, typically relying on a banking-as-a-service connection. Some have graduated, or hope to, into offering credit cards as well.

Despite such factors, Tullo thinks credit cards would have scored higher but for two factors: the pandemic period and the payment preferences of Millennials and Generation Z.

“The pandemic caused many people to switch to debit transactions, because they were more flush in their accounts,” says Tullo. The reduced costs of lockdown periods and multiple rounds of stimulus checks swelled savings and checking account balances. In addition, younger consumers had a resistance to using credit cards — though other research indicates their resistance might be starting to erode.

But for now, debit cards are the most commonly used payment method with consumers overall, in the study’s 90-day framework.

Read More: FedNow Turns Instant Payments into a Must-Have for Banks and Credit Unions

Who Are the Biggest Debit Card Fans? They Aren’t All Alike

Often studies about payments compare consumer behavior by age range, but Tullo says that J.D. Power asked many questions to divide respondents into a series of behavioral types — “personas.” Its consumer groupings don’t align with traditional demographic descriptions, by design.

Here are the findings for each of the consumer groups, with the categories ordered by level of debit card usage:

• Budgeters: These consumers focus on not incurring debt and are therefore heavy debit and, to a lesser extent, cash users. Their main reason for favoring debit cards is for the ability to manage and track spending. They tend to be younger, have lower incomes, and are least likely to be college educated. Their perk of choice is automated savings plans. Among the people in this category, 85% of them say they used debit cards in the past 90 days.

“Debit brands need to be more thoughtful about product enhancements, and they need to think more in terms of segments, rather than holistically.”

— Miles Tullo, J.D. Power

• Borrowers: They are heavy users of credit cards and buy now, pay later, but they are also financially vulnerable and tend to have lower incomes. They will use debit cards for speedy transactions and for points and other rewards. 85% of them say they used debit cards.

• Minimalists: They select payment channels for ease of use and tend to stick with them out of habit. They lean heavily on debit and cash. They generally have moderate incomes. 83% of them say they used debit cards.

• Experimenters: These are early adopters of new tech like digital wallets who also still lean on traditional methods like debit cards. They skew younger and come from all socieconomic groups. They like debit for speed of transaction and their top perk is discount offers from merchants. 77% of them say they used debit cards.

• Security Seekers: This segment tends to be older and more educated than most other behavioral groups in the study. While they are heavy cash and debit users, they also still write checks. They favor debit cards because they are widely accepted, and they perceive them as a secure payment method. When available, they like debit cards that offer cash back on purchases. 75% of them say they used debit cards.

• Reward Optimizers: They are financially healthy, have higher incomes and tend to chase rewards. They typically lean toward credit cards and merchant apps for such perks. When they shop among debit cards, the hunt for rewards is also on their minds. 65% of them say they used debit.

“We’re nuanced as humans,” says Tullo, “so by looking at respondents in this way, it enables brands to look at payment methods at the point of sale through the lens of the whole consumer rather than just an age group or income level.”

Read More: TD Bank’s No-Interest Credit Card: Niche Product or Trendsetter?

Try a More Thoughtful Approach to Debit Card Product Design

Tullo recommends that banks and credit unions tailor their debit card offerings more precisely to the type or types of consumers they serve. Banks and credit unions may have dozens of variations on their credit card offerings, but Tullo says most institutions’ debit cards are uniform by comparison.

J.D. Power’s analysis suggests that different customer types might gravitate toward different combinations of features for a debit card. In a time when deposits can be harder to come by, it’s worth remembering that debit cards are the payments face of deposit accounts.

Some institutions are starting to link other types of services, such as buy now, pay later programs, to debit card programs. This includes JPMorgan Chase and Citibank.

Some, including community banks, have built their perks around interest rates. This tactic is also often part of their efforts to attract out-of-town deposits, such as at the $575 million-asset All America Bank, in Oklahoma City, Okla. Its online customers can earn 5.3% APY on Ultimate Rewards Checking. One stipulation: The user must use the debit card 10 times in a monthly cycle to make purchases from merchants.

Some types of consumers may not be as concerned about maximizing the rate on a checking account, so offering other perks to target other “personas” could help boost adoption, Tullo says.

Individual companies generally take a one-size-fits-all approach with debit cards, though a variety of perks have been tried, from straightforward cash back to rewards that tie into causes. An example of the latter is the Ando debit card program that rounds up transactions and then donates the “change” toward environmental causes.

“Debit brands need to be more thoughtful about product enhancements,” says Tullo, “and they need to think more in terms of segments, rather than holistically.”