A full consumer credit report includes roughly 1,200 data points, yet for many traditional lenders, much of it is unexplored territory.

“It’s a wealth of information about someone’s financial life,” says Renaud Laplanche, co-founder and chief executive of Upgrade. The fintech offers credit cards and other consumer lending products, along with checking and savings accounts, through partnerships with hundreds of banks and credit unions.

Laplanche says that, in his experience, many banks and credit unions use five to 10 of those data points to make credit decisions. In contrast, Upgrade uses many more of those data points, in addition to ratios built on top of them, to get a much more nuanced picture of prospective borrowers.

One example Laplanche offers is the amount of credit an individual has available versus their utilization of that credit. Suppose the consumer has generally tapped up to 20% of their available credit over several years. Then they apply for a new credit card.

The trend in usage matters. Someone who suddenly maxed out a card and wants more credit by obtaining another card is a very different prospect than someone who is still around that 20% usage level who wants the new card because they like the rewards program offered, Laplanche says.

This is a simple example, but it illustrates how more data incorporated into the evaluation of credit applicants can result in better decisions. As a fintech that relies heavily on automation and data analytics, Upgrade uses these advantages to carve out more business, which Laplanche says benefits consumers as well as the fintech itself.

Laplanche spoke in an extensive interview with The Financial Brand and a fireside chat at an industry conference earlier this year, offering detailed insight into what he sees as Upgrade’s differentiators, its strategy to attract more “mainstream” consumers and its plans to expand its product lineup.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Emphasis on Financial Health and Other Strategic Differentiators

Upgrade’s credit analysis influences pricing, which is another factor in the final decision-making process, according to Laplanche. The finer analysis can produce more yesses, but it can also suggest pricing that is prohibitive.

“When someone has had difficulties with their credit in the past, if you make a decision and the pricing is too high, it’s not going to be helpful in any way,” Laplanche says. “So it’s better to decline.”

This isn’t just lip service for Laplanche. Upgrade differs from some other consumer lenders in key ways, including its emphasis on financial health. It launched in 2017 by offering unsecured personal loans, but increasingly a central element of its business are credit cards that all have a special twist.

“Upgrade just continues to launch new, interesting products into the space in new and interesting ways,” says Andrew Davidson, senior vice president and chief insights officer at Mintel.

Upgrade is also different from many in the banking industry, in that it holds neither loans nor deposits, though both are important parts of its business. It has a handful of banking-as-a-service partnerships to facilitate its lending and operates a marketplace where hundreds of banks and credit unions take assorted loans and deposits based on criteria they set. These relationships are essential to its revenue model.

See more coverage of fintech banking strategies

Upgrade’s Credit Cards: Plastic with an Essential Difference

The first generation of neobanks and consumer-facing fintechs generally suffered from a narrow menu, even a “Johnny-one-note” syndrome.

“Upgrade is a second-generation fintech company that understood that you could do more than just a single product,” Laplanche says. “There are a lot of benefits in offering both loans and bank accounts.”

The twist on Upgrade’s credit cards is that instead of rolling over in the typical way, balances unpaid by the end of a statement period are grouped into a lump sum and turned into an installment loan plan. Through regular monthly installments, including both principal and interest, these amounts get paid off, the loan being amortized as the payments are made. The more typical credit card offering, which allows borrowers to make minimum payments, can go on indefinitely, the interest rate being applied constantly to the outstanding unpaid balance.

Another difference is that typically charges to a credit card can be paid off before interest begins to accrue, but Upgrade’s cards do not include a grace period. They are targeted more at “revolvers” (those who carry a balance on their cards) than “transactors” (those who pay off their charges every month).

“Credit cards are fundamentally designed to keep people in debt as long as possible,” says Laplanche. “If you only make that monthly minimum payment, you’re kicking the can down the road and not getting out of debt.”

The installment plan approach somewhat resembles “buy now, pay later” financing, though plans can last much longer than the common “pay in four” plans and the Upgrade plans charge interest. The rate, which is fixed, unlike many credit card plans’ variable rates, applies throughout the term of the installment plan. (Upgrade moved into credit cards in 2019.)

“‘Be more responsible’ is not a great marketing slogan, but it turns out that there is a lot of demand for this among people who are wary of credit card debt,” says Laplanche.

Read More: Green Dot Plans Big Push for Direct-to-Consumer GO2bank

‘Periodic Revolvers:’ Unique Niche for Upgrade’s Credit Cards

Since its start, Upgrade has extended more than $24 billion in credit across multiple products, the largest portion of that in personal loans.

“Personal loans started earlier, so that’s still bigger than cards, but cards are growing faster. So they are getting to be about the same size,” says Laplanche.

Asked roughly what asset size Upgrade would be if it portfolioed loans, as an actual bank, Laplanche estimates it at roughly $12-$15 billion. (Laplanche was a co-founder and CEO at LendingClub, a major personal lender that is now a bank via acquisition. He left the company in 2016 and in 2018 settled charges of misleading investors and breaching fiduciary duty with the Securities and Exchange Commission “without admitting or denying the findings,” per the SEC announcement.)

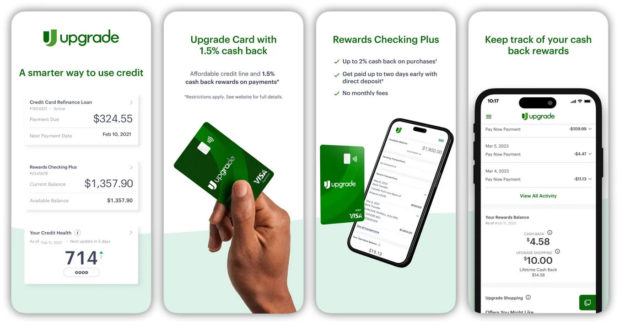

A big part of the appeal of Upgrade’s credit cards are the cash back rewards programs, with the reward percentage varying according to product category and the specific card program. None of the cards have annual fees and all generally promise lower rates than competitors, as determined by Upgrade’s credit analysis. Rates tend to be 300 to 400 basis points lower than comparable bank card rates for borrowers with similar credit quality.

Mintel’s Davidson says he sees Upgrade’s cards serving a large niche that he labels, ad hoc, the “periodic revolvers.” The most recent American Bankers Association Credit Card Monitor figures indicate that 43.4% of U.S. cardholders are revolvers and 33.6% are transactors, with the rest being classified as “dormants.” However, Davidson says he’s seen an industry figure indicating that nearly half — 48% — of cardholders need to revolve at least once a year. He says card plans tend to be designed for one type of user or the other, with few filling the niche that Upgrade does.

Read More: Credit Card Lenders Should Look Past the Almighty Credit Score for Growth

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Expanding Product Line to Add ‘Mainstream’ Appeal

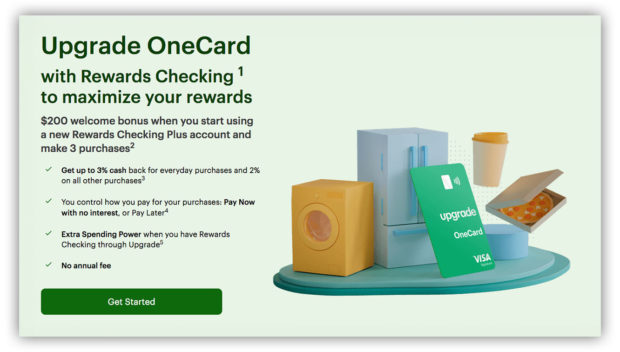

Upgrade has built multiple card programs on this model, the most recent being Upgrade OneCard.

This credit card, which carries rewards, permits users to select via Upgrade’s app the charges that will be paid off immediately by a withdrawal from their bank account, while the remaining charges get paid later via installment plan. The card comes with the option to open a Rewards Checking Plus account and opting for this triggers the highest reward levels.

Davidson sees OneCard as especially appealing to younger consumers who show a preference for debit cards and for alternatives to traditional credit cards.

Laplanche says that Upgrade has been working to establish a mainstream brand offering multiple products that, combined, appeal “to the broadest possible swath of the population.”

Some cards are offered with smaller credit lines for near-prime consumers who need a basic card for unexpected expenses. Still taking shape is a credit-builder card that could begin as a secured card and evolve into an unsecured card over time, based on borrower behavior.

Upgrade also recently launched home improvement loans, aimed at borrowers with FICO scores of 750 or better.

Read More: Will FedNow and BNPL Dent Credit Card Use?

Upgrade’s Revenue: Hundreds of Banks and Credit Unions Contribute

Laplanche says that the privately held company is profitable and he expects it to remain so.

It relies on several banking-as-a-service specialists to facilitate its credit products, which include personal loans, home improvement loans and more. It also offers a checking account and a high-yield savings account on the liability side.

Its largest BaaS relationship is with Cross River Bank, an $8.4 billion-asset institution in Teaneck, N.J., which originates personal loans, auto refinance loans, home improvement loans and personal credit lines offered by Upgrade. Cross River also provides checking and savings accounts.

Blue Ridge Bank, a $3.3 billion-asset institution in Martinsville, Va., overlaps with Cross River in that it originates some of Upgrade’s personal loans and auto refinance loans. Both Cross River and Sutton Bank, a $1.8 billion-asset institution in Attica, Ohio, issue Upgrade’s credit cards.

In addition, Upgrade has a relationship with a network of about 220 other banking institutions, the majority of which are credit unions. That’s because, as mentioned earlier, loans and deposits don’t reside on Upgrade’s balance sheet. “We operate as a marketplace,” Laplanche explains.

Members of that network can buy the various types of credit that Upgrade originates, including the card-based installment plans. They can also obtain deposits through Upgrade, with the fintech taking a fee for providing the deposit.

Network institutions can choose what to buy based on multiple criteria, including the borrowers’ geographic location, credit criteria, and, in the case of credit unions, filters incorporating their membership criteria.

“Each institution has its own buy book,” says Laplanche, “and we generally work within an agreement where we know what meets that criteria.”

The source of revenue and profits for Upgrade varies from product to product. For example, the fintech’s personal loan programs typically include an upfront fee of 5% charged to the consumer. The loan is sold to the ultimate lender at par value, another gain. Upgrade also receives a fee for servicing the loan.

On credit card receivables, buyers purchase balances at a premium and there is also a servicing fee. Upgrade picks up interchange income on each transaction as well.

The need for deposits has become acute at more institutions, and network members have welcomed having the option of receiving deposits via Upgrade. Some of these deposits allow for more asset purchases from the fintech, some fund other lending activities.

“Deposits are valuable again,” says Laplanche, “and that plays to our benefit.”

Read More: Are You Fighting Yesterday’s Checking Account War Instead of Today’s?

Fintech Envisions More Consumer-Friendly Innovation

Laplanche is convinced that there’s long-term potential in Upgrade’s basic premise, which he says is to offer more consumer-friendly versions of banking products.

“There are a lot of big areas of consumer credit that can be improved.”

— Renaud Laplanche, Upgrade

A natural question is how future innovation might be impacted by policy changes in Washington. Earlier this year, the three banking regulators implemented new rules concerning banks’ relationships with third parties, such as fintechs.

Laplanche says this regulatory move, two years in the making, hasn’t led to changes in Upgrade’s BaaS relationships thus far. Much of what the guidance requires is already part of its deals, he says

In some quarters current federal regulation appears to be less friendly to innovation. Could that interfere with Upgrade’s plans to expand further into consumer banking?

Pointing to the Consumer Financial Protection Bureau’s war on “junk fees,” Laplanche notes that Upgrade products such as Rewards Checking Plus already fit the profile regulators favor. Those accounts have no monthly fees and no overdraft fees, for example.

“I don’t think innovation is harder,” says Laplanche, “because we’re already meeting or exceeding some of the requirements.”