Revolut, the most successful global neobank measured by users, entered the U.S. in March 2020. Economically that timing wasn’t ideal. On the other hand, management decided that a mobile branchless banking app made a good fit for a pandemic and proceeded with a low-key rollout.

The U.S. debut of the London-based mobile financial app, created in 2015 by two friends — was the third leg of a much discussed U.K. and European neobank “invasion” of the U.S. market that began in 2019 with the arrival of Monzo and N26. Taken together, these moves were seen as a threat to both traditional institutions and U.S.-based neobanks.

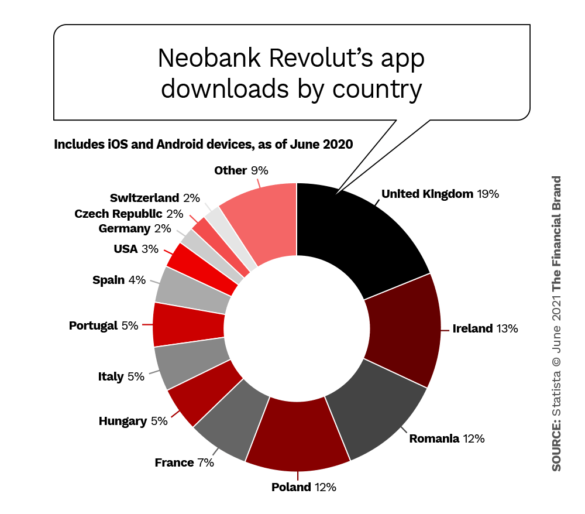

So far, however, none of these three entrants have much to show for it. In the case of Revolut, 15 months in, they have about 150,000 users in the U.S. as of year-end 2020. A tiny fraction of their 15 million users worldwide. In the chart below, based on June 2020 data, the U.S. is just slightly ahead of Switzerland in terms of Revolut app downloads.

Chime, by contrast, is the most successful U.S. neobank by users with 13 million after eight years on the market, giving it a massive lead over Revolut. The U.K. company is projecting its base will rise to one million U.S. users in 2021. And it filed an application for a California banking charter in March 2021. But that could take a year or more to be approved (if it even is approved). Currently its partner bank is New York-based Metropolitan Commercial Bank.

Given all that, why should U.S. institutions — traditional or otherwise — worry about Revolut?

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

It’s Not Over Until It’s Over

U.S. competitors should keep a close eye on Revolut for several reasons. Most obvious is that Revolut’s growth trajectory, even for a fintech, has been startling, as shown in the figures below curated by the Business of Apps website.

Revolut by the numbers

Launch date: July 1, 2015

Headquarters: London

| Users (millions)1 | Revenue (millions)2 | Total transaction value (billions)3 | Average daily signups4 | |

|---|---|---|---|---|

| 2016 | 0.1 | $3.3 | $1.4 | N/A |

| 2017 | 0.6 | $18.4 | $7.1 | 3,250 |

| 2018 | 2 | $82.1 | $28.3 | 7,000 |

| 2019 | 6 | $226.6 | $92.0 | 12,000 |

| 2020 | 12 | N/A | N/A | N/A |

| 2021 | 15 | N/A | N/A | N/A |

Sources: 1. The Fintech Times, Revolut; 2. Revolut; 3. Forbes, Revolut; 4. Revolut (Business of Apps)

Moscow-born Nikolay Storonsky, 37, who has dual citizenship in Russia and the U.K., founded Revolut with his friend Vladyslav Yatsenko, who is Chief Technology Officer. The two had both been working at Credit Suisse — Storonsky as a trader and Yatsenko as a software engineer — and decided to leave for a London fintech incubator where they would develop a mobile app that would save travelers excessive fees on foreign transactions and exchange rates.

It was classic fintech disruption — build a low-cost digital solution to solve a pain point.

Six years in, the success of the venture is undeniable — almost rocket-like. And like other fast-growing organizations, there have been some major mistakes and HR-related controversies along the way. (The Wikipedia entry for the company has two detailed sections on problems.)

But here’s the difference: Where other startups may have faltered, Revolut shook off the stumbles and just kept coming.

Dig Deeper: Check Out the World’s Biggest Database of Digital-Only Banks

What Revolut Offers in One ‘Super-App’

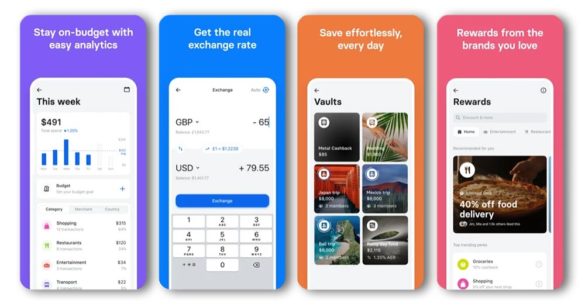

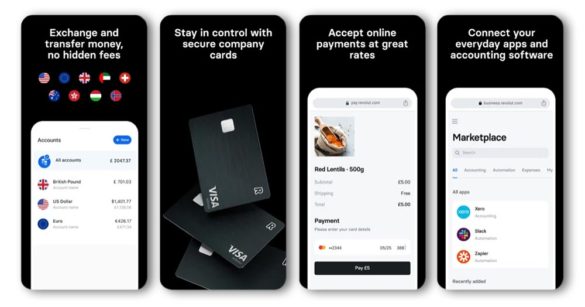

Revolut’s app does much more than most neobanks do. Many offer no-fee deposit account with a debit card, access to fee-free ATMs, savings and budgeting tools, early access to paychecks.

Revolut goes much further. It combines both retail and business banking in one app, along with device and travel insurance (not yet in the U.S.), investing, crypto access, and, most recently, merchant services. The latter puts it in direct competition with successful fintechs Stripe, Adyen and Square.

Nonstop Action:

Revolut is a product juggernaut. By the time you finish reading this article, it’s conceivable the company may have launched another service.

The company describes itself as a “global financial super app.” Revolut isn’t in the same league as, say China’s Alipay, or Amazon for that matter, with their massive platforms combining ecommerce and finance, but it is unique so far among neobanks in its breadth of services.

The images below give just a small sampling of what it has available.

There are three pricing tiers in Revolut’s “freemium” product strategy:

- Standard — free (seven features listed on the website including spending in over 150 currencies at the interbank exchange rate, free prepaid debit card, instant access to two cryptocurrencies, and a free Revolut Junior account for one child.

- Premium — $9.99 a month (13 features including priority customer support, higher savings rate, a premium card — with free delivery — and lounge passes for delayed travelers.

- Metal — $16.99 a month (15 features including the exclusive Revolut Metal card, higher withdrawal limits for surcharge-free ATMs, and one free SWIFT transfer.

Legacy Banks Are Revolut’s Primary Target

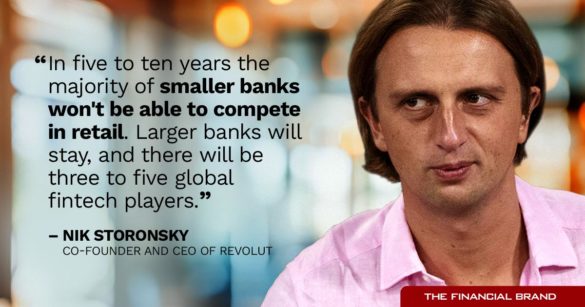

The tough talk characteristic of the early fintech era lives on with Revolut and its sometimes blunt-speaking CEO, who is nothing if not confident.

“To be honest, I’m not really worried about banks. Our product is so much better and cheaper than banks,” he boasted to CNN Business.

Other neobanks don’t concern him particularly either. “In the U.S., fintechs just do one thing — and they do it well. We offer all the tools you need in your financial life,” Storonsky states.

But Revolut’s plan isn’t to grab customers from fintechs already established in the U.S. Mainly it acquires them from thousands of legacy banks, which have failed to offer consumers, especially Millennials and GenZ, the services they want, as Storonsky told Fortune.

In an interview at the Paris Fintech Forum in early 2020, Storonsky revealed his views on the shifting tides in financial services.

He said that Revolut has been all about product innovation from its inception. “As we matured as a company and put product people — data scientists and engineers — into traditional banking [functions] such as compliance, risk and fraud we realized we can innovate there as well. So fintechs become better and better, but banks just stay the same.”

Offering a prediction, Storonsky told the interviewer: “In five to ten years time the majority of smaller banks won’t be able to compete in the retail sector. Larger banks will stay because they have a huge corporate business, and there will be three to five global fintech players whose profits come from retail.”

His reason is simple: If you sell more things to more people — i.e. the “super app” or “platform” model — the cheaper pricing you can offer makes it hard for smaller or more niche players to compete because they have less access to funding and talent.

Read More:

- Is Challenger Bank Chime the Future of Retail Banking?

- Can Traditional Banks Keep Pace With Fintech Challengers?

Tempering Revolut’s Sharp Edges

Success in financial services brings scrutiny, especially when your customers number in the millions.

“Regulators are very, very focused now on companies like Revolut, which are becoming systemic,” says Revolut Chairman Martin Gilbert in an interview with AltFi. Gilbert, who for 37 years was CEO of the U.K.’s Aberdeen Asset Management, joined Revolut in late 2019.

Bringing the retired executive on board added gravitas as the digital bank pursued plans to obtain a banking license in the U.K., where so far it has operated with what is called an e-money license. (It has a banking license in Lithuania.)

One of the things the regulators are looking for is profitability, says Gilbert, especially after fintech investments collapsed in Great Britain in the midst of the pandemic. The company broke even in November 2020.

Big Bounce:

Revolut lost 40% of its revenue after the pandemic shut down worldwide travel in 2020, but ended up 50% ahead of pre-Covid levels by yearend.

Asked how they make money, Storonsky says its very simple: Interchange, subscription revenue (from the tiered product levels), above-the-limit fees, and business accounts. The latter are very high margin, he says.

Beyond that, Gilbert adds: “Trading could be massive for us. Credit could be huge.”

Another experienced addition to the Revolut team is U.S. banker Ron Olivera, who is CEO of Revolut USA. The California native spent two decades with California’s Union Bank, running retail and small business, followed by three years as CEO of Heritage Oaks Bank and six as head of Avidbank.

“Our new customers come from traditional banks, where folks are just kind of fed up with the fees and the lack of transparency and all the things that go with large banks.”

— Ron Oliveira, Revolut USA

Oliveira is more diplomatic in his remarks than his outspoken boss. For example, Oliveira considers banking to be going through an evolution, not revolution, with traditional institutions becoming more digital and fintechs moving more mainstream.

Oliveira states in a Tearsheet podcast that it’s tough for banks and credit unions to move fast due to legacy technology systems. Revolut, by contrast, has mostly built its own modern tech platform, although it does partner when it makes sense.

“Our customers don’t come from other fintech companies,” the U.S. exec states. “Our new customers come from traditional banks, where folks are just kind of fed up with the fees and the lack of transparency and all the things that go with large banks.”

Ultimately, though the emphasis differs slightly, the message of the two neobank leaders is the same. Bank customers are Revolut’s target.

Read More: What SoFi’s Rise to One-Stop Financial Shop Means to Banking

Growth Plans for the U.S. Market

Organic growth has been a key element of Revolut’s success right along. One example of this is with its “split the bill” function. Since all parties must have the Revolut app to do this, an existing user will encourage friends to do so. “They baked the marketing into the product,” observes Mike Parsons CEO of Qualitance in a marketing case study about the neobank.

The company also offers a bounty of $5 for each qualifying new customer referral in the U.S. While organic growth and social media outreach will continue, Oliveira hints that a marketing campaign, put on hold during the pandemic, may soon crank up.

“Our name recognition is very, very low in the U.S.,” Oliveira told Tearsheet. “I’m not saying we want to be a household name — but we want to be on the tip of somebody’s tongue when they talk about the best fintech companies.”

So how are they doing so far?

Revolut’s app gets 4.7 (out of 5) on both Google Play and the App Store. Chime, by contrast, gets 4.6 from Android users and 4.8 from iPhone users.

A string of comments on Reddit in response to the question: “Should I make Revolut my main account?” is revealing. Several people said “yes,” but two issues gave others pause:

1. Widespread publicity (in the U.K.) about how the app’s AI froze users’ funds due to suspected fraud, and

2. The fact that you can’t call Revolut if you have a problem, nor show up at a branch. All customer queries are handled by live chat or chatbot.

This comment was typical on the second point:

“For me, although I am very happy with Revolut, I am not encouraged to make it my main bank; the idea that I have only chat through the app is not comfortable at all. What if my phone is broken, or my internet is down?”

Read More: PayPal Wants To Become The Banking World’s Next ‘Super App’

Will Revolut Conquer or Stall in the U.S?

Revolut is up against some stiff challenges in taking on the American market. Among them:

- Low name recognition

- Chime’s huge lead

- The popularity of PayPal’s Venmo

- Square’s dominance in the small merchant business

- The “trillionaire” national banking brands

- And, yes, branches.

It’s true that Revolut has a $5.5 billion valuation, sizeable for a startup “unicorn.” But consider that PayPal, which has similar ambitions to be a financial super app, has a market capitalization of just over $309 billion.

Also, if Revolut is, as Storonsky says, going after the customers of small and midsize institutions, that market also the target of other neobanks, making it a crowded space.

In addition, while the number of traditional institutions likely will continue to shrink, many of them are evolving, aided by their tech partners and fresh leadership. Even Oliveira states, “Community banks are vital to our country. I don’t see them ever going away … [although] they will look different.”

Maybe they’ll succeed, maybe they won’t. But they’re in 36 countries already and have gone head to head with tough competitors.

One more thing: While Revolut has not yet turned a profit, Storonsky proclaims that “every single customer is profitable. We have a number of countries that are profitable. And if we stopped launching new ventures and new products, then the whole company would be profitable.”