The unsecured personal loan business continues to boom at the same time that the competitive lineup is shifting.

The impact of inflation is not only prompting consumers to seek out unsecured personal loans more frequently but is influencing their perspective on the lenders themselves. This is leading to an overall rise in satisfaction ratings among both traditional and fintech personal lenders.

Banks and credit unions active in this space could find this an opportune time to explore cross-selling possibilities.

Plenty of fintech competitors are doing just that. They are continuing to become more bank-like, expanding the range of financial services they offer and turning the personal loan relationship into a fulcrum for cross-selling.

These conclusions come from separate research by TransUnion and J.D. Power with analysis of personal lenders’ strategies by The Financial Brand.

One major development in the personal lending sector is Goldman Sachs’ announcement in early 2023 that it would stop making personal loans through its Marcus subsidiary and sell off its personal loan holdings. The move comes as the Wall Street giant scales down its online retail banking unit, which has been a disappointment.

Marcus had held the top ranking in the 2022 J.D. Power Consumer Lending Satisfaction Study.

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Higher Volume in Personal Loans, But Slower Growth Rate

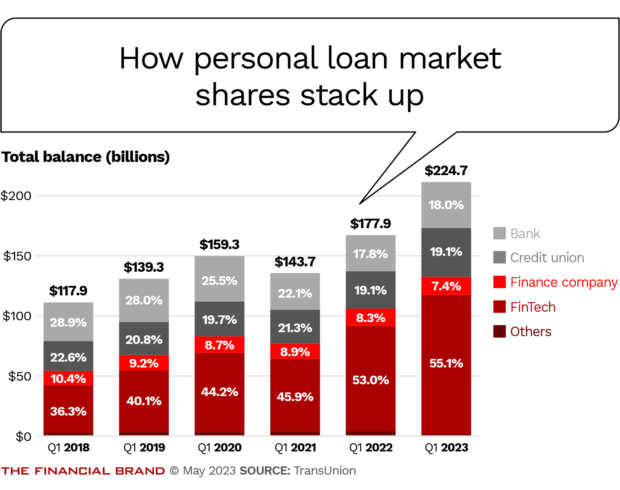

Total unsecured personal loan balances increased 26.3% to a record $225 billion in the first quarter of 2023 compared with the first quarter of 2022, according to TransUnion’s Quarterly Credit Industry Insights Report. The number of unsecured personal loans rose by 12.6%, to 26.9 million.

The growth rate in balances has been slowing for two consecutive quarters — “which may be a sign that lenders are showing more scrutiny,” according to TransUnion. Lenders’ adjustments appear to have had an impact, as delinquencies decreased in the first quarter of 2023.

“In response to limited funding, expect lenders to focus on retaining existing borrowers to keep their cost of acquisition low and to limit risk by increasingly working with known borrowers with a good track record.”

— TransUnion report

This makes the matter of consumer satisfaction ratings for personal lenders of even greater interest, given that working with known borrowers means holding onto those you have.

Generally about 60% of personal loan borrowers refinance their loans, according to J.D. Power consumer research, says Craig Martin, executive managing director and global head of wealth & lending intelligence. Unhappy borrowers may look elsewhere.

An incentive: Martin says J.D. Power’s latest study also finds that 34% of consumers say they have at least one other product with the company that made their personal loan.

Read More:

- A Bright Future for BNPL Is in the (Bank) Cards

- To Capitalize on Home Equity Opportunity, Go Beyond Credit Scores

Personal Loan Satisfaction Rises, In Some Cases by Leaps

The average satisfaction score among personal loan borrowers in J.D. Power’s survey improved to 744 on a 1,000-point scale, an increase of 14 points over the 2022 study. All but two lenders saw their 2023 satisfaction rating increase over their 2022 rating.

Martin says that the results surprised him. With the significant hike in interest rates over the past year, he says, “I was thinking that that would pull down lenders’ satisfaction scores.”

Glad to Get the Credit:

J.D. Power's 2023 personal loan study indicates higher satisfaction, likely because consumers are happy that they found fresh sources of unsecured credit.

Consolidating debt, especially credit card debt, is one of the leading purposes of unsecured personal loans. Often personal loans carry a lower interest rate than credit cards do, and the savings have become much more noticeable in the wake of the Federal Reserve’s serial interest rate hikes. But Martin says rate isn’t nearly as important to personal loan borrowers at the moment as availability.

“The ability to get a personal loan and to get that support at a time that may be more challenging, even if it’s at a rate that’s higher than you may have received a year ago, creates a better experience,” says Martin. “Rate itself, as long as it’s competitive, is not really consequential in many ways for the customer.”

He points out that some consumers view personal loans as an ongoing aspect of their finances.

Perhaps in recognition of this, multiple fintechs refer to their personal loan customers as “members” on their websites — adopting the marketing tactics of the likes of American Express.

Amex, classified as a traditional lender in this study, requires would-be personal loan borrowers to be cardholders in good standing to apply. It topped the J.D. Power satisfaction ranking.

Credit unions, for which unsecured personal loans have been a longstanding staple, of course also rely on the “member” reference.

LendingClub, which J.D. Power continues to classify as a fintech although it became a bank with the acquisition of Radius Bank in early 2021, plays off this idea by its very name.

(In the chart below lenders are identified by gray where they are traditional players or controlled by such and in red where they are fintechs or have fintech roots, such as SoFi and LendingClub, which both now have bank charters. This reflects how J.D. Power classifies them for analysis.)

J.D. Power found that the fintech group overall saw satisfaction improve more than the rest of the personal lenders, 16 points versus 12 points. In part the firm found that this is the result of less frustration — 83% of fintech borrowers say they have never had a problem with their loan. In comparison, a smaller share of borrowers from banks and other non-fintech personal lenders — 74% — have had no problems.

Read More:

- Embedded Finance Fuels Growth — Here’s How to Start

- 3 Ways to Solve for Sneaky Credit & Deposit Concentration Risks

Factors that Make Personal Lenders Stand Out

When fintech personal lenders first came on the scene, they disrupted the business by promoting the ability to apply online and obtain quick, often instantaneous, decisions and rate setting. Today digital ease and ultrafast turnaround have pretty much become table stakes. The marketing for most personal lenders promises quick answers.

Though instant gratification appeals to most people, this selling point is more important to borrowers with financial stress, according to Martin. Some lenders typically serve prime and near-prime borrowers for whom a fast (and positive) loan decision is nice to have. But lenders who serve lower credit tiers often have applicants eager for a quick yes to meet an immediate financial need, Martin says.

Even among the higher tiers, there are expenses that make an unsecured personal loan more appropriate than, say, a home equity loan or home equity line of credit, he adds. Some personal loans are for home improvements that aren’t pricey enough to justify going through the home equity credit process — such as upgrading a bathroom versus remodeling the house. Martin says banks, which have a reputation for slowness here, might take 40 days to grant home equity credit, versus an instant online personal loan.

To the degree that lenders structure their personal loan offers with emergencies in mind, the better.

“If you help me solve a problem, then you add value to my life.”

— Craig Martin, J.D. Power

By contrast, unexpected fees, delayed decisions, cumbersome applications and lack of available customer assistance all pull down scores.

The movement of three fintech lenders in the ranking in the chart from 2022 to 2023 bears mention:

• Best Egg gained 91 points and vaulted 15 places up the ranking (to second place). Best Egg, owned by Marlette Holdings, specializes in serving Americans with limited savings but good credit profiles. In late 2022 it went through a major rebranding. Beyond unsecured personal loans, it also offers secured loans, a credit card and the Best Egg Financial Health tool, a free app.

• Oportun, which gained 66 points and jumped 13 places (to sixth place), also rebranded, in the wake of its acquisition of Digit, a financial management app.

• LendingPoint gained 46 points and rose 2 places (to 14th place). The fintech lender made its customer experience officer part of its C-suite in late 2022.

Read More: You’ve Adopted Digital Loan Applications. Here’s How to Avoid Alienating Would-Be Borrowers

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Industry Cloud for Banking from PwC

See how PwC's Industry Cloud for Banking can help solve everyday business challenges.

Ditching the Commodity Approach to Personal Loans

With more companies offering personal loans and speed and online availability now the norm, the risk of becoming a commodity industry has risen, says Martin.

The solution for some has been expanding beyond personal loans, making credit cards, savings accounts, and financial health apps and education part of the brand.

“Many are adding products and services, expanding their breadth and depth,” Martin says. This helps show customers that the fintech providers are “really in it for me.”

In a sense, this follows SoFi’s playbook. Once a fintech, now a bank, it began with refinancing student loans and expanded far beyond that. The fintechs increasingly regard the personal loan relationship as an “on ramp” for broader connections.

Most of the fintechs lack the bank charter SoFi and LendingClub have. So some of these expansions rely on banking-as-a-service arrangements. Some of the fintechs have multiple BaaS relationships. Upgrade, for example, offers banking services, such as its 3.5% Everyday Savings Account through Cross River Bank. Its loans and credit lines are backed by Cross River and Blue Ridge Bank. The Upgrade Card is issued by Sutton Bank. Another fintech personal lender, Prosper, makes its personal loans via WebBank and offers a credit card issued by Coastal Community Bank.

4 Tips for Building a Strong Personal Loan Program

Based on his work in this area, Martin has four suggestions for traditional players that want to compete better in this area.

1. Understand the prospects. Finding ways to communicate with personal loan borrowers, who tend to be strictly online customers, is critical. Well-trained customer assistance staff is key. The staff must know how to quickly gain a good understanding of each borrower’s particular needs and be able to explain which of the offerings best fits those needs.

2. Manage their expectations. The more guidance that the institution can give about how the process works and what the consumer will need to provide, the friendlier the process is.

Side by side, many of the fintech websites look friendly and there are little notes here and there to add confidence. Often financial education content is right on the fintech’s product pages.

3. Stay in touch. Ongoing communication is important, says Martin, because there’s strong potential for repeat business in this segment.

4. Become an advocate and cultivate loyalty. People have needs and providers that help them meet those needs earn allegiance, says Martin.

He says consumers remember that: “You helped me get through tough times. You helped me get my financial house in order. You helped me achieve my goals.”