The small and midsize business (SMB) market has been alternately courted and ignored by many large financial institutions as far back as many can remember.

Community banks and credit unions are much more consistent as a rule, offering more personalized service than the giant banks. Both ends of the spectrum, however, now face a rapidly expanding segment of fintech providers built around digital platforms specifically addressing small and midsize business financial needs.

The market they are targeting is immense: SMBs with 20 or fewer employees account for 98% of all businesses in the U.S. That potential has attracted no fewer than 140 fintech companies providing an array of financially related services, according to an 11:FS report on the U.S. SMB market.

“Many of these disruptors partner with each other using APIs, integrating their services with those of other providers, which makes things easier for SMBs while helping the service providers extend their own reach,” the digital consulting firm states.

The research was conducted just before the full force of the COVID-19 pandemic took effect. 11:FS surveyed 1,023 small businesses and interviewed the leaders of 12 small companies as well as executives at nine financial services providers, both traditional institutions and fintechs. The resulting 94-page report uncovers key trends that the firm believes will continue in the post-pandemic world, and in many cases may be enhanced. Three key points emerged:

- 62% of SMBs don’t believe their business banking account offers any additional benefits compared with their personal accounts.

- Just over two-thirds (67%) use one of six fintech business platforms compared with 51% using one of five large banks.

- Small business owners expect financial service to be as personalized as what they provide for their customers, and are looking for a proactive partner to help them grow.

“There’s a huge gap between the jobs SMBs are trying to get done and the products that banks are offering them,” the report states. “SMBs are increasingly underserved by banks and are shifting towards using alternative digital services to help them manage and grow their business.” Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Financial Brand Forum Kicks Off May 20th

The unfair advantage for financial brands.

Better Risk Models Open the Credit Door Wider

Businesses with fewer than 20 employees have been hit particularly hard by the crisis. According to J.D. Power, nearly a third of small businesses have seen revenues drop by 75% or more, with another 16% pegging the drop at 50% to 74%. The smaller the business, the worse the revenue drop has been, the research firm notes.

Having enough working capital — always a primary concern for small businesses — is now crucial. That would seem to play right into traditional institution’s hands. Certainly with the Paycheck Protection Program loans, community banks and credit unions pulled out all the stops. Yet standard risk models — even with regulatory restraints relaxed for now — plus long-held views of what constitutes a “bankable” company, may be limiting traditional loans to small businesses.

It’s true that some fintech lenders have seen their own funding dry up during the pandemic crisis, but not all of them have, particularly the more established companies such as PayPal, Square and Stripe. As Ryan Garner, Principal Customer and Product Lead at 11:FS tells The Financial Brand, these companies have vastly improved risk models based on the data they collect. This allows them to enhance traditional banking data with what has been invoiced, giving a much clearer view of the borrower’s health. It also lets them personalize the lending products to these businesses, he states.

Ultimately, Garner believes that digital competitors will be able to price loans better and become more competitive than incumbent banks. In addition, these digitally powered companies are doing a better job of meeting the non-credit needs of small and midsize businesses — what 11:FS calls “jobs to be done.” More on that below.

Shopify Enters the SMB Banking Fray

Putting an exclamation point on fintech expansion into the SMB market was Shopify’s May 2020 announcement of a business debit card called Shopify Balance. Shopify is a digital platform entrepreneurs use to build e-commerce sites quickly. With its latest fintech features, Garner says it’s clear Shopify is a real threat to banks, offering not only a business debit card, but a buy now/pay later option for consumers called Installments, an AI powered fulfillment network for delivery of goods and integration with Facebook and Instagram for shops.

Shopify is counting on the fact that small business owners are not getting what they need from banks and credit unions. “Traditional banks are built for traditional businesses,” Craig Miller, Shopify Chief Product Officer told Business Insider. “This is 2020, the world has changed.” The fintech is working with an undisclosed banking partner to provide the banking accounts.

The key hook for Shopify’s new debit card is that as soon as a customer pays online, a merchant would have the cash available immediately, 11:FS consultant Simon Taylor states in a blog. “This will be instant and without fees, unlike most business bank accounts that take days and charge fees,” says Taylor.

Digital Changes the Equation

As noted earlier, more than two-thirds (67%) of the small businesses surveyed by 11:FS use one of six fintech business platforms. These are: Kabbage, Quickbooks, PayPal, Shopify, Stripe and Square.

In addition, nearly two of five (39%) are using PayPal to manage their day-to-day finances, according to the report. A verbatim comment from one business owner is noteworthy: “Before I get to the level where traditional banking will support me, I can use non-traditional banking like PayPal and Square. They can offer funding based on what they see there.”

“There’s a whole load of really interesting experiences that have been created by some of these fintech business platforms … and they all link to each other.”

— Ryan Garner, 11:FS

In the past, there was a more defined progression from when a company was launched using the entrepreneur’s savings, family money and/or credit cards to the point where a traditional financial institution would step in. That sequence has been altered by the dramatic expansion of older fintechs like PayPal as well as more recent arrivals like Square and Stripe. It’s less important now for SMBs to “graduate” to a traditional banking provider and they are more apt to have multiple relationships.

Access to credit from these fintechs is one reason, but another is that the newcomers are providing innovative ways to meet other non-credit needs of SMBs.

“There’s a whole load of really interesting experiences that have been created by some of these fintech business platforms,” says Garner. “Not only that, they all link to each other as well, so a small business can integrate Square with QuickBooks, for example.”

The way traditional institutions can compete with this is to make the shift away from commodity products towards truly digital services, the report states.

Read More: Gaps Grow Between Small Businesses and Financial Institutions

How Well SMB Needs Are Being Met

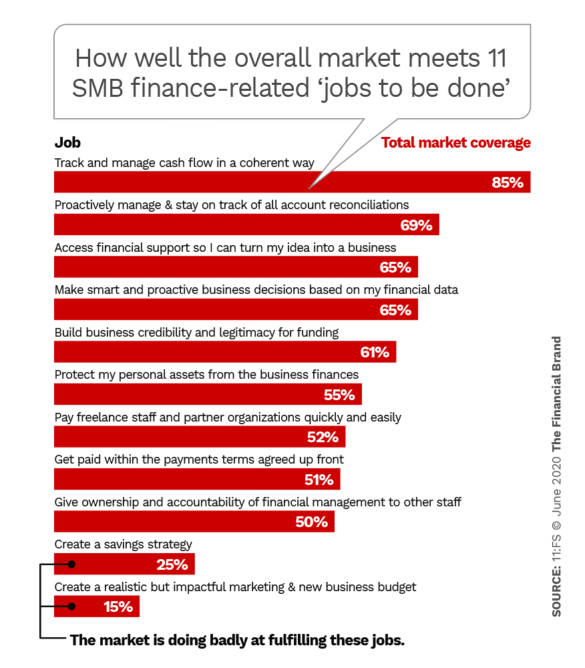

For an earlier project 11:FS created a framework for analyzing the small business market called “Jobs to be done.” The SMB report focuses on 11 of these jobs listed in the chart below. The percentages represent the firm’s analysis of the degree to which the 16 bank and fintech providers, taken together, meet these needs.

The bottom two jobs represent a clear opportunity for both traditional institutions or fintechs. However, with the exception of cash flow management, there is room for improvement in most of the “jobs to be done,” the firm believes.

“Only 18% of small businesses ‘completely agree’ that banks are providing the services they need to effectively run the financial side of their business,” the report states. Further, 11:FS maintains that in the post-pandemic period these jobs will become even more essential as businesses try to navigate intense economic uncertainty.

“Providers that respond quickly to fill these services gaps will be well positioned to win a lot of new customers,” the firm states.

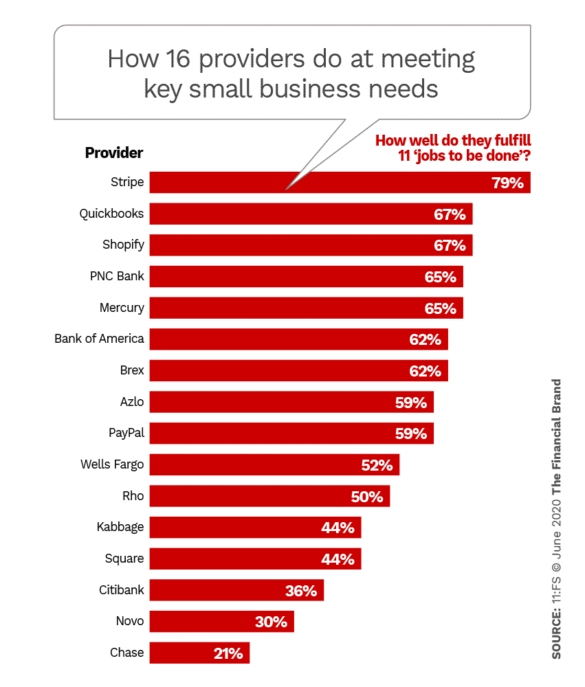

The consulting firm also scored the 16 traditional and fintech providers for how well each of them meets the 11 jobs to be done.

PNC Bank and Bank of America stand out among the banking providers studied, but three fintechs come out with even higher scores.

Market share is another matter, however. Digital banks Rho, Mercury and Azlo barely register yet — all less than 1%. Among the small businesses sampled, the two most widely used fintechs are PayPal and Quickbooks at 39% and 36% respectively. Chase, Wells Fargo and Bank of America are used by between 15% and 18% of the sample, with Chase at the upper end. Its share increases to 25% among SMBs with 10 to 19 employees.

Read More:

- The Fintech Strategy to Steal the Small Business Banking Market

- How Banks Can Help Small Businesses Through Aid Tangle and Beyond

Huge Opportunity. Who Will Grab It?

Even without the impact of the pandemic, there is a major opportunity for both traditional financial institutions and fintech firms to rethink SMB financial services, 11:FS states. Helping small and midsize businesses plan more into the future represents the biggest opportunity.

“Customers don’t want a bank. They want to enjoy running a business that they are proud to call their own,” the report states. It emphasizes the need for financial services providers to adopt a “relentlessly empathetic mindset about customers and their motivations.” An entire section is devoted to how to develop a framework to do this.

Such a shift is a challenge for banks and credit unions in several ways. Many may wonder whether the best approach should be to develop the necessary culture and digital expertise internally, to partner with the fintechs, or simply to integrate some of the latter’s services.

“There are two issues here,” Ryan Garner states. “The first is offering truly digital services. The second is being digital to the core to allow institutions to move fast and reduce the cost to serve, which we’ve seen is really important in a crisis like the current pandemic.”

Garner believes the best route forward would be either to build the capability or partner with fintechs. Simply integrating services, he states, would not solve the need to shift the institution to be truly digital, while at the same time it would provide the fintechs they are integrating with another route to market.