In 2019 much of the banking industry’s attention was riveted on the moves by big tech players — Google, Facebook, Apple, Amazon — to explore, establish, expand or solidify their positions in the U.S. as providers of banking services.

By comparison, the developments among so-called challenger banks seemed somehow less threatening. It’s not as if the highly successful German challenger N26 nor the U.K.’s Monzo, both of which formally entered the U.S. in 2019, have taken the market by storm.

But dismissing challenger banks as so many gnats would be a huge mistake. As Jim Marous writes in the Digital Banking Report‘s “2019 Challenger Bank Analysis“: “The growth of challenger banks has been unprecedented in the past several years with more than 40 million users today and close to 100 million expected within the next five years.”

Few, if any, are profitable yet, it’s true. They live off investor capital, still freely offered so far, although that may change in the wake of the WeWork fiasco. It’s also true that their revenue streams are too dependent, in general, on transaction fees — interchange fees in particular — which are being squeezed tighter and tighter for both challengers and incumbents.

Yet few people would now deny the power of Uber, Lyft or certainly not Amazon, because of their nonexistent or inconsistent profitability for many years.

And while the banking industry is a much tougher competitive nut to crack than the taxi business, fintech competitors have already deeply penetrated the previously banking-dominated payments industry. Fintech insurgents advance into just about every traditional banking product and service almost weekly.

Ironically, as Marous, Owner and Publisher of the Digital Banking Report and Co-Publisher of The Financial Brand, points out, the banking industry has in effect invited these nimble competitors into the tent.

“Most banks and credit unions have been unable to deliver a seamless consumer experience due to the continued presence of product and data silos, decades-old infrastructure, and a risk-averse culture that produces only incremental innovation,” Marous writes in the report. “This has created an open door for startups and established non-financial competitors that can leverage data, modern technology and an agile mindset to deliver enhanced experiences.”

Get the Challenger Bank Analysis Report

Navigate And Win The Branch Transformation Race

Learn how to navigate and win over customers with the right branch transformation. Listen to JP Lacroix and Marbue Brown discuss strategies, insights, and more.

Read More about Navigate And Win The Branch Transformation Race

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Another reason for the success of challenger banks is that consumers have been quite willing to change their banking habits, just the way they did when booking hotel rooms or vacation rentals or buying music or shoes. Mobile apps transformed the way much of everyday life is conducted.

Even though they seldom abandon their primary checking accounts, consumers “accessorize” these accounts by using fintech applications for savings, financial management, investments and mortgages, the report states.

Even risk-averse U.S. banking regulators have come around to recognizing the benefits of frictionless banking. Not as much in the U.K. yet, but the early 2020 approval of deposit insurance coverage for challenger bank Varo Money marked a landmark event.

It’s also worth noting that the banking industry itself has provided the means for challenger banks to offer deposit products. Such banking-as-a-service arrangements have become a profitable line of business for a growing number of traditional institutions.

Read More:

- Fintechs vs. Traditional Banks: Who Has the Bigger Advantage?

- The Future of Retail Banking Through a Digital Challenger’s Eyes

Hurdles Faced by Incumbents and Challengers

The game is far from over, however, nor is the outcome certain. Even the strongest fintech banks face formidable challenges of their own. Among them, as noted earlier, is too much dependence on interchange fees from debit card transactions.

There is also the threat — shared with traditional institutions —from the increasing forays into financial services by the big tech firms. Cap Gemini found that three quarters of tech-savvy consumers globally already are using at least one financial product from a big-tech provider.

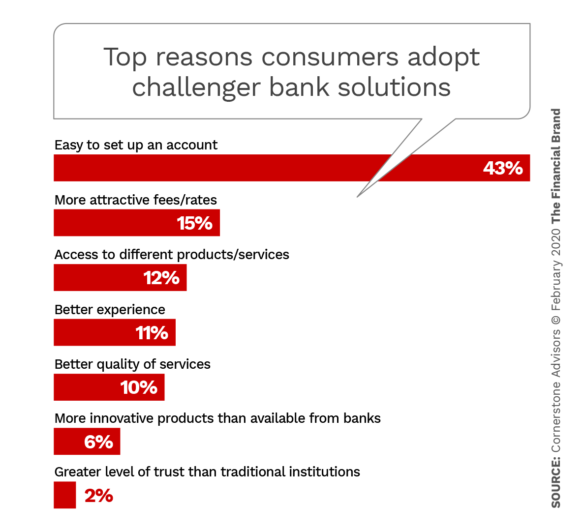

The financial institutions most vulnerable to challenger bank competition are midsize and community financial institutions. Indications are that there will be increased partnering between these institutions and fintechs. In its annual “What’s Going on in Banking” study, Cornerstone Advisors found that 65% of banks and 76% of credit unions want a fintech affiliation in 2020, up from 49% and 60%, respectively, in 2019. This would enable traditional institutions to “bolt in” a better customer experience to their legacy back end, according to Cornerstone President Steve Williams.

Marous notes, however, that this surge in interest in partnering with fintechs may come too late for some financial institutions. “Evidence indicates that the strength of fintech firms and challenger banks may be greater than ever, providing some firms confidence that they can ‘go it alone’,” he states.

Traditional institutions still clearly have an advantage of consumer trust over fintechs and big techs. Yet people are voting with their accounts, and more of them are willing to try new things. Increasingly this even includes financial advice and guidance. J.D. Power finds that digital channels are now almost neck-and-neck with in-person options as the place for getting financial advice. More significantly, the branch channel is declining as the place for advice and guidance whereas the digital channel is growing.

Read More:

- Consumer Use of Fintechs For Banking Services Skyrockets

- How a Small Iowa Institution Became The Bank Powering Big Fintech Apps

Challenger Banks That Threaten Traditional Institutions

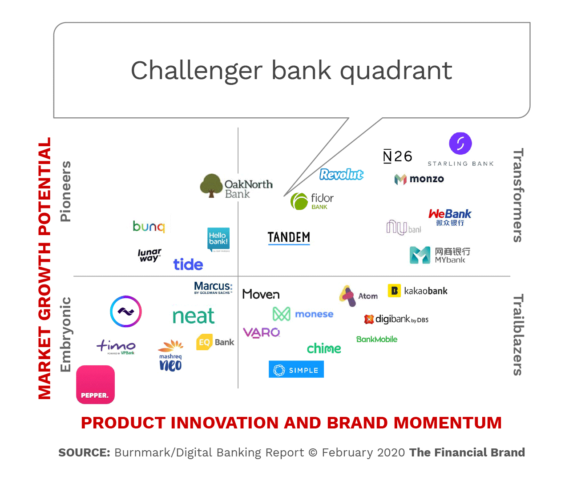

The Digital Banking Report presents in-depth analyses of 30 challenger banks. These were identified by Burnmark, a fintech research firm, as the most formidable competitors out of its database of more than 250 challenger institutions worldwide. The 30 were placed in a quadrant as part of a bi-annual ranking by Burnmark based on 26 parameters. The parameters with the heaviest weights, according to Burnmark Founder and CEO Devie Mohan, are: banking license, customer acquisition growth, funding, partners, open API and technology initiatives, product quality and customer experience.

Get the Challenger Bank Analysis Report

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Register for Discovery2024 Conference

Join us August 8th for Discovery2024, your gateway to the strategic insights and human connections you may need to navigate the evolving financial landscape.

Here are brief descriptions of each quadrant:

Transformers (top right): These challenger banks have the necessary depth and breadth of market penetration and branding, combined with the organizational characteristics to capture significant market share by volume and value. They also have a range of offerings, geographic coverage and financial strength.

Trailblazers (bottom right): Challenger banks that have achieved strong growth by playing to their strengths. They have a sizeable customer base in their current focus region but future expansion plans are unclear at the moment.

Embryonic (bottom left): Not to be dismissed, these challengers are solving consumer or business problems with domain-specific applications and technologies. They have a strong engine for innovation.

Pioneers (top left): Best-in-class execution capabilities characterize these challengers. Although slow with regard to brand momentum, they have considerable strength when it comes to their products and services, signaling significant future growth potential.

Although the “transformers” have made the most progress overall, the quadrant as a whole represents challenger banks that are the most competitive threat to traditional institutions in their respective geographies. In fact five challengers not among the “transformers” may prove to be the toughest, as described below.

Read More: This Virtual Bank Wants to Be The Engine Behind Fintech Brands

Five Surging Challenger Banks to Watch

There were some notable movements among the challenger banks in the current Burnmark quadrant compared to the last one, Mohan notes. Four challengers disappeared out of the quadrant due to slower growth and other factors: Shine, GoBank, Che Banco and Banco Original.

Starling Bank, on the other hand, moved up on both axes in the quadrant. Revolut lost some brand momentum due to regulatory controversies, but moved higher on market strength with its rapid expansion and new product launches. Monzo moved forward on brand momentum due to its expansion in the U.S.

Taking the place of the four downgraded digital banks in the Burnmark quadrant were five noteworthy challenger banks that banks and credit unions should watch closely — three of these rising stars are U.S. institutions:

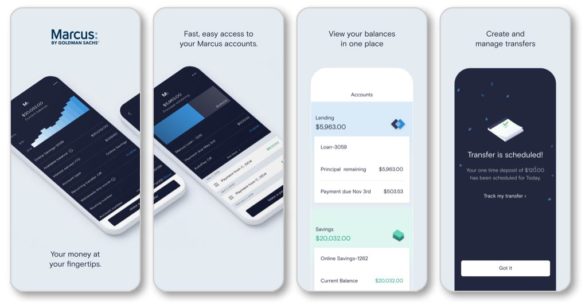

1. Marcus by Goldman Sachs. A simple model led by brilliant execution and traction across America and now the U.K. Marcus began with an online savings account and consumer loan product. Now they have launched a mobile banking app and announced plans for checking and wealth management.

2. OakNorth. One of the biggest players in small and midsize business banking, U.K.-based OakNorth has recently introduced individual savings accounts and analytical intelligence offerings. It has shown huge growth and continues to do so with partnerships.

3. Varo Money. Varo, an American challenger bank has grown rapidly and is very close to obtaining a bank charter. The nearly four-year effort will make Varo the first challenger bank in the U.S. to get a bank charter. Varo’s product offerings are customer centric and targeted particularly to the underbanked and financially challenged Millennials.

4. Current. Originally focused only on teen banking, Current has now expanded its focus to Millennials as well with checking accounts. It is showing strong growth indicators and customer-centric services.

5. EQ Bank. A completely digital offering of Canada’s incumbent Equitable Bank, EQ Bank provides a simple range of products with competitive rates. It has seen significant adoption in Canada and makes use of the latest technologies to make its services as agile as possible.