More and more organizations across industries are leveraging platform strategies to better serve consumers. With a platform strategy, interactions between external providers and consumers are made easier through the integration of data, analytics and delivery platforms. This seamless integration usually reduces friction and expands potential markets beyond what was achievable in the past. Common examples of platform organizations include Amazon, Apple, Airbnb, Microsoft, Google and Uber.

The concept of open banking is a platform strategy, and has been successfully deployed by both Alibaba and Tencent in China. Many of the other big tech organizations are also including financial services as part of their platform strategy. Most recent examples include Apple’s partnership with Goldman Sachs on the Apple Card, Uber’s partnership with GreenDot to provide checking services for their drivers (Uber Money), and the just-announced intention of Google to offer checking accounts in conjunction with Citibank and Stanford Credit Union (and potentially other financial services firms).

According to the book, ‘The Business of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power’, platform firms in the Fortune Global 2000 have higher sales growth, market value growth, and operating profits. They also achieved this growth with almost half as many employees – fewer than 10,000 on average, compared to 19,000 for the non-platform firms. They also had higher spending on research and development.

Despite the successes of many of these platforms, success is far from guaranteed. For instance, while Amazon and Airbnb have achieved extraordinary success with their platform strategies, Uber has been challenged to make money to date. Some of the reasons platform strategies can fail include:

- Getting the pricing wrong. In many cases, setting the wrong price or subsidizing the wrong side of the business model can limit or eliminate upside potential. Should the consumer or the solution/product provider get an incentive? The goal is to build momentum that can scale easily.

- Not establishing trust. When expanding beyond what consumers might know a company for, trust is imperative. In financial services, many consumers have indicated a strong trust for the major tech firms, notably Amazon, Google and Apple.

- Being late to the market. Innovation pioneers may take on additional risk, but laggards will almost always lose. This is especially true with technology advances, since digital consumers tend to be early adopters.

- Building platforms in low margin businesses. This can be both a key to failure or a key to success. Ride sharing companies like Uber and Lyft have relatively high costs and low margins, therefore requiring expansion beyond their core business. Similarly, financial services providers who have low margins can find relief by offering higher margin services beyond traditional banking products as has been done by the Chinese giants.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Uber: The Growth of a Non-Bank Financial ‘Super App’ Platform

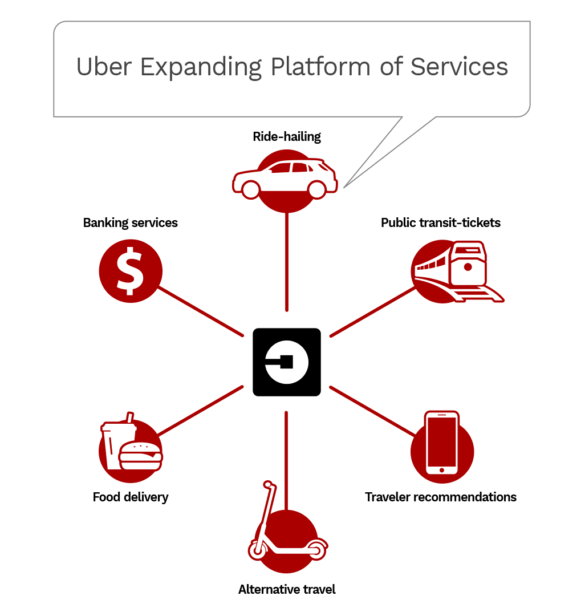

Uber is an excellent example of a non-financial institution that wants to increase their influence into a consumer’s life by leveraging data, advanced analytics and expanded services with a platform strategy. It is not a surprise to anyone who uses Uber that they want to be more than just a ride-sharing app. Several years ago, Uber launched Uber Eats for the delivery of food as well as the recommendation of restaurants within the Uber app. The company has since deployed their vehicle tracking capabilities as a separate business for trucking firms, expanded into alternative transportation with Jump e-bikes in Europe, helicopter rides in New York City and scooters worldwide, and has just announced the offering of banking services for their drivers.

It is hoped that the expansion of services using a platform strategy will help offset ongoing losses from its core ride-sharing business – which has very low margins. More importantly, it is hoped that the firm can leverage the deep insights into its drivers and riders to provide alternative value-added services in a single, integrated super app. “We want Uber to be the operating system for your everyday life,” said chief executive Dara Khosrowshah.

Similar to Amazon, Google and Apple, Uber is in an advantageous position to become a super-app because they already have a large customer base of frequent users, and have embedded payments. This level of lifestyle and payments data is valuable when expanding beyond core businesses. From being able to offer restaurant and entertainment recommendations to cross-selling ride options as customers engage in related activities, the potential for collection and use of data for an improved consumer experience is huge.

The ability to offer expanded banking services, such as loans, to more than three million somewhat underbanked drivers is also valuable. This is easier for Uber than a traditional financial institution because they have deep insights into how much each driver earns, their work habits and even how customer friendly they are. PayPal has done similarly with small businesses, using merchant payment information to offer pre-approved loans.

Finally, beyond the expansion of services, Uber can leverage customer and driver insights to build an advertising platform. Already done by giants such as Amazon and Facebook, embedding ads (without sharing customer insights with outside companies) can be a strong revenue opportunity. In fact, the vast majority of revenue for Facebook is in the ad business on their platform.

Risks of Expanded Platform Apps

As services from Uber, Apple, Google, Amazon and other platform players expand, one risk is not being able to offer a multitude of services in an easy to use app. One of the major benefits Uber has had in the past is their delivery of on-demand rides in an intuitive app. As services expand, the ability to easily navigate and present expanded options becomes more important.

Another obvious risk is the safety of the vast amounts of data being used to deliver personalized experiences. While there is currently significant trust with many of the big tech players, this trust can evaporate quickly if the data collected on consumers is put at risk or used inappropriately. Facebook experienced the downside of not ensuring data privacy of it’s customers during the Cambridge Analytica scandal and subsequent examples of data misuse.

The cost of data misuse could be significant for big tech firms. The U.S. Attorney General recently warned big tech companies that ongoing mass data collection and data misuse will draw the attention of federal regulators, potentially playing a role in antitrust analysis.

Big Tech Players Expand Financial Offerings

It is becoming clear that all the big technology companies see the offering of financial services (especially payments) as a cornerstone of their platform strategies. Moving beyond eCommerce, social media, search, ride-sharing and mobile devices, big tech firms are trying to embed their apps as an integral part of their customer’s daily life. The key is the ability to deliver highly personalized, intuitive experiences that the consumer finds helpful, reducing friction and providing added value along the way – in a safe, secure, easy-to-use super app.

With digital apps, it is all about constant engagement. Engagement can be achieved by offering enhanced efficiency of financial services delivery and by facilitating financial inclusion to underserved segments of the population. Becoming a greater part of a consumer’s life through a digital wallet could change the playing field to a far greater extent than we have seen in the past, with the emergence of new dominant – non-traditional – players. Many believe that as the number of point-of-sale systems that accept contactless payments grows, the threat of big tech competition for financial services also grows.

Traditional Financial Institutions Must Respond

Traditional financial institutions still have the upper hand in delivering financial services because of their incumbent status, access to deeper financial insights, long established trust and knowledge of the compliance and regulatory environment. But these advantages are quickly eroding as big tech players partner with existing financial institutions to deliver financial services.

Banks and credit unions can no longer sit on the sidelines as alternative providers encroach on service offerings and existing relationships. Instead of spending time looking for regulatory relief and protection from outside competitors, financial institutions must look at open banking solutions to expand offerings and leverage available customer insights to deliver an improved array of highly personalized services.

Regulations for fintech firms, big tech organizations and traditional banking are terribly out of date, many dating back to the 1970’s. These will change, albeit slower than desired by almost all players. Future regulations will most likely not regulate entities, but the services delivered. With this in mind, banking organizations must stop looking at the banking services of the past as a guidepost for the future. Successful organizations will build open banking solutions ‘from scratch’, leveraging modern technology, data and analytics to deliver a better customer experience.