When you’re the largest bank in the country, you’ve got a target on your back 24/7/365. It comes with the territory, and JPMorgan Chase got another taste of that when a bank tweet meant to motivate better financial behavior went viral, in an overwhelmingly negative way.

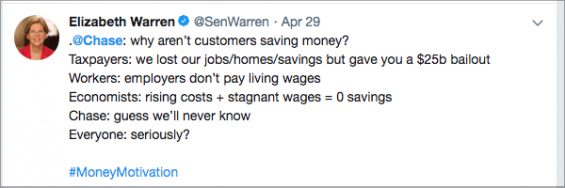

It started when Chase Bank tweeted using #MondayMotivation, a popular Twitter hashtag theme. The “advice” message was written as a chat-like exchange, probably intended to appeal to Millennials. (Chase declined to comment for this article.) For those who didn’t see it, here’s what the bank tweeted:

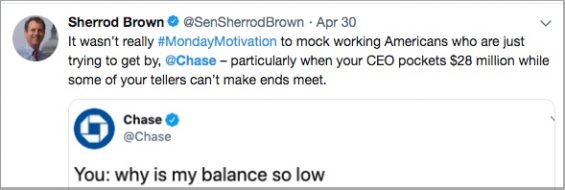

The reaction was swift and mostly vitriolic. One of the first to respond was Sen. Elizabeth Warren, the Democratic presidential candidate.

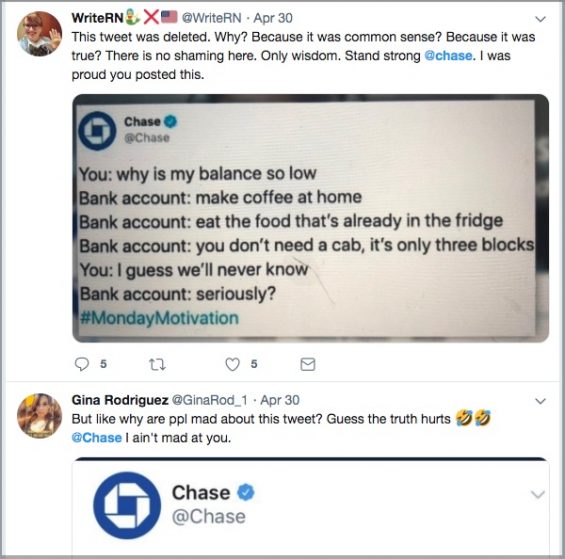

That really got things boiling, with various commenters, including California Rep. Katie Porter, using the term “poor shaming” to describe the bank’s tweet. As the pushback lit up the Twitterverse, the bank pulled down the original tweet and tweeted this brief note from @Chase:

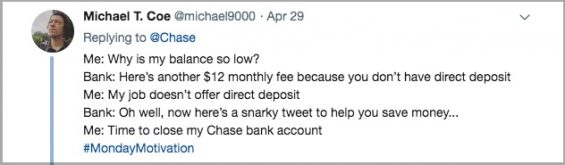

Hard to say if it helped. The negative tweets continued as media coverage kicked into high gear. One headline, from The Takeout: “Chase Bank Faceplants With #MondayMotivation Tweet.” Conan O’Brien couldn’t resist the bait and did a riff playing off Chase’s tweet. Here are some other examples.

Not everybody was outraged, however. Quite a few individuals tweeted or wrote in support of the bank’s message.

Financial advisor Dave Ramsey told NBC: “No one should ever shame someone for being poor. But all of us should be open to having our bad habits called out so we can live better lives.”

Reputation and crisis-management consultant Davia Temin put it a little more bluntly in response to questions from The Financial Brand: “This was a case of a big bank being targeted and used to make a political point. Politicians pounced on a Chase marketing tweet that was a little Millennial, but essentially harmless.”

“If a fintech startup had issued the tweet, I could easily envision a lot of people tweeting about it being the funniest thing they ever saw,” observes Ron Shevlin, Director of Research for Cornerstone Advisors. “But coming from Chase … well, that’s an entirely different story.”

In addition to Temin and Shevlin, The Financial Brand reached out to other marketing and social media experts for their views on the Chase episode and what lessons it provides to financial institutions.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Is a snarky tone appropriate for a #MondayMotivation tweet, or for any bank or credit union communication?

“I don’t think a snarky tone is ever a good idea for a financial institution. Period. You can be funny or entertaining, but walking a line that potentially crosses over to insulting or condescending is dangerous.” — Meredith Olmstead, CEO and Founder, FI GROW Solutions

“Snark might work for Wendy’s or Burger King but they are selling a $5 hamburger. Money is stressful. People are looking for help and hope from someone they can trust to guide them beyond this stress to a bigger, better, and brighter future. Not someone to shame or talk down to them.” — James Robert Lay, Founder and CEO, Digital Growth Institute

“A snarky tone isn’t appropriate for #MondayMotivation or any day. Banks should leave the snark to those of us who are experts at it.” — Ron Shevlin, Cornerstone Advisors (Shevlin writes the “Snarketing” post for The Financial Brand.)

Read More:

- Social Media & Social Issues Create Brand Challenges For Financial Marketers

- Why Banking Executives Should Follow Social Media Influencers

How can a financial institution avoid missteps on tone and optics on consumer messaging?

“I think the tone for financial institutions — and all of us — needs to be inspirational, aspirational, kind and witty. It’s the best way, and also much harder to attack.” — Davia Temin, President and CEO, Temin and Company

“Chase could have de-personalized the advice. Instead of it being a conversation between a customer and the bank (or chatbot), they could have talked about ‘customers’ in general.” — Ron Shevlin

“Offensive does not equal funny. The tone of this message is what set people off. Instead of it sounding like ‘We’re laughing with you’ it sounded like ‘We’re laughing at you.’ Motivation should always be helpful and never make assumptions, such as assuming that someone who does not have money in their checking account must be spending their money on things like buying coffee or eating out. The bank could easily have worded its tweet differently — the tone was almost condescending.” — Ida Burr, Digital Ads Manager, FI GROW Solutions

“It’s easy to over-manage communication. At a minimum, however, a digital brand communication guide that provides a framework around style and tone would be helpful. Also, banks and credit unions can use the ‘buddy system’ before posting anything to ensure digital communication is within the agreed-upon brand voice and tone. The best oversight comes not from micromanaging communication but instead from offering digital communication training that is rooted in empathy and emotional intelligence.” — James Robert Lay

Is pulling a tweet to cut the damage the right move?

“Once the Chase tweet went viral the damage was done. At that point, pulling the tweet was the best thing to do to remove the offending perspective that is out of touch and insensitive. Twitter is not known to be kind to brands. It’s often where people go to voice their outrage and dislike.” — James Robert Lay

“Chase certainly did not cut the damage, people are still going to be talking about this, and the tweet is only a Google search away.” — Ida Burr

“When you’re in a firestorm, do the right thing, and keep your head down!” — Davia Temin

What kind of Twitter response would be appropriate after a blowup?

“I liked Chase’s response tweet [shown above]. They made a misstep and they owned it. But then why go dark? Their Twitter account was still almost completely silent a week after the incident. They may have been having huge internal conversations about what went wrong, but in the meantime the account is losing marketing share and voice by not sharing content.” — Meredith Olmstead

“I might have suggested a Twitter response that was both light and serious, like this: ‘We clearly must not have had our morning coffee today — we are so sorry, and never meant to offend anyone with our morning tweet. Our goal was only to help suggest ways we can all save on the small things in order to reach big dreams’.” — Davia Temin

“Chase’s follow-up tweet was a good response as they fell on their sword and admitted their mistake. But the bank could have linked to one of the many articles on their website to provide additional context, guidance, and insight as a solution to the pain point addressed in the tweet.” — James Robert Lay

Read More:

- 10 Steps to Protect a Banking Brand Under Siege

- Just Because Customers Don’t Switch Doesn’t Mean They Love You

- 5 Ways Banks and Credit Unions Misread Consumers Today

Can financial institutions provide ‘tough love’ advice?

“This is the crux of the issue. Some people need ‘tough love’ advice. I wouldn’t recommend giving it publicly, though.” — Ron Shevlin

“Coaching is the future of financial services. However, ‘tough love’ advice is almost impossible to give at scale and would be best to do in person if the financial coach picks up on the emotional signals that such advice will create value and be helpful.” — James Robert Lay

“Financial institutions can give hard advice, but it has to be delivered in a meaningful and human way. Share a video of a customer’s testimonial or story of how one person turned their credit around. But giving that kind of hard-to-hear advice in less than 240 characters maybe isn’t the best strategy.” — Meredith Olmstead

Any concluding observations or lessons from what happened to Chase?

“One lesson to keep in mind: Anything can be vilified today, especially on Twitter, and especially in the run-up to a highly contested Presidential election.” — Davia Temin

“Emotional intelligence and empathy in today’s digital economy is a competitive advantage for financial brands. Those that truly feel the pain of people will be the ones that can position themselves as the antidote to that pain. The short-form communication worlds of Twitter and text, however, have the potential for having content taken out of context. And that can quickly deplete an institution’s ‘goodwill bank.’ So a key lesson to note is the importance of having a plan in place to deal with a communication crisis, because we are all going to make mistakes in digital communication.” — James Robert Lay

“There’s a fine line between really caring and just publishing ‘tips’ to fill in the gaps on your social media. I would recommend that bank and credit union marketing staffs ask themselves, ‘Is this advice that I would give my best friend, or sister? Would someone telling me to not buy a coffee or eat out be motivating or annoying?’ Also, why not have customers deliver your message for you? Chase published a short video on Twitter that also challenged consumers to ‘investigate their finances’ — but it was delivered by a group of women of color. It was a very similar message to the tweet that caused the controversy, but seems so much more authentic because it’s coming from real people and is delivered with empathy and caring.” — Meredith Olmstead.