Despite recent uncertainty in the financial markets, the economic outlook for the banking industry remains positive. Regulatory forces are encouraging innovation and new digital technologies provide opportunities to improve customer experiences. There are strong indications that banking organizations worldwide understand the primary trends impacting the industry as well as the actions that are needed to respond to competitive pressures.

The question is whether banks and credit unions will prioritize the deployment of human and financial resources to respond to these changes. Will legacy financial institutions embrace change, take appropriate risks and disrupt themselves to meet the needs of consumers, small businesses and corporate customers?

For the eighth consecutive year, we surveyed a panel of global financial services leaders for their thoughts on retail banking and credit union trends and predictions. The crowdsource panel included bankers, credit union executives, industry analysts, advisors, authors and fintech followers from Asia, Africa, North America, South and Central America, Europe, the Middle East and Australia.

We used the insights from our panel as the foundation to develop a global survey of executives involved in the financial services industry, providing a prioritization of our trends. Our global survey also provided an opportunity to do an end-of-year review of last year’s projections. Finally, the survey collected insight into strategic priorities for 2019 and analyzed the progress being made by financial institutions in the process of digital transformation.

“Most financial institutions understand the major trends that are impacting the banking industry as well as what needs to be done to respond to those trends. The challenge for legacy banking organizations is prioritizing and deploying resources in alignment with these realizations. The question is whether organizations are ready to embrace change, take risks and disrupt themselves?”

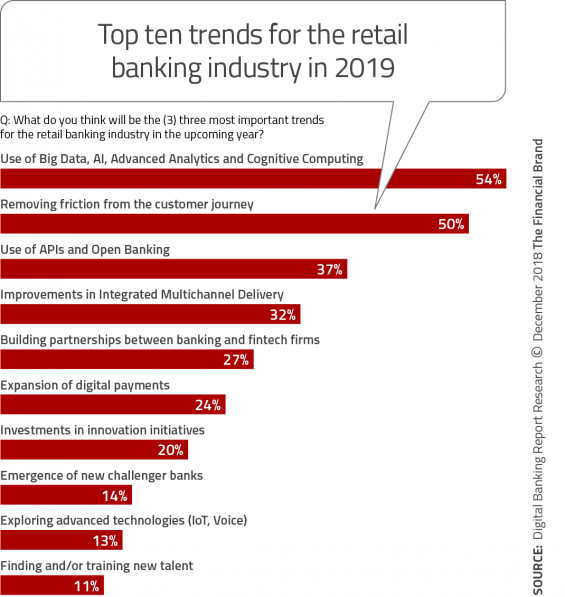

As we look to 2019, there were some noticeable changes in the trends from previous years. For the first time ever, the use of data, artificial intelligence (AI), and advanced analytics was ranked first, replacing improving the customer experience as the number one trend. In addition, there was a realization of the importance of open banking and application programming interfaces (APIs) by organizations globally. Finally, the importance of innovation was also a trend that increased in importance in this year’s survey.

By collecting insights from leading influencers, ranking the trends using an industry survey, and including extensive analysis around the progress of digital transformation, we have developed the most comprehensive annual trend report in the banking industry. For the fourth consecutive year, the research, analysis and Digital Banking Report were sponsored by Kony DBX.

Get the 2019 Retail Banking Trends Report

A Look Back: 2018 Retail Banking Trends

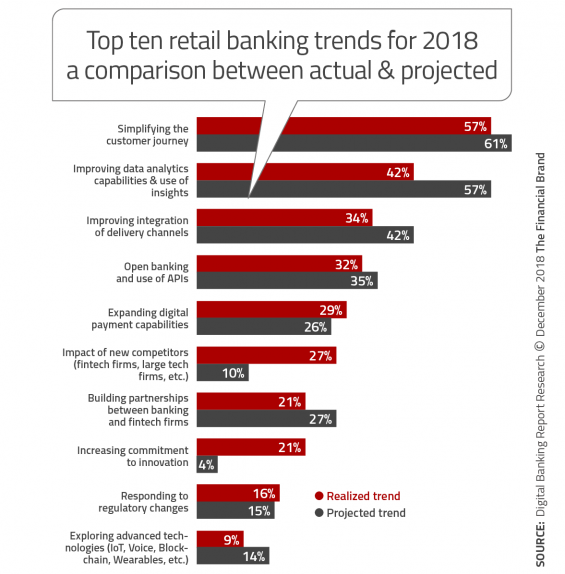

As part of this year’s research, we asked survey respondents to note the top ten trends they saw in 2018. We then compared these responses to the projections that were made last year as part of the 2018 Retail Banking Trends and Predictions report (now available for free download).

As can be seen below, the top six trends projected at the beginning of 2018 were the same six trends that were thought to be important as the respondents looked back on 2018. What is interesting, however, was that the importance of the top five trends was less than anticipated. Alternatively, the impact of new competition (fintech and big tech firms), as well as the commitment to innovation, far exceeded what was projected for the 2018 Retail Banking Trends and Prediction report a year ago. Both of these variances were reinforced by the findings in our Innovation in Retail Banking 2018 report.

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence. Read More about Success Story — Driving Efficiency and Increasing Member Value Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Success Story — Driving Efficiency and Increasing Member Value

Banking Transformed Podcast with Jim Marous

Top 10 Retail Banking Trends for 2019

The ranking of the top ten trends and predictions was done by providing a list of trends identified by our crowdsource panel of leading industry influencers and asking banks, credit unions and the supplier community globally to provide their top three predictions for 2019. The combination of evolving consumer expectations and technology trends are impacting the banking industry more than ever. As more banking interactions are completed on digital devices, increasing amounts of data are being collected and analyzed in real time.

This year’s trends and predictions reflect the reality that siloed systems that have traditionally been used for transaction, savings, investment and loan accounts are not well suited for the level of agility and scalability required for the digital age. Banks and credit unions globally have responded with an increasing array of digitalization and innovation initiatives, using cloud technologies, advanced analytics and new distribution alternatives to respond to consumer expectations.

These initiatives have driven the top three trends and predictions for 2019:

- Real-time intelligent data integration through the use of AI, advanced analytics and cognitive computing (54%).

- Customer-centric perspective and the elimination of friction from the customer journey (50%).

- Use of APIs for the transformation to an open banking platform (37%).

This is the first time since this survey has been conducted that improving the customer experience was not the top prediction. It is clear that the importance of data and advanced analytics is understood to be the most important trend in the banking industry, serving as the foundation for all other trends.

Interestingly, the importance of open banking APIs increased for the third consecutive year across all geographic segments. Given that there are yet to be concrete open-banking regulations in the U.S., the recognition of the future need for sharing data is worth noting.

Despite a change in the order of the top three trends, the overall list of top ten trends identified by the financial services industry has remained relatively consistent over time. This could be a symptom of a greater problem. The banking industry is transforming incrementally as opposed to dynamically. That said, larger financial institutions are beginning to steal market share based on their ability to deliver against consumer expectation set by the largest tech companies (Google, Amazon, Facebook and Apple).

The transformation within the banking industry will require the development of partnerships or expanded collaboration with outside organizations. It will also require modernization of outdated technologies and the rethinking of legacy processes and organization structures. The timing of this transformation will differ at different organizations, but the need for new thinking will be non-negotiable.

Top 10 Strategic Priorities for 2019

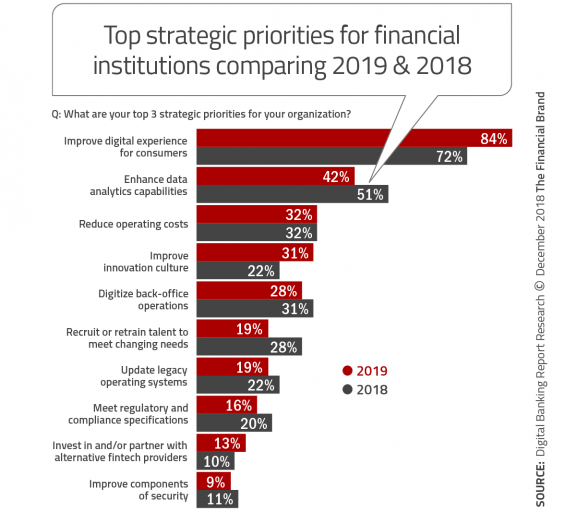

When we asked financial services organizations worldwide about their top three strategic priorities for 2019, there was a significant jump in the level of commitment to improving the customer experience compared to last year’s research. More than eight in ten respondents mentioned the priority of improving the customer experience compared to 72% last year. Interestingly, the strategic priority of enhancing data analytic qualities decreased by 9% (from 51% to 42%) conflicting with the importance shown in the 2019 trends analysis.

The reduction of operating costs remained at the same level as last year, while the priority of investment in innovation jumped to the fourth position from number seven last year (moving from 22% to 31% this year), This represents the highest level of commitment to innovation since this research started eight years ago.

Surprisingly, the priority of recruiting and training talent dropped from 28% last year to 19% this year. As with the drop in prioritization of data analytics, the drop in the prioritization of talent enhancement is a bit baffling given the fast pace of technological change in the marketplace.

According to Bradley Leimer, Co-founder of Unconventional Ventures, “After visiting Singapore, Hong Kong, Shanghai, Hangzhou, and Tokyo in the past year, it is very apparent that the next financial services business model is already here – it’s in the East in the form of super apps, where every element of banking falls into the background. WeChat and Alipay are the new normal.”

Here are what others from the crowdsource panel had to say about 2019.

“2019 will be a year of growing divergence in global regulatory standards, impacting financial institutions and Fintechs. Cyber security and data governance will be under particular scrutiny.” – Bryan Clagett, CMO at Geezeo

“Regulators will start committing to digitization, realizing that holding still means ‘accelerating backwards.’ Some regulation will be ill-designed but much will be positive, with more experimentation, collaboration, and active embrace of digitally-native regtech. AML solutions will go first.” – Jo Ann Barefoot, CEO at Barefoot Innovation Group and Cofounder at Hummingbird Regtech

“What started as a trickle last year will become a steady stream, as banks of all sizes announce they are ripping out their 25-year old core systems in a continued effort to become more modern, non-siloed digital banks.” – Don Bergal, CMO at Avoka

“The five year trend of declining deposit growth for community and regional banks will continue through 2019, as will loan originations. This will increase M&A activity as this ‘hides most bad news’, or at least defers it till a later time.” – Peter Harvey, CEO of Intelli-Global

“From fresh products and services to marketing automation, we’ll see a commitment to, and a budget for, adaptation. Even the smallest institutions are understanding that the risk of inaction far exceeds the risk of trying new things.” – John Waupsh, Chief Innovation Officer at Kasasa and author of Bankruption

“In 2019, it will be cut, cut, cut. Expect to see banks focus on operational efficiencies, headcount reductions, and branch closures. Unfortunately, innovation and customer experience are going to take a vacation.” – Steven Ramirez, President of Beyond the Arc

“Fintech has adapted to the mobile arena thereby making it much easier for hackers to leverage their way in. Cybercrooks will be at the forefront, developing new threats to target the integration with the banking systems.” – Shira Rubinoff, president of SecureMySocial and Prime Tech Partners

“My prediction is, I predict nothing. I have no idea what will happen with Brexit, or with Open Banking. I have no idea which bank will suffer an IT meltdown or whether AI will offer us better choices and more informed decisions rather than just offer a quicker more efficient way to enforce stagnate biases and beliefs. Predictions that paint a future few want get dismissed, rather than spur strategies to combat it. Predictions that promise too quick results or a utopia lead to opinion pieces about ‘failure’ and unfulfilled promises.

I predict people will keep fighting the good fight – inside banks, alternative financial institutions and new challengers. I predict money will still move around the world in a fragmented and disjointed, but still strangely efficient way. I predict we will still buy stuff on Amazon and walk down to the grocery store for milk. I predict many people will work on products and projects that will fail and many more will work on projects that quietly succeed and make work and financial services and technology better. I predict nothing, except the inevitability of tomorrow.”

– Liz Lumley, Director of FinTech and Content at VC Innovations & FinTECHTalents

Trend #1: Expanding the Use of Data and Analytics

The combination of new technologies and the ability to access and leverage real-time data allows financial institutions the opportunity to create personalization — at scale — for each individual at the right time, and with the right message.

Consumers no longer shop for a new financial institution by visiting branches, collecting product brochures and sitting down with a platform employee. Today, the vast majority of consumers do their shopping for alternative financial providers online — on a PC or a mobile device.

When consumers are looking for their new account, they are using a comparison tool that helps them determine which account best meets their needs. Ideally, this tool allows them to weigh the new options against the account they currently have, so they can see what’s similar and what’s different. After the new account is opened, consumers receive a very quick email or text thanking them for their business and helping them understand the best way to start using their account.

This assumes that the financial institution they select allows for end-to-end digital account opening, identification authorization and funding. Far too many organizations don’t provide this level of digitalization today.

It is important to make the use of data and advanced analytics a priority and develop a strategy that works from a strong foundation. Establishing a data strategy doesn’t have to take weeks or months to develop — just a deliberate top-management decision to create a path to more personalized customer experience. Most financial institutions should start making personalization work quickly with what they already have. In other words, launch an initial data and analytics pilot in days, without striving for perfection.

Building a strong personalized marketing platform at scale is a challenge with tremendous opportunities. Financial institutions that deliver customers timely, relevant, and personalized messages, however, can build lasting loyalty and significant revenue growth.

Insights from the 2019 Crowdsource Panel

“Data has long been both a competitive advantage and an acutely untapped opportunity for most banks. As they continue to grow their data capabilities in 2019, we’ll see significant advancements in the integration between their data architectures and their marketing technology stacks, leading to client experiences that are much more personalized, relevant and synchronized across channels.” – Nick Bilodeau, Head of Insurance in Canada for American Express

“2019 will be the year that we witness AI moving across the entire vertical of the financial services sector including using face recognition technology for regulatory requirements (KYC) to virtual agents on the front-end customer service side. We are likely to witness continued evolution of the digital (and invisible bank) as improved mobile devices later in year encourage greater usage of payment by face and other personalized digital interaction with the bank facilitated by AI becoming the norm.” – Imtiaz Adam, CEO at Deep Learn Strategies

“Organizations must focus on relationships and brand trust in order to build brand awareness and consideration. Combine this with the fact that people are putting more trust in others they know and authentic content, as opposed to brand content and ads. Organizations will advance with combining historical data, with more sophisticated AI learning, to assist with generating relevant content.” – Danielle Guzman, Global Head of Social Media and Distributed Content at Mercer

“2019 will be the year that machine learning and artificial intelligence really begins to make a difference — not just in bank efficiency but more importantly in the customer experience. The cost and ease of implementation has decreased dramatically, putting technology within reach of even smaller financial institutions. One place where it will be most apparent is in small business lending, where automated ‘near instant’ decisions will become the norm for the majority of loans.” – David Kerstein, Founder of Peak Performance Group

“I see tech being able to get banks to adopt ‘autonomous banking’ where we can only ask Alexa how much money we’ve spent at Starbucks for so long. That’s interesting – but not useful. What’s more useful is actually predicting what I will spend, and how much I will spend — and make it so that I don’t overspend.” – Theodora Lau, Co-founder of Unconventional Ventures

“Banking should not be thinking about a specific technology like artificial intelligence, augmented reality or blockchain. To succeed in 2019 and beyond, financial institutions must mix technologies to provide unique value propositions to customers.” – Spiros Margaris, Founder of Margaris Ventures

“Not just for the big banks anymore … we will see more smaller financial institutions embrace data/analytics to better understand their customers and create complimentary digital platforms to attract deposits and extend their geographic reach.” – Joe Sullivan, CEO of Market Insights, Inc.

Trend #2: Removing Friction from the Customer Journey

The banking industry continues to talk about ‘customer-centricity’ and ‘improving the customer experience’, but most organizations have had difficulty breaking down product silos or leveraging internal data to deliver a contextual digital experience. Long-term sustainable growth in the banking industry seems only possible with a radical departure from a sales and product obsessed mindset to one of genuine customer centricity, and further rationalization of strategies to target the right markets, customer segments, and solutions.

According to the Digital Banking Report, the objective of delivering a positive customer experience has become secondary to other bank priorities, resulting in a transactional banking relationship with the consumer. For financial organizations to change this dynamic, and meet the evolving needs of today’s consumer, there are five areas that have emerged as crucial priorities:

- Move the focus of digital engagement from cost reduction to experience enhancement.

- Leverage advanced analytics, machine learning and contextual engagement to provide a highly personalized experience.

- Allow the consumer to engage with their bank on the channels they prefer at the times they want to engage.

- Transition advisory and sales activities from being reactive to being proactive.

- Engage end-to-end throughout the customer journey, from shopping to account opening, to onboarding and through relationship expansion.

As the banking industry responds to the “Age of the Individual”, big data and advanced analytics will define the winners from the losers. It is critical for banks and credit unions to deliver on the personalization promise to win the battle of having the best customer experience.

As stated by Ron Shevlin from Cornerstone Advisors in his contributed article, “It’s time to downplay customer experience improvements and up-play product reinvention. Banks can no longer afford to let their products be the horse and buggy of the 21st century.”

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

Insights from the 2019 Crowdsource Panel

“In 2019, we’ll see banks and credit unions evolve their digital transformations into a human banking approach that focuses on experiences rather than simply selling products to their customers. For example, a human-centered bank won’t just provide a mortgage for a customer who is purchasing a house across the country. They’ll help streamline the entire moving experience by connecting the customer with an ecosystem of partners ranging from moving companies to health care professionals in their new area. Unified data and intelligent insights will power this transformation, which depends upon deeply knowing customers’ finances, goals, and relationships.” – Rohit Mahna, SVP & GM Financial Services, Salesforce

“Increased competition and an accelerating M&A pace will favor those institutions that deliver the best customer experience, dialed-in for each segment of their base, delivered consistently across all products, services and channels — how, when and where their customers desire.” – Jana Schmidt, President of Harland Clarke

“In 2019, banks will embrace a hybrid workforce strategy — offering conversational self-service to customers across channels, and seamlessly connecting to human employees as needed to handle complex questions and concerns, leveraging AI and automation to improve efficiency and customer experience.” – Jenni Palocsik, VP of product strategy operations at Verint

“After several years working on digital transformation, banks now are finally ready to jump into the ‘genuine value banking’, where customers find once again a trustful partner.” – Maria Jose Jorda Garcia, Chief Innovation Officer at BBVA Microfinance Foundation

“Real-time digital customer engagement will continue to be a key focus for financial organizations in 2019. The processes, tools, and algorithms required to measure customer satisfaction will need to mature beyond trailing indicators such as Net Promoter Score and voice-of-customer surveys. Investments in sophisticated customer intelligence systems will prove to be critical to delivering service excellence at scale.” – Craig McLaughlin, President of Extractable

“More community bankers will realize that they can accomplish digital transformation without surrendering human connection, which is, after all, their primary differentiator. More tools and partnerships will be available to help them achieve personalization with customers in digital space.” – Joe Sullivan, CEO of Market Insights, Inc.

“Creating a great client experience will become the mainstay in 2019, whether through the physical or digital channel. A bank that does not create a holistic approach to the client experience will not be able to compete.” – James Anthos, previous SVP and Director of Strategic Planning at BB&T

“The digital technologies and ‘network effect’ cause a dramatic change in the traditional banking paradigm — ‘transactional banking’ is disrupted by ‘experience banking’. The future KPIs should focus on experience-related metrics rather than selling-centered ones to avoid millions in losses over the long term.” – Alex Kreger, CEO of UX Design Agency

“Financial wellness will become the new digital engagement strategy. FIs will start implementing a new set of financial wellness strategies that will move from making consumers aware of the financial picture to one that offers real-time digital advice and guidance.” – Tiffani Montez, Senior Analyst at Aite Group

“In 2019, we will see financial institutions moving from the traditional product and service offering — one size fits all — to a truly hyper-personalized type of banking, where banks provide customers with tailored products that better fit the customers’ short and long-term goals. All this heavily powered by big data and ML/AI.” – Sofia Flores, Product Manager for Retail Banking at Backbase

“Smart technologies, processes and enablement will provide a giant leap forward — not the usual incremental gains — in personal and automated client experiences.” – Chris Fleischer, Director at Fiserv

“2019 will be the year in which rate takes a back seat to other relationship drivers, such as customer experience. Net interest margin pressure is extraordinary and rate is not sustainable as the sole basis for competition.” – Rick Spitler, Co-CEO of Novantas

Trend #3: Expanded Use of APIs and Open Banking

Open banking provides both a threat and opportunity for financial institutions in the future. Banks and credit unions can either sit on the sideline, or leverage the power of open APIs to compete with both small and big fintech providers. This is a global requirement that extends beyond those regions where regulations regarding open banking and shared APIs have been implemented.

Regulations around open banking, like Europe’s PSD2, will soon prove to be a boon for technology giants like Google, Amazon, Facebook, Apple and other tech giants — providing wider access to consumers’ financial data (currently held by banks) and allowing these firms to restructure their marketing strategy towards product/service expansions. With consumers in their 20s and early 30s becoming more and more receptive towards banking services offered by non-financial services companies, open APIs come at an opportune moment for these tech giants.

Third-party service providers accessing banks’ financial data may pose a threat for banks. For example, by using the customers’ data they can offer real-time finance management services, which traditional banks have been slow to embark upon.

However, banks can turn this threat into opportunity through careful positioning and should avoid turning their back to initiatives like open banking APIs. Rather than making room for fintech firms to innovate, banks and credit unions should capitalize on this opportunity to infuse innovation with their existing range of products.

In the end, preparation for the future of open banking will pay off and potentially protect legacy financial organizations from some competitive threats that are already advancing on their prime customers and members.

Insights from the 2019 Crowdsource Panel

“As the U.K. bank ‘remedies’ regime evolves and PSD2 hits in September, the coming year will demonstrate clearly what many of us have been postulating for some time: ‘That open banking is a much bigger deal than you think’. It’s not about account aggregation and dashboards, it’s about shifting the balance of power away from the banks in an always-on connected society.” – David Birch, Global Ambassador at Consult Hyperion

“In 2019, banks will be focused on two decisions that will be pivotal to their future business model – their level of autonomous banking and their degree of participation in or construction of an ecosystem model.” – Nicole Sturgill, Principal Executive Advisor at CEB, now Gartner

“Open Banking will continue to wither on the vine with little to no consumer value being recognized from aggregation services. A paradigm shift is needed in how we think about open banking. The value resides in the underlying API economy, still under-looked in much the same way as blockchain ledger technology was when we all marveled at bitcoin.”

– Daryl Wilkenson, U.K. Managing Director and Global Digital Lead at United Outcomes

“Open Banking will lead banks to open their IT infrastructures to third-party providers, fostering innovation and partnership with fintech firms and creating a friction-less banking experience for even more demanding customers. This can translate into new sources of revenues and great customer experience.”

Antonio Grasso, founder of Digital Business Innovation Srl

“Open banking will result in a growing ecosystem outside banks with traditional banks losing their unique identity. My (hidden) champions in this ecosystem will be voice, digital assets and tokens.” – Andreas Staub, Managing Partner at Fehr Advice

“With the European Banking Authority’s Strong Customer Authentication requirements due to come into effect in September, 2019 looks to be an important year for PSD2 and adoption of Open Banking. It will also be interesting to see if merchant payments are going to start migrating to account-to-account rails, particularly in markets where cards are strong today.” – Zilvinas Bareisis, Senior Analyst at Celent

Trend #4: Improving Multichannel Delivery

As banks and credit unions around the world retool their branch experience for the digital age, many are pouring more tech into their brick-and-mortar environments. But such digital investments might do little more than simply delay the physical delivery network’s eventual obsolescence.

As has been stated frequently, becoming a digital organization goes beyond simple redesign or replacing tellers with technology. A digital branch network requires a complete rethinking of digital delivery and how the branch works with other channels. It requires much more than replacing paper. Entire processes must be rethought, with the development of a personalized customer experience at the forefront.

The goal should be to migrate more than 90% of simple customer activities to assisted or self-service formats, while having 90% of employee time spent on targeted, analytics-driven activities. Technology in the branch will assist both the consumer and the employee, with new data sets available that will reduce misappropriated resources.

The financial impact of transformed branches will include human cost savings from transaction migration and the real estate cost benefit of smaller branch footprints. At the same time, new analytics and targeted communications will improve sales results.

Once all of the processes are optimized for digital delivery, consumer insight should then be leveraged to determine the number, size and location of physical branches. Not the other way around. While the result will not be the “death of branches”, the need for branches in the future will be significantly less than today.

Insights from the 2019 Crowdsource Panel

“High performing institutions will be focused on ‘audience-of-one’ highly personalized relationship marketing programs to their customers. Relevant, timely and actionable pieces of multi-media content delivered via a personalized URL (PURL) will be the next big trend in digital marketing.” – Scott Hansen, Chief Marketing & Strategy Officer at Harland Clarke

“To remain viable, financial services brands will dramatically increase their investments in sophisticated platforms that orchestrate the continuous delivery of personalized experiences — through digitally-empowered relationship managers, automated customer care centers, and AI-driven self-service interfaces.” – Wilson Raj, global director at SAS

“As adoption of remote channels becomes more reliable and less complex, digital and in-branch experiences will become increasingly similar and interchangeable, with potentially less dependence on in-branch banking. In order to do this, banks must invest in innovative cutting-edge technology to give customers the same experience when banking in person as remotely.” – Bill Safran, CEO of Vizolution

“Financial institutions will re-think their approach to ‘branch transformation’ to be more about the customer journey and less about implementing self-service technology. Consumers still use branches — they just use them differently. But when they drive to a branch, park their car, and walk in they still want personalized service, not just another automated alternative. We need to use technology more to support front-line staff in providing advice and support, not just providing another alternative to what can already be done on mobile apps or the internet.” – David Kerstein, Founder of Peak Performance Group

“Customer preference for full self-service will result in more banks enhancing their mobile capabilities to stay relevant in 2019 and beyond. In addition, competition for deposits will heat up significantly driving banks to increase rates.” – Alpine Jennings, Director, Product Management at State Farm Bank

Trend #5: Building Fintech Partnerships

The banking ecosystem is in a state of transformation. New fintech entrants are coming into the marketplace regularly, while traditional providers are trying to adjust to the realities of digitalization, advanced technology and increasing consumer demands. Traditional financial institutions and fintech firms now understand that collaboration may be the best path to long-term growth.

Understanding the opportunity for collaboration with fintech firms and being able to take action on this opportunity are not the same thing as traditional banks and credit unions hope to jump-start innovation. Between differing cultures, vastly different infrastructures and an ever-changing compliance playing field, collaboration between banking and fintech is far from simple, derailing many proposed partnerships.

The rationale for any strong collaboration is the ability to bring a synergy of strengths together that create an entity stronger than either individual unit could bring on their own. For most fintech organizations, the primary differentiators are an innovation mindset, agility (speed to adjust), consumer-centric perspective and an infrastructure built for digital. These are obviously advantages that most legacy organizations don’t possess.

Alternatively, most fintech organizations lack the ability to scale adequately due to brand recognition and trust. They also usually lack capital, knowledge of compliance and regulations and an established distribution network. These are inherent strengths of traditional banking organizations.

The real goal for banks and credit unions is to find the right mix of fintech solutions and traditional banking. Play to the tried and true strengths of each type of organization while also opening up to new opportunities to access tools that will empower consumers and reinvigorate marketing opportunities.

Insights from the 2019 Crowdsource Panel

“As mobile banking matures and commoditizes, banks find it getting difficult to differentiate through digital experience. Many will re-focus on branches hoping to differentiate with human touch. Others will seek to provide innovative services by integrating with non-banking fintech partners.” – Danny Tang, Worldwide Channel Transformation Leader, Global Banking at IBM

“Community financial institutions will face expansion in net interest margins in the next 18 months. Innovative fintech firms will focus on acquisition and analytical tools to better retain and gain deposits for partner traditional banks of all sizes.” – Tom Shen, advisor for Malauzai Software

“Large financial institutions will continue to stretch their asset dominance in the U.S. through solution acquisition, digital product offerings, hiring talent, and strong tech partnerships. The super regionals and top 100 banks will look to partner with fintech firms to build offerings specific to their customer needs. The smaller banks and credit unions will face even more of a technology product gap and have to look for unique engagement/joint product offerings in order to compete.” – Sam Maule, Managing Director, North America at 11:FS

“The fintech ecosystem will go inclusive, vertical and (even more) collaborative in 2019. There will be a number of adjacencies crossing the fintech space, with the B2B (corporate), pension and wealth management, and the real estate world bringing additional opportunities for new business models and innovation.” – Matteo Rizzi, Co-Founder of FinTechStage Limited

“P2P lending and investment platforms will be tested as the economy starts slowing down. The question always was if fintech newcomers will be able to weather the recession. When the music finally stops playing, we’ll see who is left standing.” – Alex Nechoroskovas, Founder of Fintech Summary

“There will be some fintech firms that will continue to survive on their own, but there will be a lot that will not be able to succeed without partnerships. When we think about some of the challenges that fintech firms will have, it will continue to be things like scale and distribution, which they can get through partnerships.” – Bill Sullivan, Vice President – Global Head of Financial Services Market Intelligence at Capgemini

“We will continue seeing what I call ‘the complete open sourcing of financial services’ through apps, APIs and analytics. The front office relationship is in an app, the middle office processing is through an API, and the back office is all about analytics. And all of this will be done by a lot of specialist fintech companies that have narrow focus.” – Chris Skinner, CEO at The Finanser, Ltd.

Trend #6: Expanding Digital Payments

Digital payment trends have consistently been ranked in the middle of annual projections. During most years, the payment space has changed less than anticipated. The long-anticipated surge in mobile wallet usage seems to be underway, though, as more consumers are reaching for their phones instead of their wallets to make payments.

While financial marketers can’t do much to move the needle with regard to merchant acceptance of mobile wallets, people are beginning to demand this functionality. What banks and credit unions can do is change their communication of the benefits to pay with a mobile phone versus a credit or debit card. This communication cannot be left to a one-time communication — it must be reinforced over and over again in all channels.

With acceptance of mobile wallets gaining momentum, changing consumer behavior becomes more important than ever, whether the shift is from plastic to mobile, or to your payment option as opposed to your competition. Look at the amount of marketing the biggest financial institutions employ to promote the use of their mobile wallet. Look at American Express.

Financial marketers face a classic “limited-time opportunity” here. Those large players are spending money now because changing consumer habits is easier now than it will prove in 12-18 months.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Insights from the 2019 Crowdsource Panel

“The key for payments in 2019 and beyond will be anticipating what comes next, adapting to changing consumer expectations, and offering connected, intuitive experiences. Financial Institutions will continue to plant a flag in new payment options, which will result in new business models and segments of clients. As these payment options evolve, speed of payment and the use of data will continue to be critically important as a focus on owning the payment relationship. Done well, these things will solidify the financial institution as a trusted advisor for the consumer’s financial assets.” – Matt Wilcox, SVP, Marketing Strategy and Innovation at Fiserv

“Since alternate and instant payments are evolving, transaction fees are getting lower and lower. Banks will soon no longer be able to generate enough revenue from transaction banking. Going forward, there will be a need to transform the business and create new types of products and services with added value for the customers. The stage of being competitive by digitalizing existing physical banking services is over. It’s time for complete digital business and payments transformation.”

– Barbara Biro, Digital transformation, alternative channel & digital payments consultant

“2019 will see the continued consolidation of the European payments industry and the emergence of a truly European payments market.” – Ron van Wezel, Senior Analyst at Aite Group

“Faster payments will reach critical mass in 2019 as more banks, credit unions and financial services providers launch real-time P2P. Real-time payment providers like TCH, Early Warning and others will also see increased interest in their offerings as gig economy startup companies launch innovative new services that allow consumers to get access and transfer money ubiquitously reducing friction.” – Deva Annamalai, Director, Innovation and Client Engagement at Fiserv

“With payments and all banking services, organizations will strip away focus on products, allow for the pure bank utility to emerge, and build for consumer behaviors. Those organizations that eliminate the internal product silos will strip away the friction, improve the customer experience and win the battle for tomorrow’s consumer.” – Brett King, CEO and Founder of Moven and author of Bank 4.0

“The year 2019 will be see the acceleration of financial inclusion. In 2017, 1.7 billion adults (31% of adults) lacked an account according to The World Bank. The good news is that two-thirds of them have a mobile phone. Traditional and non-traditional financial organizations that aggressively leverage mobile money applications will see enormous success.” – Sebastien Meunier, Senior manager at Chappus Holder & Co.

“The first U.S. bank will trial some kind of payments functionality with smart cars, as the death of the physical plastic card enters its final phase.” – Bryan Yurcan, Senior Strategist at Caliber Corporate Advisers

Trend #7: Investing in Innovation

The banking industry is beginning to incorporate the traits and practices that were once the domain of fintech startups. Banks and credit unions have become more comfortable with a faster pace of innovation, using data and analytics more extensively and digitizing processes as opposed to simply turning paper into PDFs.

This increased commitment to innovation in response to consumer expectations and increased fear of non-traditional players are two of the primary findings of the 10th annual Innovation in Retail Banking report, published by the Digital Banking Report.

The report found a trend away from innovation to “save money” to an increasing focus on improving the consumer experience. With banks providing client access, industry expertise and ready-made infrastructure, fintech firms are bringing innovative solutions, new uses for technology and agility to the table.

Combining the power of traditional banks with the dynamic potential of fintech firms has changed the game in banking. More than ever, we are realizing that innovation in a digital world requires cultural change. Financial institutions must grow comfortable with new ways of delivering their services and organizing as a business.

To move forward at the speed of change will require a doubling down on providing a culture of innovation throughout organizations, combined with a willingness to embrace change, take appropriate risks and disrupt what has been the norm in the past. This requires getting out of our comfort zone and finding a way to serve the consumer in the way they are being served by big tech alternatives.

Insights from the 2019 Crowdsource Panel

“2019 is the year that ‘innovation’ as a means of creating enterprise value is added to everyone’s job description. Not just the board or the C-Suite. Not just the cool kids in the hoodies and jeans in the innovation lab. And certainly not just the outside consultants. It’s time for everyone to find new ways of creating real value for customers, shareholders and communities.” – JP Nicols, Managing Director at Fintech Forge

“With continued record levels of data breaches, identity fraud and paralyzing customer fear, associated industry technology spend will finally lead to breakthrough improvements in cybersecurity. New pinpointed methods will emerge for assessing how particular data compromises increase risk in order to better inform investments that can finally strengthen relationships and everyone’s bottom line.” – Jim Van Dyke, Founder and CEO of Futurion.Digital

“The new year will mark the beginning of ‘doing’ instead of ‘talking’, as banks and credit unions begin to truly develop a variety of innovative products/services that put the ‘client-first’ instead of their own interests. No more ‘one-size fits all’ marketing plans to support this seismic change.” – April Rudin, Founder and CEO at The Rudin Group

“The banking industry will finally be required to justify their innovation efforts with tangible results. Attending flashy conferences, building innovation spaces with inspirational quotes on the wall and bean bags for seating, and meeting with startups that don’t ever lead to partnership will all be on the chopping block if they don’t have demonstrable results.” – Jason Henrichs, Managing Director at Fintech Forge

“Digital commerce platforms such as Amazon and Alibaba are likely to emerge as clear innovation leaders by 2022. Consumer technology companies such as Google and Apple come a close second. The growing realization that the biggest threat for banks comes not from within the industry but from new players with advanced digital capabilities in critical areas of competitive differentiation is making banks notch up their innovation efforts.” – Sanat Rao, Chief Business Officer and Global Head at Infosys Finacle

Trend #8: Greater Impact of Challenger Banks

While the perception of fintech start-ups as a threat has gone down, the biggest perceived threat now is from technology firms, new challenger banks and existing large incumbent banks. The increase in perceived threat from challenger banks has risen in each of the past three years, fueled by significantly more accommodating regulations in Europe. The increase of threat from technology firms is led by the perceived threat from Amazon.

The threat from challenger organizations such as large tech firms and challenger digital banks is driven by the increased acceptance of using non-traditional financial institutions by consumers.

In response, many legacy banks are launching challenger brands themselves. We predict that many new banks will launch challenger brands in 2019 and beyond, creating a nimbler entity with which to prosper in the digital age.

Insights from the 2019 Crowdsource Panel

“Two things will happen to challenger banks in 2019: First, they will graduate from being start-ups and move into the grown-up marketplace, gaining meaningful market share. Second, this will lead to growing pains that the incumbents are all too familiar with. They will discover that even challenger banks can be challenged by their IT architecture! Challenger banks will find that without transparency and a reduction in complexity, their pace of innovation will be dulled.” – Laura Crozier, Global Industry Director, Banking at Software AG

“Within the next five years, the majority of new bank accounts will be issued by challenger banks. Over the past handful of years, the foundation has been established, as challenger banks have slowly siphoned away customers from traditional banks, attracting a younger and more diverse client base with mobile apps and ease of access, as well as lower fees and better rewards.” – Jason Gardner, Founder and CEO of Marqeta

“The future profitability of banks and credit unions can be predicted by their capacity to attract, engage and retain Millennials. In 2019, many players will experience their ‘youthquake’ as Millennials put more trust in non-traditional tech players” – Rocky Scopelliti, Director, Center for Industry 4.0 at Optus

“Congressional Democrats, mentored by Sen. Elizabeth Warren, will demand that federal regulators, including the Fed, promote more competition, pointing to the U.K.’s Financial Conduct Authority as a model. Results against the political power of the big banks will be limited.” – Tom Groenfeldt, Writer for Forbes

“The entrance of foreign neobanks (like N26 and Monzo) along with increased competition for deposits from existing online-only banks, will prompt smaller institutions to explore launching their own digital-only brands. A few will succeed. Most will arrive too late.” – Jim Perry, Consultant and Strategist for Market Insights

“2019 will be the year that a significant competitive threat comes from way out of left field. The fintech charter may be a catalyst, but I suspect the form of the new competition will be a surprise.” – Steve Cocheo, Executive Editor at The Financial Brand

“Despite the huge investment banks are continuing to make, most will still struggle to shift to new business models so we’ll see an increasing number of ‘greenfield’ or ‘beta banks’. This approach helps banks to more rapidly pursue and prove new business and operating models.” – James Haycock , Managing Director at Adaptive Lab

“In emerging markets, new digital financial players like Ant Financial (Alipay) and Tencent (WeChatPay) will expand and challenge banks. Fintech firms will continue to change the financial landscape as regulators open markets via regulatory sandboxes.” – John Owens, Senior Advisor for Digital Financial Advisory Services

Trend #9: Exploration of Advanced Technologies

The scope and speed of evolution in regulation, customer behavior and technology — coupled with the emergence of new competitors — mean that the future of banking will not be a continuation of the past. New technologies will transform banking as we know it, providing both opportunities and challenges for financial institutions.

Many of the new technologies that are threatening the banking industry also present significant opportunities. In fact, those organizations that can leverage big data, advanced analytics and new technologies to improve the customer experience can build trust, loyalty and revenues that are the keys to success in the future.

As opposed to technology taking a secondary position, supporting only the processing of transactions, future technologies will be more customer-centric and efficient, and provide more targeted, secure and intelligent solutions. With technology as the driving force in the future, organizations will be able to redefine themselves to be more competitive and responsive to marketplace needs.

As quickly as past technologies have become the norm, a new wave will combine digital technologies and the power of data to set new standards. The prioritization and investment in each of these technologies will vary based on the business model and strategic goals of each organization. For instance, while the marketplace as a whole does not foresee investing much in blockchain technology, the financial services industry ranks this as a high priority.

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect. Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked. Read More about The New AI: A Banker’s Guide to Automation Intelligence

Why Industry Cloud for Banking?

The New AI: A Banker’s Guide to Automation Intelligence

Insights from the 2019 Crowdsource Panel

According to David Gerbino, Principal of @dmgerbino consulting and consultant at Beyond the Arc., “Forward thinking banks and bank venders will begin to deliver on the power of the voice as an enhancement to the user experience for both bank customers and bank employees across many services. Multimodal voice-powered mobile and web apps will be joined by multimodal smart devices powered by Amazon’s Alexa, Google’s assistant, and other leading voice technologies.”

“As banks continue to focus on improving their customer digital experience, they are finding limitations from their legacy technology capabilities. In 2019, we’ll see renewed efforts to apply digital technologies to address these issues. In particular, machine learning, robotic process automation, and cybersecurity will be areas of increased funding. The era of standalone capabilities for single systems will also begin changing. This includes enterprise-wide fraud, identification, authentication, signature, and underwriting capabilities.” – Alex Jimenez, VP and Senior Strategist at Zions Bancorporation

“More early adopters will move out of pilot and into production with vrtual banking assistants, available through conversational interfaces. Digital banking platform providers will begin to offer virtual banking assistants as add-on features.” – Keith Armstrong, Co-Founder of Abe AI

“As earnings pressures build in 2019, there will be a shift in digital priorities — with less focus on CX improvement and more focus on driving efficiencies across the business via robotic process automation, AI, chatbots, digitized lending platforms, etc.” – Mary Beth Sullivan, Managing Partner of Capital Performance Group

“In 2019, we will see 5G Mobile technology deployed at speed, scale and impact globally. As with any technology that is 30 times faster than its predecessor, it will be more disruptive to banking than what 4G was through transforming the industry to a mobile-first financial services world — and it will happen in a third of the time” – Rocky Scopelliti, Director, Center for Industry 4.0 at Optus

“Banks will increase the study of quantum computing. Although it may take several years to deploy it in real business, these organizations will need to understand the impact of technology on areas like cryptography well in advance to plan their future infrastructure.” – Makato Shibata, Previous Head of Global Innovation at Bank of Tokyo-Mitsubishi UFJ

“The exponential changes that tech breakthrough has brought about has placed the customer in the driving seat, much more so than ever before. This is truly the Age of the Customer. In this new environment, integrated CX journeys, leveraging different tech offerings (chatbots, blockchain etc.) will definitely be an emerging trend to be reckoned with.” – Helene Li, Co-Founder, GoImpact

“The focus in the future will be on improving customer engagement through AI, digital transformation, and an orderly ‘passing of the torch’ to Millennials/Gen Z. However, I expect eking out operational efficiency gains — via bots and other small-scale changes — will be the bigger focus because of recession concerns.” – D. Scott Andrick, Sr. Director, Industry Principal – FS Sales and Marketing at Pegasystems

Trend #10: Finding and Training New Talent

With unemployment in the U.S. reaching near historic lows, financial institutions are struggling to fill critical positions essential to their digital transformation strategies. Demand for talent now outstrips supply when it comes to openings in several key roles, from data analytics and user experience (UX) design, to artificial intelligence (AI) and software engineers. Sure, there may be lots of IT talent out there, but those people aren’t lining to take a job at your local bank or community credit union. They are knocking on doors at Google and Amazon — hot companies with deep wallets.

According to the research done for the 2019 Retail Banking Trends and Predictions report, close to four in ten organizations are concerned about job loss caused by technology and automation.

Finding the right people to drive and implement innovation will continue to be a challenge according to our research. As a result, the need to partner with outside organizations continues to be a primary focus, followed by training current employees or hiring in the traditional manner. Using innovation events like hackathons was seen as the least likely source of finding talent over the next three years.

Another option is to pull smart, ambitious employees who are interested in pursuing an IT career from other areas of the organization and get them into a formal training and certification program. The rationale? It’s easier to teach someone the tech skills they need than it is to find someone willing to work in banking. If you can convince someone to work in the financial industry, the hard part is over.

Insights from the 2019 Crowdsource Panel

“Ongoing efforts to change banking culture will begin to gain traction; a changed mindset of customer centricity will move out of the C-suite to unify the front lines of business and technology, presenting a significantly improved customer experience.” – Dan Latimore, SVP of Banking at Celent

“Instead of MBAs and traditional bachelor’s degrees, banking organizations looking for the brightest will look at those who self-learn through nanodegrees (behavioral science, data analysis, etc) or opt for informatics to solve real problems. Commitment and buy-in is already part of these individuals’ make-up. Less time will be spent on executive search for these individuals through traditional firms, with more time spent on direct connect via social channels and smart leaders.” – Lisa Kuhn Phillips, VP at Allied Payments Network

“Banks will continue to increase recruitment of technology specialists in 2019 as they rush to fight rising competition and find new sources of talent. Banks will increasingly be engaged in a ‘war for talent’ as they are forced to compete with big technology groups in addition to traditional rivals in the financial services industry.” – Eduardo Roma, a partner at Bain & Company

Regarding the use of social media, Jay Palter, Chief Engagement Officer at Jay Palter Social Advisory, said: “LinkedIn will emerge in 2019 as the most consequential social network for financial businesses, executives and leaders. If you’re not using LinkedIn effectively to stay connected, informed and visible within the ecosystem, you’re leaving money on the table.”

Closing Thoughts – A Digital Future

As we enter 2019, all of the major trends and predictions move traditional banking organizations towards the ultimate goal of digital transformation. The need to ‘”ecome digital” is not a matter of “if”, but “when”. The consumer expects the banking industry to follow the lead of technology and fintech leaders.

Digital transformation in financial services requires a departure from traditional operating models in order to develop hyper-personalized financial products and services. This movement calls for leveraging new technologies to create more frictionless ways of interacting and transacting. This transformation includes the use of the blockchain and the digitization of virtually all back-office processes, all within the constraints of an evolving regulatory environment.

The process of digital transformation is not easy. It requires a shift from legacy IT systems and traditional business models towards integrated, agile, customer-centric processes. Possibly more importantly, this transformation requires a cultural adjustment and mindset shift in application development and data flows. All of this with a focus on quality and compliance adherence, and security protocols to ensure privacy and data integrity.

Since legacy systems are incapable of supporting the future needs of a real-time digital bank, this means that many firms will need to partner with outside organizations to facilitate the innovation and changes needed. Because the marketplace is rewarding digital organizations, there is a greater need to find partners who can provide the solutions that can be implemented quickly and integrated easily. From new products to improved marketing capabilities, sitting on the sideline is no longer an option.

Closing Thoughts from the 2019 Crowdsource Panel

“I see RegTech emerging as one of the largest spaces in 2019, with several firms offering solutions to make managing this complex regulatory environment easier for banks as well as supervisors.” – Devie Mohan, Co-founder and CEO of Burnmark

“2019 could be the year of grave disappointment in finance. The promise that fintech and regulation brought have come and gone, and little has changed to transform banking products into true humanized experiences for the consumer. Technology alone can’t move us along — the answers are not in crypto, open banking, cloud or blockchain, but limited by banks’ capacity for change. This is the limit which we’ve reached for now, and the only compelling promise for real transformation may be an overt GAFA-level entrant attacking traditional banking directly and raising the bar that few can reach.” – Duena Blomstrom, Co-founder and CEO of People Not Tech

“This coming year will see regional, mid-market and community banks scrambling fast to address the gap that has opened between their limited digital customer acquisition journeys and the slick platforms that tier one banks have already rolled out. The panic to attract customers in the digital, mobile-first age has already begun for these smaller organizations, and will only intensify in 2019.” – Don Bergal, CMO at Avoka

“Banks will begin to become invisible in 2019. The idea of completely erasing friction is turning into reality, with technologies automating the historical role of banks and solutions being integrated in the heart of everyday actions (payment) and life courses (real estate purchase, financing of a company, etc.). When all the friction disappears, banks will become invisible and their ancestral model being shaken, even annihilated.” – Jean Baptiste Lefevre, Head of Digital and Open Innovation DX Lab at BNP Paribas

“In 2019, blockchain technology will enable disruption with Security Token Offerings redefining the IPO business. We will also see the creation of decentralized ecosystem platforms powered by smart contracts, opening up innovative new P2P business opportunities that were not possible before.” – Oliver Bussman, CEO and founder of Bussman Advisory AG

Thanks

I would like to thank the members of this year’s crowdsourced panel who accepted our invitation to be interviewed for this expansive annual report. The insight shared was extraordinary, and the continued support of this effort is greatly appreciated.

I would also like to thank the more than 300 banks, credit unions, suppliers and vendors who took the time to help us prioritize the trends from both 2018 and 2019. We know you’re busy, so some special thanks.

I would also like to thank Carol Ryan, Jim Booth, Jeffry Pilcher, Geoffrey Rucinski, Bill Weil and the rest of the Digital Banking Report team for the daily support, inspiration, insights and laughs. My wife, Linda, and son, Cameron, also get a huge thanks for putting up with me daily (it’s not easy).

Finally, and most importantly, I would like to thank the sponsor of this year’s research, Kony DBX. Without their support, this research would not be possible.