As competition for deposits heats up, banks and credit unions in the U.S. will need to take the Hispanic market seriously. According to an in-depth 48-page report from Raddon (a Fiserv company), institutions that take a fresh look at this pro-savings demographic can pick up more market share if they adjust their thinking on banking channels, means of outreach, and product design and promotion.

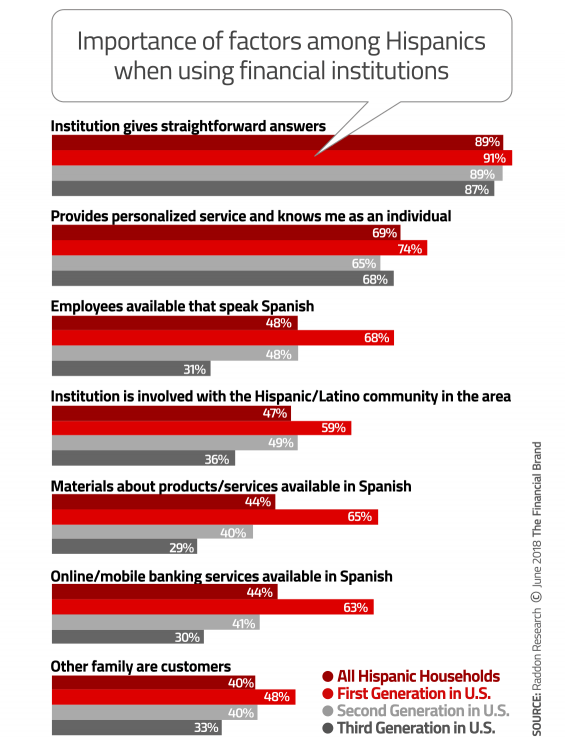

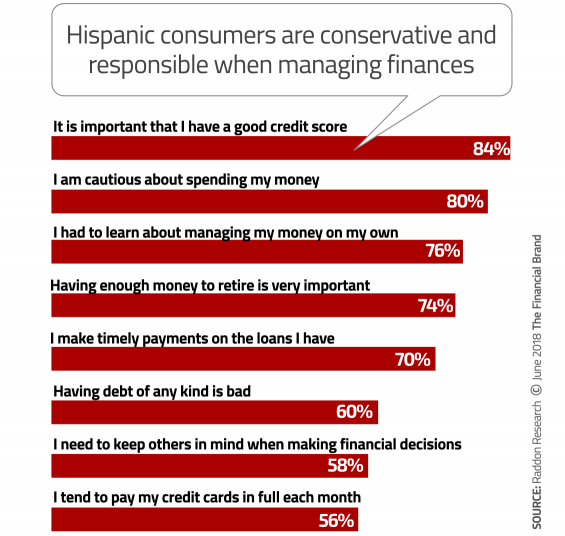

The first thing financial marketers must do is realize that Hispanics come from many different country and cultural backgrounds, with their own subtle differences. Diversity is strong in this group. And being bilingual is only a beginning. Offering Spanish marketing and account materials and bilingual front-line staff remain important overall, but the significance of this decreases with each new generation of Hispanic consumers. Understanding the mindset is as important as language — e.g., they exercise caution in spending, pay debts in a timely way, and often dislike having debt in the first place.

An individual’s generational segment — Boomer, Millennials, etc. — and how many generations someone’s family has been in America have a huge impact on their attitudes, behaviors and preferences related to banking. According to the U.S. Census, “Hispanic origin can be viewed as the heritage, nationality, lineage, or country of birth of the person or the person’s parents or ancestors before arriving in the United States. People who identify as Hispanic, Latino, or Spanish may be any race.” The U.S. Census also points out that Hispanics are the third-fastest-growing group in its tallies, projected to grow steadily so that by 2060 it will more than double, to 29% of the U.S. population.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

According to the Raddon report, Effectively Serving The Hispanic Market, nine out of ten Hispanics are already “banked.” Most Hispanic households (69%) use a major banking institution, but Raddon’s research revealed significant generational differences. Among first-generation Hispanics, major banks have 92% of the share. However, 67% of second-generation Hispanics are with a megabank, 12% with a regional bank, 12% with a credit union, and 8% with a community bank. By the third generation, the mix is more evenly distributed: 59% use megabanks, 14% use regional banks, 15% use credit unions, and 10% use community banks.

Generally, the smaller a bank, the more satisfaction Hispanic consumers reported with their primary financial institution, for a high of 59% “very satisfied” with community banks versus 45% very satisfied with megabanks. Among those using a credit union as their primary institution, more than half (52%) said they were very satisfied.

Read More: Banking Providers Improving Experience For Hispanic Consumers

1. Appeal to Hispanics’ Financially Conservative Nature

Raddon’s research underscores two key characteristics of this growing demographic. One is that Hispanics are more oriented to goal-setting than other Americans. Hispanic’s financial attitudes also tend to skew more conservative than the typical American consumer’s thinking. In addition, while many consumers lean increasingly towards digital access to banking service, Hispanics as a group demonstrate greater demand than is typical for traditional channels such as branches.

Three quarters of the sample told Raddon they’d had to figure out how to manage their finances by themselves. As a result, the report suggests that education from providers would be valued by Hispanics.

Raddon analyst Lynne Cornelison says that first-generation individuals, younger Hispanic consumers, and those who use a major bank as their primary financial institution place the greatest value on financial literacy programs.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

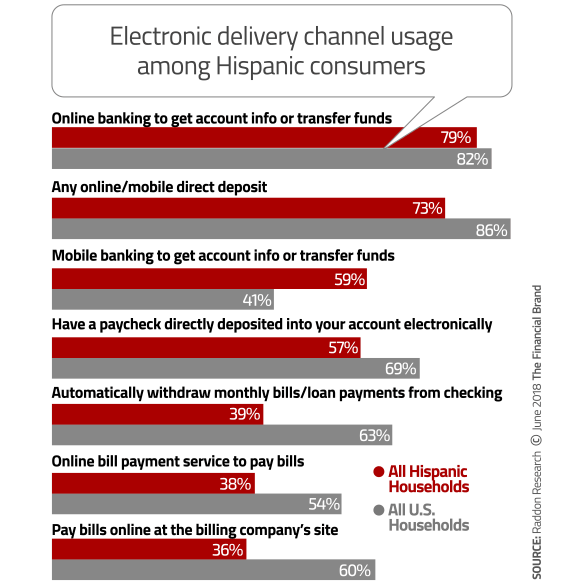

2. Don’t Underestimate the Desire for Digital Banking Tools

Hispanic households are uniquely high-tech and high-touch, according to Raddon. Looking at electronic channels overall, Hispanic households generally rely more heavily on them for information and receiving and transferring funds, and for payments. For instance, 79% of Hispanics use online banking to get account information or to transfer funds, 73% use direct deposit in some form, and 59% use mobile banking for account information or to transfer funds.

Mobility appears to make a significant difference when it comes to paying. Nearly half of Hispanics use person-to-person electronic payments; at 47%, this is more common than among all U.S. households at 41%. PayPal currently reigns among Hispanics for P2P, but nearly one out of three say they are interested in P2P offered by banks or credit unions.

In addition, Hispanics are much more likely than the norm to make mobile payments, with 35% doing so and 42% likely to do so within the next five years. This compares to only 13% of all U.S. households currently making mobile payments and only 12% adopting this channel further on.

Given Hispanics’ comfort with electronic channels, Raddon recommends making them extremely friendly to this demographic group. Financial institutions will also need to focus on providing a seamless experience for this dual-faceted segment.

“To enhance the user experience and ease of use, institutions should consider bilingual access,” the report suggests. “Institutions can also strive to maximize the traffic within these channels with other product and service information that may meet potential service needs.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

3. Strike the Right Balance Between ‘Digital’ and ‘Personal’

Hispanic consumers like digital services, but Raddon’s study also found that Hispanic households perform in-person transactions more frequently than the population at large.

“Hispanic consumers are more likely than the average U.S. consumer to use the branch, and are almost three times more likely to use a grocery store branch,” the report states.

Coupling this with the strong desire to be known as individuals and to receive personalized service, Raddon recommends financial marketers play to those preferences.

“In markets with a large Hispanic population, financial institutions may want to consider staffing their grocery store branches with more proficient employees focused on personal banking, sales, and advisory services as opposed to merely transactional capabilities,” Cornelison says.

She adds that Hispanic customers want to deal with branch staffers that they can view as “trusted advocates.”

Read More: Marketing Tips for Banks and Credit Unions Targeting Hispanics

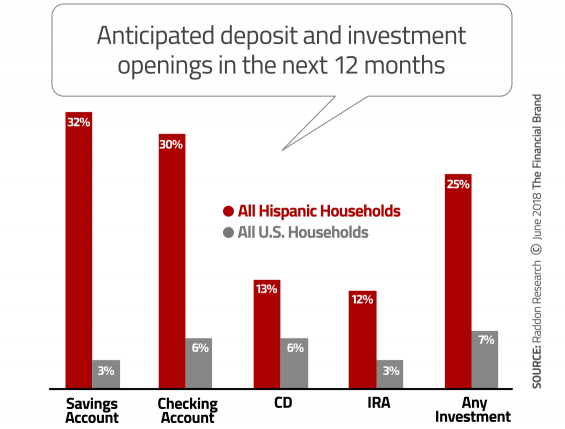

4. Offer Goal-Oriented Hispanics Attractive Deposit Products

The growth potential of the Hispanic market is attractive for banks and credit unions, given their current need to compete harder for deposits and to find fresh sources of funds. Banks and credit unions face a struggle for deposits that many in the business haven’t seen for a decade.

As the chart below shows, Hispanics’ desire to open new savings, checking, CD, and retirement accounts often dwarfs the demand projected among all other consumers.

Regarding retirement plans, fewer Hispanics currently set aside retirement money regularly compared with all U.S. households — 33% versus 41%. (Another 22% put away retirement money whenever they can, slightly ahead of the 19% among all households.) However, the report shows a greater number of the Hispanics who are not saving for retirement now plan to do so compared to the nation as a whole.

The aversion to debt mentioned earlier also plays a part in savings towards two major purchases: homes and cars. Among Hispanics, 52% reported that they could make a 20% down payment on a home — 18 percentage points higher than the rate for all Americans. Hispanics are much more likely to be in the market for cars — 40% expect to be in the market to buy one in the next two years versus 24% of the total population.

The Hispanic market’s emphasis on goals comes through strongly in the report. Hispanics have needs and desires that they are willing to save towards.

“A financial institution will greatly benefit from providing services around financial goal-driven objectives,” the report says, “setting incentives on increasing savings levels, and emphasizing the importance of retirement readiness.”

Author Cornelison recommends educational efforts to help Hispanic customers develop even stronger savings habits in order to increase the dollar amounts they put aside towards goals. One suggestion is playing to this market’s strong interest in emergency savings.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

5. Offer Reasonable Short-Term Consumer Loans

As Raddon sets out in detail, Hispanics have stronger intentions of buying a home in the future than all households. The report also points out that Hispanics most commonly obtain auto financing from dealerships, which means banks that reach out to create awareness of their direct auto loan options may pick up some business from this market.

However, a particular appeal for Hispanics would be short-term installment credit. Raddon’s report illustrates that Hispanics’ use of alternative loans — payday loans, title loans, deposit advances, and other options — is greater than all households. Payday borrowing is twice as common in this segment.

In fact, Raddon found that almost half of Hispanic households would welcome a short-term borrowing opportunity with their primary financial institution. The report adds that seven out of ten said that they have good or excellent credit. Cornelison calls this “a significant engagement opportunity.”

This suggestion comes at a time when the Office of the Comptroller of the Currency has urged national banks to increase shorter-term consumer installment lending.

Tips and Insights for Marketing to Hispanic Consumers

A plus for marketers trying to reach the Hispanic market is that the target audience wants to know more about what banks and credit unions are offering.

“Hispanics are more likely to be dissatisfied with the financial information currently available and to not know what services are right for them,” according to a study by Univision. “The good news for marketers is this has spurred Hispanics into action. Two-thirds of Hispanics actively seek information about financial products and services.”

In fact, the companies’ research indicates that Hispanics are twice as likely to find financial advertising interesting, due to their desire for more information. Two thirds of the survey sample said that using Spanish in the advertising creates “more of an emotional connection.”

Here are some tips for reaching Hispanics from Hilda Marquez of Balcom Agency:

- Go with multiple channels. “Brands often treat the Hispanic market as an extension of their current overall strategy, but the Hispanic consumer deserves to be treated with more attention and respect,” Marquez says. “This means creating an integrated media mix with traditional media as well as digital; broadcast remains a favorite amongst Hispanics when compared to the total U.S. population.”

- Think rifle not shotgun. Marquez says financial institutions should create strategies that are hyperlocal, because market size, purchasing power, age, acculturation, and consumption channels will differ depending on geography.

- Think create — not translate. According to Marquez, developing culturally relevant creative will go further than simply translating creative to Spanish.”

Marketers can’t ignore social media for this group. Here are some key points from a joint report between ThinkNow Research and Mitú, a Latin-oriented media company:

- Hispanics use smartphones and tablets more frequently than non-Hispanic whites.

- Hispanics use Instagram and Snapchat more than other ethnic groups.

- Hispanics are “always on” social media, more frequently than non-Hispanic whites.

- Younger Hispanics (18-34) tend to use social media more heavily, including for seeking brand recommendations.