The buying process and demands of the banking consumer are being impacted more than ever by forces outside of financial services. While smaller fintech competitors are combining the power of data, analytics and digital technology to build more personalized experiences in banking, large non-banking players like Amazon, Facebook, Walmart, Apple and Google are impacting every aspect of the how a consumer manages their daily life.

As brands find new ways to engage consumers beyond traditional commerce interactions, consumers are beginning to embrace new technologies like voice-activated devices, purchasing from search results, and using mobile devices for all stages of the buying process. While these new activities are initially taking hold in the retail industry, they are impacting all industries, as consumers are becoming educated in the benefits of a connected lifestyle.

In addition to becoming accustomed to new ways to connect through voice-activated devices and mobile phones, the consumer is increasingly expecting seamless interactions that result in close to immediate satisfaction. Where in the past, consumers would be patient with the availability of products and services they wanted, the desire for simple purchasing processes and lightning-fast delivery is changing the business models across all industries.

Winners in the future will be expected to have easy buying processes, across multiple touchpoints, using data to improve engagement while not negatively compromising a consumer’s trust. According to the Walker Sands Future of Retail 2018 study, “As the lines between retail and other industries blur, brands and retailers need to transform the commerce experience into a more integrated part of the consumer lifestyle.”

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Death of Traditional Channels

Consumers value their time more than any part of their lifestyle. As a result, there is the desire to own connected devices and engage digitally more than ever. The impact of mass media and offline channels has decreased. Consumers are more connected, digitally savvy and open to a sharing economy than ever before.They are less likely to have a traditional cable package and more likely to have a membership in a streaming service.

Today’s consumer wants to control when and how they make purchases. The purchase may be in a traditional branch or store during normal business hours … or it may be by smartphone in the middle of the night.

Impact on Banking: For the banking industry, these trends increase the importance of developing better digital channel solutions, including mobile banking solutions with an improved UX.

The Need for Speed

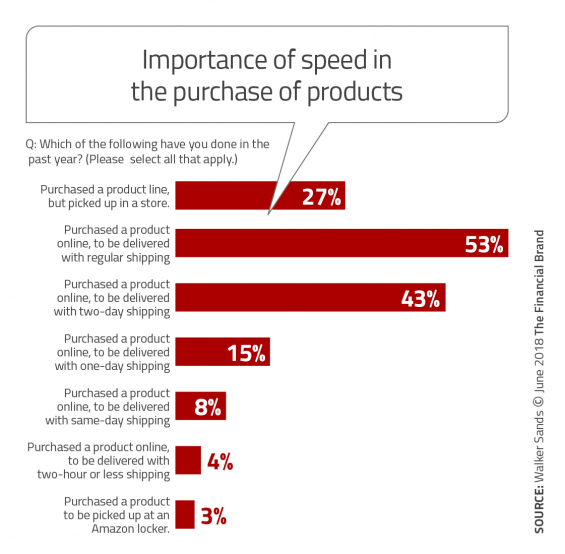

One of the biggest changes in the retail model is the shift towards online buying. According to the Walker Sands report, 7% of consumers ages 18-25 shop online daily, with 6% of consumers 26-35 doing the same. According to Forrester, 98% of adults go online once a day for various reasons. This changes the way organizations in all industries need to support branding and search.

In addition to the channel shift for shopping and buying, consumers value speed. They increasingly expect fast and free shipping as a standard offering. This expectation is strongest with the younger demographic segments. According to the Walker Sands research, 54% of consumers under 25 years of age say same-day shipping is their number one purchase driver followed by next-day shipping.

Impact on Banking: While banking doesn’t ship physical products or need to deal with free returns, the consumer expectation of immediacy goes across industry verticals. Consumers are increasingly frustrated with ‘friction’ in a buying process. This includes long forms, lack of transparency and the inability to complete an entire transaction digitally.

Financial organizations will be expected to provide end-to-end account opening capabilities without the need to visit a branch office. Very soon (if it hasn’t happened already) a significant percentage of consumers will make purchase decisions based on this capability.

Social as a Purchase Channel

Social media is increasing as a commerce channel, but not all social media channels are created equal. “More than half of consumers (54%) report using social media as part of their purchase journey in come capacity, whether it’s to browse, research, gain inspiration or purchase,” according to the Walker Sands report. “As consumers become more comfortable purchasing goods across categories online, they’re also expanding the channels on which they shop and purchase on a regular basis.” Uses of Facebook, Instagram and Pinterest are increasingly becoming a part of the consumer journey.

Impact on Banking: Will consumers become comfortable shopping or buying financial services through social media channels? This question can only be answered through testing by banks and credit unions. Consumer behavior in every industry is changing daily and the benefits of being a first mover have never been greater (or shorter lived). Financial marketers should continuously test social media’s impact at different stages to determine the marketing ROI of these channels.

Read More:

- Top 10 Trends Impacting the Future of Payments

- What’s The Best Mobile Payment Platform: Zelle, Venmo, Square or Apple Pay?

- P2P Payments Is The ‘Next Shiny Object’ In Mobile Banking Solutions

The Halo Effect of Amazon

Amazon has had the most dramatic impact on retail than any competitive force … ever. They have impacted the shopping experience as well as what consumers expect from ever purchase engagement across industries. Organizations in every industry are fearful of Amazon, not only because of the size and loyalty of their consumer base, but the frequency of engagement.

The Future of Retail 2018 report found that two in five consumers (42%) receive 1-2 packages from Amazon per week. That

number increases to 50% for consumers ages 18-25, and 57% for consumers ages 26-35. If nothing else, Amazon has the ability to connect with the consumer base of every B2C category more frequently than any other brand.

Impact on Banking: There is much debate around the potential impact of Amazon on the banking industry. It is unknown how much the retail giant wants to encroach on the financial services model and how this may occur. But, to take this potential threat lightly would be a mistake.

Not only do they have the ability to connect with bank and credit union households on par with the frequency of mobile banking ‘touches’, but the offers that are possible for buying a financial service are far more appealing, Imagine getting Amazon Prime for free or getting a % off on every purchase made with a Amazon debit card attached to a deposit account.

Of greatest concern is Amazon’s ability to leverage data they have collected over several years to build a solution that is customized to each household’s specific lifestyle.

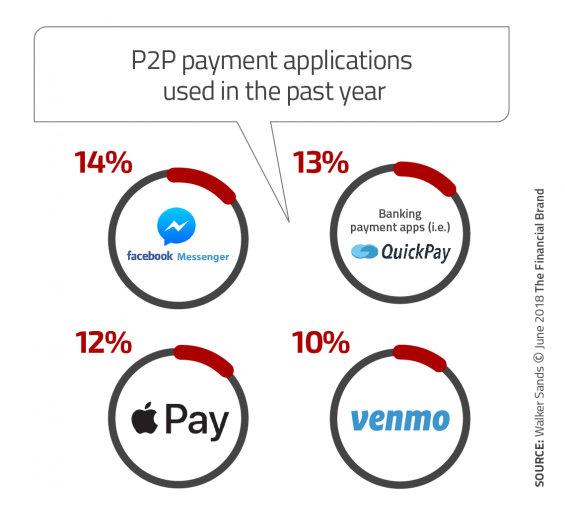

The Death of Cash

While the expansion of mobile payments at the retail level have lagged expectations, the same can’t be said for the growth of P2P payments. While still gaining traction, P2P payment options from the banking sector and from fintech providers seem poised for even greater acceptance. Bottom line, there is not the immediate potential of the death of cash, but as more retail purchase transactions are done digitally, the use and need for cash is definitely going to be impacted.

Impact on Banking: How are financial services organization positioning themselves within a consumer’s lifestyle? Is your organization going to be a brand that is at the forefront of the P2P, mobile and online transaction, or will your bank and credit union be in the background with no brand equity. Many believe payment process could be one of the most important components of a new banking ecosystem that extends beyond just financial services.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Power of Voice

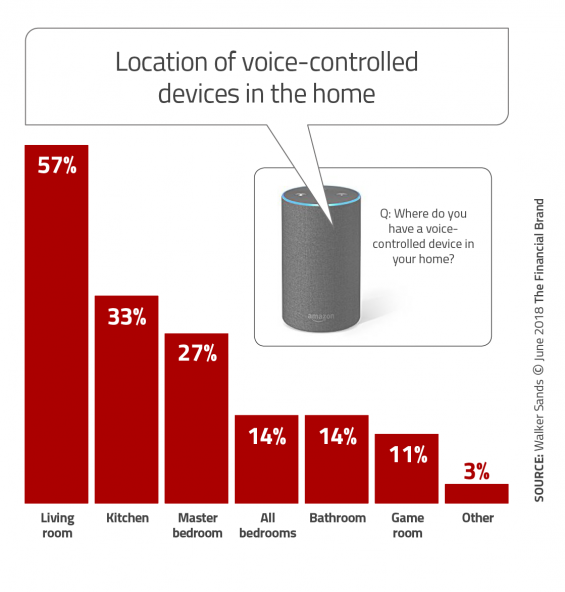

The adoption of voice-controlled devices represents the fastest acceptance rate of new technology since the mobile phone. Not only has this changed the engagement equation, but it also has the potential to complete disrupt the consumer journey from research, to shopping through the purchase decision.

This relatively new technology is the best example yet of the consumer desire for speed, personalized engagement, simplicity and the removal of friction from the buying process. In fact, unlike mobile payments, this technology may represent a migration where the consumer acceptance precedes the ability for industries to respond with solutions.

According to the Walker Sands report, “Of those who own a voice-controlled device, nearly two in five (39%) report owning at least two voice-controlled devices, and 7% report owning four or more devices. Additionally, 64% of those who own a voice-controlled device use it at least once a week and 18% use their voice-controlled device at least three times a day. While much of this usage is for entertainment, the learning curve is expected to escalate greatly as consumers get accustomed to the devices ultimate capabilities.

Impact on Banking: Some organizations have already built applications for voice banking, most notably USAA, Capital One and Bank of America. As with many technologies, the applications are relatively basic without much artificial intelligence (AI) benefits provided. Eventually, it is expected that voice-controlled devices may become an intelligent concierge, where recommendations in banking and beyond across an entire consumer’s lifestyle.

Look to the Retail Industry for Future of Banking

The retailing industry is at the forefront of integrating technology to improve the consumer experience. Many organizations who didn’t read the ‘tea leaves’ of consumer preferences are no longer in existence or are a small player compared to their impact in the past. For a view into the future, the banking industry needs to keep an eye on retail trends.

Some of the key trends in retailing for banks and credit unions to remember are:

- The consumer uses many channels as part of the purchase decision, wanting the ability to shift channels at any time.

- The consumer is usually multi-tasking and makes decisions on their time clock amd not usually during ‘normal business hours’.

- Speed and simplicity are increasing in importance. This trend is only expected to become more important.

- While not yet mature, payment and voice technology (independent and together) will eventually drive market share.

Finally, the physical channel in retailing and banking will change, but will not go away for most organizations. The biggest change will be the positioning of physical facilities that support digital – as opposed to the other way around.