More and more banking organizations are leveraging artificial intelligence to launch chatbot solutions, reducing costs and serving increasingly tech-savvy consumers. In many instances, chatbots are developed to facilitate two-way communication, replacing channels such as phone, email or text. The objective is to provide quick service and transactional support.

Most basic tasks such as balance inquiry, bank account details, loan queries etc. can be handled by a bot efficiently, allowing customer service representatives time for complex issues … leading to a more positive banking experience. Over time, artificial intelligence (AI) and new digital technologies will provide the banking industry with expanded forms of engagement, potentially moving beyond bots to digital voice interactions.

It is projected that chatbots will save banks billions of dollars in the coming decade. According to a report released by Juniper, chatbots will be responsible for over $8 billion annual cost savings by 2022. According to Gartner, by 2020 chatbots will be handling no less than 85% of all customer service interactions.

While many larger institutions have jumped on the artificial intelligence and chatbot bandwagon, not everyone is sold on the solution in the short term. According to Ron Shevlin from Cornerstone Advisors, “For banks and credit unions to succeed with AI/chatbots/voice, a more fundamental change in the attitudes consumers have towards the banks and credit unions they do business with – and a fundamentally different type of relationship – is required. A relationship built on a value proposition of advice, not convenience.”

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Why Use Chatbots?

The channels the banking customer uses and the path they take to conduct banking is more complex than ever. It is no longer possible to chart a single customer journey. Consumers use online and offline channels, and expect a personalized experience from their financial institution at all steps of their journey.

Financial institutions must engage with their customers and members in the right way, and at the right place and time. A good integration of chatbots as part of the engagement process can provide consumers with quick and personalized interactions, using machine learning and artificial intelligence as a foundation. Although only 19% of consumers are currently using chatbots, 95% think they will make more use of chatbots in the coming years.

There are many reasons to use a chatbot for consumer engagement in banking.

1. Cost savings. Chatbots are relatively inexpensive to develop and maintain compared to the human equivalent. Chatbots require less coding than standalone banking apps, can be supported by an expanding array of channels and don’t require expensive data storage thanks to chatbots’ cloud-based systems.

2. Ease of use. Chatbots are more intuitive and easier to use than a traditional banking app. There is no download required and the experience can be personalized over time through machine learning.

3. Conversational interfaceStudies have already shown that people find phone calls tedious and slow as compared to instant chat. Customers are looking for speed and personalization when interacting with their financial institution. At the same time, they don’t want the impersonal experience of email or online forms. Customer support chatbots offer a mix of both live conversation and speed.

4. Financial advice. Advanced banking chatbots provide access to all of a customer’s data. It can track spending habits, provide credit scores, set and manage budgets and tell the consumer where they are spending their money. This allows for AI-based recommendations and advice for better money management.

5. New account generation. If a prospect visits a bank’s website and is greeted with a polite ‘hello’, invited to ask questions about a product, and pointed in the right direction where they can find relevant information, the engagement is more likely to result in a new account opening.

6. 24/7 digital support. A 24/7 instant chat feature is expected by the increasingly digital ‘always-on’ consumer. This means that banks with chatbots built into their websites have a competitive advantage, and are likelier to attract and retain customers.

Read More:

- Artificial Intelligence Chatbots for Banking: 7 Essentials for Decisionmakers

- Secret to Online Banking Customer Support? Ditch the Scripts

- Chatbots to the Rescue: How Conversational AI Will Save Call Centers

Limitations of Chatbots

As with any digital innovation leveraging machine learning and artificial intelligence, the benefits and limitations of using chatbots are changing over time as more organizations develop use cases and continue expanding the functionality of the technology. At this time, some chatbots have limited functionality compared advanced chatbots being used inside and outside the banking industry.

The limitations below are general in nature without every chatbot having these limitations.

1. The dialogue capability can be limited to very a very specific set or format of questions that are established by the chatbot development team. This limitation is quickly diminishing as the technology is being tested and implemented.

2. Chatbots have significant limitations based on accents and languages. For organizations in multi-lingual regions, this limitation becomes a more significant barrier.

3. Chatbots cannot hold the conversation which means it cannot answer multiple question at the same time.

4. Not all consumers are familiar with or comfortable with chatbots because their limited understanding.

5. The expansion of chatbot capabilities is limited by the ability to hire trained teams or partner with organizations familiar with this rather new technology.

Sampling of Chatbot Implementations in Banking

Bank of America

As a market leader in both mobile banking use and AI implementations in the U.S., Bank of America introduced Erica, (from the word AmEricaa) to send notifications to customers, provide balance information, suggest how to save money, provide credit report updates, pay bills and help customers with simple transactions. Since the introduction, the capabilities of Erica have expanded as an advanced virtual assistant to help clients make smarter decisions.

Erica is available inside the Bank of America mobile banking app. Customers can get help via voice or text regarding their banking problems. This banking chatbot sends personalized recommendations, offers and advice after analyzing the customer’s data. Erica can also send educational videos on finance.

JPMorgan Chase

Unlike many of the chatbots introduced in banking so far, JPMorgan Chase is utilizing bots to streamline its back-office operations. The bank launched COIN to analyze complex contracts quicker and more proficiently than human lawyers. According to JPMorgan Chase, the organizations has saved more than 360,000 hours of labor.

The chatbot also uses the technology to parse messages for employees, allow access to software systems, and handle basic IT requests like resetting passwords. Going forward, the bank has indicated the intention to keep using bots to find sources of income, ways to decrease expenses and new ways to reduce risk.

Wells Fargo

Wells Fargo’s chatbot uses artificial intelligence and Facebook Messenger to respond to natural language messages from users, such as how much money they have in their accounts, and where the nearest bank ATM is. This is a normal introduction path for banking organizations to follow since this is what most customers use chatbots for.

Wells Fargo’s chatbot uses artificial intelligence and Facebook Messenger to respond to natural language messages from users, such as how much money they have in their accounts, and where the nearest bank ATM is. This is a normal introduction path for banking organizations to follow since this is what most customers use chatbots for.

According to Wells Fargo, after a simple registration, customers can ask for their account balance, most recent transactions, how much they spent on food last week, and the location of the nearest ATM, among other things. Request by request, the information quickly appears.

Wells Fargo’s chatbot for Facebook Messenger is the company’s latest effort to engage and serve customers directly on social media — via desktop, smartphone, and other mobile devices — through an artificial intelligence-powered chatbot.

Read More: What Banking Looks Like to Wells Fargo Innovation Chief

Capital One

Capital One has introduced a text-based chatbot assistant named Eno to help customers manage their money using their mobile phones. Initially introduced as a pilot program for 100000 users, Eno can adapt itself according to the user and can learn consumer behavior over time.

Clients can get information from the chatbot about account balance, transaction history, and credit limit as an instant message and can pay bills instantly. Eno can even understand emojis as well as the meaning of thumbs given by customers.

Eno is the second of Capital One’s virtual assistants after the introduction of its own Amazon Alexa app, accepting inputs in the form of voice commands. This bot enables Capital One clients to know about upcoming payments, check account balances, and pay their credit card bill using their voice.

Ally Bank

Ally Bank was one of the first banks to implement a chatbot, with the launch of Ally Assist in 2015. Ally Assist is a virtual assistant within the Ally Mobile Banking app. Ally Assist can be accessed via voice or text to perform functions such as making payments, transfers, P2P transactions and deposits.

A customer can also request an account summary or transaction history as well as monitor saving and spending patterns. Through machine learning, Ally Assist can predict customer needs by analyzing accounts and transactions to provide relevant help topics and messages The assistant also uses natural language to address common customer service queries.

USAA

Going beyond traditional rules-based voice or chatbot digital banking solutions, a non-bot, natural language banking experience is being offered to USAA members in an Amazon Alexa pilot with Clinc. Combining the science and technology from academia, with the needs for a better voice-first mobile banking capability, Clinc uses sophisticated natural language processing engines trained with a deeper knowledge of the financial and banking industry as opposed to using a rules-based approach.

Unlike solutions that currently exist from Siri, Alexa and Cortana, Clinc’s machine learning capability allows the application to expand knowledge and improve responses with every query. By identifying and analyzing dozens of factors like speech patterns, word structure and sentiment, Clinc is able to understand, to remember and to respond to unconstrained, contextual, messy human language.

With no specific rules or commands to learn, USAA members receive an experience that feels like an intelligent human conversation. Finally, as opposed to using specific customer data, the Clinc solution can plug in seamlessly to a mobile app and other digital products using an API (outside the core).

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

American Express

Leveraging their relationship with merchants, American Express provides benefits to their customers with the help of chatbots, including real-time sale notifications, contextual recommendations, and reminders about credit card benefits. Customers have to connect their card first with the AmEx messenger chatbot to get benefits for this chatbot.

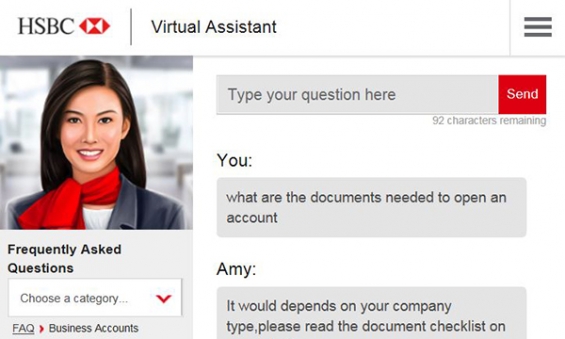

HSBC (Hong Kong)

Amy is a customer servicing platform which takes the form of a Virtual Assistant Chatbot for corporate banking at HSBC Hong Kong. Amy can provide instant support to customers’ inquiries on 24×7 basis. Available on desktop and mobile in English, Traditional and Simplified Chinese, Amy currently covers a number of product pages and its coverage will be further expanded.

An embedded customer feedback mechanism will allow Amy to learn and enrich her knowledge over time so that she can cope with increasingly broad queries. Subsequent delivery phases will see Amy integrating with live Chat to enable seamless human intervention on more complex queries, and the improvement of Amy’s learning process with the latest AI technology.

Hang Seng Bank (Hong Kong)

Hang Seng Bank introduced two chatbots, HARO and DORI, to its retail banking customers, promising human-like conversations fueled by machine learning technologies. HARO, available online and through the bank’s mobile app, handles general inquiries about the bank’s products and services, such as calculating mortgage payments, while DORI is in charge of searching dining discounts and making recommendations based on customer preferences. DORI is embedded in Facebook’s instant messaging app, and is said to function similarly to Apple’s Siri or Google Assistant.

The chatbots can communicate in Chinese and English, and can also understand Cantonese as well as the mixing of English and Chinese. Through interacting with customers, HARO and DORI will continuously improve their ability to address customer inquiries.

Covering the Bank’s mortgage, personal loan, credit card, medical insurance and travel insurance services, HARO will handle general inquiries about the products and services, help customers identify suitable products and provide application information. HARO can also assist customers with calculating repayment amounts for designated personal and mortgage loans.

SEB (Sweden)

SEB has released Aida, a female chatbot for customers — and a follow up to an internal chatbot SEB released called Amelia, for employees. In Amelia’s first three weeks, over 4,000 conversations were held with 700 employees, and she solved the majority of issues without delay. Rather than helping customers with traditional banking needs, Amelia’s tasked with working with employees and assisting internal IT support.

By early 2017, Aida was rolled out across SEB’s internal help desk and hired as a “trainee” for the bank’s front-end customer service. Currently, she handles about 13% of all IT support questions, as well as helping bank customers with card issues, account queries and booking meetings.

Although Aida is continually expanding skills – including sensing emotions – their capabilities are still far behind their human colleagues. Nordic languages have proved to be an issue. Currently, Aida does not identify the customer she is helping, but in the future she could tap into detailed customer data to provide more personalized advice.

Commonwealth Bank (Australia)

Commonwealth Bank launched a chatbot called Ceba to assist customers with more than 200 banking tasks such as activating their card, checking account balance, making payments, or getting cardless cash. Within one year, CBA expects it will understand 500,000 ways customers might ask for 500 different banking activities.

Commonwealth Bank Executive General Manager Digital, Pete Steel, said artificial intelligence will play an increasingly important role as digital banking moves beyond just enabling seamless transactions. “Banks are moving towards providing personalised and insightful online banking experiences for our customers, and artificial intelligence along with the powerful technology behind it sits at the centre of this shift.

Here are some of Ceba’s top questions:

- Can I have a copy of my statement?

- I want to open a new account

- What is my credit card limit?

- I want to activate my new car loan

- I’d like to pay my bill

What’s Next With Chatbot Development

As mentioned, chatbots currently are somewhat limited in functionality, from understanding conversational interactions to using customer insight to provide advanced recommendations. Most chatbots are developed for limited tasks and are unable to handle requests requiring knowledge outside the functional domain.

There is an opportunity for financial organizations to provide a differentiated experience applying customer insights for advanced recommendations and advice. There is also the opportunity to engage in conversational banking where insights are delivered proactively through contextual decision making.

According to PwC, chatbots can add a ‘personal touch’ to provide a ‘Wow’ experience

- When a customer logs into their account, a chatbot can greet the customer and discuss customized offers instead of the conventional pop-up notifications or banners that occupy valuable real estate.

- During the conversation with the customer, the chatbot can use advanced speech and natural language processing capabilities, and even sentiment analytics to gauge the tone, emotions, and voice accent to offer solutions that are deeply customised to the overall context of the conversation.

Read More: Banking By Bot: Are Chatbots Better Than Real People?

This type of customer engagement can enhance customer loyalty without costly manual intervention.

Going a step further, PwC suggests that financial institutions can leverage innovative technologies to integrate chatbots into more advanced uses..

- Facial recognition to enable zero-click transactions using chatbots

- Using chatbots and virtual reality to visually illustrate the impact of long-term savings

- Using chatbots to provide a real=time status update on a cross-border blockchain transaction

- Using IoT devices integrated with chatbot technology to converse with customers through voice

The banking industry has only begun to scratch the surface with regard to the potential of AI, machine learning, chatbots and advanced technology. At the foundation of all of these advances is the ability to collect insights and apply advanced analytics to benefit the consumer.

While not every institution is ready to place chatbots high on the priority list of investments, the potential of the technology should not be ignored.