According to various sources, Amazon is considering partnering with various banks in an effort to offer a “checking-account-like” product for consumers. It has been reported by The Wall Street Journal that Amazon is in early discussions with organizations, including J.P. Morgan Chase, Capital One and others, to launch Amazon-branded checking accounts targeted at younger customers and under served segments.

The WSJ said that the talks were in the early stages, and that nothing may actually come from them. The story also didn’t discuss whether Amazon would offer services beyond checking accounts. Either way, it seems clear that Amazon would like to expand it’s reach beyond retailing, adding value to Prime relationships, especially in the parts of a consumer’s life where there is friction and where the experience is less than superior.

A recent example of extending into inefficient industries is when Amazon announced that it was entering the health care insurance business in partnership with J.P. Morgan Chase and Warren Buffett’s Berkshire Hathaway. Amazon already offers a Prime Rewards credit card from J.P. Morgan Chase that is issued by Visa to make purchasing on Amazon easy and less expensive. In other words, financial partnerships are not new for Amazon.

Federal regulations make it difficult for non-financial organizations to participate. And there is no reason to think that Amazon would ever want to become a bank. This could be why Amazon is looking for a big bank partner (or partners).

With millions of Prime members, extensive insights into consumers and their buying habits, and access to the the computer screens and mobile phones of some of the most active digital consumers in the marketplace, there is no reason to think Amazon wouldn’t want to disrupt the banking ecosystem as well.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Consumers Open to Banking with Amazon

According to a LendEDU survey, 44.5% of consumers were open to the idea of using an account created by Amazon as their primary bank account, while 39.1% were unsure, and only 16.4% rejected the idea. Of those consumers who were Amazon Prime members, 55.3% said they would be open to an Amazon bank account.

One of the primary benefits traditional banks and credit unions had over their competition in the past was trust. Nobody want to put their life savings at risk or to partner with an organization that wouldn’t protect their identity and privacy. According to the LendEDU survey, it does not appear as though trust is a big problem for Amazon.

A combined 87% of respondents answered with either “yes, very much so,” or “somewhat” when asked if they trusted Amazon to always have the consumer’s best interest in mind. According to the report, “The plurality of respondents, 38.3%, answered they would have “about the same level of trust” in Amazon handling their finances instead of a traditional bank. Meanwhile, 17.2% actually would trust Amazon more, while 21% were unsure, and 23.5% would have less trust in Amazon.

This should raise concerns for traditional banking organizations who believed they were insulated from major competition due to trust and security advantages. By the way, 21.5% of Amazon Prime members have more trust in Amazon than their current bank.

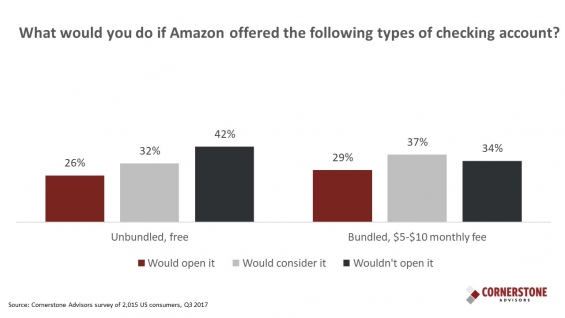

In another study, Cornerstone Advisors conducted a survey asking respondents what they would do if Amazon: 1) Offered a free checking account, or 2) Offered a checking account bundled with other services like cell phone damage protection, ID theft protection, and roadside assistance, for a fee of $5 to $10 a month.

Overall, about a quarter of consumers would open the free account and a third would consider opening it. What’s interesting, though is that a slightly larger percentage of consumers would open or consider the bundled, not-free account.

The Power of Advanced Insight

For decades, most traditional banking organizations have viewed the basic checking account as a ‘loss leader,’ with little attention paid to developing a customized relationship around this product. In fact, even the movement towards digital banking and mobile banking has been driven by cost savings for the bank as opposed to a better experience for the consumer.

As opposed to viewing the traditional checking account as a ‘commodity’ by both the bank and the consumer, Amazon could change the competitive landscape, leveraging its robust machine learning algorithms. Instead of being a transaction service, Amazon could combine banking insights with eCommerce insights to personalize the Amazon.com experience.These insights could extend to other services such as lending, investing, insurance and payments.

The Best Checking Account Ever?

As mentioned, the checking account product is considered by many consumers and financial institutions as a commodity. The product serves as a repository for short term funds that are used to facilitate deposits and payments. Up until now, the ‘ultimate’ checking account was a product without fees. In some cases, interest could be earned on the account, but that rate has been close to zero for more than a decade.

For Amazon, the checking account is far from being a ‘commodity.’ It provides the mother lode of insight into how a consumer not only conducts their financial life, but how they live their daily lives overall. As a result, Amazon could easily justify ‘paying’ for the opportunity to have access to this insight.

What if Amazon decided to provide Amazon Prime at no cost to any new checking account customer? The monthly Amazon Prime membership rate is currently $12.99 a month, or $99 for an annual membership. That’s quite an incentive considering that the membership benefits often are much more than $99 a year.

Alternatively, what if Amazon offered higher balance checking account customers the added benefit of ‘specials’ on the price of frequently purchased products or on Whole Foods groceries? Unlike traditional banks, where the range of services are highly constrained with thin margins, Amazon could provide benefits from free movies to discounts on books to pure cash incentives.

And, if Amazon wanted to disrupt the delivery of financial services, they are in an envious position to integrate easily Amazon Alexa into the mix, enabling voice banking on the highest level. In other words, Amazon could ‘jump the shark’ as it relates to open banking, working on behalf of the consumer to provide many of the benefits that could make the life easier … with the Amazon checking product at the center of the ecosystem.

Even without the bells, whistles and special offers, Amazon is still in a position to offer the best checking account ever – if they leverage their ability to act on consumer insight to proactively serve the consumer better. This is something that the vast majority of traditional banks have not done.

What Do Financial Services Influencers Think?

We asked a number of the Digital Banking Report crowdsourced panel of financial influencers to provide a perspective on what an Amazon checking partnership with big banks could possibly mean to the banking industry.

“Can I quote myself from 4 years ago, when I wrote: ‘Amazon still wants banks in the equation. And some banks stand to gain business from partnering with Amazon to get that business’.”

– Ron Shevlin, Director of Research at Cornerstone Advisors, Inc.

“It turns out the Amazon of Banking might be Amazon after all. Not surprising that Alibaba launched this strategy with Yue’Bao some years ago, and Amazon is following suit. It’s clear that the optimal platform for banking is no longer just being a bank, but being embedded in your daily life. In that respect, Amazon has significant advantages over traditional players.”

– Brett King, CEO and Founder of Moven and author of Bank 4.0

“As predicted, Amazon is moving into banking but not by opening their own bank or acquiring a license, but by partnering with one of the biggest banks in America. They’ll make a great team, and what we should be saying is ‘well done JPM’.”

– Chris Skinner, CEO at The Finanser, Ltd.

“I have been challenging financial executives not to obsess too much on the rise of fintech startups, when the twin threats of the ubiquitous tech providers and the digital arms race within the industry were larger proximate threats. Losing customers and transactions to a large bank is no better than losing to two people in a garage. We will continue to see more combinations like this that underscore the need for every institution to consider what partnerships can help them compete on their own terms”

– JP Nicols, Managing Director at Fintech Forge

“What’s a better way to get into financial services than through a massive commerce platform? The future model for financial services lies in the intersection of payments, commerce, and through being an active participant in our daily digital routines – whether they are intrinsically financial or not. We’ve seen this play out with WeChat and Baidu and other aggregated experience platforms in Asia. Banks aren’t going to build the open platforms of the future, but technology giants will, as they understand the value of embedding day-to-day social and commerce experiences alongside our ability to manage our financial lives, not the other way around.”

– Bradley Leimer, Managing Director and Head of Fintech Strategy at Explorer Advisory and Capital

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

“Keep your friends close and your enemies closer.It will be a good win for financial institutions eyeing to win over millennial consumers. More interestingly, will we see a future where consumers pay bills and cash paychecks at their local Whole Foods?”

– Theodora Lau, Financial Services Thought Leader, LinkedIn Top Voice, Top Female FinTech Influencer

“Banks are working to expand their digital footprints while customers are changing the way they find financial services. Finding ubiquitous digital channels, powered by virtual assistants and chatbots, offers legacy institutions an attractive alternative to engage new consumers.”

– Mike Quindazzi, Managing Director, PwC

“News of amazon looking to partner with several banks on checking accounts expands Amazon’s existing card partnerships with banks. It shows banks that Amazon is ready to play on their turf, but as a partner rather than a disruptor. Joining forces with Amazon could be a great way for banks to align themselves with an incredibly strong brand that is popular with young consumers – who will need additional financial products in the future. Many have called for strong partnerships between fintech and banks. This may be a tipping point for the industry.”

– Matt Wilcox , SVP, Marketing Strategy and Innovation at Fiserv

“Teaming up with the right big bank could be a way to further capitalize on the mass amount of data Amazon is sitting on, to connect with consumer segments with rapidly changing customer expectations and financial habits. After all, it’s just one more product for Amazon to distribute….”

– Danielle Guzman, Global Head of Social Media and Distributed Content at Mercer

“BigTech firms such as Amazon have massive customer bases, are trusted, and have mastered how to leverage data and insights to deliver personalized experiences and services to their clients. Instead of taking on the complexity of building their own bank, it is a logical next step to further expand their role in the evolving financial services ecosystem through teaming up with banks.”

– Bill Sullivan, Global Head of Financial Services Market Intelligence at Capgemini

“Co-branded credit cards are so last year. Now BigTech firms like Amazon want co-branded checking accounts too. What does this mean? The further consolidation of money relationships with the big banks.”

– David Gerbino, Principal of @dmgconsulting

“Banks should have invested in meaningful transformations to allow them to become relationship custodians similar to other strong brands. What we are seeing now (and it will be even more evident in Europe very soon due to enabling regulation) is brands realizing they can utilize the emotional capital they have built to round up their relationship portfolio with financial services and monopolize the experience, potentially turning banks into nothing but the invisible rails that power this interaction.”

– Duena Blomstrom, Founder and Author of Emotional Banking

“If this is surprising, you probably still think of Amazon as a bookstore. Amazon offers several financial services in the US – this is just the next step in their deposit displacement game. Every institution needs a strategy for competing against Amazon, Apple, Square, Google, Facebook, etc for core deposits.”

– John Waupsh, Chief Innovation Officer at Kasasa

“Amazon is a margin eating monster. Imagine the impact to $amzn bottom line by simply alleviating interchange while gaining even more data about each transaction.”

– Wade Arnold, Investor, fintech speaker, and open source advocate

“This isn’t Amazon’s first move into financial services and it won’t be their last. The best way for banks and credit unions to prepare for Amazon’s foray into financial services is to better leverage the data they already have on hand to build a better user experience.””

– Jon Ogden, Director of Content Marketing at MX

“There are no surprises here. Amazon will offer a product “like a checking account”, only better. And integrated into Prime..”

– Steven Ramirez, President of Beyond the Arc