To prepare to succeed in an increasingly competitive banking environment, banks and credit unions will need to become intelligent organizations, enabling quicker, insight-led decision making. More than ever, the winning financial institutions will leverage data, analytics and new talent to transform their organizations internally and engage with consumers to meet their ever-changing expectations.

Digital technologies, exploding data availability, and increasing consumer expectations are the driving forces behind the need for banks and credit unions to transform how they do business and move toward being intelligent organizations. According to a study from Accenture and HfS:

- Nearly 80% of organizations are concerned with disruption and competitive threats, especially from new digital-savvy entrants.

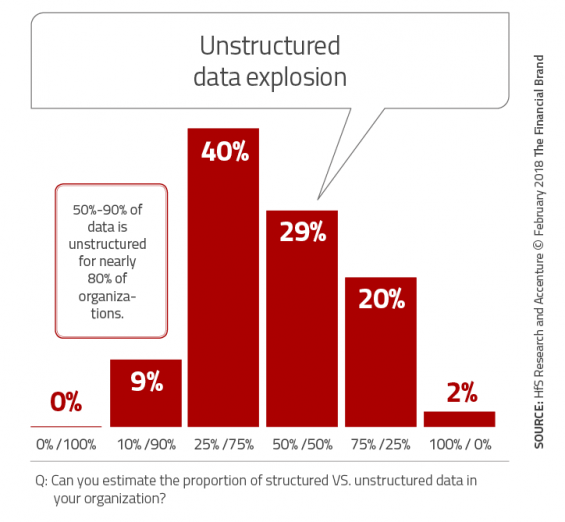

- Data is rapidly becoming a key driver of operational and competitive advantage. That said, nearly 80% of respondents estimate that 50%-90% of their data is unstructured from a variety of sources. Few are adequately prepared to leverage this data in real-time and for the consumer’s advantage.

- A strong customer experience strategy is the most significant driver of internal agility, yet nearly 50% of enterprises say their back office is silo-based and unable to support a seamless digital flow.

“To win in today’s market and ensure future viability, it is essential that organizations capture value quickly, change direction at pace, and shape and deliver new products and services. Organizations also need to maximize the use of ‘always on’ intelligence to sense, predict and act on changing customer and market developments,” said Debbie Polishook, group chief executive, Accenture.

The good news is that, despite what appears to be an ominous future, over 40% of executives see more opportunities than threats compared to two years ago. The key is to break down silos and leverage data and insights to support both internal and external business needs.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

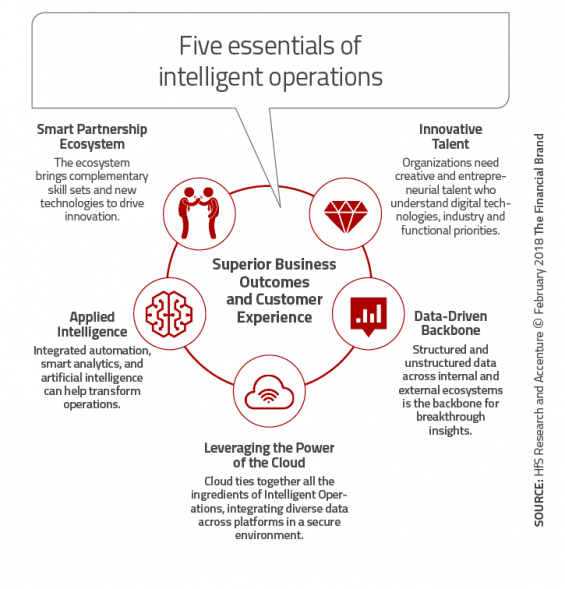

The Five Essentials of Intelligent Organizations

Intelligent organizations have five essential ingredients that contribute to a lasting and impactful business process transformation. These essential provide the foundation for an agile, flexible and responsive organization that can act swiftly to market and consumer changes and be in a better position to succeed

1. Innovative Talent. The talent of the future will need to creative problem-solving skills in addition to strong digital, operational and domain expertise. This will require a revised human resources function and recruiting that leverages open talent marketplaces.

2. Data-Driven Focus. Data and advanced analytics will help organizations generate required customer insights to meet expectations. This will include a strong data-driven strategy that will leverage both structured and unstructured data from internal and external sources. The key differentiator will be how well an organization can turn data into insights and then into actions.

3. Applied Intelligence. The combination of automation, analytics, and artificial intelligence (AI) will become the ‘holy grail’ of business and process transformation, according to Accenture. Using these powerful tools will require the combination of creative talent, technology and transformed back-office operations.

3. Applied Intelligence. The combination of automation, analytics, and artificial intelligence (AI) will become the ‘holy grail’ of business and process transformation, according to Accenture. Using these powerful tools will require the combination of creative talent, technology and transformed back-office operations.

4. The Power of the Cloud. The combination of modernizing legacy systems and leveraging the power of cloud infrastructure are required given the massive increase in data and advanced analytics required in the future. While many organization have plans to replace legacy back-offices, the process is slow, but the rewards are significant.

5. New Open Banking Ecosystems. It is clear that partnering with fintech organizations to build an expanded customer-focused ecosystem will better enable organizations to exploit market opportunities. The good news is that traditional business service providers are increasingly collaborating with outside organizations on behalf of smaller partners to enable a positioning that can compete with larger players.

It is important to note that to remain competitive, financial organizations will need the dual business strategy of investing to become intelligent organizations, while still being focused on reducing costs to be closer to on par with digital-first financial services organizations. Many studies believe that legacy organizations may have a cost structure that is at least 25% higher than digital competitors.

Marketplace Challenges Create Ongoing Headwinds

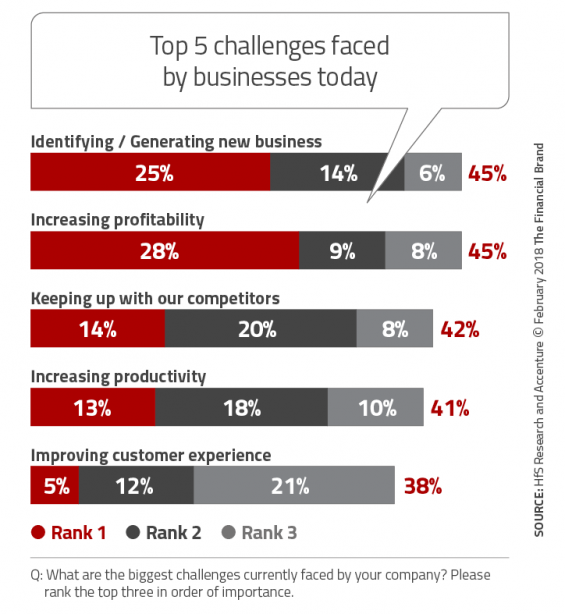

While every survey done by the Digital Banking Report in the past 24 months places an improved customer experience at the top of financial institution’s business priorities, survey respondents in the Accenture/HfS research place top-line growth as the biggest challenge, along with generating profitability. Next is the pressure to ‘remain competitive’, boost productivity, and improve the customer experience.

When asked about the drivers impacting business strategy, respondents to the Accenture/HfS research noted the ability to make more predictive, data-driven decisions in real time (51%), personalize customer interactions (44%), create more digital experiences instead of physical engagements (41%), and stay ahead of or at least match digital disruptors (39%). Interestingly, all were seen as having a greater impact on the enterprise than the need to reduce costs (36%).

When asked about the drivers impacting business strategy, respondents to the Accenture/HfS research noted the ability to make more predictive, data-driven decisions in real time (51%), personalize customer interactions (44%), create more digital experiences instead of physical engagements (41%), and stay ahead of or at least match digital disruptors (39%). Interestingly, all were seen as having a greater impact on the enterprise than the need to reduce costs (36%).

Intelligent Operations Driven by Data, Digital Technology and Customer Expectations

The ability to make data-driven, contextual decisions using real-time data is the key to competitiveness and potentially survival for banking organizations in the future. Unfortunately, most organizations have more data at their disposal than they are using, and the ability to convert data to insights, and then to an improved consumer experience, is often close to impossible.

The foundation of much of this challenge is the increase in unstructured data, which often is unprocessed and/or inaccessible. When we refer to unstructured data, this usually relates to social media feeds, consumer conversations, digital pictures, videos, web content, paper-based documents, voice messages, etc. which provide deeper insights into customer and member needs and behaviors, and ultimately the ability to deliver exceptional experiences.

On top of the threat of the data explosion is the realization that digital technology is opening the door for new competitors and new experiences. The need to transform to a digital banking organization goes beyond the mobile experience, including the digitization of processes and back-office operations. The biggest challenge is presented by siloed internal processes, which approximately 80% of organizations cited as barriers preventing them from achieving their business goals.

On top of the threat of the data explosion is the realization that digital technology is opening the door for new competitors and new experiences. The need to transform to a digital banking organization goes beyond the mobile experience, including the digitization of processes and back-office operations. The biggest challenge is presented by siloed internal processes, which approximately 80% of organizations cited as barriers preventing them from achieving their business goals.

According to Accenture and HfS, “Keeping pace with customer experience improvements, anticipating and understanding customer needs, collecting the right data, implementing self-service, and social media engagement are emerging as top priorities for customer experience strategy in the digital age.”

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Data and Advanced Analytics at the Core of Intelligent Organizations

When properly connected and analyzed, structured and unstructured data provides the insights requisite to improve business performance. In fact, over 90% of Accenture/HfS survey respondents believe that data-driven decisions will help them achieve their business goals. The ability to collect, and deploy these insights is one of the biggest challenges for financial organizations today.

Ninety-nine percent of executives surveyed are developing a data strategy around three main pillars of data management:

- Data aggregation to compile data from various databases with the objective to prepare combined datasets for insight generation.

- Data lakes to store data in its natural format in a single store, making it more actionable.

- Data curation to organize, integrate, and present data collected.

According to Accenture, “Enterprises must put data at the core, leverage applied intelligence (the spectrum of automation, advanced analytics, machine learning, natural language processing, and other AI technologies) to unlock unique intelligence that is powered by domain and industry expertise. This unique human-machine capability is required to drive innovation and breakthrough results.”

Market leaders of the future will be able to access a single source of insight and intelligence that will enable seamless back office processes and digital customer experiences that are in real-time and add value both for the organization as well as the consumer.