All of the examples in this financial service sales communication showcase were provided complements of Mintel Comperemedia.

Their searchable competitive database tracks direct mail, email, print advertising, mobile advertising and online banner advertising and is a go-to resource for The Financial Brand.

We thank them for their partnership in this effort to show some best-in-class bank and credit union marketing examples.

New Customer Acquisition

The acquisition of new customers has become as much of a science as an art, with the combination of advanced analytic models and offer/pricing optimization that can maximize response while minimizing the effective cost of acquisition. While significantly lower amount of mailings are done today than in the past, Chase, Bank of America and USAA continue to be major players.

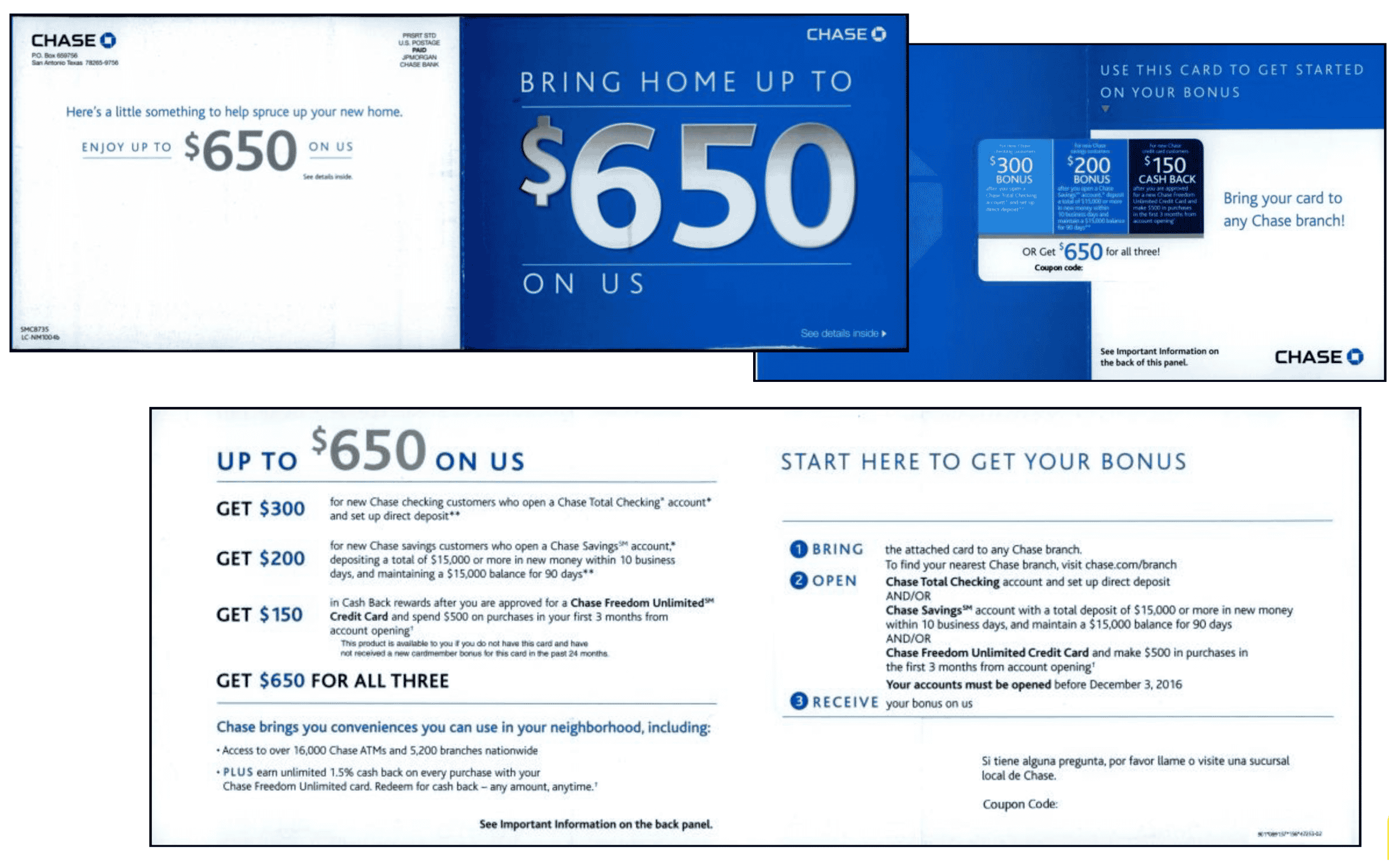

Chase Checking/Savings Acquisition Direct Mail

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

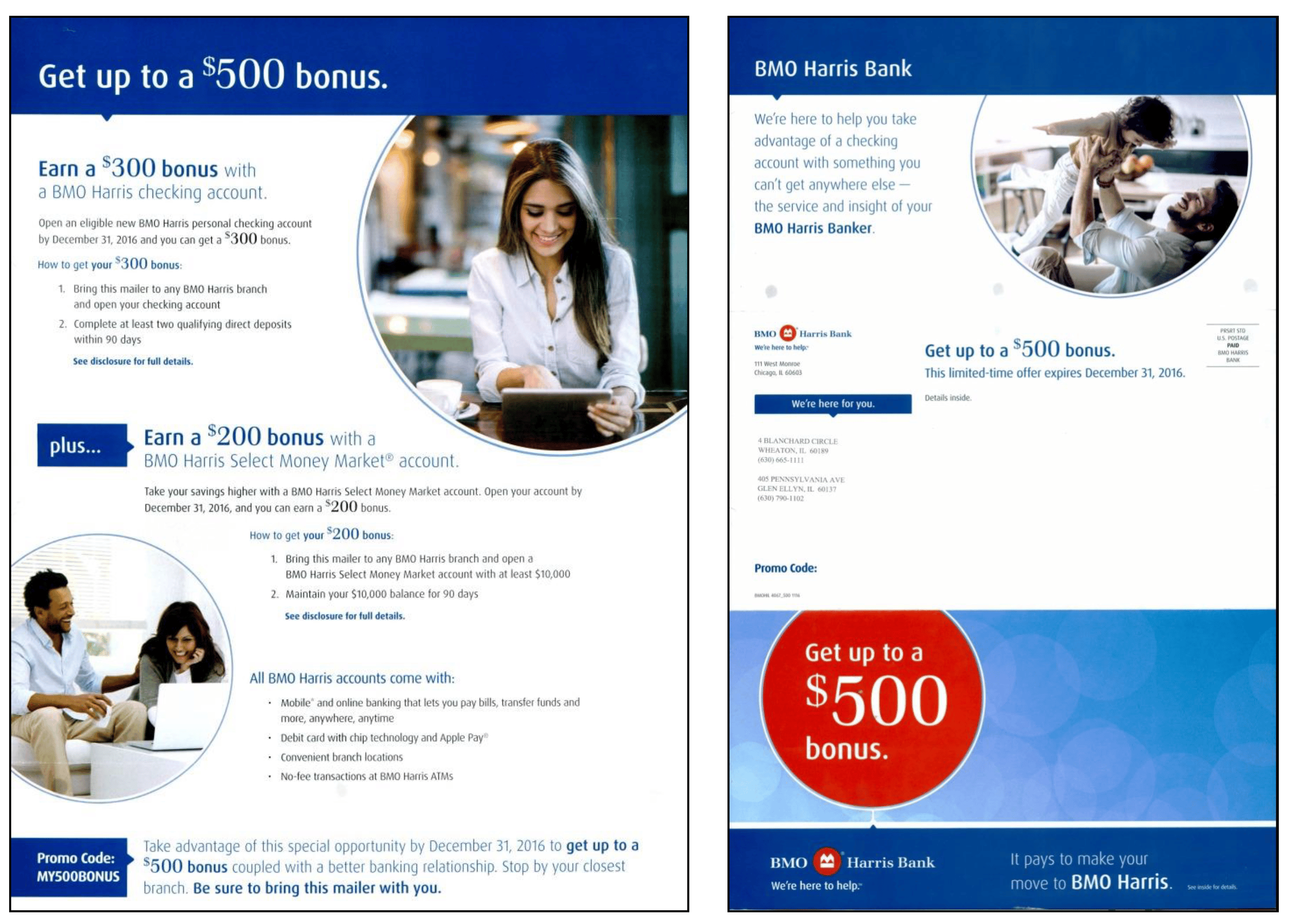

BMO Harris Checking/MMA Acquisition Direct Mail

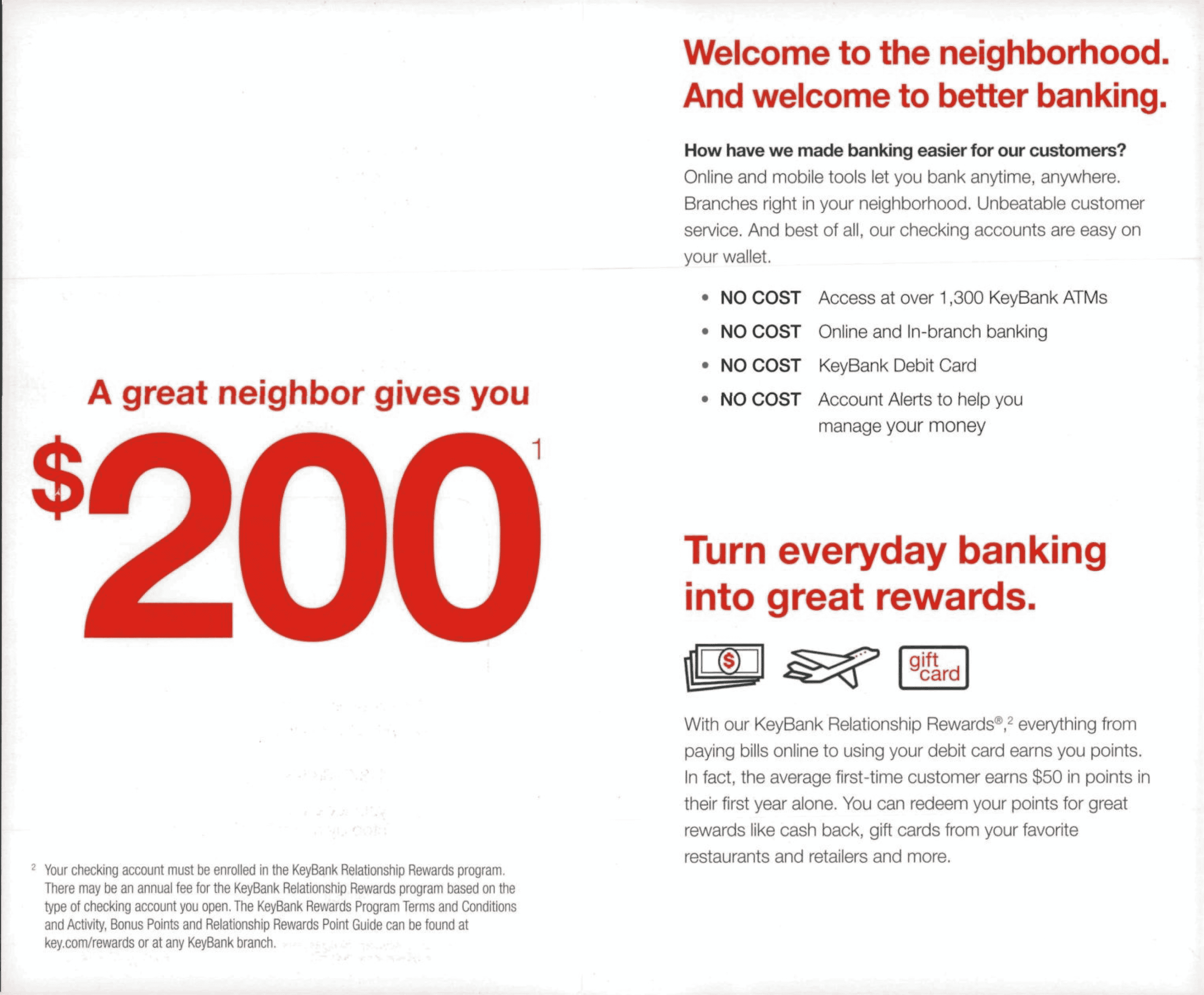

KeyBank New Mover Acquisition Direct Mail

New Customer Welcome

The initiation of the new customer onboarding process usually includes a welcome message through direct mail, email, SMS text and/or online communication. Many organizations include some form of user guide explaining the upcoming onboarding steps in a flow.

By referencing how the customer can best use and benefit from their account, early usage of the account occurs, growth of the relationship is more likely, and satisfaction increases. JD Power has found that welcome and onboarding messaging should include between 7-9 communications using multiple channels to maximize the benefits.

USAA Welcome Email Landing Page

Citibank Credit Card Welcome Personalized Video Email

USAA Welcome Email Landing Page

Regions Bank Welcome Email

Regions Bank Welcome Email

Mountain America Welcome Direct Mail

New Customer Onboarding and Engagement

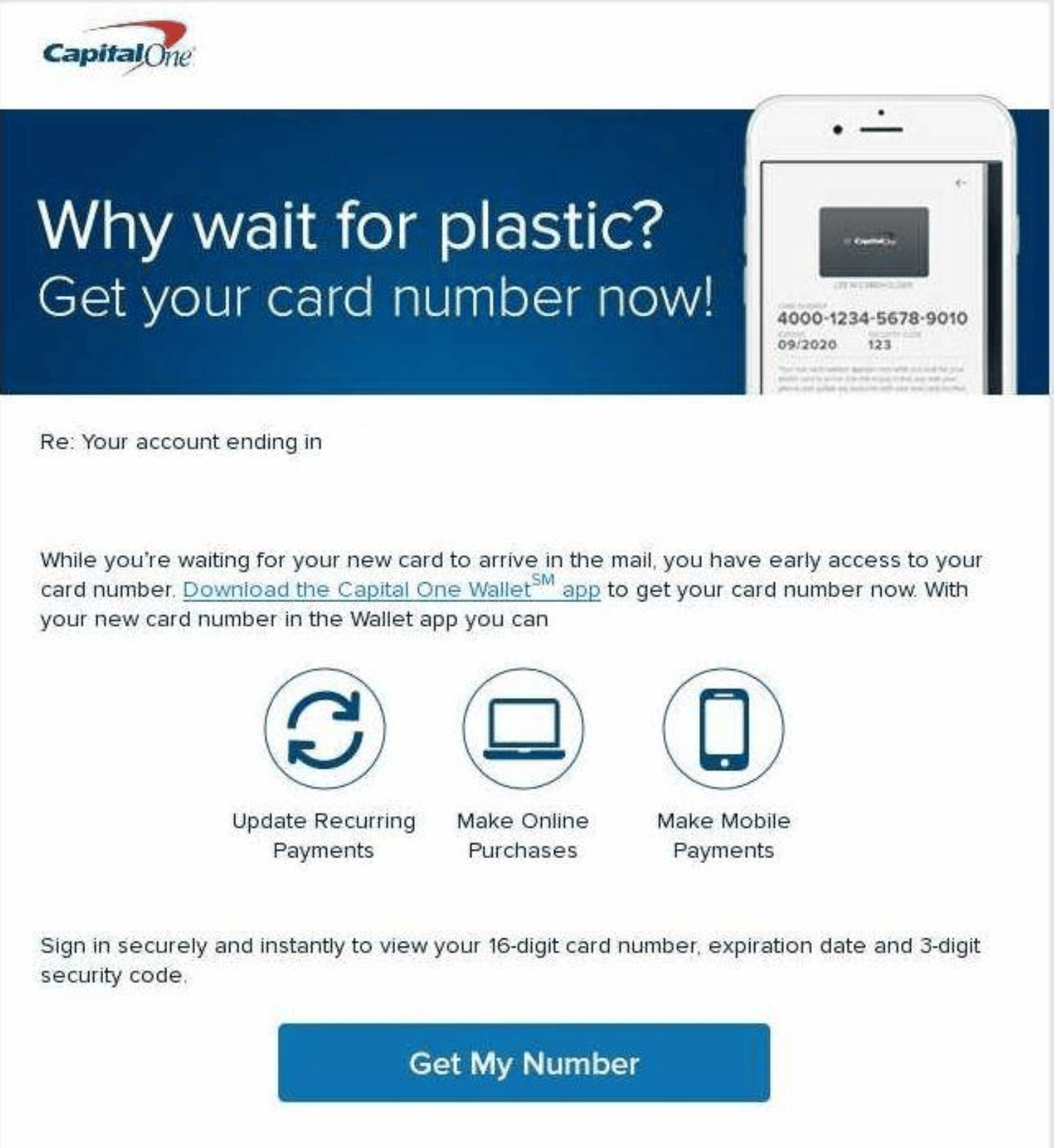

Beyond the early welcome (that is delivered within 2-5 days of account opening), the new customer onboarding process usually extends an additional 3-6 months. The purpose of these communications is to increase broader usage of the new account.

These communications many times focus on products like mobile banking, digital bill pay, direct deposit and additional services like mobile deposit, account alerts, etc.

Capital One ‘Instant Access’ Engagement Email

Bank of America ‘Deposit Alternatives’ Email

Amex Mobile Alerts Activation Email

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Notre Dame FCU Bill Pay Activation Email

Bank of America Digital Product Engagement Email

Bank of America Mobile Banking Usage Email

Customer Cross-Sell

In the past, the majority of cross-selling was done by branch personnel when the customer visited the branch office to make deposits, check balances, cash checks, etc. Over the past decade, more than 60% of the branch traffic has moved to digital channels, increasing the importance of digital channels to cross-sell additional services. Some organizations also have implemented highly targeted appointment setting programs with the intention of replicating the 1to1 engagement from the past.

Bank of America Mobile Banking Usage Email

Bank of America Appointment Scheduling Email

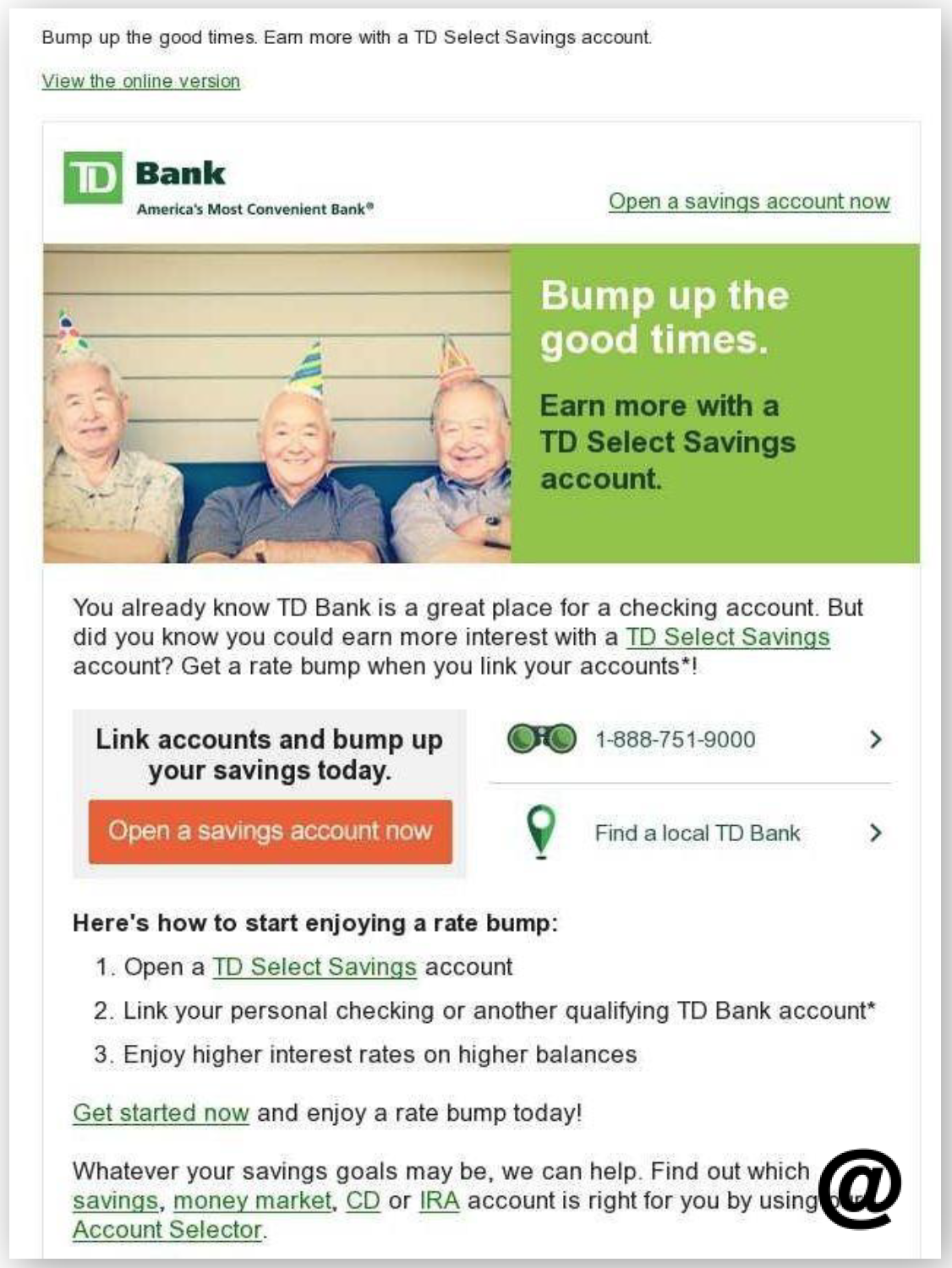

TD Bank Savings Cross-Sell