As financial institutions look at how best to adapt their current practices to meet the needs of customers across an expanding array of digital channels, banking executives look for insights to inform their digital transformation strategies. A research study among digital strategy and marketing leaders in the banking industry sheds light on some of the key challenges and opportunities for making effective strides toward delivering more personal and omnichannel customer experiences.

Digital transformation must begin with a cultural transformation within an organization, according to the study, in order to best lay the foundation for critical cross-department cooperation. This cooperation, freeing needed data and capabilities from departmental silos, is required to achieve seamless omnichannel service at each point along the customer lifecycle.

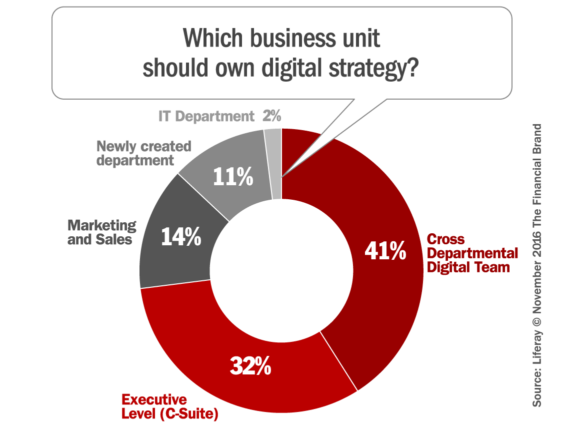

With 87% of the financial institution respondents saying that technology is intrinsic to digital transformation and must be considered in tandem with strategy, it’s a natural fit for CIOs to lead the way in vetting and implementing the technical platforms and solutions that will form the backbone of an organization’s digital strategy. However, this is not to say that the IT and more technical teams should lead digital transformation initiatives alone. When asked which business unit should own digital strategy, only 2% of respondents named IT — instead, 32% wanted to see executive level ownership (the C-suite), with a plurality of 41% preferring a cross-departmental digital team.

Read More:

- How One Community Bank Closed Its Branches And Went Fully Digital

- Building The Future-Proof Digital Bank

- Integrated Digital Delivery Models: It’s Now Or Never

- 5 Roles of a Successful Digital Banker

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

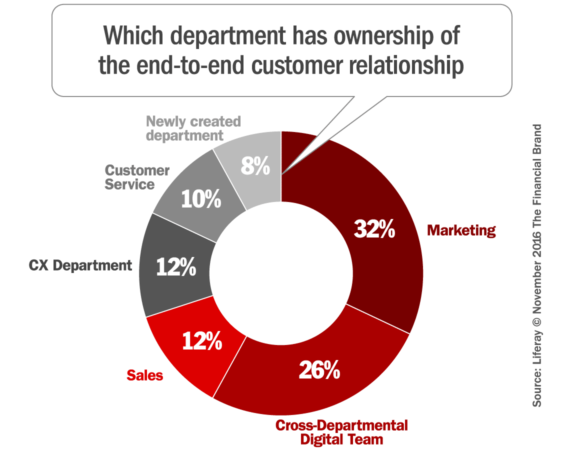

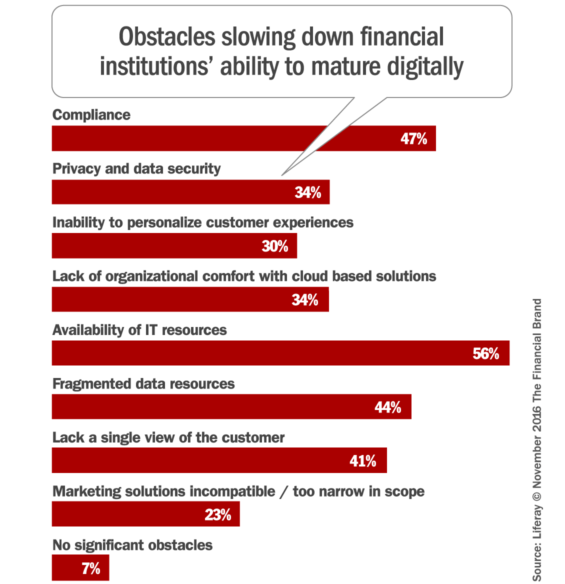

The wide championing of departmental cooperation by respondents seems to stem from the fact that siloing is perceived as the root of obstacles slowing down digital maturation. When asked about these roadblocks, 56% citied a limited availability of IT resources, 44% mentioned fragmented data resources, and 41% pointed to not having a single view of the customer. Asked what is the biggest barrier to addressing the full customer lifecycle, 46% of respondents acknowledged the fact that different business units own different parts of the lifecycle – far and away the most common response.

Taken together, these answers form a picture of financial institutions as being held back from their goals of providing high-quality customer experiences throughout the lifecycle, from acquisition to retention to winning brand advocates. Siloing and a lack of proper technology are the culprits often preventing the cross-functional team collaboration that would best serve the customer.

The good news for financial institutions is that the race to implement digital transformations ahead of competitors is a marathon, and most are currently finding themselves in the middle of the pack. When asked “Where is your company in its digital transformation,” 49% of respondents said they were roughly halfway there, while 37% said they were only currently beginning to roll out a strategy. Still, a financial organization that can establish a culture free of silos – and carry out effective digital transformation quickly and successfully – will certainly earn itself an effective competitive advantage and be able to deliver a differentiated level of customer experience.

Financial institution CIOs should apply their technology expertise and play a significant role in guiding digital transformation, but no one department can (or should try to) control the entirety of a business’s digital applications. Creating and empowering a cross-departmental digital team is an effective method for escaping silos and delivering a digital experience to banking customers that is unified across platforms and the full customer lifecycle. This will require consolidation and easy access to data from multiple departments in order to produce these consistent experiences, and all departments – not just IT or marketing – should have an active role to play.

By incorporating advice from other industry leaders and fostering a company culture ready to embrace cooperation alongside new technology, financial institutions can best execute the digital transformations necessary to keep pace and potentially stand out in their industry.

John Choi is the Director of U.S. Operations at Liferay, an open source platform provider that helps companies create digital experiences on web, mobile and connected devices.