Almost every banking provider claims to be engaged in some form of digital transformation today. Sure, many financial institutions are making large investments in digital today, but research firm IDC says these are only isolated or superficial efforts — what they call “islands of innovation” that pose as digital transformation projects. These “islands of innovation” are usually little more than product-specific digital initiatives most often manifesting as cloud or mobile-centric projects.

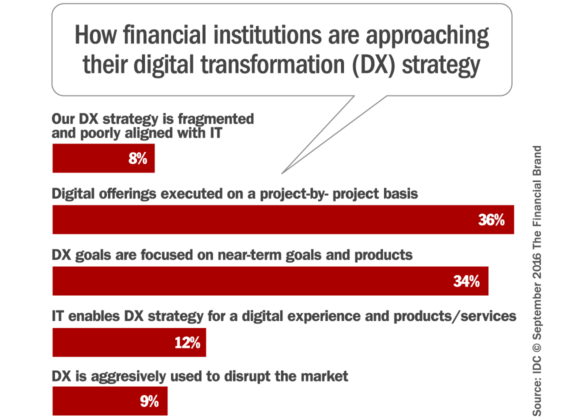

In a study fielded by IDC, 96% of the institutions surveyed acknowledged that they had some kind of digital transformation (DX) initiative underway, but around one-third admitted they were only approaching it on a project-by-project basis. An equal number confessed there wasn’t a long-term strategy at their institution, and that any initiatives were focused purely around short-term goals. Only one in five institutions said their DX efforts were significantly disruptive or strategic.

Only a quarter of financial institutions in IDC’s research approach DX as part of an organization-wide strategy, while one in five say it is only a back-office program. IDC believes that this is not sustainable, and that IT must work with business lines to create an integrated, enterprise-wide approach.

Read More:

- How Digital Investments Are Changing the Face of Banking

- The Future of Digital Banking is Now

- Banking on Digital Simplicity

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

What Should Your Digital Transformation Journey Look Like?

IDC defines digital transformation as the continuous process by which an organization adapts to- or drives disruptive changes in their market. They do this by leveraging digital competencies, innovate new products and services, and seamlessly blending digital + physical experiences while achieving operational efficiencies and improving performance.

IDC breaks down where financial institutions are in their DX journey using a proprietary “Digital Transformation MaturityScape” model.

“Digital transformation is not a ‘mobile-only’ initiative. It affects the entire enterprise.”

Digital Reactor (12% of institutions) — Line of business and IT digital initiatives are disconnected. No coordination from leadership. Various lines of business use digital technologies reactively, and buy solutions without IT approval.

Digital Explorer (31% of institutions) — The institution has identified a need to develop a digital strategy, but execution is still on a project basis. Digitally-enabled customer experiences and products are inconsistent.

Digital Player (32% of institutions) — IT and lines of business are better aligned around common goals, and share in the creation of digital products and experiences. IT enables lines of business through infrastructure DX initiatives. The institution provides consistent and repeatable products and experiences, but no true innovation at this stage yet.

Digital Transformer (17% of institutions) — Integrated, synergistic relationship between IT and lines of business to deliver digitally-enabled products, services and experiences on a continuous basis. The institution is a leader in its markets, delivering an exceptional overall digital experience across all channels.

Digital Disruptor (8% of institutions) — The institution is totally agile in the use of new digital technologies. Lines of business are continuously synchronized with IT to maintain and expand the digital environment. The institution’s business model is able to disrupt markets to its advantage.

IDC says those that are leading the race to digital transformation have three characteristics:

1.) Strong executive commitment, which leads to a collaborative culture.

2.) A focus on the “digital core,” including analytics and open, agile technologies.

3.) A willingness to partner with external providers — e.g., fintech startups, technology providers, and other non-financial services firms.

The Digital Core

The institutions IDC surveyed said they understand that having a “digital core” is an important enabler to achieve enterprise-wide transformation. The institution’s core enterprise IT should serve as a unifying platform, allowing greater agility in on the front lines without losing control over risk and processes in the back office.

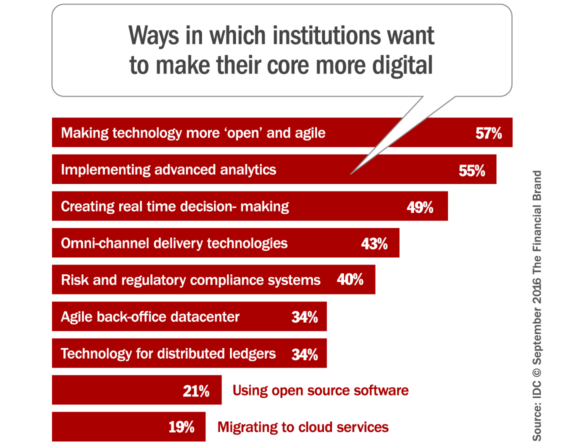

When asked to prioritize the technology challenges that need improvement to accomplish their DX goals, respondents cited open and agile technologies, advanced analytics, and real-time decisioning as their top three priorities.

For DX initiatives to be truly game-changing, IDC says innovation teams will need to leverage the collective technology assets and data of the entire organization — through agile development platforms and tools, APIs, access to complete and real-time data and analysis, cross-departmental access to financial data while being able to manage and anticipate risk associated with new business processes and products versus going about it on their own and working in siloes as is so often the case.

Evolving The Banking Business Model

IDC says the banking industry could learn much from health insurers that have transformed themselves from “humorless loss indemnifiers” into “digital lifestyle assistants,” where they incentivize people to live healthier lives using tools like social apps and gamification. Analytics on customer data are then fed back to those customers in a variety of useful ways — e.g., comparing fitness activities among friends, or rating the driving habits of fleet of company drivers, or showing progress over time toward goals.

IDC says one first step for banking providers might be to give consumers more robust financial management tools. For example, Halifax in the U.K. has begun providing customers projections of their account balance at the end of the month based on their typical cash flows. But IDC believes banks can go much further down this road. By using big data from people’s collective spending habits and analyzing transactions, they could give consumers ideas about how to save more with cheaper products and alternative services. Add mobile and social layers to this, and IDC says it could become a powerful and engaging tool for consumers.

Another example IDC offers comes from the mortgage lending side. They suggest that banks and credit unions could combine all the home buying features and functions a consumer shopping for a new house could possibly want into a single website portal or mobile app. Everything a home buyer would want to know could be right at their fingertips, from school ratings and commute times/distances, to insights drawn directly from the user’s data — how much home they can afford, the mortgage amount and rate they could qualify for, monthly payments and more.