When personal financial management (PFM) tools first started weaving their way into the banking industry, both consumers and financial institutions alike struggled. Consumers didn’t fully trust and understand PFM, while banks and credit unions wrestled with how such tools fit in their product mix and how to market them. As a result, adoption rates for PFM languished.

Today, nearly every aspect of consumers’ financial lives has migrated to digital channels. People desperately need online and mobile PFM tools that can keep up. Someone has to break the spell that bad PFM experiences of the past has cast.

“What it comes down to is that people need advice, but they don’t seek advice,” says Rita Sly, managing director of channels at ATB Financial, a Canadian regional bank that successfully launched their TrackIt PFM tool from MX. She says it’s great when people waltz into a branch because then it’s fairly easy to connect them with a personal banker (if you have one)… but that rarely happens — at least nowhere near enough.

“Delivering advice in a way that naturally fits within people’s patterns of behavior, that’s the sweet spot for all financial institutions,” adds Sly. “If you don’t leverage technology to make it part of customers’ day to day lives, you’re missing an opportunity to help them.”

Ms. Sly must know what she’s talking about, because it only took ATB six months since launching TrackIt in December of 2014 to get 46% of their online banking customers adopting their new PFM product.

Nate Gardner, EVP of client services at MX, the Utah-based fintech firm behind ATB’s PFM solution, says their company wanted to wipe the slate clean and reinvent the category. “We fundamentally tossed the traditional notion of PFM into the trash — the notion that says, ‘We have PFM, let’s check the box and move on.’ Instead, money management should be a key part of the banking experience across all channels.”

Gardner’s PFM philosophy is pretty straightforward. He believes a good PFM solution should do the heavy lifting for users — make life easier. So the development team at MX threw themselves at a critical component in consumers’ PFM experience: ensuring that user transactions are automatically categorized with precise accuracy. It may sound simple, but Gardner swears this is the trick. Once that’s in place, Gardner says it’s unbelievably easy for users to auto-generate budgets — and continue managing them.

“Once end users pull in all their accounts and see their spending effortlessly organized for them, they stick with the product,” Gardner says.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Key to Innovation: Investigating Disruptive Threats

“Because banking is such a traditional industry, the risk is that you think you’re safe,” says Sly at ATB Financial. “You think you’re insulated and that you can make small, incremental improvements and that’s going to be successful long term.”

Not so, Ms. Sly cautions.

“There’s so much innovation happening in the marketplace around financial services, and we need to be actively seeking out what’s on the horizon.”

To explore innovations within the industry and ferret out disruptive threats facing their bank, ATB Financial created what they call the Emerge Group. This special intelligence squad makes recommendations to senior leaders throughout the organization, explaining which ideas are worth pursuing… and which ones aren’t.

The Emerge Group loves disruptive topics. They’ve investigated everything from crowd funding to collaborative savings plans, but it was ultimately PFM that ultimately stood out. The Emerge Group didn’t see PFM as a disruptive threat, it seemed to have real potential.

For starters, PFM wasn’t a technology prevalent in Canada at the time.

“There was one bank in Canada seriously providing it and one just dabbling,” Sly recalls. “That’s why ATB got in front of it.”

Despite ATB’s success with PFM, Sly says there are still doubters.

“A lot of people in the industry still ask the question, ‘Why invest here?’” says Sly of PFM skeptics. “They struggle to find the business case of why it makes sense.”

Now of course, calculating the ROI of anything is tricky, and PFM is no different. But ATB says the decision to offer TrackIt was based on a desire to help people improve their financial health.

“We’re here to make banking better for people and make their lives richer, and this was the tool we needed in order to do that,” explains Sly.

The ROI of PFM

According to MX Training Director Erin Caldwell, PFM users are often the most engaged, the most loyal and most profitable account holders.

“PFM users log in to online banking more than twice as often as non-users, and spend twice as much time in the online banking environment once they’re there,” Caldwell says. “And they’re more likely to hold more accounts.”

In both the U.S. and Canada, it’s common for consumers to have one relationship with a big bank and another with a second bank — a smaller regional bank like ATB. Caldwell says these secondary institution’s can use PFM as a lever to pry consumers away from big banks, and Ms. Sly at ATB Financial agrees.

“If you have the better, easier, more efficient online experience, offering an integrated view of all bank accounts and credit cards,” Sly explains, “well, that starts to make you my primary bank regardless of what products I may hold with other institutions. Next time I need a new product, I’ll have more interactions and exposure with you, which means more opportunity to gain my future business.”

As Sly and the ATB team watch PFM adoption rates soar, they are also looking for any potential increase in share-of-wallet over the next 12 to 18 months. The fundamental theory they are testing? That more customer engagement increases, the greater chances are that you become their go-to resource for financial services.

Leveraging Data for Insights

ATB plans to figure out if TrackIt has changed consumers’ behaviors. Are they paying more bills with bill pay? Have they opened more products?

As they analyze results, ATB groups customers into three categories:

- Active Users — Customers who have aggregated, have created an alert or are deeply using something like a budgeting or goal tool within the suite of TrackIt services

- Passive Users — They check their spending occasionally, but don’t set budgets or manipulate transaction categories

- Non-TrackIt Customers — 52% and shrinking

“We’re now at the point where a considerable pool of customers are using TrackIt to do a deep dive analysis of their financial picture,” says Sly.

With a little analytics wizardry, PFM data can be leveraged to target customers with product offers specifically geared toward their needs and situation. For instance, if someone repeatedly classifies transactions as a “Child Expense,” it’s safe to assume they probably have children. Drawing assumptions like this, many banks have seen success from cross-selling services, with click-through rates on targeted offers like these averaging 25% — a big leap from 7.6% untargeted.

“Why wouldn’t we use that information to target things that might be helpful for people?” wonders Sly. “We want this to be seen for what it is. We’re trying to help people make their banking simple and their lives better.”

David vs. Goliath: Is PFM the Slingshot Banking’s Underdogs Need?

“When you look at what’s happened in the financial industry in the last 15 years, you’ll see a really big shift in asset concentration,” says Caldwell with MX. “It’s to the point where now, the 10 biggest banks in the United States control more assets than all other institutions combined.”

One of the major reasons for this shift is that big banks have more resources and can invest earlier than others, specifically where technology is involved. Consumers are also more prone to look outside of banking altogether. According to data from MX, 20% to 25% of people today use digital tools to manage their finances, and of those people, about 75% are using third-party tools such as Mint.com.

“Consumers will flock to organizations that provide these conveniences,” Caldwell says. “Technology that makes people’s lives just a little bit easier — even if it’s going to save five or 10 minutes — is a really big deal.”

Rachael Schwartz, electronic marketing specialist for Farmers Bank & Trust, has also launched the MX white label PFM tool, which they branded Clarity. Schwartz says rolling out PFM was essentially a matter of survival.

“Even though we’re a small bank, we have to stay competitive with large banks, and Wells Fargo is the major one in our area that offers a PFM tool,” Schwartz explains. “We knew this was something we had to do to compete — to retain customers and offer them new products.”

Farmers Bank & Trust launched Clarity in the beginning of 2014, and — like ATB — saw an almost-unbelievable adoption rate. By April, they were already at 40% and soaring higher. Impressive, considering the historical adoption rate for PFM has normally hovered around 8%.

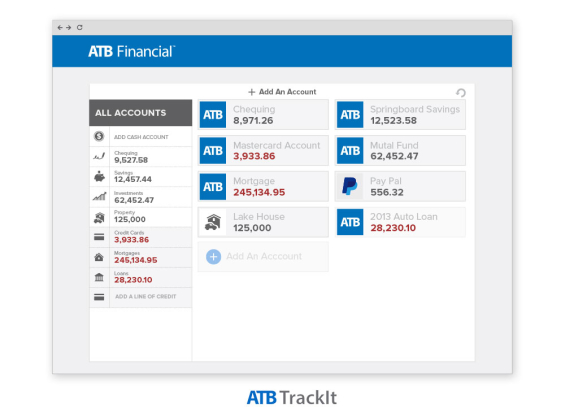

In Focus: ATB’s TrackIt PFM Solution

Rather than PFM widgets in a standalone tab, ATB integrated the experience throughout, whether it’s the account view or transaction view. “PFM can’t be an ‘also’ thing you tack on — forcing people to go to a special tab to do extra work,” says Sly. “It has to be part of their core experience.”

For every transaction, the tool automatically assigns a category, and you can adjust any categories or add custom ones. As you fine-tune the transactions, TrackIt learns your behaviors and gets even more efficient over time.

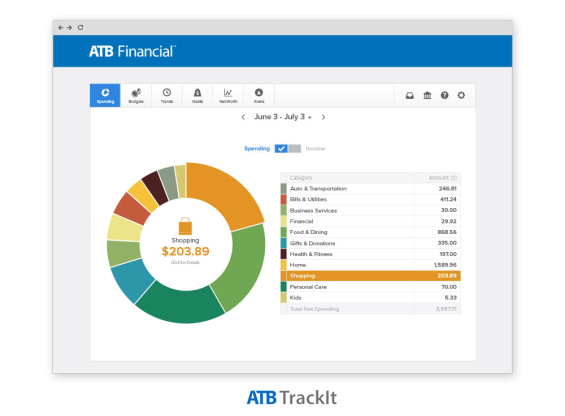

The spending wheel shows spending habits in a different view, where you can look at an overview, or click a category to see details of each spending category.

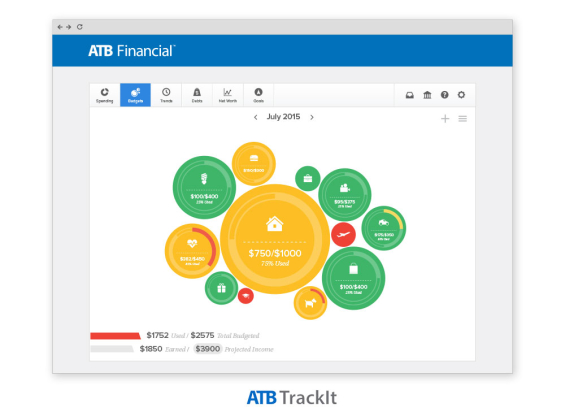

TrackIt also has an auto-budget feature that uses past transactions to create a custom budget based on that past spending. The user then simply alters the budget to reflect how they would like to start spending in that category. The size of the bubble is the relative amount of the budget, and the color shows if you’re on track or not.

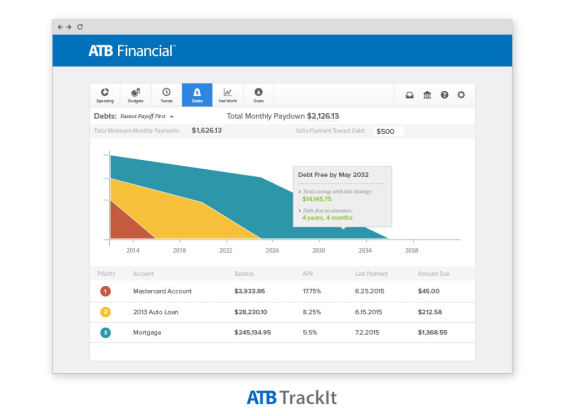

“A big selling factor is the debts page, where you can actually see when you can be out of debt,” says Schwartz. “Paying your debts isn’t always fun, but knowing there’s a light at the end of the tunnel will make you want to use it.”

For marketing on the bank’s site, TrackIt was promoted as a free upgrade, including a video that explained to customers what the tool does and how to use it. From there, the customer could say yes or no to trying it. For those that said no, the bank continued to put the teaser breadcrumbs throughout the traditional experience offered. Customers would be prompted with messages like, “ever wonder how your spending adds up?” If they click on it, the customer ends up back at the free upgrade page.

“This was the first time our marketing team has really been encouraged to be unconventional and think less like a bank and more like a tech company,” says Sly. “We told them it’s okay for a tactic not to work, but it’s not okay to not explore and stretch. Some pretty cool stuff came out of that.”

For instance, the bank hosted an online launch event for an audience of financial bloggers and customers, where Sly took the stage to walk through the features and functionality of TrackIt and explained why they chose to offer the PFM tool. You can view the recorded event by clicking here.

ATB also used Blippar, an app that uses technology similar to QR codes, but instead allows users to scan a graphic image instead of a plain, black-and-white bar code. The bank created coasters and posters that were placed in pubs throughout Alberta. When a bar patron scanned the coaster or poster using the Blippar app, a Tetris-style interactive game appeared on their phone. In the game, users drop pub items on a scale and try to maintain balance based on where you drop it, playing off PFM themes about finding financial balance in your life. Every week, ATB awarded $100 to the user with the top score.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

In Focus: Clarity PFM from Farmers Bank & Trust

For Farmers Bank & Trust, getting employees to be active users of Clarity was vital to its success. Employees were encouraged to have their own personal success story and used word of mouth to help spread the good news about the tool. Schwartz, for example, used Clarity to understand how to pay off her student loan debt in seven years, whereas before, had never created a budget for the cause.

“I had no idea when I could be debt free,” admits Schwartz. “By knowing how much extra money I needed to go towards that goal, and then actually having a budget that I could see with all my financial information on one screen, that was huge to me.”

Employees like Kevin Avery, a branch manager at Farmers Bank & Trust, actively share their PFM experiences with customers in branches.

“I’ve stopped eating out a lot, after I saw how much I spent at Chick-fil-A every week!” confesses Avery. “I’ve started buying more groceries and am really saving money that way.”

Not only were frontline staff better equipped to demonstrate the Clarity PFM tool, they even wore buttons that said if the employee didn’t talk to each customer about Clarity, the bank would pay the customer a dollar.

In May of 2015, the bank ran a sweepstakes that gave customers an entry every time they logged in to their account or added an external account, giving away iTunes cards, an iPad and other prizes. The bank had an increase of 323 users, 1,200 logins and 30 external accounts added during the contest.

Sicily Axton is the communications manager for StrategyCorps, a Nashville-based company that works with financial institutions nationwide to deliver mobile and online consumer checking solutions that enhance customer engagement and increase fee income. You can follow Sicily on Twitter and connect with her on LinkedIn.