Despite a textbook introduction that included coverage by all of the top business, technology and financial services industry publications, as well as more than 9 million views on YouTube, Coin continues to hit roadblocks as it tries to meet expectation of crowdfunding backers, industry observers, payment processors and tens of thousands of people who committed $55 to purchase the revolutionary payment-product-to-be.

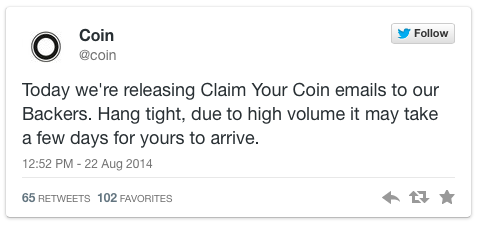

On August 22, the startup said it was delaying its full product release until the spring of 2015 (one year behind schedule), while it refines its device. On the same day, the company initiated an opt-in ‘Claim Your Coin’ beta test program for the first 10,000 pre-order customers who agreed to purchase the device for $50 (plus $5 shipping). Interestingly, by accepting the ‘opportunity’ to become a beta tester, early adopters were told they would have to pay an additional $30 for the first generation Coin card six months later (retail cost of $100).

In the first few hours after the initial announcement of a delay and the ‘opportunity’ for early backers to be part of a beta test that would cost them more money, thousands of negative comments were posted on the password protected Coin blog site. Most admonished Coin for missing their introduction deadline (after receiving an update less than 6 weeks prior that everything was ‘on schedule’).

In response to the overwhelming bad press and negative blog posts from backers, Coin sent another email the following day entitled, “An Apology and an Update,” where Coin restated that it will delay the official launch of the Coin until the spring of 2015. In the same email, they announced they expanded their beta test to 15,000 this fall (from 10,000) and eliminated the additional $30 to get the updated final version next spring.

Unfortunately, this mea culpa may have come too late as the comments on Coin’s password protected ‘apology’ blog post site have continued, illustrating the difficulty in reversing negative publicity once expectations have been missed.

An Apology and an Update

Dear Coin Backers,

First and foremost, we want to apologize to each and every one of you. We are building Coin for you and are extremely disappointed with ourselves that we made some of you unhappy with us. We want to earn your trust again.

We apologize for our lack of transparency and clarity in our communications to you. You, as our valuable backers, should have been the first to know about all product updates. We honestly thought we could make our timeline. We were overly optimistic. The San Francisco Bay Area Coin Beta made it evident that we should conduct a larger nationwide Coin Beta.

We need your help with testing nationwide, but realize that this is not a cost for you to bear. Therefore, we will run a nationwide Coin Beta for no cost to Coin Beta Backers ($0) and increase the number of Coin Beta devices by 50% to 15,000. We’ll do our best to grow this number over time. To clarify, your spot in the Coin Beta program is determined by your pre-order date, regardless of whether you opt-in with the iOS or Android app. We feel responsible to the commitment each of you has given to us by backing Coin and so we haven’t spent even one dollar of the crowd funding campaign. All our efforts and production has been supported by equity dollars.

Coin Beta was a hard decision but important step as we want to deliver the device we all expect and nothing less. Getting Coin to work with thousands of different card readers of different makes, models and regions is not easy and that’s why we need the help of an extended beta team.

We are truly sorry that the first generation Coin is not ready when we said it would. Our team has been working hard day/night and weekends since May 2012 in an attempt to deliver Coin to you on time and while we are close, we are not at the finish line. We have achieved ~0.84 mm form factor with e-ink screen and bluetooth low energy. We even found a button that has a tactile touch so you can feel feedback every time you press the button on Coin. Coin swipes successfully in 85% of the locations we visit. Our hardware team is focused on the remaining 15%.

With Coin Beta, we will validate compatibility nationwide and improve usability. Meanwhile, we’ll keep a focus on growing our manufacturing capabilities and are confident that we will deliver high-quality first generation Coins to you all.

We promise to do better with our transparency and updates to backers. We promise to keep working hard to deliver you a great product. We value your honest feedback, good or bad; and we are always listening.

Sincerely,

Kanishk and the whole Coin team

PS – We appreciate your patience and support, but if you would like to cancel, we will promptly issue a refund to you. Please email [email protected] with your order number. We hope to earn your trust again in the future.

Read More: Big Day for Payments: Plastic vs. Digital

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Coin Communication Strategy Raises Questions

The initial announcement of the Coin device that leveraged the biggest and best of industry followers as well as an unprecedented YouTube video set high expectations for how Coin would communicate going forward. On the positive side, The Financial Brand received seven email updates from Coin entitled ‘Coin Backer Updates’ and ‘Coined Backers Club’ over the past ten months. The communications included a thank you, ways to generate referrals, how to give Coin as a gift, pictures of prototypes, technological updates and projected dates of release.

Interestingly, each email included a password protected link to a blog site where comments were accepted, but kept out of the general public’s eye.

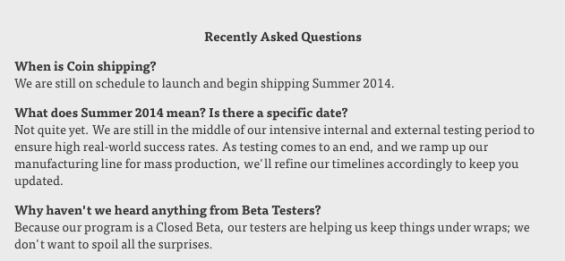

Looking back, the most misleading update came just 2 months ago to The Financial Brand, with no indication of a delay in introduction.

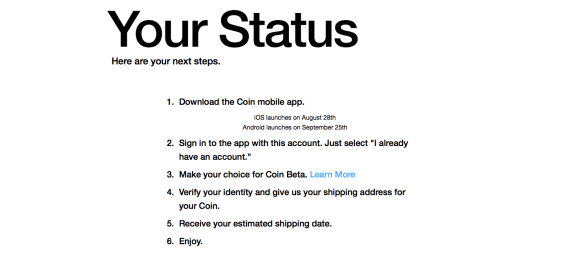

The recently received ‘Claim Your Coin’ communication was also flawed from the outset with unclear timing, non-transparent pricing and an inability to complete the opt-in process all at once (you could ‘claim your coin,’ but you could not download the Coin mobile app for iOS until August 28th or for Android until September 25th).

Finally, while Coin mentions that customer support is available from 8-5 PT, 7 days a week by email (phone coming soon according to Coin), concerns from The Financial Brand sent via email and mentioned several times on Twitter have gone unanswered for three days (and counting).

For a firm that leveraged digital media so well at the outset, these missteps are surprising.

Coin Challenges Go Beyond Bad PR

It is clear that a lot has gone into the development and introduction of Coin. Coin has developed a morse code style unlocking system to help combat fraud. To improve Coin’s two-year battery life, the device’s magnetic strip now only turns on at the millisecond it’s being swiped. Coin even built a system that will allow each Coin to send a unique code string to verify every transaction, which would “obliterate” fraud, says founder Kanishk Parashar. It is clear that Coin developers want to ‘get it right.’

Unfortunately, the pushed back shipping date and the decision as to whether to charge early supporters to help with a beta test has not been the only challenge for Coin. Similar to the challenges faced by payment innovator LoopPay, the Coin device currently only works on 85 percent of credit card terminals (LoopPay acceptance now exceeds 90 percent). Having hundreds of differently designed POS terminals, card accepting gas pumps and ATM machines creates issues for any payment innovator. To help alleviate this problem, Coin is asking its backers if they’ll help ‘test’ Coin on different devices and report their experiences.

“A major problem is that EMV functionality will not be included in the Coin card when introduced in early 2015.”

Further complicating the future success of Coin is the absence of an EMV security microchip that needs to be adopted by the entire US credit card industry by late 2015. When the consumer version of Coin launches next year, it will not contain such a chip. The company said that it will begin addressing the EMV issue after its current product begins shipping next spring. The company has repeatedly explained that the US credit card industry will remain in a transition period for years to come, which does not provide comfort from what is purported to be best-in-class payments technology.

By the end of 2015, card makers project that half of all credit cards and merchant terminals will be chip-enabled, therefore leaving the potential that Coin may introducing a device early in the year that doesn’t function in all cases 6 months later. CEO Kanishk Parashar acknowledges that Coin has not yet begun researching the development of a chip-enabled Coin.

Coin has sidestepped questions around PCI compliance

Another unresolved issue appears to be PCI compliance. In order for a device to accept or handle credit card transactions, it needs to be compliant with the Payment Card Industry (PCI) standards to ensure security for not just the customer, but also the merchant. The design of the Coin card could make it difficulties for it to receive PCI DSS Compliance because of the storage of card numbers on the device.

Without PCI compliance, Coin could be a non-starter. The issue has been sidestepped by Coin during interviews and Coin’s website does not provide insight regarding PCI compliance approval.

The concern remains that Coin collected tens of thousands of people’s money with a promise to bring unique technology to wallets that would simplify payments (or at least lighten the load in pockets). After a delay and the challenge of EMV and PCI compliance, Coin may already be behind the times.

Lessons for Banks and Credit Unions

While many in the industry envied the amount of positive press received by Coin last November, few of us would like to be in their place now as they battle the same trade publications and consumers that jumped on the bandwagon early.

Some lessons that can be learned from this situation include:

- Innovation is tough: While not a revolutionary lesson, the fact that breaking through the norm is difficult should not stop the innovation process. Maybe a better lesson would be that ‘going it alone’ is tough and that working with as many involved constituents can help minimize the risk of failure.

- Transparency in communication is key: While Coin did a good job in building a regular flow of communication, it appears their enthusiasm for the future overshadowed their complete honesty around the status of the development. In most cases, admitting challenges earlier is better than making excuses later.

- Social media reaction has no lead time: If you break the trust of consumers (and especially supporters), the response is immediate. While much of the harsh dialogue related to the changes in Coin’s schedule is hidden behind password protected blogs, it still has impact. The rollback of the fee to participate in the beta test has been removed and the questions around EMV and PCI compliance are now front and center.

It will be interesting to see if Coin recovers from the past week’s events and learns from the lessons above.