A little over 25 years ago, paying bills required some effort. Back then, your options were to write and mail a check, pay over the phone or pay your bank to do it for you. As the internet grew from obscure curiosity to popular, albeit costly, obsession in the early ’90s, financial institutions began to offer a new, more convenient option: online bill pay. No longer would you need to write check after check; all you had to do was log on and make the payments electronically.

Granted, to enjoy this convenience at the time required spending thousands on a personal computer, and hundreds more on network equipment and service fees. Still, despite the relatively small target market, online bill pay was popular among those who could afford it. For banks and credit unions, that made it a powerful tool for digital engagement and customer retention, simply because no one else could offer anything like it.

Financial institutions soon realized that if they offered this online bill pay service for free, their customers were more likely to stick around and open a savings account, take out a home loan, seek financial planning advice, and so on. The ‘stickiness’ that free bill pay created far outweighed the cost of the service.

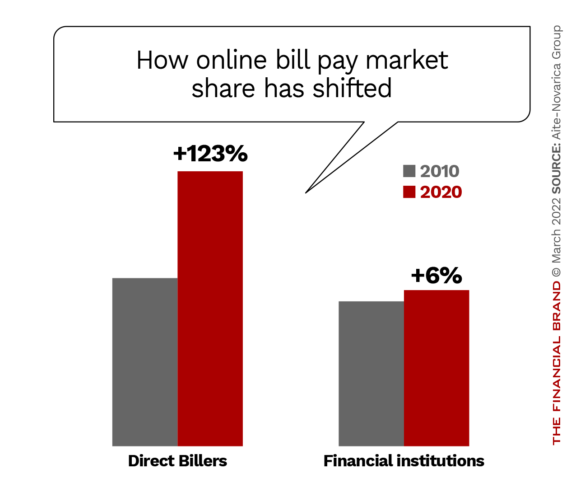

Unfortunately, for financial institutions, we’re not in the year 1995 anymore. Consumers have a number of choices in not only how they pay their bills, but also in how they deposit, move and even borrow money. Today, 76% of online bill payments are made directly at biller websites, with online payments made at direct billers growing 123% in the past decade. Meanwhile, banks’ share of online bill payments have shrunk in the past decade, from 38% down to 22%.

What’s more, a number of dynamic challenger banks and fintech startups are starting to encroach on other established bank products, displacing deposits and diminishing the importance of the checking account. P2P payment apps like Venmo make it easy to move money between friends, and consequently, just leave money in the app.

According to The Financial Brand, some $2.2 billion just sat in P2P accounts in 2017. Health savings accounts now account for $97 billion in assets in 2021, Denevir Research estimates — doubling in just four years. Banks and credit unions are no longer the central hub of their financial lives. They could be, though, if they think of today’s Millennial mobile user as 1995’s desktop internet user.

Out of Touch with Consumer Expectations

While online bank bill pay was truly a transformative technology when it was introduced a quarter-century ago, it hasn’t changed much since. Payments can take anywhere from one to ten days to post, often with no assurance from the biller that the payment has been posted. By today’s standards, it’s an inconsistent system that fails to include the many payment methods consumers now rely on: debit cards, credit cards and digital wallets.

Good Question!

‘If I can get a big screen TV delivered the same day by Amazon, why is my online bill pay still a multi-day process?’

With your average consumer paying between 12 and 15 bills a month — and most of those consumers reporting feeling uncomfortable and even anxious about paying bills on time — traditional bank bill pay simply just doesn’t meet the consumer’s needs anymore.

In the absence of any meaningful innovation in bank bill pay, most billers went ahead and created a better experience themselves. You can see your amount due and bill details if needed. You can pay with your favorite debit card, rewards-based credit card, or digital wallet. Most importantly, you can see your payment post in real time. It’s just a better experience.

While this might seem like all doom and gloom for banks and credit unions, the good news is that the same logic from 25 years ago still applies today: Bill payment is still an opportunity to engage customers; the approach just needs to change.

How to Make Bill Pay a Consumer Magnet Again

On the surface, it might seem like a herculean task to not only overcome over two decades of technological debt, but also to convince customers — who have now come to rely on their billers to make payments — to come back to bank bill pay. Though consumers’ financial lives may be headed to something more atomized and dispersed, that’s not where they want to see things headed.

Consumers love paying their bills with credit cards because they get rewards. But if the average consumer is paying 10-15 bills each month — most of them at different biller sites — that creates a fragmented experience for consumers. This leads to consumers significantly underestimating just how much they’re paying on bills. One 2018 West Monroe survey found that consumers spend 197% more on subscriptions than they think they do.

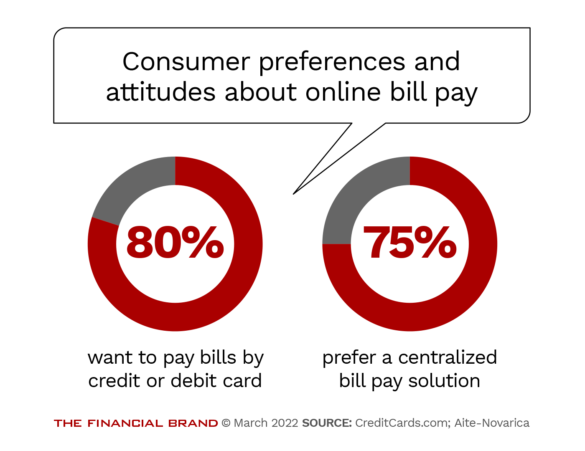

This is why 75% of consumers would prefer a centralized bill pay solution, according to Aite-Novarica, and 80% of consumers want the option to pay bills by credit or debit, according to CreditCards.com.

So, what if your customer could have their cake and eat it too? It sounds cliché, sure. But really: With currently available product options you could offer your customers a single location where they could see all of their bills, subscriptions and other financial obligations. Then they could pay eligible bills with a credit card or debit card, all in one place.

In addition to the convenience factor, giving customers complete visibility into their current financial state would make it easier for them to manage their money. That combination could ultimately bring stickiness and customer retention back to bill pay.

Look to the Future:

Customers want to easily pay their bills — three quarters of them say they want centralized bill pay and 80% want to pay with a card.

With such tools, your customers can centralize all of their bills, subscriptions, and other financial obligations, track due dates and cash flow, and create flexible ways to automate and schedule payments, especially if all that is integrated with real-time money movement.

This provides customers with a personal finance tool that empowers them with a better understanding of their financial health and simplifies money movement on their journey to financial freedom.

Bringing Meaning to Money Movement

We believe that providing the capabilities and convenience of a centralized financial hub coupled with real-time money management and movement will simplify customers’ lives and keep banks and credit unions at the center of the consumer’s financial universe.

In addition, customers who have a solid grasp of their financials are better positioned to take advantage of other products and services their bank or credit union offers. And because customers are spending more time using digital banking, financial institutions have more opportunities to offer relevant products and services to them.

Think Outside the Box:

Banks and credit unions need to offer financial insights if they want to help customers achieve their financial goals.

Beyond pure engagement metrics, such capabilities also create an opportunity to redefine the relationship with your customers. By offering the infrastructure for consumers to build a comprehensive look at their financial health, you get a clearer picture of your customer’s spending habits. This can be used to create products and services tailored to meet their specific needs. In other words, a more engaged customer base leads to a more collaborative relationship and better services.

If you’re curious about the impact the Payveris Bill Center, powered by the Instant Payment Network, can have for your institution by the numbers, take a look at our latest infographic, and get in touch. We can help you bring meaning to money movement for your customers.