The banking industry and the world around us has changed faster in the past year than at any time in our collective lives, and will most likely continue to evolve even faster in the future. What was once considered ‘business as usual’ no longer exists, with the pandemic creating a period of unprecedented turmoil and opportunity.

Financial institutions need to prioritize between short-term and long-term business objectives during a time of economic uncertainty, increased competition, changing consumer expectations, and new technological advances that are opening doors to a complete transformation of the banking ecosystem. The underpinnings of most traditional banking organizations present a challenge due to heavy operating costs, outdated core systems, cumbersome back-office operations and processes, and legacy leadership and culture.

The good news is that traditional banks and credit unions often benefit from strong capital and liquidity positions, scale of existing customer bases, inherit loyalty and trust, management experience and community involvement. The question becomes, can organizations leverage the benefits they have to position themselves for the evolution of banking in 2021 and beyond? Based on research done by the Digital Banking Report, the path to digital transformation may not be the same for small, mid-sized and regional financial institutions as it will be for the largest banks.

Read More:

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

- Banking Must Bridge the Growing Digital Transformation Skills Gap

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Cost Cutting Becomes Short-Term Remedy

As financial institutions focus on top-line growth during a period of low interest rates, slim margins and diminished demand for credit, many have focused on traditional short-term strategies like cutting costs across the entire organization. In addition to reducing and restructuring investment in new technology and innovation, many organizations also scaled back workforces, eliminated product lines, stopped serving certain segments and geographies, and closed branches.

Recently, financial institutions globally have pursued mergers and acquisitions to create greater scale for future growth while eliminating duplicative costs. In many instances in the U.S. and abroad, the biggest initial benefit from consolidation is the ability to close or repurpose branches, merge back-office functions, and reduce technology spending as a percentage of assets. One of the negative impacts of cost-cutting has been the shift away from less profitable businesses and populations, including less wealthy segments and geographies.

Key Insight:

Financial institutions can’t cost-cut their way to prosperity. Investment must be made in meeting consumer expectations for enhanced digital experiences and employee expectations to become digitally ready for the future.

Bridging the Gap Between Consumer Expectations and Banking Priorities

With the onset of the pandemic, financial institutions needed to provide access to virtually all financial services via digital channels. With the restrictions on in-person branches, banks and credit unions needed to transform all processes – from account opening and loan applications, to account servicing and sales – to digital alternatives. The vast majority of financial institutions globally were unprepared for this shift, Digital Banking Report research found. In many instances, while the ability to conduct banking via digital channels was made possible, the experiences were far from optimal.

According to the World Retail Banking Report 2021, sponsored by Capgemini and Efma, “42% of bank executives polled said that they were not sure how to integrate and streamline mid-, back- and front-office functions effectively, and 46% said they are unsure how to embrace open banking, orchestrate the ecosystem or become a truly data-driven organization.” At the same time, consumers adjusted to the lock-down reality by embracing digital experiences that saved them time and money … in every industry.

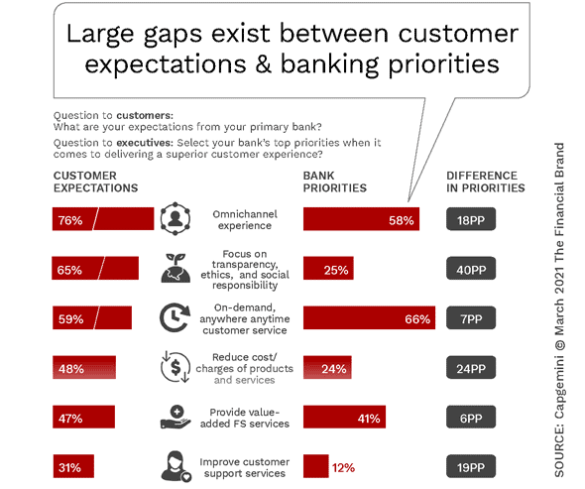

The disparity between the expectations of the consumer and priorities of the banking industry are stark and revealing. The World Banking Report found that, despite being vocal about improving the customer experience, the banking industry’s delivery of the key components of a strong customer experience, such as improving transparency and social responsibility, improving customer support and reducing the cost of services falls far short of customer expectations.

To remain competitive, legacy financial institutions will need to increase investment in areas that the consumers value the most. This ranges from improving the speed and simplicity of digital engagement, using data and analytics to provide proactive real-time recommendations, creating new ways of engagement and customer care and exploring value-added ways to make a consumer’s life easier – even beyond financial services. Moving from a product-centric perspective to being customer-centric needs to become part of an organization’s culture.

Consumers Drive Post-Pandemic Evolution

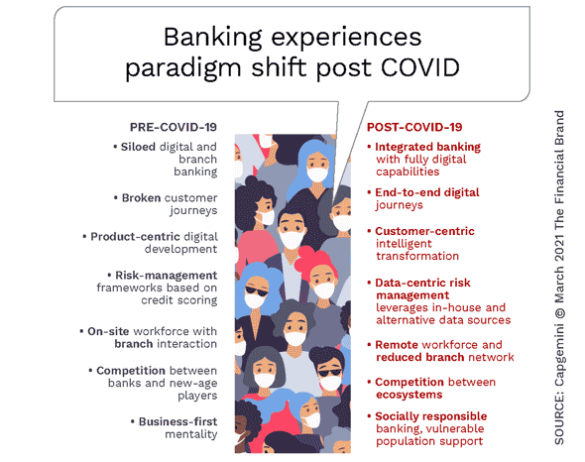

The vast majority of traditional financial institutions are not structured for a new digital paradigm shift. As consumers became aware of the possibilities created when data, advanced analytics, new technology and digital communication were leveraged by big tech and fintech firms, expectations rose. And they continue to rise. No longer are institutions able to process data fast enough, due to siloed organizational structures and antiquated analysis tools. Quickly, remote workforces have to collaborate and rethink legacy product alignment, repositioning the offering of services and the commitment of resources around the customer.

According to Capgemini, “Banking-as-usual is evolving into a digital-first, seamlessly integrated banking experience via coexisting digital channels and modernized branches. A shift to enhance the customer journey by enriching the last-mile delivery will also occur, with product-centric innovation giving way to customer-centric intelligent transformation.”

Banking-as-a-Service (BaaS) Platforms Go Mainstream

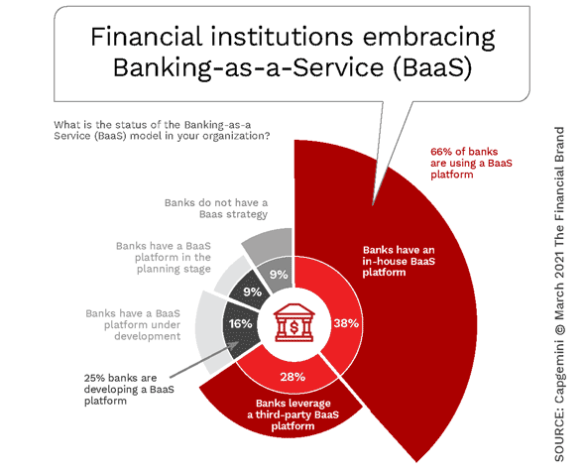

The expansion of the Banking-as-a-Service model across the entire financial services industry is facilitating value creation as well as value exchange between both financial and non-financial entities, with the consumer being the primary beneficiary. BaaS platforms are democratizing the offering and delivery of products and services, accelerating the innovation process, allowing for faster iterations as consumer behavior changes.

The World Retail Banking Report found that two-thirds of financial institutions are currently using a BaaS platform, with 25% stating that a BaaS platform is in the planning or development stage. This has greatly increased the number of incumbent financial institutions that are collaborating with fintech, big tech and other non-banking entities to increase scale, expand distribution options, create new products/services, reduce costs, diversify revenue streams and gather greater consumer insights.

The ultimate objective of a BaaS model is to increase engagement by the customer beyond checking daily balances. Loyalty and overall customer value can be enhanced as financial institutions move more toward “embedded finance” that is part of a consumer’s everyday life. Combining financial services with social media, retail, transportation, hospitality, investment and advisory services increases the potential to provide incremental value to retail consumer segments or even on an individualized basis. Part of this value can also include improved engagement and back-office processes, new products and even new ways of monetizing customer relationships.

Key Insight:

75% of financial institution executives say they are interested in partnering with other sectors to offer non-financial products and services to their customers – World Retail Banking Report 2021.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Super Apps Emerge as Consumers Diversify Relationships

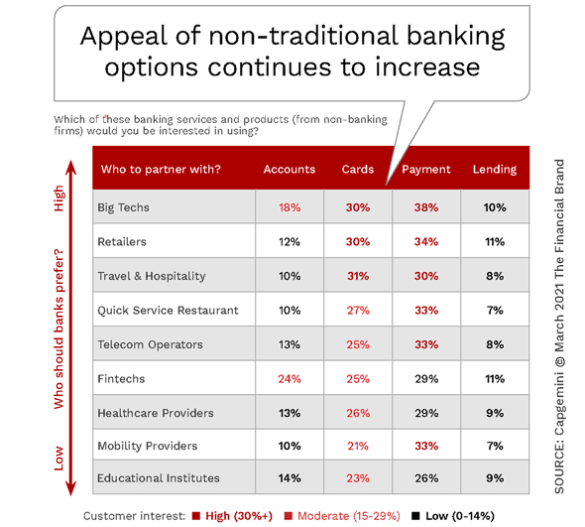

From Apple, Google, PayPal and Amazon to retailers, telecom companies, fintech firms and old school providers like Goldman Sachs, the number of organizations entering the banking ecosystem continues to expand. Supported by a massive influx of capital through external investments, partnerships inside and outside financial services are leveraging established name recognition, trust and timely niche offerings to meet the consumer’s lifestyle needs. What must be realized is that digital engagement is at the core of all of these super app combos.

When consumers were asked what banking services they would use from non-traditional providers, the array of responses were far broader than in any previous research. This indicates increased comfort by consumers to expand their financial relationships beyond the traditional banking system.

The impact of this shift is not readily apparent in research around switching of banking providers. In fact, immediately before the pandemic and since, the percentage of consumers switching primary banking providers has remained at an historic low. This is not an indicator of customer satisfaction, but the reality that consumers do not need to close an account to shift (or expand) a relationship. In fact, even the definition of “primary financial institution” (PFI) should be reconsidered as many Millennial consumers would not consider their PFI to be their checking account bank, but more likely their payments provider (Venmo, Square, PayPal, etc.).

Cloud Computing for Enhanced Customer Experiences

After years of hesitation around the adoption of cloud computing for a variety of reasons, the realization of the benefits of cloud technology are bringing cloud implementations to the forefront. Part of this acceptance has been because major providers have addressed concerns around security, implementation timelines, costs and ROI rationale. In fact, the World Retail Banking Report found that 32% of banking executives were ready to pilot cloud computing, with 56% saying they would implement cloud at scale by 2022.

The benefits most stated for moving data processing to the cloud include faster innovation, reduced costs, improved productivity, scalability and flexibility and robust continuity management (up-time). For most organizations, the move to cloud computing is only a preliminary step towards complete cloud transformation. As the importance of personalization of the customer experience becomes a business requirement, the need to process data and create actionable insights in real-time will require a strong cloud architecture.

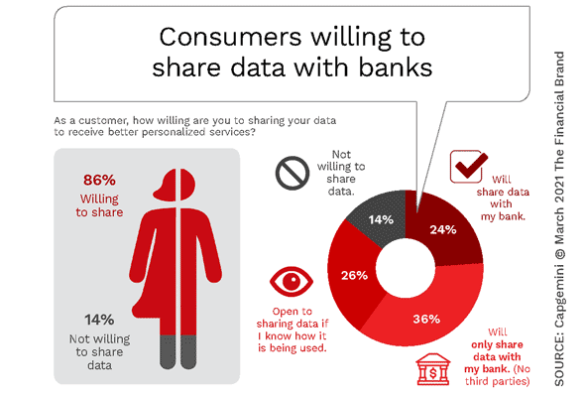

Data sources will only become more prevalent in a digital world where the collection, processing and use of data insights for the consumer’s benefit becomes imperative. The good news is that, if value is provided to the consumer for the use of their private information, the consumer will share more in the future, making relationships even stronger.

Key Takeaway:

The key to survival in 2021 and beyond is to embrace the change that we are experiencing and plan for the long-term with data, advanced analytics, fast and easy digital functionality, and revised back-office processes that reflect a digital future.

As banking becomes more ubiquitous and embedded in customers’ lives, legacy financial institutions will be challenged to be at the center of that ecosystem. There will be more organizations vying for that position than ever – with many not even being traditional financial organizations. The key will be to use data and insights to provide value in exchange for trust and loyalty. This will also require collaboration with players outside of traditional banking that will provide the reason for consumers to be even more engaged with their “banking” app than they are today. This will require a robust digital CX layer that makes engagement intuitive and easy.