The COVID-19 pandemic has increased the urgency around digital banking transformation in financial services. As consumers and businesses have accelerated their shift to digital options, the importance of integrating digital and physical delivery capabilities has become an imperative for success and survival.

More than just creating a seamless digital account opening process or a pretty mobile banking app, financial institutions must embrace the application of enhanced data, artificial intelligence, robotics, cloud computing and other technologies for an improved customer experience and better decision making.

The mission of digital banking transformation is not easy. However, it provides immense opportunities for increased internal efficiencies and improved marketplace competitiveness – as both fintech organizations and big tech players continue to encroach on traditional banking strongholds. The challenge is that the process of digital banking transformation touches many areas of the organization, requiring prioritization of investments. The process also requires ongoing engagement and potential reorganization, because there is not a static endpoint.

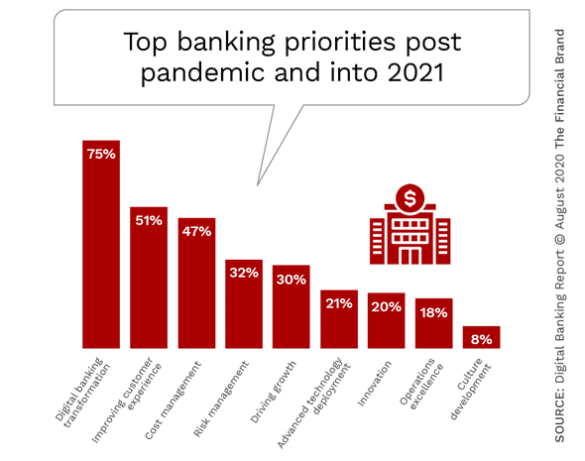

Our research for the soon to be released Digital Banking Report revealed an overarching awareness and enthusiasm around the process of digital banking transformation. 75% of organizations worldwide cite it as a top three priority for 2020 and into 2021. This was followed by “improving the customer experience” (51% mentioned as a top three priority) and “cost management” (47%) .

On the surface these top priorities appear to be aligned with future banking needs. However, there still are several disconnects within the priority ranking, since three of the lowest priorities mentioned are instrumental to achieving digital transformation success.

Only 21% of the respondents cited “deploying advanced technology” as a priority, with “operational excellence” (20% mention) and “culture development” (8% mention) rounding out the bottom three priorities. The lack of focus on technology, operations and culture will ultimately derail most digital banking transformation efforts.

Read More:

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Knowing What’s Important Is Not Enough

Unfortunately, while some form of digital banking transformation is taking place in nearly all financial institutions, additional paradoxes were observed around digital banking transformation strategies, investment and talent development. This suggests that while there is an awareness of the importance of digital banking transformation, the successful implementation is far from assured.

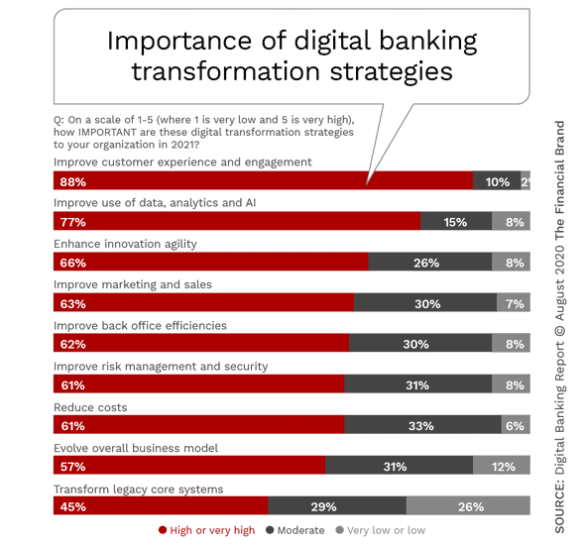

In the Digital Banking Report research conducted among financial institutions worldwide, 88% of financial institutions of all sizes noted that “improving the customer experience” was the most important digital banking transformation strategy. In other words, there was an almost universal agreement on the connection between customer experience and digital transformation.

The second most mentioned strategy needed to achieve successful digital banking transformation was “improve use of data, analytics and AI.” Few could argue with the connection between understanding your customer, deploying personalized solutions based on this knowledge and building solutions that are a result of this analytic journey.

As shown below, after the top two strategies, the next five strategies were seen as equally very important towards the process of digital banking transformation, each with roughly two-thirds of organizations ranking the strategy as “high or very high” in importance, with less than 10% believing that the strategy has “low or very low” importance.

What was interesting about ranking the level of importance of differing digital banking transformation strategies was the significant drop in importance of “transforming legacy core systems.” In all previous research studies on the subject, the upgrade of a financial institution’s legacy core was rated much more important. The shift can be best explained by the availability of new vendor solutions that help an organization achieve improved results without updating an entire back office system.

Read More:

- The Top 7 Digital Transformation Trends in Banking

- The Illusion of Digital Transformation in Banking

- Most Banks Underestimate The Urgency of Digital Transformation

The Success Paradox

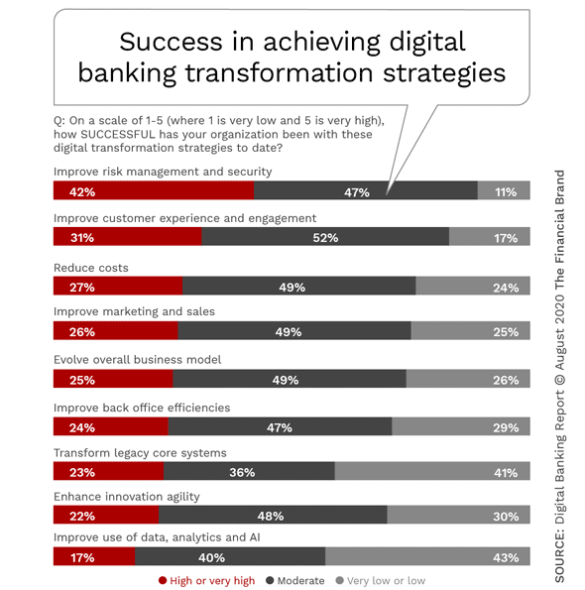

While 75% of respondents indicated that digital transformation was a top post-pandemic priority for their organization, and the majority understood the importance of the components of digital banking transformation, it is clear that most organizations are not successfully deploying the strategies needed to succeed.

For instance, while an overwhelming 98% of organizations stated that improving the customer experience was either “very high”, “high” or “moderately” important, only 31% stated they were either “highly” or “very highly” successful at doing so. Just over half (51%) stated they were moderately successful at improving the customer experience.

The level of success of all of the other digital transformation strategies (except for improving risk management) were even worse, with roughly one-quarter of institutions considering themselves successful at any of the core components of digital banking transformation.

Of significant concern is the fact that the lowest success metric was in the category that was considered the second most important area of focus – “improving the use of data, analytics and AI.” Less than one in five (17%) of organizations considered themselves either highly or very highly successful with data and analytics … and the success metrics were highly skewed towards the largest organizations. The reality that just over four in ten organizations (43%) considered themselves to have low or very low success with data and analytics is even more concerning.

Finally, when organizations were asked whether they expect an increase or decrease in budget next year in the category of data, analytics and AI, less than 50% of every asset category of financial institution expected an increase in budget … despite the awareness of importance and inability to be successful with data.

Read More: Every Financial Institution Must Embrace Digital Transformation Now

Inconsistent Commitment to Digital Banking Transformation

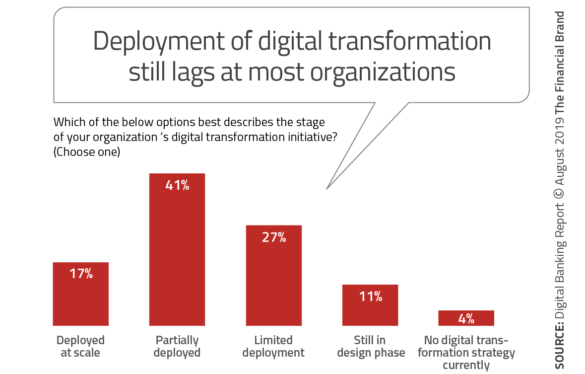

Given the paradoxes described, it should come as no surprise that less than 20% of organizations believe they have deployed digital transformation “at scale.” While the largest organizations have a slightly higher percentage than average, so do the very smallest organizations. In both the largest and smallest organizations, more than half were not satisfied with the results.

Across all asset categories except the smallest organizations, roughly half of the organizations stated they had “partially deployed” their digital transformation strategies and they were delivering “as expected.” The smaller organizations had 36% partially deployed satisfactorily. Roughly the same percentage across all asset groups had a process that was partially deployed without satisfactory results.

As could be expected, the largest organizations had no examples of digital transformation in the design phase or not designed, while the smallest institutions had slightly less than one in five (17%) that were in the design or not yet designed phase.

Past research from the Digital Banking Report around digital transformation suggests that the greatest inhibitor of digital transformation success is in the area of legacy culture. Being aware of the opportunities of digital transformation and not supporting the initiatives or investments required to achieve success is a weakness at the highest level.

As senior executives and boards of directors hope to transform their organizations for the pandemic fueled digital age, the culture of organizations must support innovation, the application of data and analytics, increased employee training and the investment in advanced technology to achieve the level of customer experience possible with digital transformation.