An online discussion forum built by Wells Fargo lets college-bound students and their parents ask and answer each others’ financial questions. Company representatives start and guide conversations, but the purpose of the site isn’t to push loans in people’s faces.

While millions of graduating high school seniors are in the middle of finalizing their college selections, Wells Fargo has launched WellsFargoCommunity.com, a free online community for students, parents, guidance counselors and financial advisors.

The site is designed to foster “an open dialogue,” the bank says, about college planning topics — e.g., timing, selecting a major, financing an education and housing.

“We’ve created this community so you can get questions answered – and provide helpful information to others,” the bank explains.

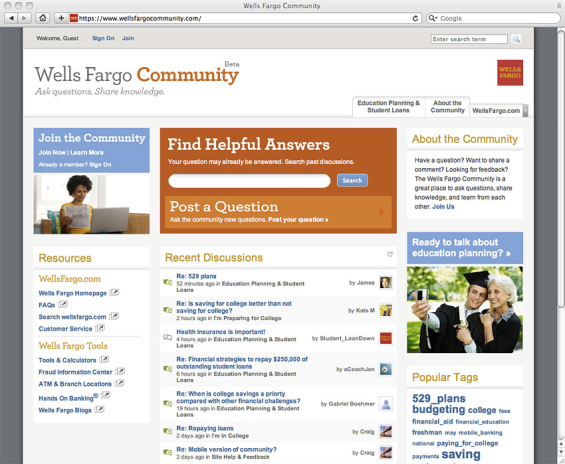

The community is built on the structure of a classic online forum, one of the oldest forms of social media dating all the way back to the internet’s genesis. To use the forum, anyone can create an account (the registration process is simple), then post a question or topic in the forum. Anyone else in the forum with a registered account can reply to others’ posts.

Wells Fargo has its own representatives active in the forum, all clearly denoted with a “Works@WF” badge.

Topics span college financing options, 529 plans, field reports on campus visits, and how parents with young children can begin to save for college.

The forum presently has 63 “conversations” running. The most popular, a post about a dad+daughter visit to Oregon and Washington campuses, has been viewed 895 times and has 12 replies.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

“Wells Fargo is inviting everyone involved in the college planning process to join the community,” said Kimarie Matthews, VP of Social Web for Wells Fargo. “As a result, members won’t get just one answer to their questions from a single point of view. They’ll get a variety of answers and insights from different people.”

Wells Fargo’s student community website is very simple. There is the discussion forum, an about tab, a summary of popular conversations, and a list of top contributors. There isn’t much else. Surprisingly, Wells Fargo doesn’t include any links to the sprawling student lending center on its website. Maybe company representatives only slip links into conversations when they occur naturally? In any event, it’s hard to see how a link — somewhere on the microsite — would point to the plethora of student loan information that Wells Fargo has packed on its main corporate website. The closest thing though is a link to the bank’s general homepage.

How big is the market? Wells Fargo says there are over 20 million students enrolled in undergraduate and graduate programs. If Wells could capture 5% of the that market, it would be worth as much as $80 billion.

Wells Fargo seems serious about reaching the student audience. The bank distributed some $68 million to 8,000 different educational programs and schools across the U.S. just last year alone.

With fees at in-state public four-year schools increasing an average rate of 5.6% per year above the general inflation rate, students need all the help they can get. This school year, the average cost for tuition, room and board is $17,131, up 6.0% over last year.

“Students and parents have a number of questions when it comes to college planning,” explains Kirk Bare, head of Wells Fargo Education Financial Services. “So we’re facilitating the sharing of knowledge, advice and experiences through the Wells Fargo Community.”

The Education Services division that Bare counts more than 1.9 million student and family customers across the U.S. The division provides tips and tools to keep college-related financial decisions on the right track.

The bank boasts a robust student loan area on its website. Among the 14 different tabs about financing an education, there is a section with resources and information for students, a section for parents and planning calculators.

Well Fargo offers a wide range of programs to undergrads:

- Collegiate Loan – cost of education (minus other financial aid) at 3.40% APR

- Student Loan for Community College – up to $15,000 for two-year programs and $20,000 for four-year programs at 5.24% APR

- Student Loan for Parents – up to $25,000 per school year at 4.00% APR

- Specialized loans for graduate students and health/professional students.

Wells Fargo says it has been in the student lending business since 1968, or some 44 years.