The report: Driving Resilience and Revenue Through Social Business Transformation [January 2024]

Source: Deloitte Digital

Social media is rapidly evolving from a marketing channel into a strategic driver of enterprise growth, resilience and transformation. In a recent report, Deloitte Digital argues that leading “social-first” brands have already recognized this, achieving an average 10.2% revenue increase in 2022 directly from their social strategies.

By taking an interconnected approach focused on community engagement, collaborative content creation, and social commerce, these companies are unlocking multi-faceted benefits that reverberate across the organization.

Key Takeaways

- Social-first brands are 3 to 4 times more likely than low-maturity organizations to have the value of social media recognized by the entire C-suite.

- They are eight times more likely to have exceeded revenue goals in their B2C lines of business by 25% or more over the past year.

- Co-created content — developed in partnership with customers, influencers and creators — is seen as the most important source of content for effective social strategies.

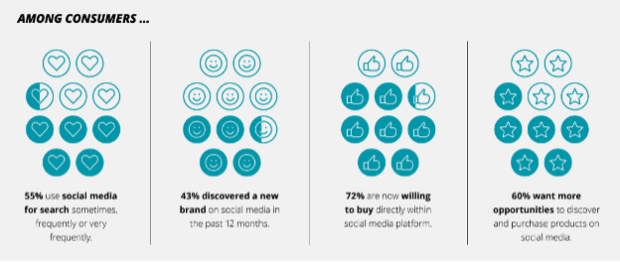

- With product discovery increasingly migrating to social platforms, 72% of consumers now express willingness to purchase products and services directly through social media.

What we liked about it: The Deloitte report quantifies the potential impact of being “social-first” on the metrics that matter: revenue and growth.

What we didn’t: The report is vague on some of details of how to operationalize being “social-first”.

Why we picked it: Social media platforms have moved to the center of marketing and e-commerce strategies in retail, hospitality and other industries. Can banks follow the same path?

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

- 60% of consumers want more opportunities to discover and purchase products on social media platforms.

- 9 in 10 consumers say they trust creators and influencers they follow as credible sources of information.

- Compared to low-maturity organizations, social-first brands are 5.7x more likely to state that user-generated content is a very high priority for their social strategy.

The Rise of the Social-First Enterprise

Brands have traditionally treated social media as a siloed marketing function focused on amplifying content and building communities. Now, forward-thinking enterprises view it as central to the entire customer experience. These “social-first” leaders are collaborating with online communities, co-creating content with customers and influencers and facilitating social commerce — unlocking strategic benefits that span the organization from product innovation to customer care.

How can banks become “social-first”?

Community-centric engagement: At the core of the “social-first” approach is a philosophical shift in how brands engage their audiences. Rather than broadcasting one-way messages and marketing content, successful social brands are participating authentically in the communities where customers already congregate.

This community-centric ethos requires banks to humanize themselves through two-way dialogue and make the customer voice a core part of the engagement model. Social-first brands recognize this, being 4.7x more likely than low-maturity organizations to use social platforms extensively as channels for customer service and support.

They are also 2.5x more likely to plan to increase the number of social platforms where they engage customers over the next year. Crucially, these brands manage paid and organic social tactics together 3.1x more often than others, improving consistency in messaging and experiences.

Collaborative content is prioritized: The most compelling and effective social content is no longer created solely by brands themselves. While one-way branded content still has a place, social-first organizations understand that collaborative co-creation — through partnering with customers, influencers, and creators — is paramount for connecting with audiences.

Reflecting this strategic priority, leading brands are 5.7x more likely than their low-maturity counterparts to state that user-generated content is a very high priority for their social approach. Many leading brands go even further, actively engaging creators in product research and development initiatives to drive innovation.

Shoppable social experiences: As social platforms double down on immersive commerce experiences that blur the lines between viewing content, discovering products, and making purchases, consumer willingness to buy through social media is skyrocketing.

“Social-first brands are now focused on meeting and serving consumers in their own communities through a two-way dynamic of communication and connection.”

Across surveyed consumers, 72% express being open to purchasing products and services directly through social apps, while 60% want more opportunities to discover and explore new items this way.

Social-first brands have been quick to capitalize on this shifting behavior. They are 2.9x more likely than others to say driving commerce and sales is an extremely important component of their overall social strategy. Effective social initiatives now aim to boost SEO and discoverability in addition to facilitating purchases, with top brands being 3.5x more likely to prioritize SEO.

Looking Ahead

With social media’s sphere of influence expanding well beyond simply marketing, taking an integrated approach that spans community engagement, collaborative content creation, and facilitation of social commerce is quickly becoming table stakes. The leaders dialed into this reality — the social-first brands — are already demonstrating the growth upside.

Compared to their low-maturity counterparts, social-first enterprises are 3.6x more likely to have social recognized as a major catalyst for growth across the entire organization. By making social media a cross-functional priority that intersects product, customer experience, marketing and more, they are improving resilience and driving real, quantifiable business impact.

As consumer behavior evolves, banks must evolve their social strategies in parallel – turning social media from a separate channel into the connective fabric woven across every customer touchpoint. Those that successfully make this transformation will be best positioned to thrive in the social-first era.

Dig deeper into social media strategies:

- How Bankers Can Master Relationship Building on LinkedIn

- Redefining CX Through Innovative Social Media Strategies

- How to Become an ‘Unmarketer’: Stop Marketing and Start Engaging

Editor’s note: This article was prepared with AI language software and edited for clarity and accuracy by The Financial Brand editorial team.