Community and regional banks are solidly on board with social media, but they’re still figuring out its potential as a sales tool, identifying ways to stretch limited resources and grappling with regulatory oversight.

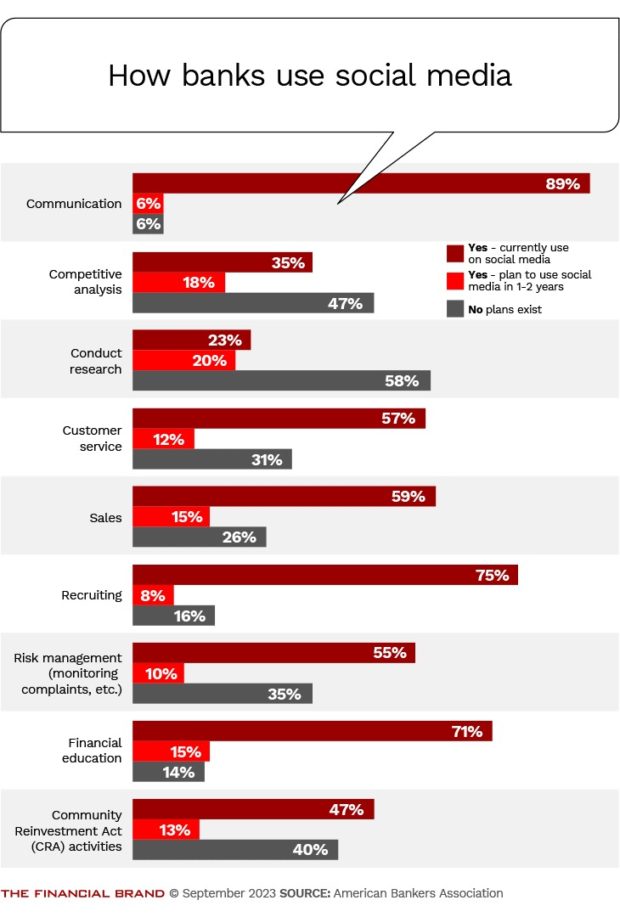

A striking 88% of participants in the American Bankers Association’s 2023 Social Media Survey described their banks as “very active” or “active” on social media. The remainder said they were “not very active” or “not active at all.” Asked to pinpoint how they used social media, they ranked communications, recruiting and financial education ahead of sales and marketing.

More than 330 banks — 99% of which have assets of less than $10 billion — participated in the survey. Most (53%) had assets of $500 million or less, followed by 27% with $500 million to $999 million, 19% with $1 billion to $9.9 billion, and 1% with more than $10 billion.

Major banks already have a massive presence on social media, with household names like JPMorgan Chase, Citibank, Wells Fargo and Capital One racking up “likes” and “views” in the millions and followers in the hundreds of thousands. Community and regional banks count their successes in smaller numbers, and the ABA survey provides insights into the state of play for their brands. For many of the community banks, a department of one or two marketing generalists do it all, including social media.

In an otherwise upbeat assessment, the ABA acknowledged that community and regional banks “have only scratched the surface of social media.” For example, large percentages either don’t use or have no plans to use social media for research (58%), competitive analysis (47%), Community Reinvestment Act activities (47%) or customer service (31%). Yet these are all “areas where social media can really shine,” the report said.

“Banks don’t yet appreciate the full business value of social media,” it added. A finding that 45% of bankers don’t consider social media to be a revenue-generating channel backs up this assessment. Only 23% agreed or strongly agreed that social media was driving dollars; 31% were undecided.

Here are four takeaways from the survey.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

1. Selling Lags Other Uses of Social Media

Community and regional banks are concentrating on low-risk, branding-oriented uses for social media. Communication (89%), recruiting (75%) and financial education (71%) significantly outpace the higher-risk category of marketing and sales (59%).

Concern about regulatory compliance complicates bankers’ willingness to promote products via social media. But they are learning to leverage social media to build relationships that set the stage for sales, Doug Wilber, chief executive of the social media management platform Denim Social, told the ABA. (Denim Social announced September 7 that it had been acquired by Capacity, a platform that automates customer support tasks.)

“Banks have come a long way in the past five to 10 years,” Wilber said. “Most have adopted social media on the brand side of things; the evolution is toward social selling.”

One banker described generating leads via social media as the end game in a strategic continuum. Posting content on personal and business social channels “is a way we can keep our brand top of mind,” Alyssa Schwabe, vice president and digital marketing manager at Johnson Financial Group in Racine, Wis., told the ABA. “Ultimately, we want our followers to build deeper relationships with us by taking that next step and getting in touch with an advisor who can help them with their financial goals.”

2. Bankers See Room for Improvement, Especially in Measuring Social Media’s Impact

While community and regional banks projected confidence about their social media efforts, they also identified areas where they could be doing better.

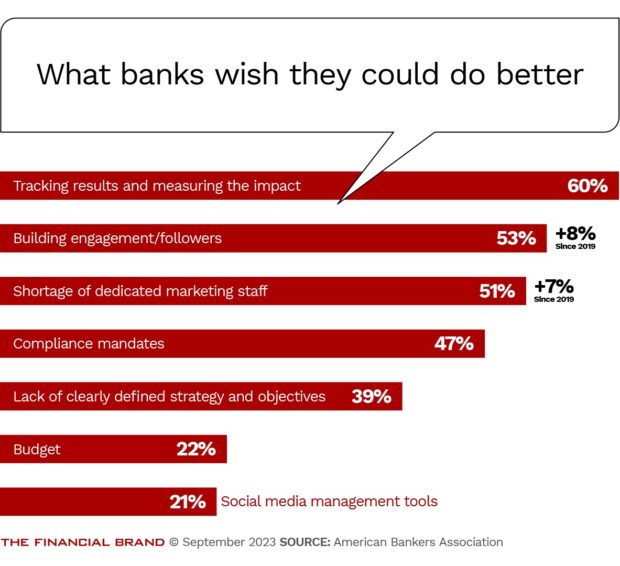

Asked what they would like to change about their social media efforts, most community and regional banks said they wanted to be more active and have more resources. They see a need to build followers and audience engagement (53%) and a need to do better at tracking results and measuring social media’s impact (60%). But they lamented the shortage of dedicated marketing staff to pursue a robust social media strategy (51%). They also fretted about compliance requirements (47%).

Though it was not at the top of the list, a striking 39% of the survey participants cited a lack of a clearly defined strategy and objectives for their social media initiatives. A rudderless social media program is a recipe for frustration, and it may explain why the survey uncovered undercurrents of doubt about whether the investment is worth it.

While 64% said they were either very satisfied (16%) or somewhat satisfied (48%) with the outcomes of their social media efforts, 22% said they were neither satisfied nor dissatisfied, 12% said they were somewhat dissatisfied, and 2% said they were very dissatisfied.

Read more:

- 5 Key Social Media Questions Answered to Help Guide Banks’ Strategy

- Bankers Should Be Active on LinkedIn — Leaders Need to Encourage It

- The Top U.S. Banks on Instagram for 2023

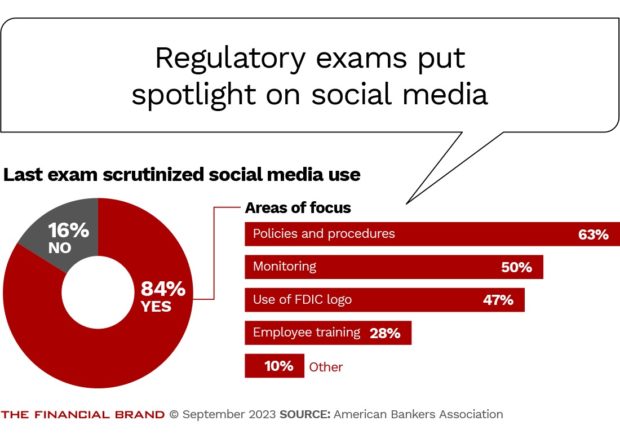

3. More Than 8 in 10 Bankers Say Their Last Exam Included Social Media

Community and regional banks have tended to take a conservative approach to social media because saying the wrong thing can have profound ramifications for highly regulated financial institutions, the survey suggests. Many stick to posts that are more about about brand-building than business, like photos of employees doing volunteer work in the community.

“There are things I could do if I were a clothing boutique that I cannot do because we’re a bank,” Amber Burge, vice president of marketing for Flatwater Bank in Gothenburg, Neb., told the ABA. “We work within regulatory constraints and guidelines, and that’s of utmost importance to everything we do. We probably tend to be more conservative than many other businesses, but that’s because we want to make sure we’re working within those compliance guidelines.”

Examiners are certainly taking note. Social media was part of the most recent regulatory exam for 84% of survey participants. Policies and procedures were getting the closest look (63%). But examiners were also scrutinizing banks’ monitoring efforts (50%), their use of the FDIC logo (47%) and employee training (28%).

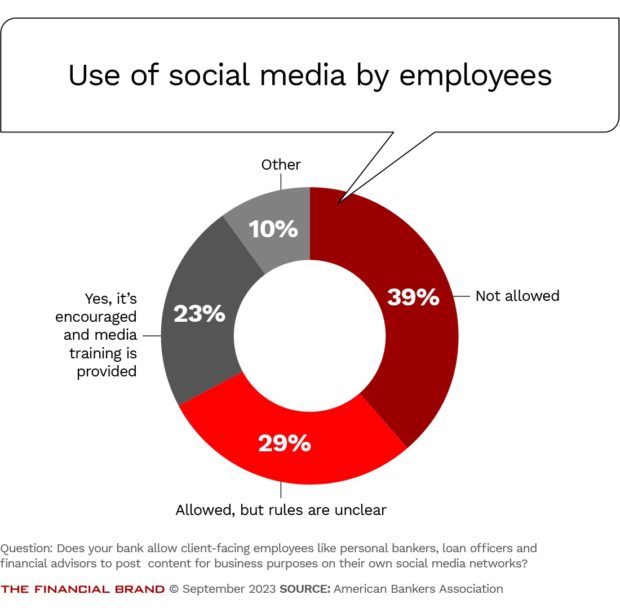

4. Yet About a Third of Banks Let Employees Use Social Media Without Clear Rules

Community and regional banks are grappling with whether and how to unleash the power of their teams’ personal presence on social media.

More than a third of participants (39%) don’t allow client-facing employees to post for business purposes on their personal social media accounts, such as Facebook and LinkedIn. Another 29% allow it — but say the rules are fuzzy. And 23% not only allow it but provide training and sometimes support to facilitate it.

Banks are more reluctant to allow client-facing employees to share content for business purposes on their personal social media accounts, with 50% disallowing it. Another 24% allow employees to post content even though they’re not sure how to manage this, and 18% encourage employees to post bank-related content and provide training about how to do so.

Getting a grip on how to allow client-facing employees to leverage their social media accounts for business purposes is important, and an approval process is essential, according to Wilber, of Denim Social.

“Banks are leaving opportunity on the table if they’re not empowering loan officers, advisors and more to share on social media,” he told the ABA. “With a coordinated approach, both marketing and compliance can be confident that anything being shared is approved.”

See which institutions stand out:

The Power 100: Our Social Media Rankings of Banks and Credit Unions