ChatGPT picked up 100 million users within two months of its November launch, a feat that drew comparisons to TikTok.

TokTok, a social media app for sharing short videos, had taken nine months to acquire that many users.

But Threads skyrocketed to that level in just five days, making it the new recordholder for the fastest-growing app in history. The new Twitter competitor is from Meta, the parent company of Facebook, Instagram and WhatsApp.

Many banks and credit unions are among those who joined Threads in the first two weeks. Megabanks like Bank of America and Citibank and regionals like KeyBank, PNC, Regions, Truist and U.S. Bank are all on the platform, though they have yet to start posting.

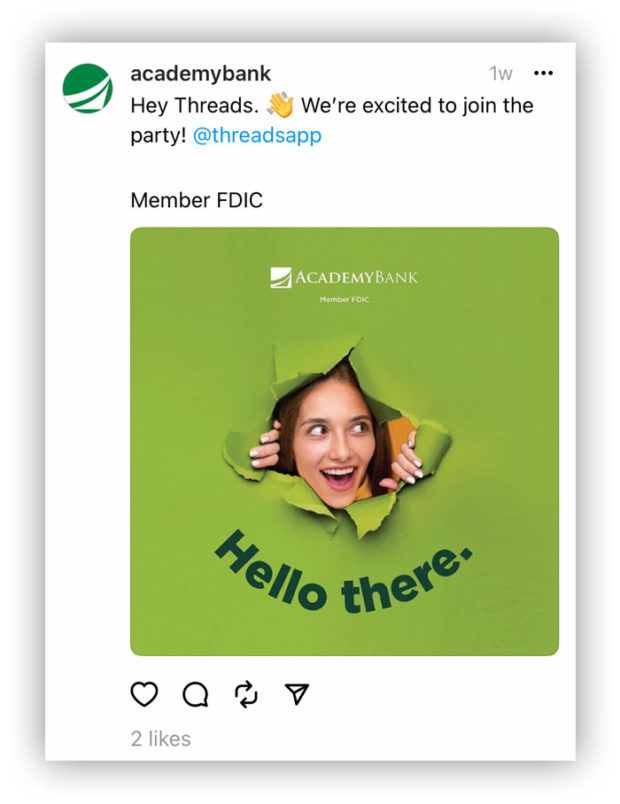

Numerous community banks are there too, including some, like Academy Bank in Kansas City, Mo., that have, at least, shared their first thread. Jessica Gardner, chief marketing officer for the $3.7 billion-asset Academy, says the bank wants to engage with customers wherever they are.

“If they are on Threads, we’ll be there,” Gardner says.

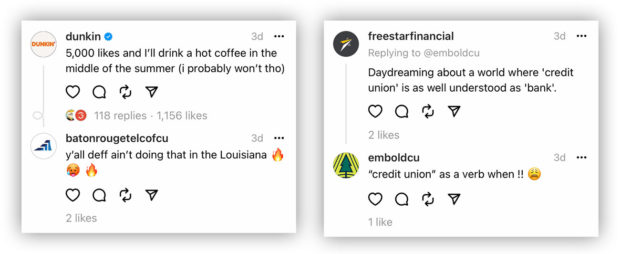

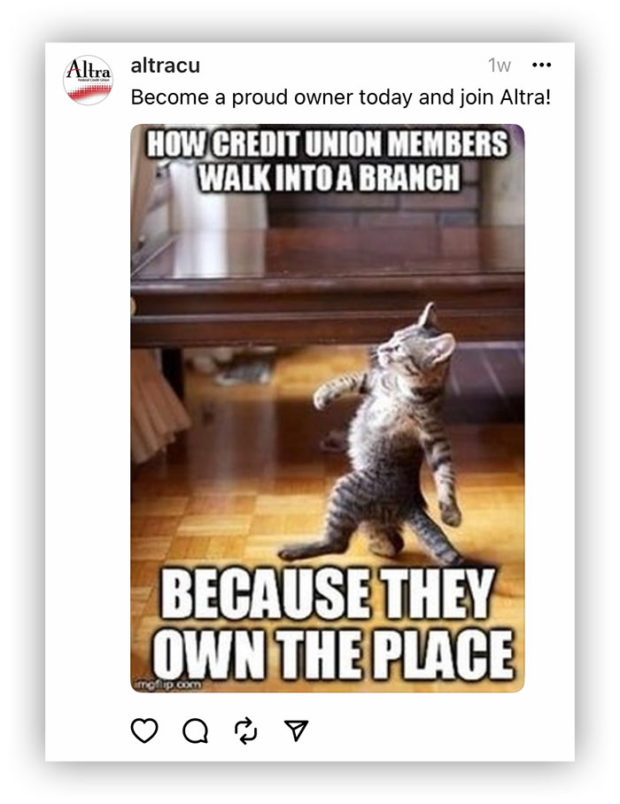

Credit unions are even more numerous than banks among the early adopters of Threads. Some are also very active, posting memes and commenting on threads posted by their peers.

Cheryl Dutton, the chief marketing officer at Altra Federal Credit Union in Onalaska, Wis., says her team is “threading away,” as they figure out the best frequency for posting.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

What Is Threads? How Does It Work? And Does It Matter?

Threads’ timing could hardly be better.

Twitter users have become increasingly disenchanted since Elon Musk took over the platform in October 2022. The latest angry backlash — set off by a temporary limit on how much content Twitter users could view each day — happened just shortly before the Threads launch.

Meta Chief Executive Mark Zuckerberg said in a Threads post that the new platform is meant to be a “friendly public space for conversation.”

Twitter has roughly 250 million active users. By comparison, Instagram has more than 2 billion active users globally, and Meta is using this advantage to help jumpstart Threads.

Users sign up for Threads through their Instagram accounts and keep the same username, password and account name. They can also import the list of accounts they follow on Instagram. That way they’ll automatically follow the same list on the new platform, if and when those Instagram users also create Threads accounts.

It’s not possible to create a Threads account without having an Instagram account first. Threads also lacks a desktop version, so is available only by using an app, via either Apple’s iOS or Android.

Something To Keep in Mind:

A Threads account can be deactivated, but deleting the account also deletes the Instagram account attached to it.

The information the app collects about users includes location, contacts, search history, browsing history, contact info and more, and some have raised concerns about this. What’s especially worrisome is that Meta will be adding to the vast amount of personal data it already has on people across all of its social media platforms.

The Financial Brand reached out to marketing executives at banks and credit unions to ask what they think of the new social media app and what they anticipate their strategy will be on Threads. This is what we learned.

What banks and credit unions are the leaders on social media? Check out our top 100 rankings to find out!

Likely Threads Strategy: Quick-Hit Financial Advice and Dad Jokes

Clint Demeritt

Marketing Communications Specialist

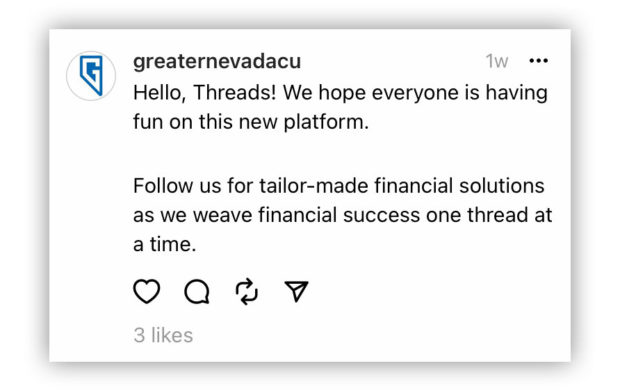

Greater Nevada Credit Union

Reno, Nev.

Asset Size: $1.7 billion

First impression?

It has been really interesting watching Threads go live. Since it’s so new, there hasn’t been any established vibe or etiquette, so it has been fun watching people post whatever they want and see what sticks. It’s been a breath of fresh air.

I do like the minimal feel of Threads. But on the other hand, it’s pretty chaotic, and you are seeing a lot of posts that aren’t too relevant to you personally. There are still privacy and anti-trust concerns. You also can’t delete Threads without deleting your Instagram as well. So it’s a mixed bag.

I think Threads needs to add more features and connect you better with the people you follow if it wants to have staying power.

Have you signed up for it on a personal level?

I have not. I am more of a Reddit and Discord guy. I seldom look at my Insta feed or Twitter, so Threads didn’t appeal to me personally.

Is your credit union on Threads?

We wanted to get up on the platform first thing to stake our claim. It has been helpful because people can import their contacts from Instagram to Threads, so we have just been included on that list, and we have been seeing a lot of follows, pretty much automatically.

I don’t see us being too active on it right away since it is so chaotic and users are just seeing a lot of random posts from a wide variety of brands and influencers. It’s difficult to get a message across in all the noise.

If we were to get more active on the platform, I would like to post a lot of quick-hit financial advice and dad jokes. If Sprout Social integrates Threads (which I’m sure it will), we would also post our regular social content to Threads as well.

Do you anticipate your strategy for Threads will be different than for Twitter or Instagram?

We do have Twitter and Instagram accounts. But Threads is just too chaotic at the moment, and I would like to see the platform take shape a little bit more so we could get a sense of what works and what doesn’t.

What’s your view of Twitter? Has your institution considered scaling back activity there?

We have scaled back on Twitter a little bit. It always has been an underperforming platform for us, and with bad news like the tweet view limit and other signs of decline, we’re not seeing a lot of return from Twitter.

Read more:

- Social Media Savvy Stokes Outsize Customer Engagement for This Bank

- See all of our latest coverage of bank marketing strategies

Threads Is Twitter 2.0 and ‘We Are Excited’

Jessica Gardner

Chief Marketing Officer

Academy Bank

Kansas City, Mo.

Asset Size: $3.7 billion

First impression?

My first impression of Threads is that Meta has created Twitter 2.0. In fairness, Twitter made many changes that make it harder for brands to engage with consumers, so an alternative is timely. Plus, Meta made smart decisions to keep the platform feeling familiar and easy to interact with.

Have you signed up for it on a personal level?

Have you signed up for it on a personal level?

I’ve signed up personally to see what’s happening, but mostly I’m there for the Threads puns. Not surprisingly, some of my favorites are coming from Wendy’s.

Is your bank on Threads?

As of today, Academy Bank is on the platform. We want to engage with our customers and clients where they want to engage, so if they are on Threads, we’ll be there!

Do you anticipate your strategy for Threads will be different than for Twitter or Instagram?

It seems like Threads will allow more interaction with clients and we are excited about the opportunity to engage with them to tell our brand story more memorably, provide greater value through education, and foster a deeper sense of community. I can’t say that we know exactly how our strategy will develop over time until we see more development of this community.

What’s your view of Twitter? Has your institution considered scaling back activity there?

We just don’t know yet. We’ll be watching to see where we can spend our social media resources most effectively to connect with, empower, and engage our customers.

Read more:

- How Bank of America’s Social Media Chief Drives the Brand Online

- What to Do About Surprise Risks of Social Media and Mobile Banking

Threading Away and Figuring It Out

Cheryl Dutton

Chief Marketing Officer

Altra Federal Credit Union

Onalaska, Wis.

Asset Size: $2.6 billion

First impression?

It’s another platform to get our brand in front of an engaged audience. People are pleading for things to change on Twitter, and they haven’t. Threads is that change that I think many Twitter users are hoping for. To get out on the platform early would be key in differentiating ourselves and getting a head start as the “experts” in key areas.

My first impression was that it’s like Instagram and Twitter combined and came out with Threads. The first couple days seemed messy as far as the algorithm not kicking in yet and seeing pretty much anything and everything in the feed, but since then it has gotten quite a bit better. Businesses are using Threads to really interact with their customers and entertain them in short, funny but informative snippets.

My first impression was that it’s like Instagram and Twitter combined and came out with Threads. The first couple days seemed messy as far as the algorithm not kicking in yet and seeing pretty much anything and everything in the feed, but since then it has gotten quite a bit better. Businesses are using Threads to really interact with their customers and entertain them in short, funny but informative snippets.

Have you signed up for it on a personal level?

Some people on our marketing team are on it. Some are waiting to see how it is used and if they want to add yet another social media platform to their phones.

Is your credit union on Threads?

We are currently on Threads and ‘threading’ away! Still not certain on our approach as to how many threads per day or per week we will throw at it yet. Still testing the waters.

Do you anticipate your strategy for Threads will be different than for Twitter or Instagram?

Threads will be a different animal. If you don’t post more than Instagram, the threads will be buried by everyone else — very similar to Twitter. People and businesses have been posting threads every hour in some instances. That’s not the approach we have taken on Instagram. But we could certainly use a Twitter strategy on Threads.

What’s your view of Twitter? Has your institution considered scaling back activity there?

We haven’t been active on Twitter for some time and just recently added it back into our social media calendars. The activity on Twitter would just allow us to maintain our “voice” and find the audience that is looking for our services on the platform.