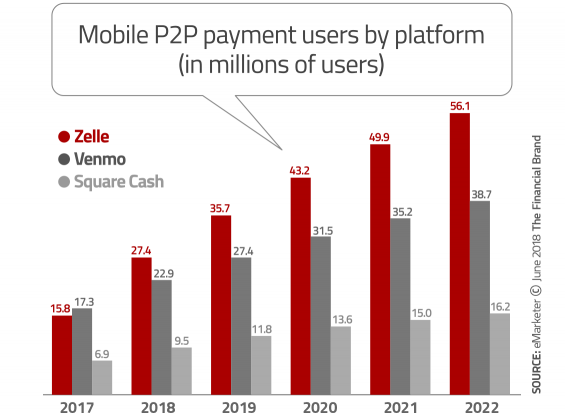

Since this time yesterday, the number of people enrolled in Zelle increased by 100,000. By this time tomorrow, that number will have increased by another 100,000. On average, anyway. At this rate, according to eMarketer and others, Zelle will outstrip current market leader Venmo this year.

Until recently, digital banking options covered most of the bases save one exception. Consumers could make digital payments to businesses, and businesses could make them to one another. But when a consumer owed a buddy a few bucks, for too long the only option was to hand over cash or write a check.

In a digital world, that’s an inconvenience at both ends. To marketers, of course, inconvenience at both ends indicates a need waiting to be filled, so it’s not surprising that Google, Apple, PayPal, Venmo, Square, and others have rushed to the market to fill the void.

Yet Zelle is a relative newcomer, having officially launched only last year. What accounts for its meteoric rise? (Full disclosure: I’m not an unbiased writer. Many of the financial institutions that offer Zelle work with Fiserv to connect to the service, and I lead marketing strategy and innovation for the Digital Banking Group at Fiserv). What this does mean is that I can give you an inside look and share what I believe P2P portends for the future of financial institutions.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

A Well-Designed Product

With any product launch, it pays to start with a product that works and works well. The late advertising icon Bill Bernbach famously said, “A great ad campaign will make a bad product fail faster. It will get more people to know it’s bad.”

Fortunately, Zelle developer Early Warning Services began with an analysis, not just of needs, but of expectations, which are usually higher. As a result, they determined that Zelle would be:

- Intuitive

- Work in real time

- Allow universal participation (whether or not a through a participating bank)

- Present a consistent look, feel, and functionality across all access points

- Be fully brandable by participating financial institutions

- Provide user flexibility (such as the ability to split restaurant checks)

- Protect users’ funds with state-of-the-art security

Speed was paramount. Even when consumers accepted the holding of funds, they never quite understood why and, they had little patience for it. In today’s always-on, real-time, all-the-time world in which instant gratification is the norm, consumers accept no delays of any sort.

That’s why near-instant, real-time P2P is a hallmark of Zelle’s performance by design. Simplification is another. Besides eliminating the hassles of giving account information, authenticating to third parties, and monitoring funds in supplementary sites, Zelle’s interface is intuitive even to multi-tasking and distracted users.

Still, even the best-designed product requires adept marketing and distribution. Instant, worldwide distribution is an advantage of digital products. But, it’s equally a disadvantage, since competitors have instant, worldwide distribution as well.

The Power of Partnership

It would be naïve to hope consumers would simply happen upon your needle amid the clutter and noise of the gargantuan, fast-growing haystack of digital payment options. What placed Zelle neatly and visibly atop the haystack was its unique partnership with leading banks.

An early alliance included Ally Bank, Bank of the West, and BECU. Before long the list of participating banks grew until it seemed the greater challenge was to find a non-participating bank. Distribution-wise, bank support went further than making Zelle available – Participating banks gave Zelle near-ubiquity.

Wherever you banked, chances are your financial institution placed Zelle under your nose while doing a thorough job of demonstrating its benefits. Moreover, the aura of trust associated with banks has rubbed off on Zelle.

A 2017 Fiserv study conducted by Harris Poll showed that clients prefer making digital payments through banks rather than via merchant sites. Consumers, it seems, have confidence in traditional financial institutions.

With Zelle nearly everywhere, and carrying the imprimatur of trusted banks, people are signing up at an accelerated pace. And, returning to the importance of starting with a product that works – Zelle delivers a great user experience. This, in turn, has begun driving payment usage and, therefore, stickiness on a larger scale.

Within a year of implementing Zelle, a top-20 bank documented a four-fold surge in P2P transactions, and their case is not unique. Demand-driven, positive consumer response to Zelle has validated financial institutions’ eager participation. Zelle has turned out to be as good for banks as for the clients they serve.

Zelle gives many institutions reasons to establish real-time capabilities required to support the service. That’s an agnostic real-time connection they can use as a foundation for their other bank-branded payments products, like bill pay and account to account transfers. With that, there are new possibilities for differentiating their payments franchise for intelligent retail and commercial payments applications.

The Foundation for Greater Engagement

For some time, industry pundits predicted that third-party options spelled the inevitable doom of the traditional financial institution payment franchise. If that was so (which, for the record, I do not concede), Zelle shows early promise for reversing the trend and reclaiming the future for traditional financial institutions.

Zelle got off to a slow start; according to a LendEDU survey last July, 94% of respondents had never heard of Zelle, and only 36% would ever give it a try in place of Venmo. In a survey just conducted by LendEDU, it appears the payment app is making up some serious ground. The poll revealed the following key findings:

- 42.6% of respondents have heard of Venmo while 29% have heard of Zelle; 23% of those respondents have used Zelle and 30% have used Venmo.

- 29.7% of respondents that have either never heard of Zelle, only use Venmo, or use both Venmo and Zelle, would consider using Zelle as their primary P2P payment app after being told what it is. 35% were unsure.

- 22.4% of respondents that have used both Venmo and Zelle have been more satisfied with Zelle, while 21% have liked Venmo better. 50% had an equal level of satisfaction.

Fast, easy P2P is the new financial services lifeblood. By virtue of its frequent use, smooth-running P2P options reinforce trust daily, which further cements relationships on an ongoing basis. For financial institutions, that’s a ticket to high-value engagement.