Zelle has become the payments growth engine that could.

Five years in, it has shown that it can keep attracting new users and increasing volume. And it can even deliver attractive side benefits to the banks and credit unions that offer it, helping to increase efficiency and lower the cost of funds. (Skeptical? Just ask Bank of America.)

Transactions on the bank-owned Zelle Network rose 26% in number, to 2.3 billion, and 28% in transaction value, to $629 billion, in 2022. The strong growth arises partly from a 40% increase in the number of banks and credit unions that have joined Zelle. This factor, in turn, contributed to Zelle’s snowballing momentum on several fronts: more consumers are enrolling (including at financial institutions that have offered Zelle since its start), use of its person-to-person payments services is up, and so is its use for small business transactions.

Most consumers with a checking account can pay with Zelle, by downloading and using Zelle’s app. But when a consumer’s bank or credit union joins, users can typically make and receive payments via Zelle through their institution’s own mobile banking app.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Redefining CX Through Innovative Social Media Strategies for Financial Services

Learn how Sprinklr is redefining success in the financial sector by harnessing the potential of tailored content and personalized engagement.

Read More about Redefining CX Through Innovative Social Media Strategies for Financial Services

Zelle Adds Banks & Credit Unions as P2P Use Rises

Zelle, which began operations in 2017, is run by Early Warning Services, a jointly owned venture of Bank of America, Capital One, JPMorgan Chase, PNC, Truist, U.S. Bancorp and Wells Fargo.

The fact that 80% of all Americans with checking accounts can now access Zelle via their financial institution’s mobile app has a lot to do with the huge customer bases of the larger banks. Adding in those who have the Zelle app on their phone brings the potential audience to 97% of checking account holders, according to Al Ko, chief executive officer of Early Warning Services.

Zelle added 500 banks and credit unions to its network in 2022, bringing its total to more than 1,800 institutions.

The peer-to-peer payments service now has nearly 118 million customers enrolled with Zelle and 69 million monthly unique Zelle users, according to Ko. By contrast, Venmo, which launched more than a decade ago, has 90 million active accounts, with 60 million being active monthly. Venmo plans to open teen accounts, expanding its potential user base by approximately 25 million.

The bulk of the transaction growth for 2022 came from adding new users at institutions that were already live on Zelle. Ko says larger numbers of those customers have been adopting Zelle. (Something that may encourage greater marketing of Zelle by participating institutions is a finding of a Curinos study, sponsored by Early Warning, that Zelle users have significantly higher engagement with their financial institutions.)

Ko believes overall growth is increasing exponentially as past growth feeds on itself — he refers to this as “the network effect.”

“People are more likely to use Zelle as more and more other banks go live because they understand that the friction of knowing that you can receive a Zelle payment that I’m about to send you is going down,” says Ko, in an interview with The Financial Brand.

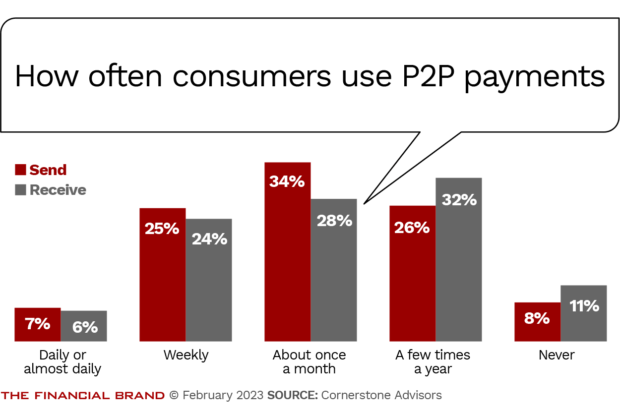

P2P service in general is gaining more devoted users, according to a Cornerstone Advisors research report that Zelle sponsored. When the consulting firm asked consumers how they would react if their primary financial institution stopped providing P2P capability, three out of four said they would take action. Those actions included:

- Use an account with a different institution more frequently 30%

- Close my account with the primary institution 24%

- Open an account with another bank or credit union 23%

- Use the primary institution less frequently 18%

- Be less likely to recommend them to friends and family 17%

- Complain to them 14%

Read More:

- ‘Pay By Bank’ Trend Is Next Front In Merchants vs. Banks Payments War

- Bill Pay: How to Revive Digital Banking’s Neglected Product

- FedNow and the Future of Instant Payments

How Small Businesses Factor into Zelle’s Growth Plans

Ko declines to predict 2023 numbers, but says he anticipates adding hundreds more banks and credit unions to the network and growing business payments further. “We’re in the third inning of a much longer game,” he says.

There are many potential consumer users yet at institutions that only recently went live with Zelle who can be marketed to in order to turn them into active users.

And Ko expects to expand services for small businesses. Cornerstone found that 16% of its consumer sample identified as small business owners and about half of them accept some form of digital payment, with convenience being the leading reason. The report noted that the vast majority of small businesses today have one employee — the consumer owner.

Zelle reports that businesses received 150 million payments in 2022, totaling over $72 billion. Those represent increases of 77% and 84%, respectively, compared with 2021. In addition, small businesses are tapping Zelle to pay their employees and their rent.

The number of unique small business senders rose by 66% compared with 2021. They accounted for 133 million payments amounting to $87 billion in 2022.

Read More: Zelle Small Business Payments Help Power the ‘P2P’ App’s Rapid Growth

Zelle Benefits: Fewer Checks, Lower Cost of Deposits

Yearend 2022 earnings briefings and other presentations by banks add some context to Zelle’s own numbers. Among the seven bank owners of Early Warning Services, two specifically addressed the P2P payments service in their presentations.

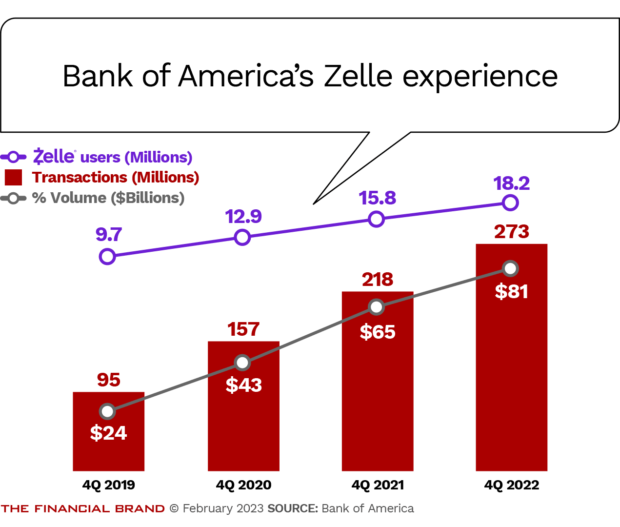

Bank of America went into the greatest detail, showing in multiple charts, adapted here, how Zelle has ramped up. BofA cast Zelle’s payments volume as a driver in reducing check use, which is a telling perspective coming from the country’s second-largest bank by assets.

At the end of 2022, BofA had 18.2 million customers using Zelle — about 15% of Zelle’s total. During BofA’s fourth-quarter earnings call, Brian Moynihan, chairman and CEO, noted that the number of Zelle transactions among BofA customers had about tripled in 2022 over 2019 levels, which is exponential growth by anyone’s measure. In addition, the volume of transactions in dollars had more than tripled over the same period.

Zelle transactions, as well as adoption of other digital channels, he said, “allowed us to run the business with fewer employees and lower our cost of deposits ratio below 120 basis points.”

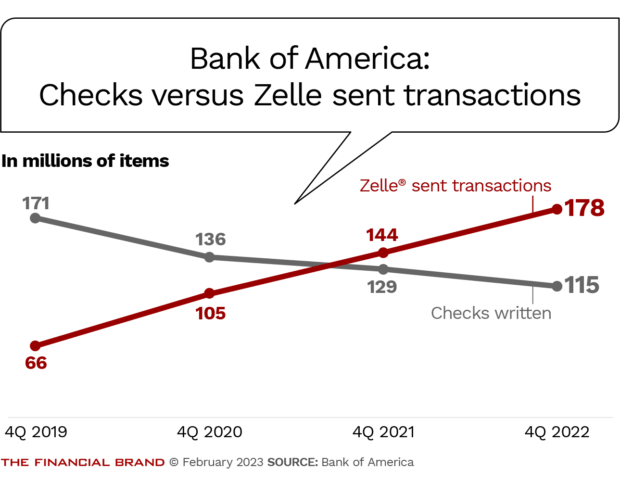

Moynihan noted in a separate investor presentation that Zelle is already changing usage levels in other aspects of consumer banking.

Zelle draws on checking accounts without creating checks and obviates the need for cash between people and between people and small business. This impacts both check and ATM operations.

“There’s more Zelle transactions sent by our customers than there are checks written by them,” said Moynihan. “That crossed over … and is growing at a much faster rate.” He said that he believes Zelle will ultimately replace all small-balance checks.

In his yearend earnings briefing, Truist’s chairman and CEO, Bill Rogers, said Zelle transaction volume at his bank increased 42% in 2022. Truist tallied 66 million Zelle transactions for the year, representing just over a quarter of the bank’s digital transactions. (The bank counts transfers, Zelle, bill payments, mobile deposits, automated clearinghouse transactions and wire transfers as digital transactions.)

“Zelle continues to represent an increasing percentage of our overall transaction mix and highlights the importance of continuing to invest in money movement capabilities,” Rogers said.

Read More: Will New P2P Startup ‘Chuck’ Edge Out Venmo, Square and Zelle?

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Sizing Up the Evolving P2P Market

Comparison across payment channel categories can be a bit dicey as each evolves. Right now, for example, Zelle, which began as a P2P platform, serves some purposes on the business side, such as payments by consumers to small businesses, especially local ones. Early Warning Services is developing a digital wallet, though at this writing that is meant to be a separate effort from Zelle.

Interestingly, in an earnings call, Dan Schulman, president and CEO at PayPal, notes this correlation: When people use P2P via PayPal or Venmo (which is also owned by PayPal), their revenues to PayPal at retail checkout tend to rise by 20% or so. This suggests that Early Warning’s development of a digital wallet could give participating institutions an edge.

Venmo began as a P2P product and has been pushing further into retail. It is now accepted at both Amazon and Walmart, for example. Further, Zelle is strictly linked to checking accounts. Transactions on PayPal’s Venmo service can be funded by balances kept in the user’s Venmo account or by links to deposit accounts and to credit cards.

Zelle is the fourth-most used provider of digital P2P payments, according to the Cornerstone report. “Four in 10 consumers use PayPal to make payments, while roughly one in five uses Square Cash App and/or Venmo,” the report says.

More specifically, here are consumers’ choices for sending money digitally to people or business:

- PayPal 40%

- Cash App 22%

- Venmo 19%

- Zelle 16%

- Apple Pay 13%

- Google Pay 11%

- Facebook Pay 7%

- Samsung Pay 3%

Cornerstone found that P2P transactions, both on the sending and receiving side, clustered at $250 and below, with about half of transactions below $100. Zelle skews just a little larger, in part because of the growing number of business-related transactions. Zelle’s average transaction size has hovered in the high $270s, Ko says.

The leading uses for P2P, according to the Cornerstone research:

- Gifting 44%

- Transferring money between accounts 28%

- Paying for services, like babysitting 27%

- Splitting restaurant bills 25%

- Buying a product, such as at a garage sale 24%

- Paying rent 22%

- Splitting other bills 20%