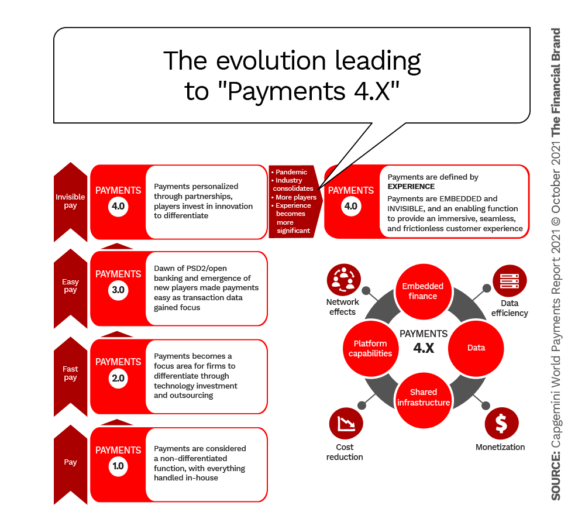

The rapid evolution of consumer and business payments has crossed a threshold into an age that global consultancy Capgemini has christened the era of “Payments 4.X.” In this new world customers, used to digital innovation in other fields, demand more than ever of payments providers.

In its World Payments Report, Capgemini identifies this as time when payments firms are expected to provide convenience and smooth and seamless processing through embedded services that improve the customer experience. Contactless payment options, faster transaction settlement and utterly reliable security are among the ingredients going into the Payments 4.X experience.

Increasingly, the report states, to accomplish this for both consumers and businesses, “financial firms are collaborating with fintechs, paytechs and peers to share compliance burdens, launch pan-regional initiatives, and generally industrialize/commercialize previous investments.”

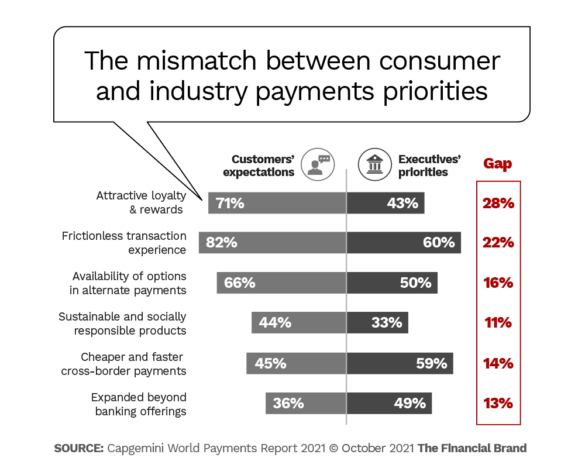

The report found that while the assortment of new efforts and payment alternatives is booming for both consumers and businesses, expectations continue to exceed what the industry has in mind in some key areas.

“Customers increasingly seek seamless and frictionless experiences. This growing demand encouraged the launch of ‘super apps’ as one-stop consumer destinations… Now, more and more merchants embed online and in-store payments within the shopping experience.”

— Capgemini World Payments Report 2021

Payments evolution continues, according to the report, even though the pandemic’s impact on 2020 non-cash payment volume ended an eight-year streak of double-digit increases. 2020 levels increased by only 8%.

“Nevertheless, a rebound appears imminent,” the report states. “Consumers are expected to crank up spending as vaccinations advance, restrictions ease, tourists and business travelers resume itineraries, and shopper confidence builds.”

Capgemini projects that global non-cash transactions will reach 1.8 trillion in 2025, up from 785 billion in 2020 and nearly double the 922.6 billion projected for 2021.

The firm’s annual study draws on two main sources, a consumer survey conducted among thousands of respondents in multiple countries and a survey of over 200 payments and banking executives. The study cites examples from many countries and quotes executives from numerous payments players.

For example, a payments executive from Amazon quoted in the report neatly summarizes the state of things — and the stakes:

“Embedded payments will become a lucrative business function throughout all ecosystems. Banks and credit unions may play a crucial role by expanding their offerings and seeking new markets. Companies such as Uber and Starbucks are already making financial products available directly to customers and employees. Leading fintechs have partnered or are being acquired by financial services companies to form the technological backbone for the industry and solve business challenges with data in ways not previously possible.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Traditional Firms Feel the Squeeze and Strategize a Comeback

In this time of major payments change, declining revenues and rising costs challenge the mainstream, longtime payments providers. Among the reasons cited by executives:

- Lower spending during the pandemic and declining interchange fees have eaten into credit card revenue.

- New forms of payment — notably buy now, pay later plans — have been eroding credit-card volume.

- Costs of keeping up technologically drain profits, but investment is essential in real-time payments implementation and other leading-edge methods.

- Continuing squeeze on interest margins is still shrinking revenues.

- Alternative rails, some with the backing of local regulators and central banks, are slimming traditional banks’ market share.

- Compliance costs are broadly on the rise.

- Fraud and cybersecurity risks keep increasing.

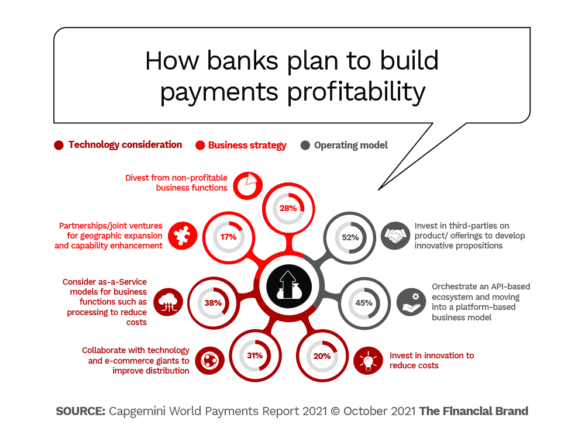

Executives told Capgemini researchers how they were counteracting these strong headwinds. The top three gambits were: 1. investing in third-party firms to develop innovative solutions; 2. using application programming interfaces (APIs) to build out proprietary platforms; and 3. creating “as-a-service” approaches to reduce costs.

Interestingly, abandonment of services that no longer turn a profit is very much on the radar. About 28% of the executives surveyed said they might divest activities that are no longer profitable.

New Payments Profit Source:

If “data is the new oil,” some companies said they are becoming the drillers. Their aim is to create value from payment data. But only 18% presently consider data an asset they can sell to third parties.

40% of the firms surveyed do use payment data internally. Yet 15% don’t look back at this data at all.

Read More:

- Credit-Hungry Americans Like BNPL, Cards (and Whatever’s Next)

- Is PayPal’s Expanded Financial Offering a Threat to Banks?

- 9 Tech and Payment Trends Shaping Community Institutions’ Future

Consumer Payments Keeps Morphing

Cards continue to dominate payments volume, but, as the report states, “their share in the global non-cash payments instrument mix is stagnant.”

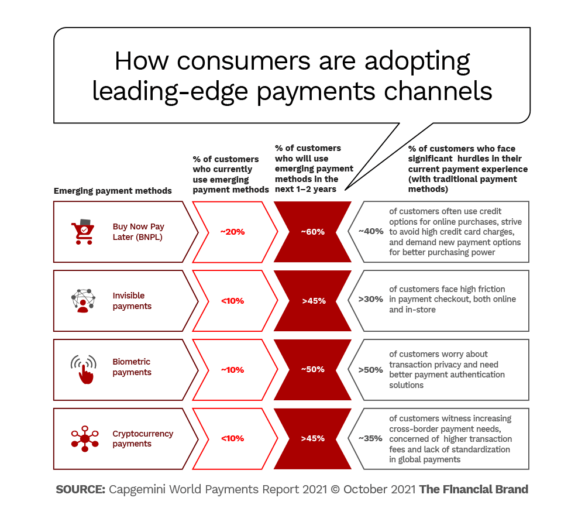

Increasingly cards’ share may be going to channels that were negligible or nonexistent a few years ago. According to the firm’s projections, within a few years four payments approaches — BNPL, invisible payments (like the Amazon Go stores that charge based on body scans), biometrics and cryptocurrencies — will come into their own.

If some of the firm’s projections seem ambitious, the report indicates that Capgemini is extrapolating from the rapid uptake of digital payments during the pandemic, especially in 2020.

Another section of the study suggests that executives need to pay closer attention to signals consumers are sending about what their priorities are for payments. Capgemini’s research indicates there are significant gaps in some areas.

A Growing Payments Do-List:

Capgemini insists banks and payments firms must step up their efforts to plug the gaps between what they stress versus what consumers want.

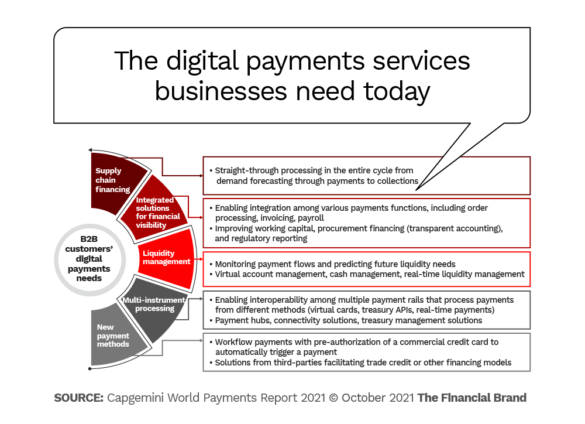

B2B Payments Can’t Be Ignored

Though consumer payments tend to grab the headlines, huge amounts of money move between companies.

“Global B2B non-cash transactions will increase at a 10.2% compound annual growth rate during 2020-25 to reach nearly 200 billion transactions by 2025… as more businesses go digital.”

— Capgemini World Payments Report 2021

That said, the report indicates that North America thus far has been a laggard on the B2B front. For example, “in the U.S., 60% of B2B payments are still made with paper checks,” according to the report.

Banks, credit unions and payment companies have to remember that the lessons of the pandemic will stick with businesses for some time. “Companies sought digital options to access and reconcile payments virtually,” the report points out. “Digital payment methods reduced the challenges of traditional (paper-based) processing while managing regulatory, compliance and cost-based tasks.”

Adds the report: “Commercial clients say they want ‘solutions’ versus ‘products’.”