Some in the banking industry may think that lending is the defining essence of banking. But the people running the payment systems think otherwise. Lending is important, they know, but payments is the foundation of the relationship between financial institutions and their customers. That may explain why banking executives have long worried about letting payments slip away to nonbank providers.

They’re getting really worried now. On top of literally dozens of niche fintech players grabbing pieces of the payments pie, the 2019 launch of Apple Card, the upcoming Google checking account and Facebook’s bold plan for a cryptocurrency/digital wallet have caught the attention of leaders at banks and credit unions from the smallest to the top five.

“Many of these fintech attackers have recognized the value of payments as a gateway to customer acquisition,” observes McKinsey. In the case of the big techs, data acquisition, more than customer acquisition, motivates their payment-related moves.

Handling and facilitating payments — retail and business — is absolutely core to the business of banking. One reason is that 90% of the data banks have about their customers comes from payment transactions, according to McKinsey. And while transaction-generated fees are relatively modest compared to interest income, they provide a steady and predictable revenue stream that banks and credit unions would be hard-pressed to do without.

“New payments technology and changing customer expectations are shattering the status quo and ushering in a growing number of new players that are challenging the traditional role of banks.”

— Sean Viergutz, EY

All that is increasingly at risk. But the same forces creating disruption are also creating opportunities — for those willing and able to embrace them.

First must come acknowledgement of what has changed.

“The way we make payments is changing faster than any other area of financial services,” says Sean Viergutz, EY’s North America Corporate, Commercial and SME Banking Technology Head. “New technology and changing customer expectations are shattering the status quo and ushering in a growing number of new players that are challenging the traditional role of banks.”

The following list of five critical trends reshaping payments can serve as a reality check and point of reference for bank and credit union executives.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

1. The Commoditization of Payments

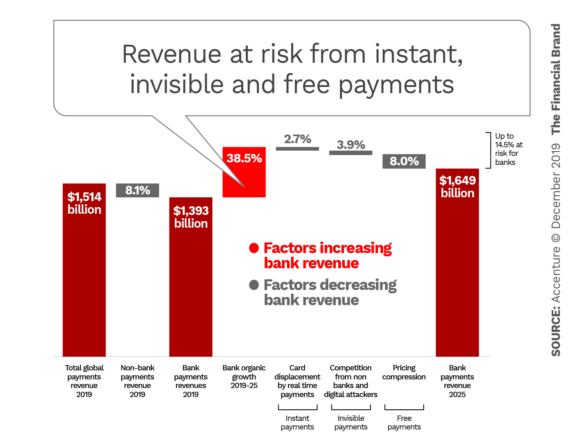

Global payments revenues will grow at a 5.5% CAGR through 2025 to reach a total of $2.1 trillion, Accenture predicts. In North America, however, payments revenues will grow more slowly. The firm projects that the growth rate there will drop from 6% for the four years through 2018 to 4% for the six years through 2025, with traditional institutions expecting to capture less of this diminishing revenue stream.

“A majority of retail payments executives in the top 20 U.S. and top five Canadian banks commonly believe they will lose 11% to 15% of their revenue pool in the next three years to non-banks, fintech, big tech, challenger banks and other incumbents,” Accenture states in an insight paper.

The consulting firm predicts a loss of 15% of global payment revenue by 2025 equal to about $280 billion. That would leave traditional institutions with a payments operating margin of just 4.3%. Accenture believes this reduced margin trend will accelerate.

In the chart, “instant” reflects the growing trend to real-time paymemts. “Invisible” is explained in a section 4, below. The “free” reflects Accenture’s view that payments are increasingly becoming a commodity. “Consider that consumer payments for debit card revenue per transaction dropped 14.6%, from $0.34 in 2015 to $0.29 in 2018, and credit card revenue per transaction dropped 11.6%, from $1.21 in 2015 to $1.07 in 2018,” the firm states in its 2019 Global Payments Pulse Survey. Factors influencing the trend include regulatory and legislative pressure on fees as well as the effect of (typically) fintech competitors that do not charge fees for such things as over-limit transactions, late payments, or foreign transactions — on credit cards in particular.

As a result, 71% of a group of bankers and corporates surveyed felt that payments would become free, Accenture notes. In North America, the percentage was lower, 61%, but still notable.

Read More:

- Surge in Contactless Cards Creates New Challenges for Financial Marketers

- Big Banks Line Up Against Smaller Rivals in War for Faster Payments

2. Big-Tech Competition Will Build Off Payments

It’s telling that the arrival of big techs into the banking universe has largely been via the gateway of payments. Even though Amazon, Facebook, Apple and Google were already deep into payments via mobile wallets, credit cards and other arrangements, 2019’s blockbuster announcements have raised the stakes significantly.

The tech giants are hyper-competitive and as long as there are financial institutions willing to provide the necessary account and payment system access the beachhead will only enlarge. Amazon, for example, is partnering with fintech Paymentus to enable consumers to pay utility bills via Amazon’s Alexa digital assistant. The plan is to expand the capability to other regularly recurring payments.

“For big tech firms, the payments space represents a new way to convert users and attention to dollars and cents,” Business Insider states in a payments report. “Payments and commerce represent a natural expansion opportunity for these providers as they look for ways to add value for their users and tie them more tightly to their apps.”

Some large players (and a few smaller institutions as well) have embraced the trend. Citibank saw a golden opportunity to enlarge its deposit-gathering reach by partnering with Google. So did Stanford Federal Credit Union at the other end of the size spectrum. JP Morgan Chase has developed a new e-wallet designed to help e-commerce platforms like Amazon, Uber and Airbnb defend their businesses, as reported by Bloomberg. “JPMorgan’s strategy is to cede some control of its payments business, which accounted for 10% of the bank’s $109 billion in revenue last year, and build more partnerships,” as noted by Banking Dive.

Other institutions may may also conclude that working with a giant nonbank competitor could have more upside potential than down. Beyond that, there is now a clear need for banks and credit unions to be able to match as soon as possible the kind of fast and low-friction account opening and onboarding capabilities that Apple demonstrated with the Apple Card. Doing that, on their own, or through a technology or fintech partner, could help mitigate the big tech threat.

3. Surge in Mobile Wallets and Other Contactless Payments

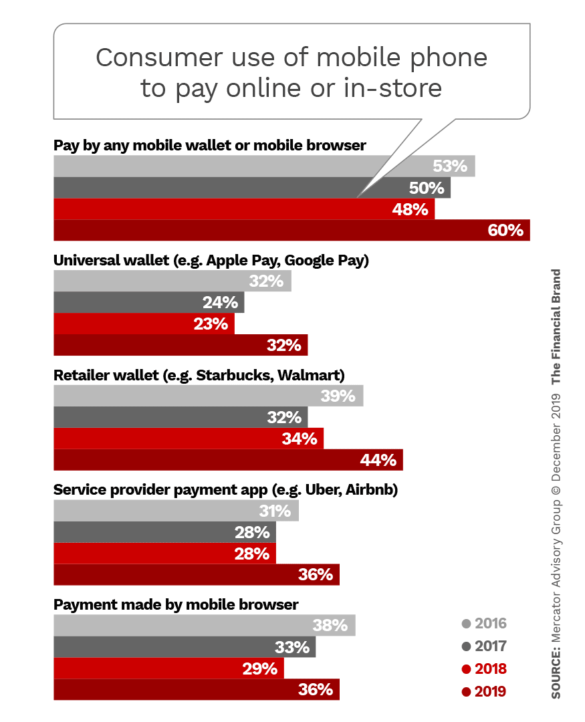

The success of the Apple Card is not the only reason for the rapid rise in use of mobile wallets. Mercator Advisory Group’s mobile payments research, conducted just before the Apple Card launch in August 2019, shows a dramatic reversal in consumer use of mobile payments.

“There was a lot of hype around the release of mobile wallets a few years ago and, once people started using them, they may have encountered spotty acceptance of mobile payments and app difficulties and stopped using them,” states Peter Reville, Director of Primary Data Services at Mercator Advisory Group. As shown in the chart above, there was a clear falloff in usage, but then a rebound in 2019. The increase comes in all categories of mobile wallet but is perhaps most dramatic in the closed retailer wallets such as those used by Starbucks and Walmart. Both of those mobile wallets use barcodes — or QR codes — not near-field communication, like Apple Pay and contactless cards use.

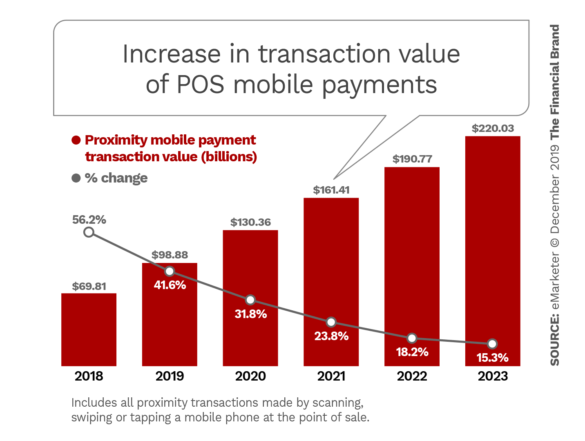

Payments consultant Richard Crone predicts that both formats will coexist. He notes that barcodes are device- and carrier-independent. No need to pay 15% to a device maker, as card issuers must pay Apple. The chart below indicates the dramatic increase in actual and forecasted transaction value from point-of-sale use of mobile payments.

Also surging in 2019 and likely to continue into 2020 is contactless card usage in the U.S., where it has lagged other countries for several years. All the major card issuers are well into reissuing all of their cards with “tap and go” capability.

“For many Millennials and Gen Zers, a phone in hand or in their back pocket is more natural to use for payment than pulling out a card.”

Business Insider postulates that all the card issuers “pushing out contactless cards will help familiarize consumers with paying with wallets. For many Millennials and Gen Zers, a phone in hand or in their back pocket is more natural to use for payment than pulling out a card. Simpler yet would be a smart watch or other wearable set up for contactless pay, which can easily used while holding a cup of coffee.

Read More: Open Banking Is Key to Relevance in Payments for Traditional Institutions

4. Invisible/Embedded Payments Change the Game

Payments by wearable devices and even by mobile wallet are closely related to invisible and embedded payments. The terms refer to the fact that in a growing number of use cases payments are moving into the background, becoming essentially completely frictionless.

“Customers now expect a seamless shopping experience and will be frustrated by payments solutions that require enrollment, entry of payment data, and/or additional effort of any kind,” notes EY’s Sean Viergutz. “[The] lines between shopping, purchasing, and paying continue to blur with the payments system operating in the background.”

The analyst points to the “Just Walk Out” shopping experience of Amazon Go stores where there is no checkout line. (Customers open the Amazon Go app when they enter, pick up the items they want, and walk out. Payment is automatic with a receipt sent by email.) There are about 15 of these stores in operation now and Richard Crone says at least 100 other retailers are testing the technology. Financial institutions need to work to get their payment app embedded with such merchants. That is what Chase is doing with Chase Pay, Crone notes, which is embedded in merchant and gas company apps.

EY also sees partnerships between payment networks and other companies to embed payments using the Internet of Things (IoT). For example, MasterCard, IBM and General Motors are creating in-car payments systems using vehicle consoles and voice-enabled assistants to provide frictionless payments, according to Viergutz.

Uber is another example of how an innovative digital company completely takes all physical payment options — cash, cards, even wearables — completely out of the equation, Accenture notes in a paper.

When payments are invisible, of course, it becomes much harder to maintain a strong brand presence. This makes it more important than ever for financial institutions to provide an enhanced customer experience based on the data from the payment transactions they handle.

5. Payment Data As the New Revenue Driver

The biggest cause of potential payment system revenue loss is the radical reconfiguration of the customer value proposition from transactions to experiences, Accenture states. The reality is, the transactional aspects of payments are increasingly becoming a commodity. Customer experience, the firm maintains, is the new driver of brand value and competitiveness in retail payments, and customer experience can be greatly enhanced by the intelligent use of data.

Ultimately, says Alan McIntyre, Accenture Senior Managing Director for Banking, the underlying transactions are not going to make anyone money, but the data from them “can be the absolute key to building those personalized compelling customer experiences that continue to put the payments … at the heart of financial services and the heart of the broader commercial world.” He calls such payments information a “critical raw material.”

One example McIntyre cited during a presentation was U.K. challenger bank Monzo. By analyzing payment data it had plus data from a commuter rail API, the mobile bank was able to create a very specific credit offer for a cash-strapped consumer, enabling the person to buy a monthly rail ticket at a significant net savings. As a result, said McIntyre, the consumer now thinks, “This bank’s on my side,” thus creating a viral marketing moment.

Monetizing data is the wave of the future, Accenture believes, but legacy financial institutions must continually strike a delicate balance between trust and privacy to serve customers well.