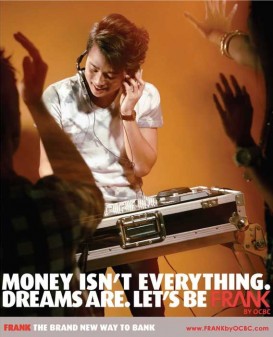

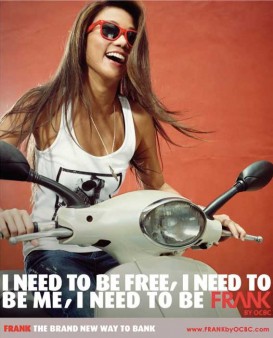

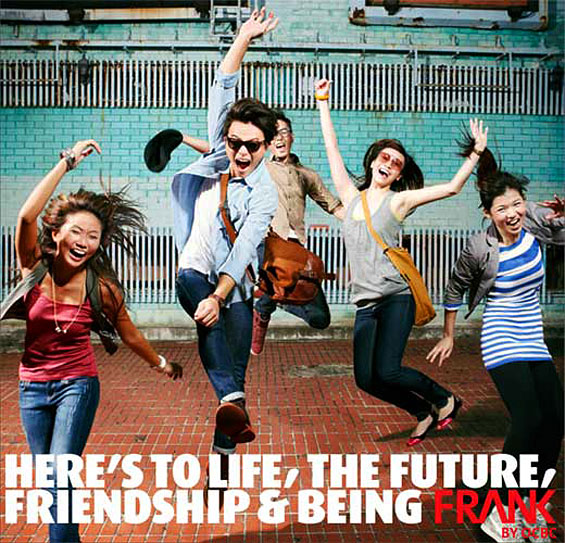

If you’re a bank or credit union targeting Gen-Y, this is definitely one of the best ways you go about it.

Take a look at FRANK by OCBC and you’ll see a hip, stylish and trendy brand dripping with obvious youth appeal. To launch FRANK, OCBC conducted a ton of research, innovated new products, designed a cool new store and did it all with heaps of style.

The $200 billion financial institution already controls 26% of the total youth market in Singapore — estimated to number 748,000 strong — but hopes its FRANK initiative will help seal its iron grip on Gen-Y.

The FRANK name stems from the phrase “frankly speaking,” and is intended to convey honesty, sincerity and simplicity. (Singapore is an English speaking nation, so there aren’t any language barriers to worry about.) The bank chose to capitalize FRANK simply to balance out the OCBC acronym, which stands for Oversea-Chinese Banking Corporation.

The new brand is wrapped with the slogan, “FRANK, The New Way to Bank.”

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

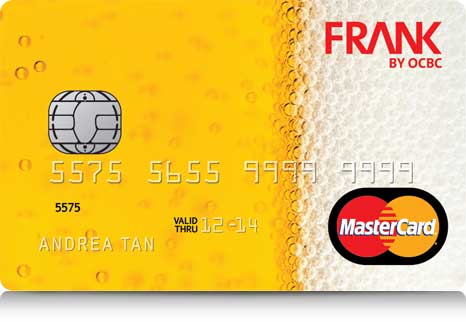

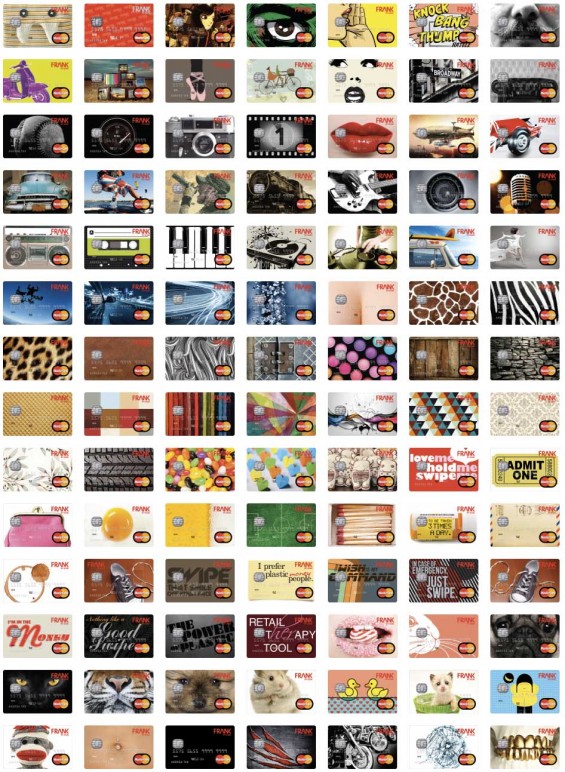

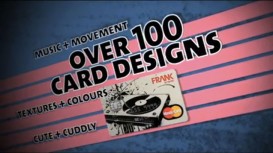

Cool debit cards with over 100 designs

FRANK offers over 100 different card designs. Customers can change the design anytime they want at a fee that ranges from S$10 to S$50, depending on the card design chosen.

Those who sign up for the FRANK Debit and Credit cards can enjoy privileges and discounts at popular online retailers and fashion blog shops. Customers can enjoy bigger discounts if they gather friends to make group purchases at some of these retailers.

The cards sport more than just hip, sardonic, bold imagery. Even the titles OCBC gives its FRANK debit cards are edgy. One card with a close-up of cleavage is titled “Deep in the Valley.” A picture of beer is called “Bottoms Up.” Another one with a book of matches is titled “Light My Fire.”

With photos of everything from booze to bosoms, many kids in Singapore will head to FRANK simply to get one of the cards. You have to admit, they are pretty cool (you want one, don’t you?).

OCBC says it will also be rolling out a FRANK credit card soon.

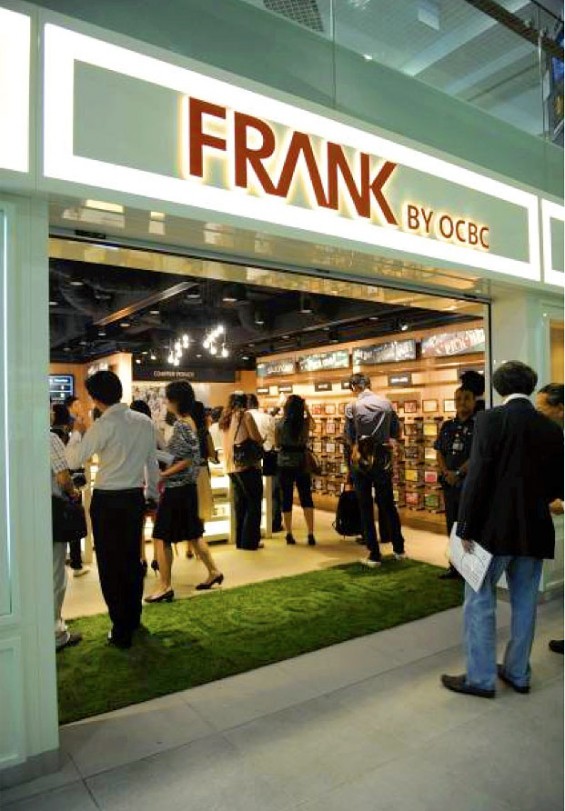

Retail stores create new shopping experience

The FRANK retail store concept is a marked departure from OCBC’s traditional branch design. The store is designed to allow FRANK customers to take their time to browse, touch and ask questions about the products and discuss their banking needs.

It is modeled after a shopping experience that youths and young working adults are familiar with, such as shopping for a gadget or fashion item.

“We then prototyped everything in our design studio out of cardboard, paper and print-outs,” McQuillen recalled. “We actually built a to-scale model of the store out of cardboard in our studio and brought people in to go through it so we could refine and improve it.”

One of the things that make the FRANK store work is that it has been optimized for a standard stall in any typical shopping mall. This not only creates a design that is easy to replicate, the bank’s target audience — youth — hang out in malls.

Beyond the first FRANK store that debuted in May 2011, OCBC says a second location will be open another month or so, and a third by the end of the summer. They say a couple more will be popping up in malls after that.

OCBC has 54 branches in Singapore, with a total of 500 branches across 15 different Asian countries. They worked with Union Experience on the design concept for the FRANK store.

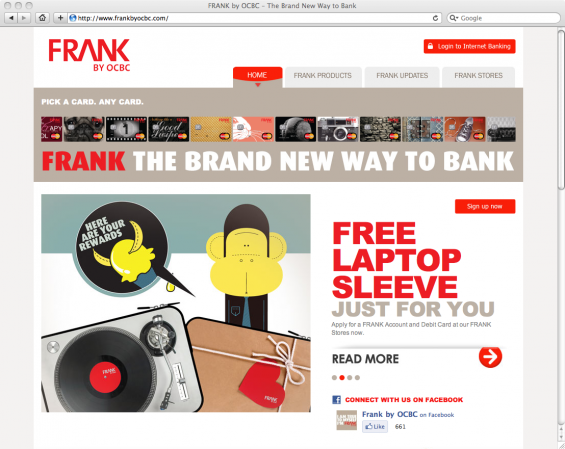

A banking microsite like no other

Structurally, the website is very simple. There isn’t even an “About” page. The bank decided to eschew anything that could even remotely been deemed superfluous in favor of a more streamlined design.

The home page gets right to it, featuring FRANK’s vibrantly wild card designs in an animated strip at the top of the website.

There are only three products for the time being: a FRANK account, debit cards and a tuition loan for students. (Actually that makes two products, if you count checking w/debit as one.)

OCBC has teamed up with various retailers to offers special deals and other incentives kids will likely find attractive. You can get a movie gift voucher if apply for a tuition loan. Or you can get a free laptop sleeve if you open a checking account. Sign up with four of your friends and you’ll all get $50 worth of free Ben & Jerry’s ice cream.

FRANK is also on Facebook, where they have uploaded images of all their unique debit card designs.

FREE LAPTOP SLEEVE DESIGNS

Goal-based ‘savings jars’

FRANK accounts earn higher interest rates than normal savings accounts in the Singapore market. The account features a “savings enabler” to help customers reach certain goals. Customers can create “savings jars” — sub accounts — for each separate goal. Money is in savings jars cannot be accessed through an ATM.

There are no fees for a FRANK account, and no minimum monthly balance requirement for FRANK Account customers 26 years of age and younger.

Research reveals Gen-Y insights that shape brand

OCBC said a study encompassing over 1,000 young people revealed that Gen-Y feels neglected by- and disengaged from financial providers.

“FRANK started with a long period of customer research,” said David McQuillen, Group Customer Experience at OCBC Bank. “Ethnography was a big part of our effort to understand the youth.”

“We hung out with them at malls, ate dinner with them, went shopping and clubbing with them and spent a lot of time looking in their wallets and talking about money,” he said.

Among OCBC’s finding, they discovered that Gen-Y feels career is key, fashion is important and adventure exhilarates them. They want to be “captains of their own lives.”

Looking to link the FRANK brand with Gen-Y’s passionate and expressive nature, OCBC built the core of its strategy around five values: honest, sincere

reliable, smart and stylish.

After 15 months of this extensive customer research on the psychology, behavior and banking needs of this segment, OCBS was ready to roll out FRANK.

Campaign work was produced by Wild Advertising & Marketing agency. Wild indeed!