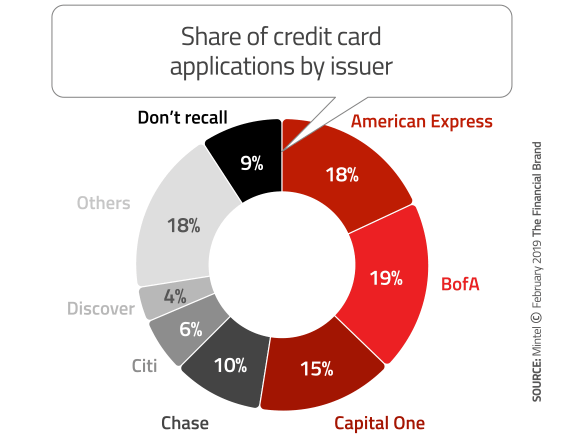

The latest data on card marketing trends points to some significant shifts in the consumer finance space including a 21% decline in card applications. Data from the Mintel Comperemedia “Credit Card Response Rate” report reflect a changing competitive situation, and give a read on the economy as well.

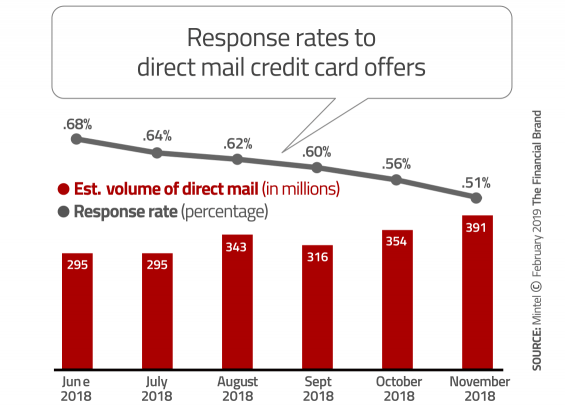

The Mintel report, based on input from 3,000 consumers, confirms that direct-mail response rates to credit card offers have been declining.

One-fifth of all credit card applications originate from a direct mail offer, even if a growing number are completed digitally, notes Tom Gall, Research Analyst at Mintel Comperemedia, so direct mail can’t be ignored by financial marketers. And they haven’t. Mailed offers were up an estimated 32% from June through November. The combination of more mailings with a decline in applications pushed down the response rate.

Typical Response Rates to Direct Mail Offers

- American Express had the highest issuer response rate in November at 1.84%.

- Bank of America had the second-highest response rate in November at 0.96%.

- Chase’s response rate decreased from 0.68% in September to 0.50% in November.

- Citibank’s response rate decreased from 0.54% in September to 0.43% in November.

- Capital One saw its response rate decrease from 0.58% in April to 0.35% in November. It sent the highest number of offers per household over the period of September through November.

- Discover’s response rate decreased from 0.33% in September to 0.30% in November.

Source: Data from Mintel Comperemedia

Read More: Cranky Business Customers Sound Off on Credit Card Features & Apps

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Issuers Expand Card Offer Reach

“2018 was a big year for new products and rewards program restructuring.”

— Tom Gall, Mintel Comperemedia

The percentage of consumers receiving a credit card offer rose from 54% to 67% over nine months last year, suggesting that card marketers are making efforts to either reach new demographics or under-served segments. “We’ve noticed a bump in applications among consumers making between $20,000 and $50,000 a year,” says Gall.

Some of this outreach could be targeting the subprime category. Much the same trend has been happening in the mortgage lending market. But not all of the broader card marketing reach is subprime, observes Mark Miller, Associate Director of Insights for Mintel Comperemedia. Some of it results from changes in creditworthiness scores, he believes.

VantageScore, launched in 2006, uses a broader range of creditworthiness factors than the FICO score and has been gaining significant traction. The new Ultra FICO score, due to pilot early in 2019, allows consumers to add checking, savings and other information to potentially boost their existing FICO score. People who previously would have been locked out of having a credit card because of a lower FICO score might now be a target audience through some alternative risk metrics, Miller explains.

Read More:Differentiate or Die: Financial Institutions Must Rethink Brand Mission

Why the Big Drop in Credit Card Applications?

Through November 2018, Comperemedia observed a 21% reduction in credit card applications — mail, email, phone, online, in-person. This drop is somewhat surprising considering the big surge in the volume of marketing offers sent. The research firm doesn’t have data that specifically points to why, but Miller surmises it’s the result of both macroeconomic and competitive factors.

Rising interest rates certainly could be discouraging people from taking out new cards, he notes, although so far this has not impacted card usage among existing cardholders. The American Bankers Association reported in its January 2019 Credit Card Monitor that credit card use increased in the third quarter in the subprime and super-prime categories, although not in the prime category. And Nerdwallet reports credit card balances continue to inch up. The average U.S. household has an estimated $6,929 in revolving credit card balances, it says.

Another reason for the decline in applications, says Miller, is the big jump in personal lending offers in 2018 and the rise in point-of-sale financing. “There are many products out there directly competing with credit cards,” he notes. The creatives on these offers, particularly coming from online lenders, have shifted from debt consolidation to offers to fund vacations, weddings, and home improvements, according to what Miller is seeing in the Mintel database.

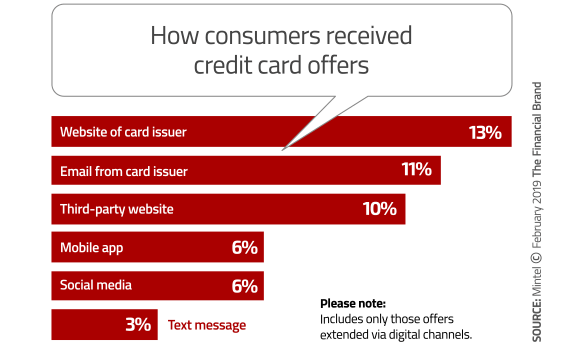

Third-Party Referral and Affiliate Websites Drive Digital

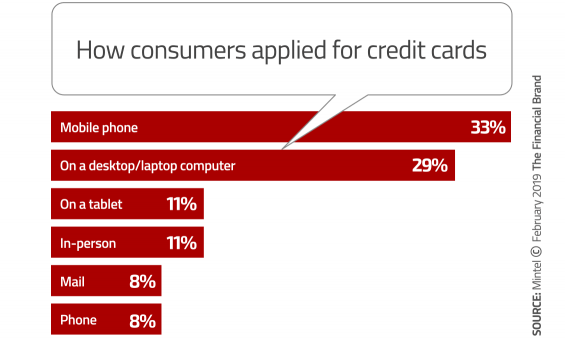

44% of credit-card applications now are submitted over mobile devices.

The shift to digital credit card marketing is clear from the Comperemedia data. Comparing third quarter data from 2016-18, digital marketing offers for credit cards rose from 45% to near 50%. The figures in the two charts below, by type of digital, are from November 2018.

What’s notable, however, is that while half of all credit card offers are now made digitally, nearly three-quarters (73%) of all card applications are received digitally. In other words, people receive a card offer in the mail, but more of them now apply online or on a mobile phone rather than mailing in the application. Comperemedia reports that 44% of credit-card applications are submitted over mobile devices (including smartphones and tablets).

Consumers’ increased usage of third-party aggregator websites gave a boost to digital applications, according to Tom Gall. These sites, such as Credit Karma and Points Guy, compare and rank different card offers to assist consumers to choose the best card for them. Miller observes that as traffic to these sites has grown, Chase, Bank of America, Wells Fargo and other big issuers have been doing “large-scale advertising with them.” Consumers can just click on a link to apply for the card they choose.

Read More: How Chase Bank is Tackling Top Digital & Mobile Challenges

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

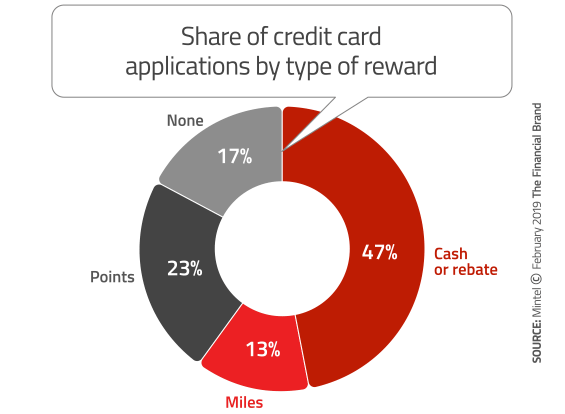

Card Reward Trends for the Year Ahead

For the first time since Mintel began running the response-rate report in 2014, the response for mileage reward cards (0.36%) dipped below the rate for non-reward cards (0.41%), says Gall. Points reward cards remained at the top at 0.61% followed by cash reward cards at 0.51%.

Gall says having response rates for all four reward types so close is noteworthy. Usually points rewards cards have held the top response position by a wide margin.

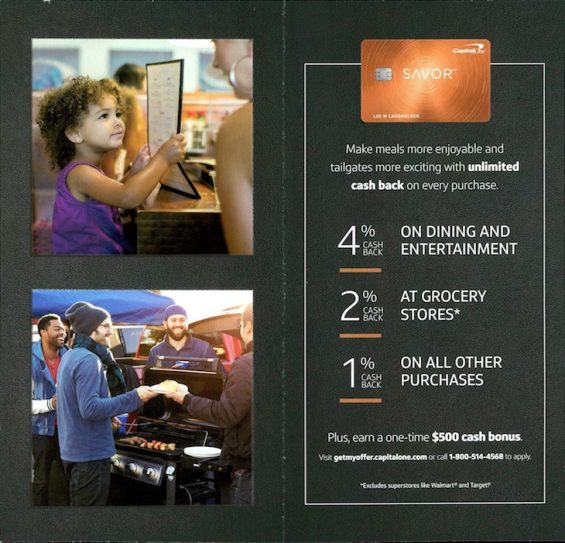

Miller observes that many attractive alternatives to points have come to market. One he mentioned is the Savor Cash Rewards card from Capital One, which offers a $500 cash bonus and carries a $95 annual fee that’s waived the first year. “Given an offer like that, we expected to see a spike in competing cash offers,” says Miller, and that occurred. American Express’s relaunch of its Gold Card in October 2018, for example, has a cash back feature among other perks, and has been doing well in terms of application share, according to Gall.

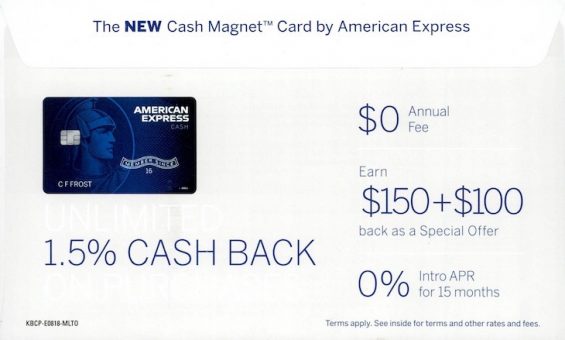

In addition, a trend both analysts expect to see in 2019 is a shift away from a bonus upfront to ensure ongoing card use. Citing Amex again, Miller notes that its Cash Magnet card offers $150 in the form of a statement credit after the user spends $1,000 within the first three months.

Discover was early with this approach, offering a double cashback reward after the first year of use rather than upfront. “We’re seeing a lot of movement in this space,” Miller states, “and we expect to see more attempts to keep customers using the card and engaged.”

Beyond that, Miller says 2019 will see many variations in annual fees and different reward structures, all with the hope of finding that “sweet-spot value proposition.”