The new Purchase Eraser scheme from Capital One allows its customers to make a travel-related purchase with their rewards card, then wipe out the cost of that purchase from their statement using their accrued miles.

How Does ‘Purchase Eraser’ Work?

Customers first make a travel related purchase — such as a flight, cruise, hotel stay or car rental — from their favorite travel provider using their Capital One Rewards credit card. Then they have 90 days to erase the purchase cost with their miles for a statement credit, online or on an iOS or Android device. The miles balance will update automatically and the credit will be reflected in their account balance within 5-7 business days.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

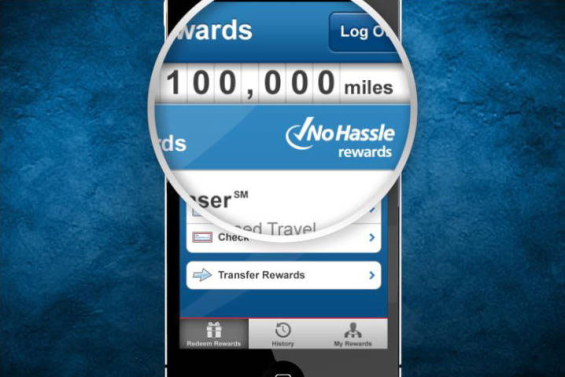

A screenshot showing Capital One’s ‘Purchase Eraser’ utility in action on a smartphone.

“As a traveling mom I am always looking for ways to make my life a little easier,” said family travel expert and TravelingMom.com founder Kim Orlando. “Purchase Eraser is easy to use, gives me the flexibility to redeem my points on the go and use my Venture rewards to redeem for a variety of travel charges, not just airline tickets and rental cars.”

“At Capital One, we offer rewards that our customers can actually use and enjoy,” said Amy Lenander, VP/Rewards Programs at Capital One. “Purchase Eraser makes it easy for our customers to book travel wherever they get the best option to fit their life. They keep the memories and erase the cost on their statement using their rewards.”

Capital One and its subsidiaries held $213.9 billion in deposits and $296.6 billion in total assets as of June 2012. The banking arm has around 1,000 branch locations, primarily in New York, New Jersey, Texas, Louisiana, Maryland, Virginia and the District of Columbia.