Remember the 1980s? Reagan was president, and the Cold War was still raging. Madonna was atop the charts. VCRs, Sony Walkmans, fax machines and mobile “brick phones” were the hot technologies. And while it may seem hard to believe, back then, most people still paid cash for most things.

But just like the Ice Age which brought about a wave of mass extinctions, the Digital Age has produced its own list of dinosaurs and other anachronisms. The internet vaporized huge sectors of the traditional retail industry — bookstores, record stores, video stores — and when smart phones came out, people stopped wearing watches, lugging around cameras and ditched their iPods.

Between these two powerful digital forces — the internet and mobile devices — it seems only logical that cash would be a likely candidate to follow.

Read More:

- Will Cash Ever Die?

- Studies Reveal Consumers Still Clinging to Cash and Branches

- 6 Reasons Why Cash is Still The King of Payments

Americans waste an average of 28 minutes a month traveling to get cash.

Indeed there are many signs that the world is moving towards a cashless economy. As just one example, a large study spanning 60 countries found that consumers made a total of 417 billion cashless payments in 2014, up from 311 billion transactions just four years earlier (or a third more, in percentage terms). One study found that only 14% of American consumers use cash for everyday purchases. And another survey reported that just 9% of people prefer to use cash, with 78% of respondents saying they would prefer to pay for things with a credit or debit card.

Many banks and credit unions have followed suit, rolling out cashless branches over the last decade. Some have gone so far as to eliminate tellers and all transactions altogether — even check deposits.

And yet cash usage in the United States still remains relatively high. In 2015, Americans spent a total of $2,359 billion in cash and $5,527 billion with cards, representing 13.1% of the country’s total GDP. Interestingly, cash usage has remained relatively steady in the U.S. since 2003, ranging between 14.3% and 15.5% of the GDP.

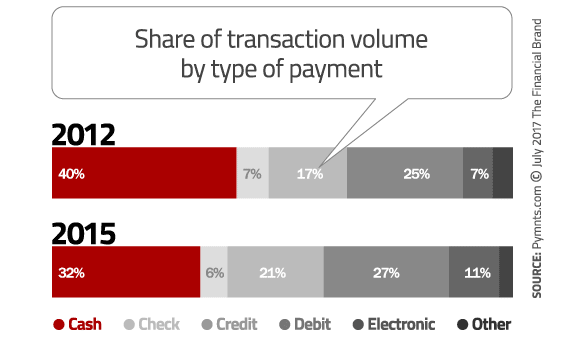

While cash continues to be one of the most popular payment methods in the U.S., its relative importance is decreasing. According to the U.S. Federal Reserve, cash usage fell from 40% of all transactions in 2012 to 32% in 2015. Pymnts.com estimates that the share of cash payments in the United States will fall to 11.7% of GDP by 2020.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

What About Mobile Wallets, Venmo and Apple Pay?

Cash is being displaced in so many ways that it’s hard to keep track. There are credit cards, debit cards, ACH payments, PayPal, P2P apps like Venmo, Apple Pay, mobile payments tools like Square, cryptocurrencies like Bitcoin, and countrywide programs like Kenya’s mPesa and India’s Paytm. According to the Federal Reserve, transactions via mobile wallets shot up 71.9% between 2012 and 2015. So obviously consumers have options to cash, and are using them.

Dr. Utpal Dholakia, Professor of Marketing at Rice University, says the world is moving rapidly towards payment methods that are more and more convenient and less and less painful.

“Stores encourage us to brandish our credit cards, and increasingly, to use our smartphones to pay in seconds with a click of a button,” Dr. Dholakia says. “Cash is frowned upon as slowing things down, outdated and suspicious — smelling like weed.”

Global demand for cash in circulation has grown an average of 8.9% every year since 2009.

— ATM Industry Association

Despite the strong 7.6% yearly growth rate in the volume of cashless payments since 2010, research simultaneously shows ATM cash withdrawals have been rising almost as quickly over the same period, at 7.1%.

So what explains the resiliency of cash, despite its costs and a growing array of alternatives? Dr. Bhaskar Chakravort, Senior Associate Dean of International Business & Finance at Tufts University says old habits and perceptions die hard.

“Cash is unique among payment instruments in that anyone can transact, any time, any place, with no third parties involved,” says Dr. Chakravort. “With this freedom comes strong privacy protection. Currency neither knows nor cares who holds it or when and where a transaction occurred. People have a visceral sense of security when they have cash with them.”

“Some merchants will resist the costs of new equipment or fees that accompany cash alternatives,” he explains. “Cash is also considered more convenient and versatile, while with digital transactions there’s always concerns about hacking and fraud.”

And despite new payment methods, there are still quite a few consumers out there who are willing to pay bills — even typically larger transactions like utility bills — with cash.

“There’s a perception that consumers either can’t or won’t pay their bills in cash,” says Mike Kaplan, SVP/Business Development at cash bill-pay service PayNearMe. “But families earning less than $25,000 use cash for 48% of their transactions, and those who earn between $25,000 and $50,000 use it for 33% of transactions. That equates to roughly 45% of households who are using cash for at least a third of their transactions.”

The Federal Reserve found that consumers are writing far fewer checks today than 15 years ago. Checks accounted for just 13.4% of noncash payments in 2015, compared with 57.8% in 2000.

One third of consumers say paper checks will be gone over the next five years, while 83% say it will take another 20 years before they disappear.

“P2P payments are really is growing phenomenally year-over-year,” says Michelle Moore, Bank of America’s head of digital banking. “But our customers wrote almost a billion checks last year. Checks will be around for a while.”

What’s Wrong With The United States?

In this era of smartphones, mobile banking and Venmo transfers, the rest of the world seems to have weaned itself off paper — both cash and checks — but not the United States.

Just look what’s happening in Europe. Finnish banks stopped issuing checks way back in 1993. Sweden dramatically cut down on them by introducing fees and marketing alternative modes of payment. The Netherlands abolished checks in 2002, and Denmark officially killed them at the start of 2017. Checks are all but extinct in Germany, Belgium, and Switzerland. And Bloomberg reports that the U.K. backed off plans to phase out checks by 2018 following a consumer backlash, even though they are seldom used there.

Tom Hunt, the director of treasury services for the Association for Financial Professionals, says the U.S. faces unique challenges. For starters, there are more than 10,000 depository institutions, making it difficult to implement system-wide changes. There is also no central bank with the regulatory power to phase out checks, and the Federal Reserve can’t mandate how the U.S. processes payments.

That helps explain why Americans haven’t seen any major improvements to checking since a 2003 federal law known as Check 21 first allowed banks to process checks electronically, without having to handle the actual paper checks.

“The U.S. has probably the most antiquated payment system in the whole world,” said Hunt in an interview with Bloomberg.

The Biometric Future of Payments

Viewpost, surveyed a cross-section of 1,000 U.S. consumers, finding that overall, 80% of Americans are in support of “futuristic” payments technologies and currencies, including tools like sensor fingerprinting, facial recognition, retinal scanning and voice control, as well as currencies like Bitcoin.

Half of U.S. consumers say fingerprint technology will be used for authentication to pay and receive payments over the next decade. This is something we already see with iPhones and Apple Pay when people use their fingerprint to pay at stores and to pay for apps on their device.

Roughly a third of all consumers believe facial recognition has the potential to be a vital authentication technology for making payments within the next 10 years, while an equal number say they trust the technology. Some already use iris scanning to make payments with Samsung Pay, but facial recognition still needs some work before its completely secure.

18% of consumers say they can see themselves using voice commands to make purchases within the next 10 years. People can already make purchases in this manner, using services like Amazon Alexa when they order something online.

“People are willing to embrace a more convenient, frictionless payments future,” commented Viewpost CEO Max Eliscu. “Paper invoicing and checks are well on their way out. The future of the payments industry is highly dependent on leveraging innovation like biometrics, data integration, and a growing variety of payment methods to securely drive more volume with visibility, speed and simplicity.”