The combination of open platform banking and open APIs will change the entire banking ecosystem as we know it, from the products and services offered, to the delivery channels used and underlying partnerships that will shape innovation and customer experiences in the future.

This new era will redefine expectations, impacting the way that consumer insight is leveraged, and the powerful lifestyle outcomes that result.As other industries are already showing, a platform economy is already upon us.

The platform models of the future will transform fintech to ‘techfin’, with the digitalization of the industry being at the center of this transformation. Now is the time when all key areas of traditional financial institutions need to know what the open platform options are, and the best way to plan for a marketplace banking future.

How Open Banking Helped Build a Start-Up Bank

In its A New Era: Open Platform Banking report, Accenture states, “Platform businesses connect producers and users in efficient exchanges of value. These exchanges facilitate interactions on both the demand and supply sides, which have amplifying “network effects.”

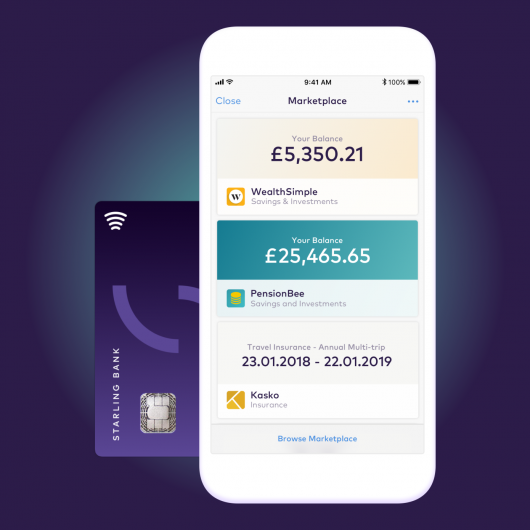

Many of the new ‘challenger banks’ in the U.K. leverage a platform banking structure to combine some of the best money-related solutions offered by third-parties under one roof. A great example discussed by Accenture in their report is Starling Bank, a ‘marketplace’ start-up bank that offers a mobile-only checking/current account, including pensions, savings, travel insurance and mortgage brokerage. This is in addition to the benefits of a mobile-only mobile wallet account, such as immediate insights on spending habits, granular and flexible card security, zero fees and interest on the account.

At Starling, the number of partnerships to benefit both consumers and small businesses continues to expand. The bank says it’s targeting 25 partnerships in total in 2018 to make customer experiences better. While the interest in open banking in the U.K. is fueled by the open APIs mandated by Open Banking/PSD2 legislation, banks of all sizes globally need to evaluate options that will meet increasing consumer demands.

In an interview of Megan Caywood by TechCrunch, she stated, “The expansion of our Marketplace is a huge milestone for Starling as we continue to give our customers control of their money like never before. We are building a banking experience fit for the 21st Century, where the best financial products are available securely in one place.

In 2017, we launched our full set of Open APIs, and enabled integration with companies like Moneybox, Yoyo Wallet, Yolt, Tail, and Flux. Now we’re excited to take that to the next level by integrating financial services providers into the Starling Marketplace.”

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Open Banking Alternatives

According to the report ‘Platform Strategy & Open Business Models,’ a platform requires one or more sponsors (someone to control who participates and resolve issues like intellectual property) and one or more providers (someone to provide an interface visible to producers and consumers). The way sponsors and providers interact helps to categorize four different types of platform models:

- Proprietary Platform (One sponsor and one provider) – Proprietary platforms use open APIs to make data accessible to developers and to offer finalized products to customers.

- Licensing Platform (One sponsor with many providers) – As an example, a sponsor may could offer white label banking solutions through licensing with multiple providers.

- Joint Venture Platform (Multiple sponsors with one provider) – In this scenario, several sponsors collaborate to create and control a single interface. Moven is an example of a joint venture platform, where several banks are using the same consumer interface created by Moven.

- Shared Platform (Multiple sponsors and multiple providers) – This model has yet to emerge in the banking industry, unlike the high tech industry with Linux being an example.

There are many unique characteristics of each model. Of the four models, the licensing model has been the most used for platform banking. According to the Accenture analysis. “Not only does it best enable developers to create innovative products, it also increases reach by involving a variety of providers, each of which can attract customers separately.”

Open Banking Transformation

A financial institution’s transformation to an open API platform banking model will be very disruptive to a legacy financial organization. It requires a non-traditional culture shift on the definition of banking, as well as a change is resource allocation, talent requirements, technology and a vision of the future.

Not only will current products need to be built for highly digital deployment, new solutions in the marketplace will need to be identified and brought under one roof for the benefit of the customer/member. Organizational, functional and technical capabilities will all change. It is this high level of modification to the current way of delivering banking services that requires preparatory strategic thinking today. It is never to early, given the marketplace dynamics and potential competitive threats.

Read More:

- Open Banking Will Change The Financial Services Industry Forever

- The Time to Develop an Open Banking Strategy is Now

- The Future of Banking Depends On Open Banking APIs

Why Should Non-Money Center Banking Organizations Care?

While the largest tech firms (GAFA) are leading the charge towards implementing open API platforms, they may not be the model that most banking organizations should follow. Not only do most financial institutions lack the technical expertise or the financial wherewithal to implement these models and support a vast developer community, the ability to acquire new customers to replicate their success is unlikely.

That said, an open banking platform future is within sight for all financial organizations. For instance, account aggregation is becoming much more commonplace, with firms like Citibank developing completely new digital-only products with this capability. Similarly, traditional banking functions like taking deposits or making payments could become integrated within non-traditional organizations (Starbucks, Amazon, etc.). In the end, all key managers in virtually all financial organizations should already be meeting to determine what their organization may look like in the future and how services will be created, marketing and distributed.

According to the Accenture report, all financial institutions should look at five key steps today:

- Embrace an open platform banking model, identifying the capabilities and investments needed to make it happen.

- Cover the basics by targeting specific lifestage moments using external APIs.

- Look for partners aligned with you open platform vision.

- Choose a strategic ecosystem model this is close to your strategic priorities and market positioning.

- Create new business models. revenue models, product development processes, and sales strategies to optimize the value of open banking.

In the end, preparation for the future of open banking will pay off and potentially protect your organization from some competitive threats that are already advancing on your prime customers and members.