Mobile banking has moved quickly beyond being simply online banking using a smartphone. It is at the hub of the customer relationship and is quickly becoming a point of differentiation and a potential source of revenue for progressive banks.

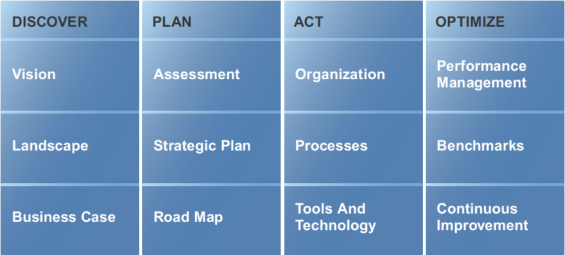

To assist banks with the development and implementation of a successful mobile banking strategy, Forrester Research is developing a 12 chapter Mobile Banking Strategy Playbook. Within this playbook, extensive research is being compiled around marketplace assessment, mobile strategy development, optimal organizational structures, technology selection, best practices, measurement benchmarks and ways to continuously improve the mobile banking experience.

As part of the review of mobile banking best practices, Forrester just released their 2013 Global Mobile Banking Functionality Rankings (with breakouts for the US and UK) ranking the mobile offerings from 15 of the largest banking organizations in the U.S., Canada and abroad.

While only ranking some of the largest banking organizations worldwide, this research is invaluable to any bank wanting to see what the best in our industry are doing. Beyond rankings, this research also provides extensive examples of innovative mobile banking apps and advanced functionality.

Organizations were judged on the following:

- Range of touchpoints (devices and platforms supported)

- The enrollment and login process

- Account information and money management capabilities

- Transactional features

- Service features

- Cross channel functionality

- Sales and acquisition capabilities

- Overall usability

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

While no firm is the best in every category, the evaluations provide insight into the strategic challenges and opportunities available to banks of any size.

Of the banks evaluated, Chase mobile banking was ranked the highest overall with a score of 71 out of 100, while Spain’s la Caixa come in second with a score of 67 (the average score of all major banks evaluated was 56 out of 100). Chase’s transactional functionality was highly regarded as was la Caixa’s native mobile and tablet apps across all four of the major operating systems.

Overall, the large banks evaluated scored best on the range of touchpoints and account information, but poorly on sales and service features that are important to customers.

Peter Wannemacher, analyst for Forrester, says, “The most obvious missed opportunity among the 15 banks reviewed is that few are making effective use of context to make information more relevant to customers. Sales is another big missed opportunity, with many banks not even trying to cross-sell products and services through the mobile channel.”

One of the key findings was that, while there are definitely examples of successful mobile banking implementations, far too many banks are not doing much more than meeting the basic needs of the consumer, rolling out apps and features without a clear assessment of where customer expectations and business objectives align.

In fact, even though some of the larger banks were lauded for new applications and functionality, the industry as a whole still seems to be missing the mark in the eyes of the consumer.

In evaluating the major global banks, the Forrester reports not only provided a benchmark for the current state of mobile banking functionality, but uncovered many ‘best practice’ examples in each category reviewed which directly impacted enrollment, use, engagement and revenue potential.

Supporting Mobile Touchpoints

With the range of mobile platforms increasing, it is important for banks to be able to provide support across all touchpoints (optimizing for size and shape of unit) and across alternative delivery methods, including two-way SMS banking, dedicated mobile website, downloadable phone apps and tablet apps.

While it may seem that everything is moving to either downloadable smartphone or tablet banking apps, there are still many reasons to support SMS banking, including alerts or even the initiation of bill payments or transfers via an SMS (as is done by la Caixa). Oh yeah, and not everyone has a smartphone yet, therefore requiring support of basic mobile features through SMS text banking.

The offering of dedicated tablet mobile banking capabilities has definitely lagged behind smartphone applications but provides greater promise in many ways due to the added functionality and preferable demographics of tablet users. While more and more banks have developed apps for the Android tablet and iPad, far fewer support either the Windows or Kindle platforms.

Encouraging Mobile Banking Enrollment and Use

Thank goodness for early adopters. Despite roadblocks and painful enrollment processes that were significantly more challenging than for online banking, smartphone devotees have found a way to sign up for mobile banking and use the service. To move beyond moderate levels of adoption and use, however, will require simplified enrollment and ease of use.

Forrester believes one of the biggest impediments to enrollment today is that many banks still require mobile banking customers to have an online banking relationship. This requirement obviously limits mobile banking growth to only a subset of online banking customers as opposed to allowing all customers to benefit from mobile banking. Citibank was noted as one of a growing number of banks no longer requiring online banking for a mobile relationship.

Surprisingly, Forrester also found very few banks that let customers enroll for mobile banking using their mobile phones. This is obviously counter intuitive from the customer’s perspective. Wannemacher suggests, “Digital banking teams should build processes that let customers enroll through as many channels as possible, including ATMs, branches, call centers, mobile and online.” In addition, he suggests the elimination of any ‘validation period’ before a customer can access their account.

Once a customer is enrolled, some banks need to reconsider the process of requiring separate online and mobile credentials or multiple authentications. For instance, my GoBank account allows me to authorize the viewing of balances without entering my login credentials. In addition to seeing my balance without a complete login, GoBank also allows me to enter my mobile banking account with only a password (as opposed to multiple login credentials).

If a bank is going to require multifactor authentication, it is recommended that a consistent sign-in process be used for both the online and mobile banking relationships. This is currently being done by many large banks including Bank of America, Wells Fargo and PNC Bank.

Finally, it is important to have a bank’s entire front line and customer service team familiar with the mobile banking platform and trained to answer questions from a perspective of having used the service themselves. Some banks have even provided incentives to employees for conducting customer training sessions.

Enhanced Account Insight and Money Management

Most banks get the basics right, from providing balances to allowing access to previous transaction history. The differences come in providing more than the ‘basics’ from a customer experience perspective. As mentioned above, a bank can differentiate itself by the ease of getting account balances. Interestingly, only a few banks currently allow histories as far back as 90 days, with Bank of America being the only institution reviewed that allowed searches by keywords.

The real area of growth recently has been with the overlay of Personal Financial Management (PFM) tools within the mobile banking platform. Built internally or purchased from a variety of outside providers, the ability to provide visual interpretations of a person’s financial health and ability to provide budgeting tools is exciting.

One of the foremost providers of this type of functionality is MobileDesktop. Their mobile solutions provide easy to understand tools that can help make mobile banking the hub of a customer’s financial relationship.

Expanded Transactional Functionality

Being able to perform transaction easily, using a smartphone, is the key to customer mobile engagement. The more a customer can do using their phone, and the more contextual interaction that can occur, the less likely the customer on the go will leave your bank. For instance, while doing internal transfers between accounts was rated relatively high for every U.S. bank (except HSBC that has no transfer capabilities), most U.S. banks make it much more difficult to transfer to funds to another bank.

In evaluating bill payments, Chase was recognized for being able to add a new payee directly from a mobile device, while U.S. Bank has just recently introduced the ability to pay bills by taking a photo of the bill itself. Chase and Citibank were also recognized for their P2P payment functionality, while there are several organizations in other countries (CommBank Kaching) that have moved beyond the requirement of a phone number and/or email address to allow payments via a Facebook connection.

More exciting may be the possibility to view transactions and the impact on budget immediately using a smartphone as is being done with the new start-up Moven. With this enhancement, customers will not only know what they spent and where, but how much they have spent at a specific location or purchase category in a given month as the purchase is being made. This will allow customers to make informed decisions before making a purchase as opposed to looking in the financial rear view mirror.

Mobile Service Accessibility

According to Wannemacher from Forrester, “As mobile banking becomes the primary way to conduct business for many customers, they will expect to be able to access a growing number of service-related tasks from within their mobile banking application.” As the only criteria that all of the 15 banks in the study failed, it was believed that the ability to use a search capability for basic information or transactions using a mobile device was important.

Additionally, it was believed that customer assistance should be available instantly through the mobile device. In my own experience, even the more recent banks to enter the mobile competitive marketplace find this capability difficult to provide. In fact, none of the new banks, like GoBank or Simple provide a tool to get assistance immediately like Wells Fargo does through a Twitter link. For example, in multiple tests, Simple required as much as 24 hours to respond to a basic service question.

All of the banks reviewed provided some amount of balance, transaction or security alerts with varying degrees of customization. While some banks allow set-up directly from the mobile device, others require sign-up and structuring via the online banking application.

Community Bankers’ Top Priorities This Year

CSI surveyed community bankers nationwide to learn their investments and goals. Read the interactive research report for the trends and strategies for success in 2024.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Cross-Channel Integration

While being able to access customer support directly from the mobile app a great example of cross-channel support, there are other ways for all of a customer’s interactions with a bank to be integrated. Interestingly, while almost all of the banks reviewed by Forrester provided phone numbers for customer service, none provided instant chat, IM or a direct link for phone support.

One of the more dynamic ways to integrate channels is the way U.S. Bank, PNC and others are helping customer locate ATMs through an augmented reality functionality, providing a street level view of where branches and ATMs are located. This functionality is a great example of how the geolocational capabilities of a mobile device can provide benefits to both a customer and the bank. In the future, the availability of merchant-funded rewards could also be communicated in this manner.

Finally, the integration of social media within a bank’s mobile banking application is being done much more extensively overseas than in the U.S. according to Forrester. Probably none do as much integration with social media like Facebook and Twitter as Commonwealth Bank of Australia. Not only do they show live tweets in real time on their mobile banking platform, but their integration with Facebook and YouTube content is one of the strongest in the industry. In fact, CommBank has recently added Kaching for Facebook as an extension of their traditional mobile banking product lineup.

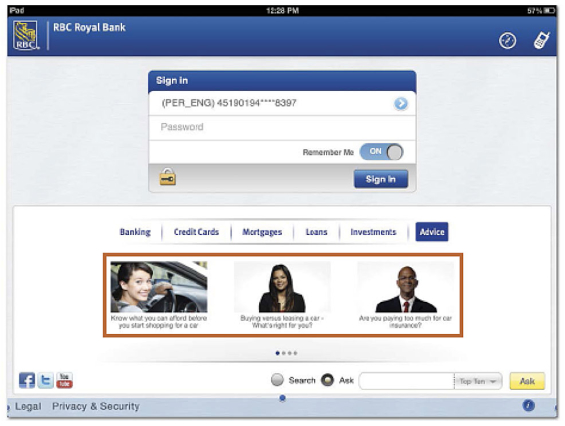

Marketing and Cross-Selling Through Mobile

As mentioned at the beginning of this post, banks have yet to fully utilize the potential of the mobile banking channel for the marketing of additional services the way they have leveraged the online banking channel. While there are spacial and time limitations on what marketing can be done on a smartphone or tablet compared to a computer screen, potential still remains that is untapped.

U.S. banks did very poorly compared to their counterparts overseas, with virtually no marketing being done via mobile, with the exception of some brand reinforcement and banner adds by Wells Fargo. Potentially cautious about impacting the transactional focus of most mobile banking functions, U.S. banks have yet to leverage the massive amount of contextual insight available with a mobile device.

Forrester found Commonwealth Bank of Australia again to be one of the most advanced organizations from a perspective of marketing via the mobile platform, with Bank of America being recognized for what is beginning to occur with the availability of merchant funded rewards through the mobile device.

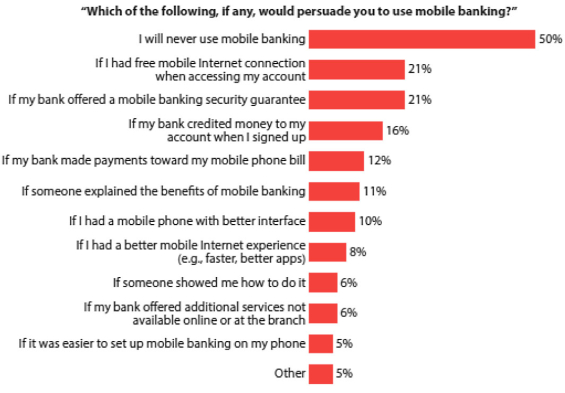

Promoting Mobile Banking

We are at the tipping point between the acceptance of mobile banking by early adopters and the potential of the mass market (some may say we have passed this stage). As a result, banks must begin to promote mobile banking to a wider audience using messaging that appeals to those consumers who don’t understand the benefits of the channel.

- Forrester research recommends the following mobile banking marketing strategies:

- Integrate mobile banking within all brand marketing campaigns

- Rather than promote mobile banking generically, promote individual functions and features (‘there’s an app for that’)

- Leverage target marketing opportunities to segments such as frequent users of online banking, bill pay, heavy ATM users and/or customers who frequently do balance inquiries

- Leverage traditional media such as POS, ATM messaging, direct mail, email to support targeted efforts

- Use social media like Facebook and gamification to promote mobile banking

- Leverage video within the mobile banking site to explain the benefits of mobile banking and ways to use the service that are unique to the channel

- Encourage current mobile banking users to recommend services to friends and family

- Help customers overcome security concerns with guarantees

- Provide interactive devices in branches that can demonstrate how mobile banking works

- Fully explain all costs involved

- Provide incentives for enrollment and use

Why Does This Matter?

As the penetration of smartphones increases, customer expectations are increasing as well. As more innovative applications are developed within and outside the financial services sector, the ability for banks to keep pace becomes both more difficult and more important.

Online banking already seems to be hitting a threshold of acceptance, with some consumers skipping over this stage of financial engagement and moving directly to mobile banking. With the growth in tablet use, consumers are able to access highly graphic and sophisticated financial planning tools on the road or while multi-tasking in their home. New devices and new tools provide an increased level of engagement and contextual interaction to those banks that seize the opportunity.

While most banks already offer some mobile banking functionality, the challenge going forward will be to execute a strategy that is a differentiator both from a customer experience and revenue perspective. By building an agile, best-in-class mobile infrastructure, the impact can be realized through increased differentiation, lower cost customer acquisition, improved channel efficiency, enhanced customer retention, and greater revenues through cross-selling and up-selling of products and services and through merchant-funded rewards.

By executing and optimizing a successful mobile banking strategy that is integrated with a wider multi-channel strategy, banks will be better positioned for the future of both mobile banking as well as mobile payments.

According to Peter Wannemacher from Forrester, “Before rolling out more standalone mobile apps, digital banking leaders need to lay out a vision for how mobile will change the way their bank sells and serves its customers. With this in mind, digital banking in the future must be simple, ubiquitous, personal, empowering and most importantly, reassuring.”