Most Millenials will begin their research for new banking products online. They are, after all, digital natives. So it’s imperative to make sure that the details Millennials care about most — like mobile capabilities, fees and locations — are ridiculously easy to find on your website on all platforms (e.g., desktop, tablet, mobile).

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

What Matters Most to Millennials

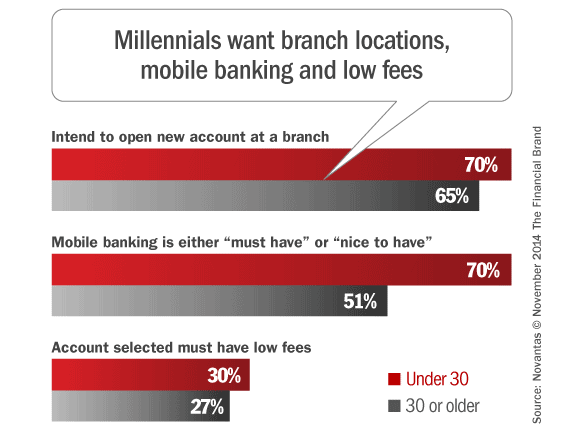

1. Convenient locations. This is the real challenge for retail banking institutions: Branch locations are the primary reason Millennials include institutions in their consideration sets, and while many will open their account at a branch, future visits will be sporadic at best. Leading institutions will be successful leveraging alternative means to drive growth outside of branch locations.

2. Low fees. Price is one the biggest drivers for purchase decisions across all age groups and Millennials are more likely to select an account because it had low fees than any other age group. Many banks and credit unions include features that appeal to Millennials (e.g., ATM fee rebates) with accounts that require high balances to waive monthly fees. This mismatch is a big reason why some institutions have trouble winning Millennials.

3. Mobile capabilities. Millennials have the highest level of interest in mobile banking features compared to other age groups. In a recent survey on FindABetterBank, over 70% of Millennials said mobile banking was a “nice to have” or “must have” feature, compared to just over 50% of shoppers over 30 years old. And while nearly every institution says they offer mobile banking these days, many institutions don’t highlight these capabilities enough to convince Millennials to open an account.