Rapid technological advances and significant socioeconomic shifts have positioned financial institutions at the cusp of a major generational transition. Millennials, who represent ages 28 to 44, are often defined by their tech dependence and unique financial challenges and have been an ongoing acquisition target for banks and credit unions. This demographic’s distinct behaviors and preferences have set the course for new banking practices and strategies; financial industry leaders are racing to innovate the digital banking experience alongside a product portfolio that will capture the largest intergenerational wealth transfer in history.

Alkami recently conducted a national generational study that included a rigorous methodology with 1,500 participants weighted to the 2020 US Census for age, gender, region, and ethnicity. All respondents currently have a bank or credit union account and are active in digital banking. From the rising interest rate environment to the opportunities for regional and community financial institutions (RCFIs), the research explored a variety of millennial financial trends, beliefs, behaviors and preferences.

The Generational Trends in Digital Banking Study reveals that for millennials, the price of entry for financial institutions is an exemplary digital banking experience, where the digital banking channel is equal parts sales and service. The path to differentiation comes with data — banks and credit unions will need to leverage data and artificial intelligence in banking (AI) to deliver increasingly personalized offers, thereby evolving into the data-informed digital bankers of the future.

The Millennial Journey

Millennials have experienced significant financial hurdles that have uniquely shaped who they are today and have been the driver behind most of their financial decisions. From the repercussions of the Great Recession to the recent upheavals dictated by COVID-19, millennials have navigated through financial instability and an evolving job market. Now, as they step into key career phases and peak earning years, the impact of these experiences is profound and complex with very specific digital banking preferences and product demands.

1. Economic Pressures and Behavioral Response

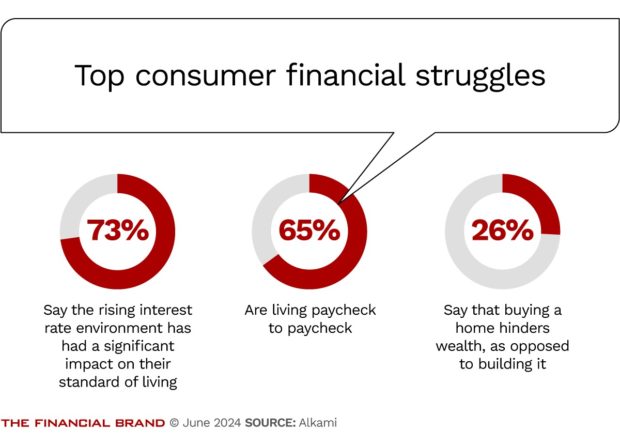

Interest rate sensitivity: The rising interest rate environment has notably impacted millennials, with a staggering 73% of millennials (ages 28-44) saying the rising interest rate environment has significantly impacted their standard of living, significantly more than Generation X (Gen Xers) and baby boomers. Additionally, 65% of millennials report they feel they are living paycheck to paycheck.

Homeownership reconsidered: Traditionally seen as a path to financial security, homeownership is viewed by more than a quarter of millennials as a monetary burden rather than an asset, reflecting a significant shift in the perception of traditional wealth-building strategies.

2. Banking Preferences and Expectations

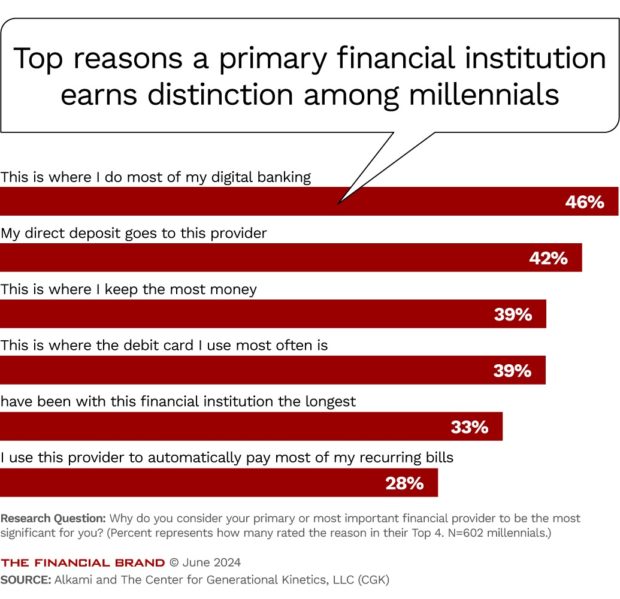

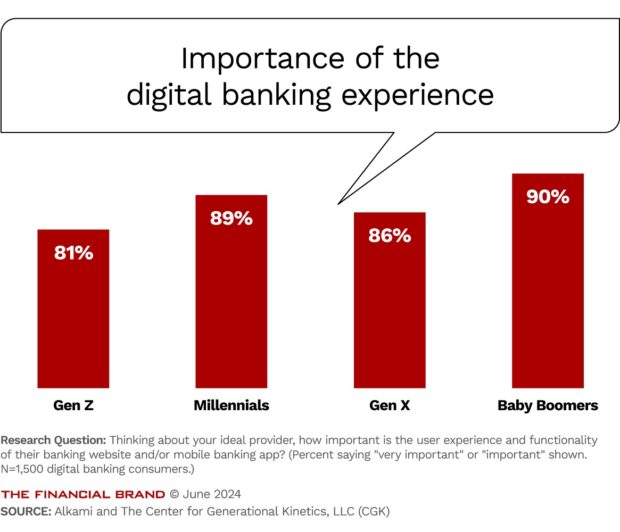

Digital banking experience: For millennials, a digital banking solution isn’t just about convenience, but also the experience and engagement with the technology. This demographic expects online and mobile banking interactions that integrate sales and service. Interestingly, the study found that millennials are more likely than older generations to say that the digital banking experience is very important (cited by 61%) and they define their primary financial institution (PFI) as the one where they do most of their online or mobile banking (cited by 46 % of them as one of their top 4 reasons).

Millennials are also significantly more likely than older generations to change financial providers if another offered a better digital banking experience (58%). Here’s the good news for RCFIs concerned about potentially disenfranchising older generations in their pursuit of millennials: A great digital banking experience is age agnostic, with more than 80% of respondents in each generation saying it is important or very important to their selection of a financial provider.

Personalization through data: Millennials favor financial services that offer personalized experiences. They value relevant product recommendations powered by data analytics and AI, aligning services closely with their individual needs and financial goals. For RCFI leaders, becoming a data-informed digital banker is the path to differentiation and growth with millennials. They are more likely than any other generation to be comfortable with their financial data being processed by AI if it gives them a better banking experience (51%).

3. Growing the Millennial Relationship

Millennials are ready for the taking: There’s a significant opportunity for RCFIs to attract millennials who may feel overlooked by national giants. Personalization, understanding regional nuances, and the digital banking channel can play crucial roles.

“For millennials, the price of entry is an exemplary digital banking experience, where the digital banking channel is equal parts sales and service.”

— Allison Cerra, Alkami

Innovation and adaptation: RCFIs that innovate and adapt to the digital preferences of millennials, such as integrating advanced data analytics for personalized service, are more likely to succeed in capturing this market segment. Millennials are significantly more likely than any other generation to wish that their financial provider offered a more personalized digital banking experience (55%).

Increased product adoption: The impending wealth transfer in some cases has already started as baby boomers are estate planning and preparing for retirement. Millennials as the beneficiaries are anticipating the need for more products, as they are 56% more likely to grow their relationship with their PFI over the next twelve months than Gen Xers and baby boomers.

Opportunities for RCFIs

With half of millennials considering institutions not viewed as a major national bank or credit union as their primary financial institution, RCFIs have a significant opportunity to capture this generation of account holders and capitalize on the intergenerational wealth transfer.

The national study revealed that millennials have 14% and 28% more products with their personal financial institution than Gen Xers and baby boomers, respectively. Millennials are a highly appealing audience due to the number of financial products they currently have and are expected to obtain in the next year – and the foot in the door with them is the digital banking experience.

To effectively engage with millennials, financial institutions need to adopt several strategic approaches:

Enhance digital banking tools: Invest in technology to improve the digital banking experience, making it intuitive, efficient, and secure. As the gateway to the PFI relationship, a “good enough” digital banking experience simply won’t cut it to attract tech-dependent millennials.

Develop competitive products: Lure in millennials with attractive deposit and loan products that are convenient and easy for them to open or apply for online.

Become the data-informed digital banker: Utilize data and AI to provide tailored banking advice and product recommendations that resonate with millennials, particularly as the generation that was arguably most impacted by the Great Recession.

Build on financial education: Offer resources and tools that help millennials navigate their finances to in turn build trust and loyalty.

Assess digital maturity: Benchmark against financial institutions in the US through the Digital Sales & Service Maturity Model self assessment to determine the level of digital maturity within your institution and how to evolve the digital banking channel into the digital sales and service platform millennials want and deserve.

Data can drive strategy: And strategy can be a foundation for building a banking ecosystem that will support the trillion-dollar use case of millennials’ future money and asset influx. As we witness millennials navigating their financial status and positioning themselves to secure and evolve bank or credit union relationships, regional and community financial institutions are poised to respond to the unique needs of this generation, thereby setting the stage for growth.