In the next five years, TransUnion estimates there could be anywhere from 13.8 to 17.1 million first-time homebuyers entering the housing market.

For its analysis, TransUnion developed a model that examined thousands of credit scores and attributes determining credit worthiness and propensity to purchase a home. The resulting “First-Time Homebuyer Propensity Model” identified specific consumers likely to become first-time homebuyers. Using this model, TransUnion determined that there could be as many as three million first-time homebuyers over the next year.

“It’s clear that there should be many new homebuyers in the market in the next few years.”

— Steve Chaouki, EVP/Financial Services at TransUnion

This would add a significant number of consumers to the mortgage pool. For comparison, 6.2 million consumers opened a new mortgage in 2015, approximately three million of which were first-time homebuyers.

TransUnion’s projections are based on U.S. consumers who do not currently have a mortgage, coupled with long-term estimates for growth in the mortgage purchase market and the percentage of first-time homebuyers in the traditional mortgage market.

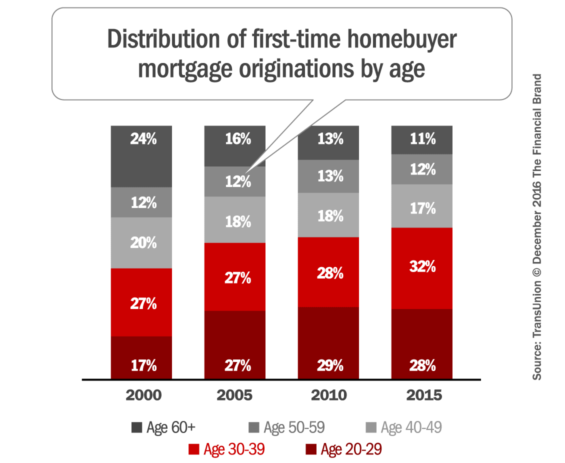

The study shows that Millennial consumers aged 20-39 will likely represent the majority of first-time homebuyers. In 2015, consumers in this age group represented 60% of first-time homebuyers, up from 44% in 2000. The youngest consumer subset studied, those ages 20-29, also have experienced major growth among first-time homebuyers, as their share has risen from 17% in 2000 to 28% in 2015.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

In another study fielded by TransUnion, nearly a third of Millennials (consumers ages 18 to 34) said they hope to purchase a home within the next year, but more than 40% are worried they may not have the credit to do so.

When asked their primary concerns about the home-buying process, Millennials said they are worried about having a low credit score (47%), not being able to fund a down payment (59%) and/or not qualifying for a low interest rate on a mortgage (56%), above all other concerns.

Credit scores are lowest among young adults ages 18-29 year olds, which have FICO scores below 699, than any other age groups, according to data collected by credit scoring system FICO. Approximately 32% of FICO consumers ages 18-34 have a score below 600, including 10% which have no credit score at all. The national average credit score is 667.

The increase in younger consumers planning to purchase their first homes comes at a time when first-time homebuyers are comprising a historically larger percentage of purchases than they have in past. At the start of the new millennium, first-time homebuyers comprised less than half of home loans. By 2015, this had grown to over 55%.

Joe Mellman, VP/Mortgages at TransUnion says these data trends reveal that first-time homebuyers have distinct, identifiable credit characteristics that distinguish them from non-buyers, and the conclusions derived from the analysis are highly reliable.

“Home buyers often have higher credit scores than non-buyers. Even within the same credit risk band, they are often more credit active and exhibit more credit responsible behavior,” Mellman explains. “We are quite pleased with the model’s accuracy in identifying first-time homebuyers. Earlier this year, we predicted just over 500,000 first-time homebuyers for the first quarter of 2016. Looking back, it turns out that is exactly how many first-time homebuyers there actually were.”

Marketing Implications of the Millennial Mortgage Boom

All these new homebuyers could be a major boon for banks and credit unions, particularly as the refi market starts drying up.

“First-time homebuyers are valuable prospects in the eyes of many mortgage lenders, as that time in a borrower’s life often corresponds to additional financial needs,” says Mellman.

Not only do first-time homebuyers represent a critical consumer segment — Millennials — there are significant cross-selling opportunities. According to TransUnion, more than 20% of first-time homebuyers open additional accounts with mortgage lender.

Financial institutions should start positioning themselves for this Millennial mortgage boom immediately. An aggressive and targeted content marketing campaign focused on the steps Millennials must take to prepare themselves for the home buying process will help banks and credit unions build relationships with potential homebuyers long before they start shopping for a mortgage provider.

Financial marketers should prepare various tools, resources and educational videos that would be relevant and useful for first-time homebuyers — credit score monitoring, managing one’s credit profile (e.g., how many credit cards they hold, total available credit, paying off cards), mortgage calculators, saving for a down payment, the impacts of PMI, etc.

The entirety of mortgage materials produced can then be packaged into a first-time homebuyer’s guide. This guide could become the centerpiece of a broader marketing campaign targeting first-time homebuyers.