As the largest generation in American history, Millennials (ages 18-34) are a crucial market segment for financial institutions to attract, engage and retain. And while most Millennials don’t even remember a time before the Internet, smartphones, or social media, this segment seems to crave for more from their bank or credit union than generations before them. They have very unique needs, and simply expect the best in terms of products, services and experience.

So just how committed are Millennials to their financial institution … or are they? And what would motivate them to switch?

In a research study, commissioned by Kasasa and conducted online by Harris Poll, Americans ages 18+ were asked about their perceptions of financial institutions, as well as the factors that influence where they conduct financial business and what they look for when seeking a new institution. The results offer insight into how community financial institutions (i.e., community banks and credit unions) can tailor their strategy to meet consumer demand, build profitable relationships, and capture greater market share among Millennials.

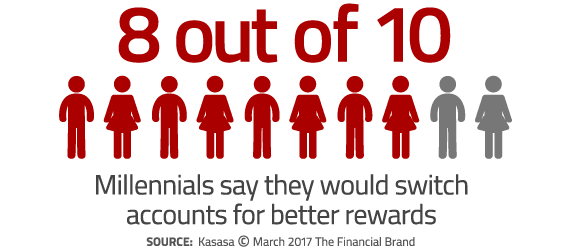

The playing field for brand recognition is actually more level than might be expected, and the motivators for switching are well within the reach of community financial institutions. In fact, the vast majority of Millennials (roughly eight out of 10, or 83%) would switch banks if one offered more or better rewards (e.g., high interest rate on checking, cash back on purchases, ATM fee refunds) than another. Nearly two thirds (65%) of Millennials would be more open to switching to a community bank if it offered mobile services (e.g., a mobile app, mobile check deposit). Moreover, nearly half (46%) of Millennials say locally owned (i.e., not a national chain) is important when choosing a financial institution for their everyday banking needs.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

How Well Do Millennials Know Your Institution?

First, let’s take a deeper look at the playing field across megabanks, regional banks, community banks and credit unions.

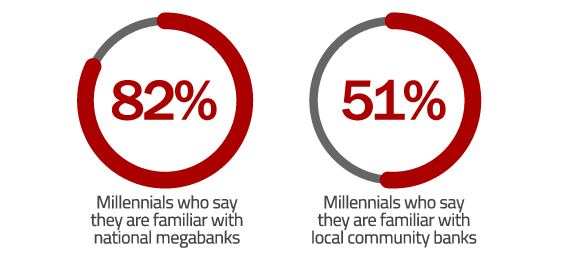

With billions of dollars poured into advertising and marketing each year, it’s no surprise that large national banks have greater recognition than community financial institutions. In fact, 82 percent of Millennials are familiar with these megabanks.

But the playing field levels out between community banks and regional banks. More than half (56%) of Millennials are familiar with local credit unions and just over half (51%) are familiar with local community banks, compared to just over half (51%) that are familiar with regional banks. This is good news for community financial institutions that must optimize smaller budgets to cover geographic areas similar to those covered by their regional bank competitors.

Turning our attention back to megabanks and the significant gap between community financial institutions, there is an opportunity here. Community banks and credit unions may be able to raise that awareness with strategic advertising and marketing — especially if they can find ways to target consumers with low recognition of community financial institutions.

Said another way, community banks and credit unions must find ways to differentiate themselves, perhaps by partnering with a nationally recognized brand. But this only “opens the door.” Financial institutions must give Millennials a reason to switch financial institution.

Millennials Open to Switch

More good news for community financial institutions is that the vast majority (82%) of Millennials are open to switching financial institutions. In fact, of those willing to switch, roughly six in 10 (61%) would consider using a local community bank or a credit union if they were changing financial institutions, while 63% would consider a big national bank.

With megabanks having a slight advantage in Millennials’ banking preferences, this leaves room for community financial institutions to persuade Millennials to switch banks. However, the question remains – how? Unfortunately, getting consumers to take action and follow through with opening a new account seems to be difficult.

Read More: Financial Institutions Must Help Millennials With Their Money Woes

Switching Motivators: Rewards, Fees & Location

Rewards seem to be a highly valued perk offered by financial institutions, with the majority (more than eight out of 10, or 83%) of Millennials indicating they would switch banks if one offered more or better rewards (e.g., high interest rate on checking, cash back on purchases, ATM fee refunds) than another.

Additionally – and not surprising – fees are still hated. In fact, according to the Kasasa April 2016 survey, the overwhelming majority (93%) of Millennials say no-fees banking is important when choosing a financial institution for their everyday banking needs, and just over the same amount (94%) shared this sentiment in Kasasa’s December 2016 survey conducted by Harris Poll.

Finally, location is important. Nine out of 10 (90%) Millennials say convenient location is important when choosing a financial institution for their everyday banking needs. This bodes well for community financial institutions — with their local presence and coverage of areas that may be underserved by larger regional or national banks.

However, Millennials’ preference for convenient locations can easily be trumped if there is a lack of convenient technology or certain tools, like a modern mobile platform. In fact, this can be a complete deal breaker for Millennials. With more than three quarters (77%) of Millennials saying they would only consider using a financial institution that offered online banking as well as in-branch operations, it seems that it is imperative to offer strong solutions for both digital and physical channels.

The Key to Capturing Millennial Business

To become the institution of choice for Millennials, community banks and credit unions need to closely evaluate their product and service offerings and make sure it aligns with this group’s unique needs. Millennials want rewards, no fees on banking and convenience, both in regards to location and technology – areas community institutions can succeed in.

Additionally, a significant portion of Millennials are familiar with community financial institutions (credit unions – 56% and community banks – 51%), and nearly half (46%) of Millennials say locally owned (i.e., not a national chain) is important when choosing an institution for their banking needs – more good news.

Moreover, 41 percent of Millennials say it is important to them to conduct their banking at the same bank as their parents or other family members. This presents even more opportunity for institutions, where account holders can easily refer others, especially through channels Millennials prefer like social media.

Ultimately, community banks and credit unions can take back the majority market share they previously held by tapping into the interests of Millennials and strategically marketing to this group that appeals to them.