Gen Y consumers, those born in the early 1980s to the early 2000s, will earn almost half of the income in the US by 2025. However, young adults are widely misunderstood – and often ignored – by many of today’s financial institutions.

These are the findings from a study encompassing nearly 9,000 consumers fielded by Javelin Strategy & Research and sponsored by design and strategy agency, Comrade. The study highlights top myths about this key generational segment and offers advice on how financial institutions can optimize their touch points to attract tomorrow’s most profitable banking consumers.

Myth #1: Gen Y Consumers Are All the Same

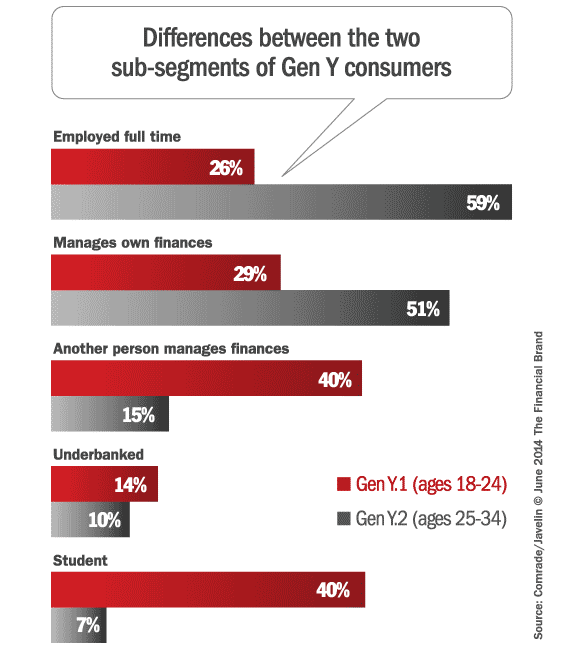

Getting in with Gen Y is a “do or die” initiative for digital service providers, and it’s an expensive mistake to treat these young consumers as a single group. Gen Y is actually made up of two groups. Gen Y.1 are those ages 18-24 years who are financially inexperienced and uncommitted to any one service provider. Gen Y.2 who encompass ages 25-34 and are tech-savvy consumers, highly engaged in financial services, with a greater appetite for banking products. There is roughly 31 million consumers in the Gen Y.1 sub-segment, and 42 million in the Gen Y.2 group.

Tips to overcome it:

- Don’t wait until they’re profitable.

- Provide the older Gen Y group with products suited to their career-driven life stage.

- Design digital banking for speed and simplicity to serve the younger Gen Y.1 audience.

- Look for opportunities to create financial co-management tools.

- Opportunities for older Gen Y.2 lies around budgeting, savings, and education.

Read More: What’s the Biggest Myth About Gen Y?

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Myth #2: Gen Y is Mobile-Only

“Mobile-only” consumers don’t really exist. Although 41% of Gen Y consumers are active monthly users of mobile banking, very few avoid other banking channels. Not only are mobile-only consumers scarce within Gen Y, but also among all age segments. Today, only 2.4% of Gen Y consumers are mobile-only bankers vs. 1.4% across all other segments of the population. Millennials still turn to a variety of channels to manage their finances. Although adoption rates among mobile/smart-device users are rising, the reality is that most consumers aren’t yet ready to commit to a banking experience that is exclusively phone and tablet based.

Tips to overcome it:

- View your initiatives through an omnichannel perspective.

- Take advantage of the unique capabilities of each device type.

- Support mobile account opening and enrollment.

- Consider investing in HTML5 with responsive design to create a consistent yet optimized experience.

Read More: Banks Killing Credit Unions in Tech Tug of War for Gen Y Consumers

Myth #3: Gen Y is Not Profitable

Given recent regulatory changes and economic pressures from the lingering Great Recession, financial institutions are struggling to find a profitable way to approach young consumers. Gen Y consumers are facing unprecedented student loan debt and a less-than-welcoming job market, suggesting they will be less wealthy and ultimately, less profitable. That said, organizations must think about their long-term revenue potential and must start catering to these consumers who expect convenient, innovative, real-time services that enable them to bank and spend money when and how they want.

Tips to overcome it:

- Start now to build a long-term relationship.

- Focus onboarding on engagement rather than crossÅ]selling.

- Use alerts to help young consumers avoid missteps.