The media today paints a complex portrait of the modern Millennial: one whose proclivity for binge-watching has pummeled broadcast TV ratings, one whose dependency on social platforms makes Instagram and Snapchat the first and last stop every day, one whose expectations for experiences (both online and off) has redefined every industry, and one who is crushed by such an oppressive weight of debt that it’s bruised the housing market.

But are Millennials really so different? Considering what has happened at a macro level in Millennials’ lifespans, it’s not hard to see why Millennials’ risk-averse attitude towards money is a distinct and definitive generational trend. Enduring the financial crisis and growing up through a technology boom has created a cautious population, one that expects information at their fingertips. Indeed research fielded by C Space shows that 8 in 10 Millennials are more comfortable living a life without significant financial risks, and 7 in 10 Millennials say that taking any risks with their finances makes them feel “out of control.”

Distrust of Wall Street is nothing new. Millennials’ conservative approach to saving mirrors that of their grandparents and great-grandparents, those who grew up in the Great Depression and came of age in the post-War era. However, Millennials have a unique combination of pressures on them that impact bank and credit union marketers in significant ways:

- Often exceedingly high education debt and a job market in which wages were adjusted downward as a result of the Great Recession

- Lack of time given long work hours and often multiple jobs to pursue education, despite no curated path to do so

- A dizzying array of options for coverage, banking products and retirement plans, many of which primarily offer a digital consumer experience and which shift the burden from the company to the customer to compare and contrast options

Considering the poor, and in some cases non-existent, financial education schooling in U.S. curricula, it’s no surprise that just 24% of Millennials surveyed by the National Endowment for Financial Education and George Washington University demonstrated basic understanding of how to manage their money.

Read More:

- Are Millennials Really That Different?

- Not All Millennials are Created Equal

- Millennials: The ‘Debt Averse’ Generation

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

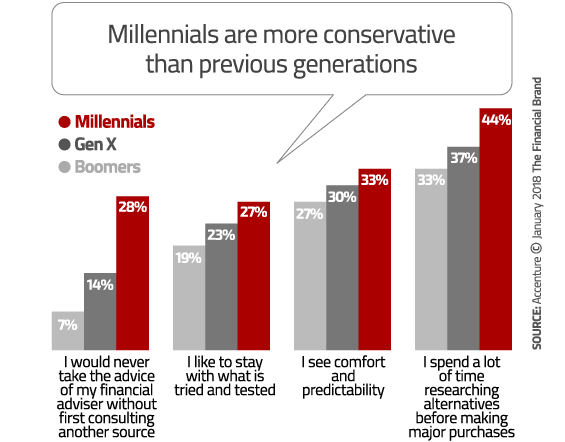

Millennial confusion over financial options blends with a general feeling of institutional distrust, a warped sense of financial competency, and a hunger to amount wealth. This mindset drives Millennials to consult with multiple sources before making decisions, more so than other generations.

This reflex to consult multiple sources stems from (1) Millennials’ desire for control — a logical consequence for a generation who grew up with so much uncertainty — and (2) the seemingly infinite amount of information at the tip of their fingers. This attitude is reflected in Millennials’ reluctance to invest in stocks; less than one third of Millennials have their wealth invested in stocks. Instead, the desire for control propels Millennials toward safer alternatives like physical assets and cash.

Similarly, the desire for control influences Millennials’ preferences for financial advice. Despite the widely held assumption that Millennials are so tech savvy that robo-advisors should be an automatic home run with this audience, Millennials’ reaction is fairly similar to older generations’. Millennials fear a hands-off, automated digital tool will come at the expense of personalized advice and human-contact. This results in low adoption and usage rates. Although the mainstream media frequently depicts Millennials as being glued to their smartphones, Millennials still crave human interaction — particularly when it comes to their finances. LendEDU reports that Millennials are nearly twice as likely to work with a financial advisor as they are to use a robo-adviser — they believe that a robo-adviser will perform worse than a human.

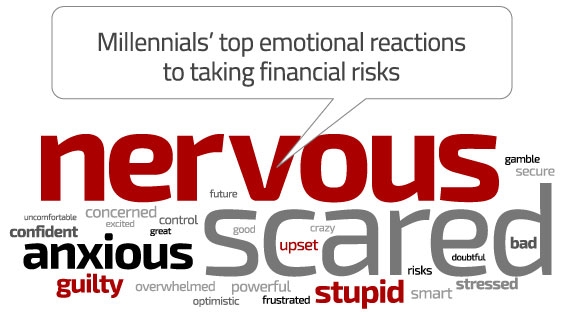

When asked how they feel about taking risks with their finances, Millennials share feelings of fear, nervousness and worry. In C Space research, 7 in 10 Millennials said they know that taking some financial risks may be good, but associate those risks with strong negative feelings.

The magic bullet to reduce Millennial consumers’ feelings of stupidity and anxiety and to increase perceived control over their finances comes down to increased knowledge/information, ease of implementation, use and customization of financial tools and services.

Take Samsung Pay for instance. Unlike Apple or Android Pay, Samsung’s mobile wallet uses magnetic secure transmission (MST), the same magnetic strip in retailers’ card readers, making Samsung Wallet available almost everywhere. Samsung Pay hosts Samsung Rewards, a straightforward incentive structure that plainly rewards users for every Samsung Pay use. Together, Samsung has created an easy, dependable and straightforward product, which is why two-thirds of users make at least one mobile payment per week vs. 56% of Apple Pay users.

Another key factor driving adoption rates among Millennials is the ability to personalize. Ellevest is entrenched in customization, designed to adapt investment recommendations using factors that are unique to women such as longer lifespans, salary projections, etc. By offering a relevant financial experience, Ellevest attracts female investors, making investing less intimidating and minimizing the gap in male vs. female likelihoods to invest.

With today’s barrage of financial-focused tools and services, those that stand out to Millennials offer painless set up, consistently deliver across channels and allow for customization, making money growth straightforward, quick and relevant. For financial service providers, delivering on ease and relevancy requires understanding of Millennial consumers and the apprehension and other emotional drivers that influence perceived control over money.