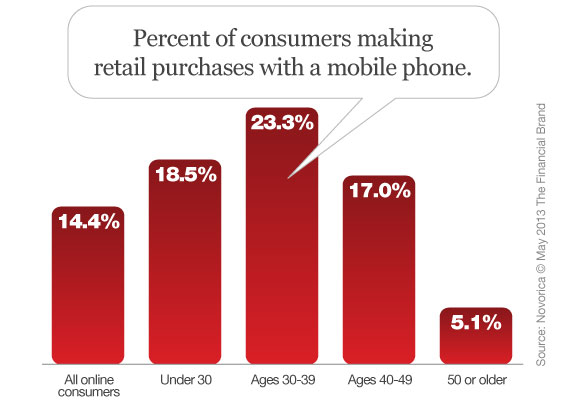

Nearly 15% of online consumers have made a mobile POS purchase in the last 30 days.

Consumer adoption of mobile point-of-sale (POS) payments will be largely driven by the availability at the point of sale. Today, more and more retailers are deploying POS systems allowing consumers to complete purchases using their mobile phones. By the end of the year, more than 2 million retail locations in the US will offer mobile POS as a payment option.

A recent survey fielded on FindABetterBank revealed that 14.4% of online consumers have made mobile POS purchases in the last 30 days. But surprise! Consumers under 30 are less likely to have made a mobile POS purchase than consumers ages 30 to 39. Why? Many young consumers do not have the ability to make mobile payments at POS because they don’t have checking accounts or credit cards. Young consumers are also more likely to be managing their balances to the nub and may be fearful of losing track of their balances by using too many payment methods.

Gen-Y Consumers Are Less Likely to Use Their Mobile Phone to Make Retail Purchases

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The payments space has long been dominated by banks and credit unions. Checking accounts were — and still are — the main hub for most consumers’ payments. New players emerged with the advent of ecommerce (e.g., PayPal), and now mobile POS is bringing even more non-banking competition into the payments space.

PayPal is clearly in the “pole position” with 57% of mobile POS users. This is largely because PayPal has been aggressively courting the merchant service providers that provide retailers with POS systems. Coffee and convenience retailers — most notably Starbucks — have rolled out their own mobile apps to accept payments. Typically, these apps enable customers to “load” an amount of money in an account to use at POS. While consumers under 30 are less likely overall to have made a mobile POS payment, retailer apps are most popular with this group.

Bottom Line: The net effect is a disaggregation of features consumers once associated exclusively with their checking provider. This represents a tremendous risk for banks and credit unions because it whittles down the value of “primary banking relationships” — essential to growing relationships and revenues.