When it comes to the Millennial segment (those born between 1980 and 1996), financial marketers shouldn’t believe everything they hear. Along with several important truths, there are many long standing myths that can negatively impact the effectiveness of marketing initiatives to Millennials.

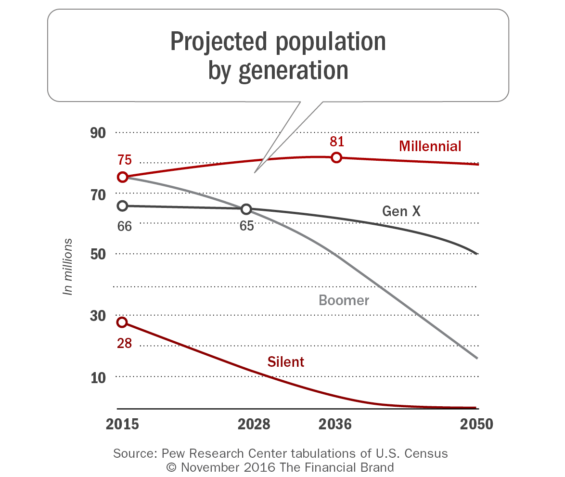

There is no arguing that the Millennial customer base is growing and will soon be more important than any previous generation. It is also true that Millennials are highly mobile, technically savvy and open to new ways to conduct their banking.

On the other hand, Millennials don’t differ as much as many marketers believe in their use of banking services. In addition, because the early Millennials are reaching their prime, this segment provides significantly more immediate opportunity than most marketers realize.

To engage Millennials and invest in this expanding customer group, bank and credit union leaders must sort the myths from the facts, and take action based on empirical data. A great source of insight is the Digital Banking Report, The Millennial Mind.

This 63-page report includes 43 charts and will assist organizations in understanding the key beliefs, behaviors, trends and priorities related to the Millennial segment. The report also provides analysis of how banks and credit unions can market to and deliver the desired experience to the Millennial consumer.

This 63-page report includes 43 charts and will assist organizations in understanding the key beliefs, behaviors, trends and priorities related to the Millennial segment. The report also provides analysis of how banks and credit unions can market to and deliver the desired experience to the Millennial consumer.

The key questions the research report addresses include:

- What is the size of the Millennial market and what are the different sub-segments?

- What is the demographic make-up of the Millennial market?

- What are the attitudes of Millennials about money and finance?

- What are the current products and services used by the Millennial market?

- How do Millennials prefer to make payments?

- What delivery channels do Millennials use?

- What is the Millennial segment attitude towards new financial services providers (fintech firms)?

- What’s the best way to reach the Millennial segment?

Below are some highlights of the Digital Banking Report, The Millennial Mind.

All Millennials Aren’t Created Equal

The Millennial generation is the largest in history, with more spending power and technical acumen than any generation before it. The Millennial generation continues to grow as young immigrants expand its ranks at a faster rate than other generations. Because they grew up with digital technology and a phone in their hand, Millennials shop and make buying decisions differently.

But not all Millennials are alike.

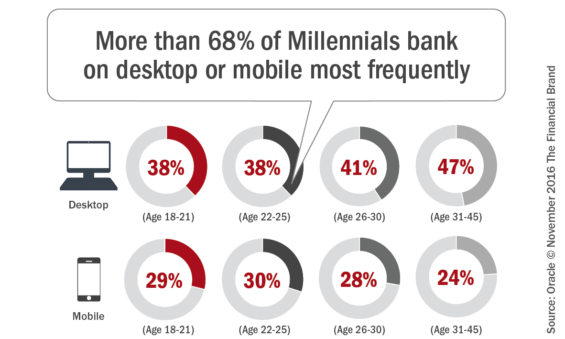

The younger spectrum of the Millennial segment has greater financial provider attrition than older Millennials, which is not unusual since younger consumers are more transient and more demanding and unforgiving than other consumer segments. The younger Millennials are also more likely to chose mobile as opposed to using a desktop as a channel of interaction with their financial institution.

Young Millennials (age 18-21) and Mature Millennials (age 26-30) are the most open to non-traditional modes of payment. Specifically, Mature Millennials are more likely to use mobile wallet and mobile money, while Young Millennials prefer peer to-peer payment platforms such as Venmo and alternative payment providers such as Paypal.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

Financial Behavior of Millennials

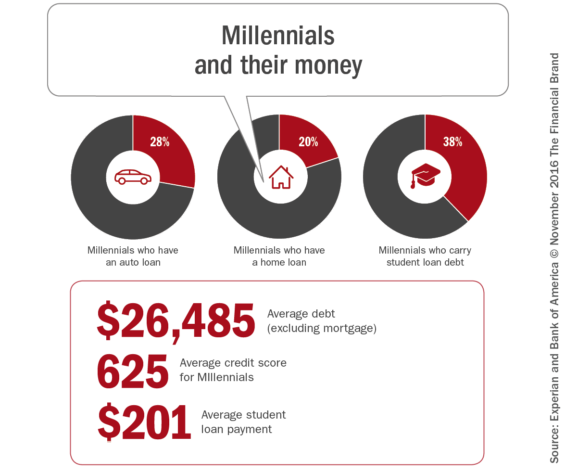

As Millennials take on increasingly complex financial lives, the ways in which they interact with their banking providers will change as well. Most financial needs/behaviors are driven by the stage of life that a consumer is currently in. The financial needs of a Millennial that is 29 years old are not significantly different than those of a Baby Boomer when they were 29 years old.

Both Millennials and Baby Boomers were/are concerned with accumulation — first home, borrowing for big ticket items, starting to save for the future, and convenience in every day transacting to assist with hectic schedules of work, new families, and busy social lives. The real differences between the Millennial age 29 and a Boomer at age 29 is the communication (both tone, frequency, and media), and the technologies used to meet the consumer’s financial needs.

Perhaps surprisingly, according to Gallup, Millennials have a higher share of wallet with their primary bank than any other generation. And when banks or credit unions engage Millennials, they gain a boost in wallet share of as much as 25% or more.

Financial marketers who believe that Millennials’ assets are too low to invest in dialogue are relying on a faulty assertion. While many Millennials are struggling with student debt and may be delaying major purchases or life decisions, the truth is that millennials have a lot to offer financially.

Despite the tremendous upside opportunity with Millennials, this generations reports the most problems and are the least likely generation to have their problems resolved. Though they use more banking channels than any other generation, Millennials also have fewer satisfying interactions.

Finally, Millennials are the generation least likely to strongly agree that their bank knows them, looks out for them or rewards them. While partially caused by being a more demanding segment, they are also the most ignored by the industry.

Millennial Product Usage

The Millennial consumer uses many of the same products as other generations, yet accesses these products differently. They are at the forefront of change in the payments sector, with financial institutions and payment providers needing to quickly adapt to new methods of payment, changes in preferred experiences, and drivers of usage.

“Millennial banking customers are just as likely as members of older generations to use nearly every core deposit product with their primary bank: a checking account, a debit or check card, online bill pay, direct deposit and a savings account,” states Gallup.

Millennials are also more likely than Generation X customers to have a home equity loan or line of credit, a credit card, financial planning or advisory services, a home mortgage loan, and an auto, boat or recreational vehicle loan.

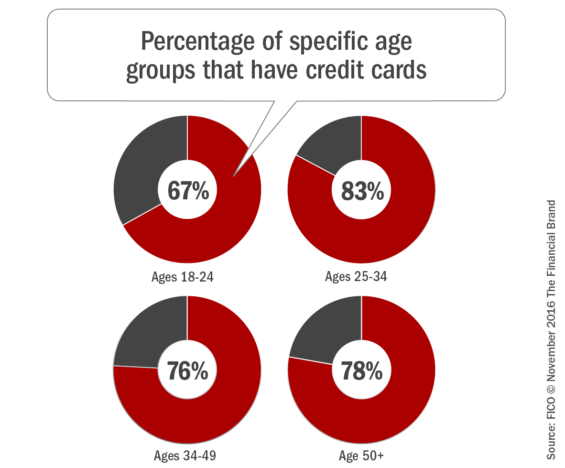

While many bankers believe Millennials are debt-averse and use debit cards or checking accounts as opposed to credit cards, Millennials actually want credit cards. While only 67% of those 18-24 own a credit card, the percentages (and use) skyrocket for 25-34 year-old consumers.

Millennial Channel Use

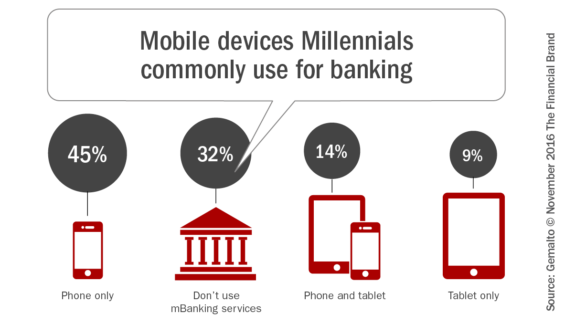

Saying that Millennials love their tablets and smartphones should hardly come as a surprise. But the extent to which they will transform the distribution and marketing landscape in the banking industry should not be underestimated.

Over a quarter (27%) of young people say they have never visited their branch and only 14% say they prefer doing their banking in person. This is in stark contrast to 82% of those ages 18-60 in the US who say they’ve spoken to a teller or a bank employee at a bank branch in the past 12 months.

Interacting with their mobile phone continuously as part of their daily life, Millennials are 2–3 times more likely than the general population to want mobile app notifications for credit limit warnings, suspicious charge alerts and payment reminders. For fraud notifications, the Millennials also want to be notified by phone, opening the opportunity for a multi-channel communications plan.

Millennial Use of Alternative Providers

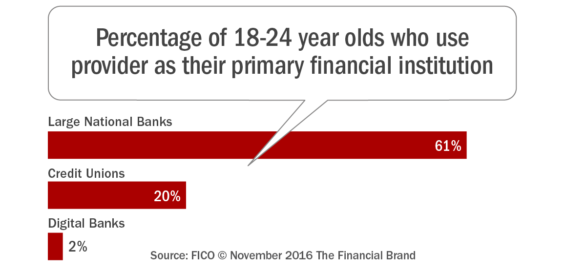

Large national banks dominate Millennial market share in the US, with these largest banking organizations garnering a larger share – mostly at the expense of smaller community banks and credit unions. Much of this shift in market share has been attributed to the advanced mobile capabilities of the largest financial institutions.

While only 2% of Millennials currently have a relationship with a “Digital Bank,” the older sub-segment of Millennials (25-34 years-old), are 2 to 3 times more likely to close all accounts with their primary financial institution than people in other age groups. This propensity is twice as high as only a year ago. This illustrates the penetration by alternative financial organizations in areas like payments and lending.

Some insights included in The Millennial Mind research report:

- 53% of Millennials don’t think their bank offers anything different than other banks.

- 1 in 3 say they are switching banks in the next 90 days.

- 33% believe they won’t need a bank at all in the future.

- Nearly half are looking for tech start-ups to overhaul banking.

- 73% would be more excited about a new offering from Google, Amazon, Apple, Paypal or Square than from their own bank.

Building Relationships with Millennials

The way to build a relationship with a Millennial is directly correlated to how well a financial institution uses the data available to build connections around this segment’s life moments. Contextual engagement that is both smart and timely is

the key.

The three required components of meeting these needs include:

- Adopt a mobile-first approach

- Provide personal, relevant and contextual solutions.

- Consider partnering with fintech start-ups.

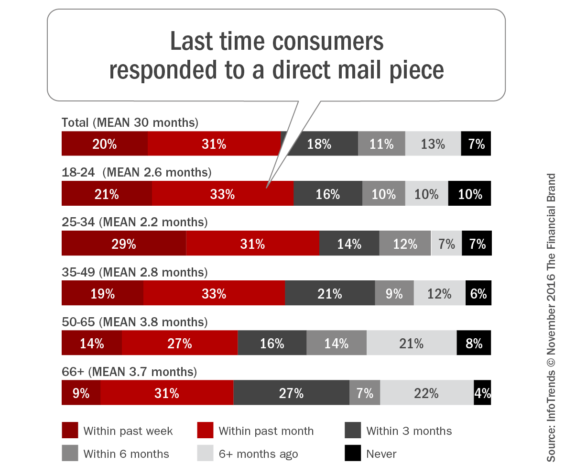

While digital channels are important, bank and credit union marketers can’t ignore traditional channels. Surprisingly, younger and older Millennials are very responsive to direct mail, possibly caused by their insecurity around finances or the novelty of the channel.

No matter which channel is used, according to Oracle, “Banks need to take a human-centric approach in their product development strategies. They should leverage their customer data strategically to design and deliver an experience that is mobile, personalized and value-added. They should act now, before other digital players take their place.”

Those FIs that better understand how Millennials approach financial decisions and transactions and use this insight to deepen relationships will be in an enviable position. To achieve such a position, issuers must recognize that Millennials truly represent the lion’s share of future revenue.