According to the TD Bank Mortgage Service Index, consumers continue to experience high levels of stress from the home buying process and are less satisfied with online tools and the overall simplicity involved with obtaining a mortgage.

This year marks the second straight that TD has fielded the study, a national survey of 1,500 consumers who purchased a home within the last 10 years. The study is designed to reveal consumers’ attitudes towards the home buying and financing process, and to help identify industry best practices for lenders.

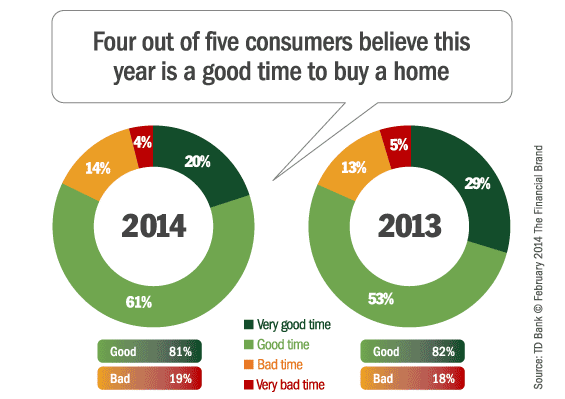

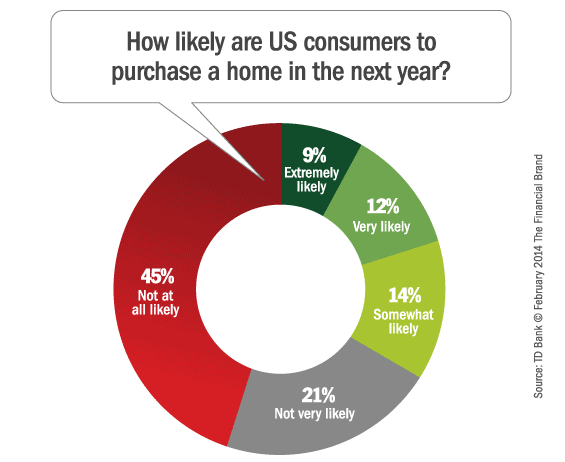

82 % of respondents feel that this year is a “very good” or “good” time to buy a home. On average, fewer homebuyers (20%) feel it’s a “very good” time to purchase a home as compared with last year (29%). Almost a quarter of homebuyers (21%), up from 18% last year, are extremely “very likely” or “likely” to purchase a home this year. 51% of respondents surveyed said that they expect the housing market to stay the same over the next six months.

First-time homebuyers account for nearly one-half (49%) of the home purchases this year, up from 45% in 2013.

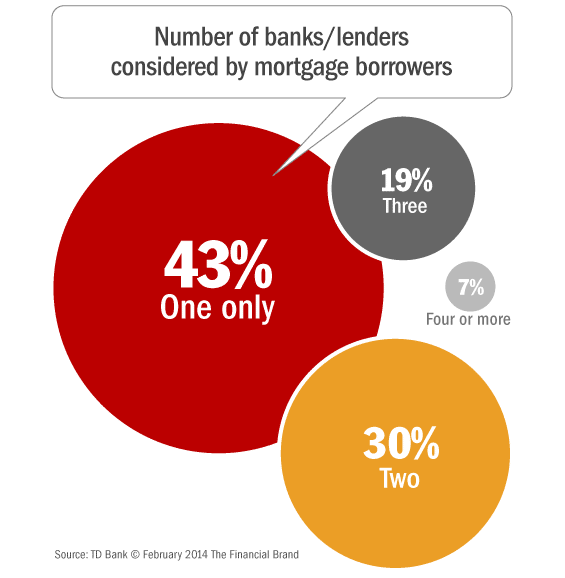

On average, homebuyers considered two banks or lenders when applying for a mortgage.

Read More: Industry First – Bank Ties Home Loan Rates to Facebook ‘Likes’

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Consumers Are Reasonably Satisfied, But It Could Be Easier

Overall, 62% of those surveyed found their most recent home buying experience to be “excellent” or “very good,” with 66% also reporting a positive mortgage-approval process. Closely tracking results from last year’s survey, more than half of respondents said they had an “excellent” or “very good” experience when looking for the right lender (56%) and the length of the entire process (51%).

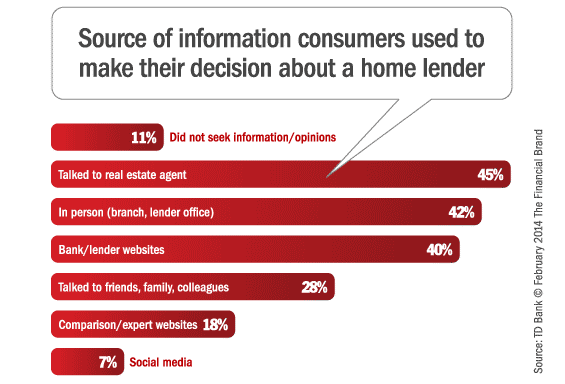

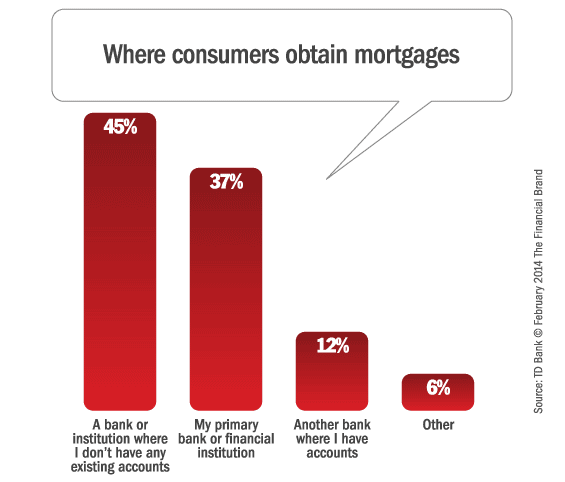

The survey also revealed a slight uptick of homebuyers looking to their primary bank or financial institution to obtain a mortgage compared with 2013 (37% vs. 34% last year). Those who purchased a home within the past two years were more likely to obtain their mortgage through their primary bank (46%). Of those buyers, 71% reported a “very good” or “excellent” experience.

As with the 2013 Index, buyers continue to cite lenders’ accessibility, transparency and responsiveness as the key to excellent mortgage experiences. Of those who purchased a home within the past two years, 70% rated their lender as “excellent” or “very good” in responsiveness, honesty and transparency, and ability to explain mortgage rates and terms. Additional factors that buyers ranked as important include:

- explained mortgage rates and terms (59%)

- instilled confidence throughout the process (58%)

- helped buyers understand the process (58%)

- explained the mortgage and available options (58%)

Simplicity (56%) and easy-to-use online tools (51%) ranked the lowest, indicating consumers were less satisfied with these aspects of the lending process.

Stress Levels Remain High

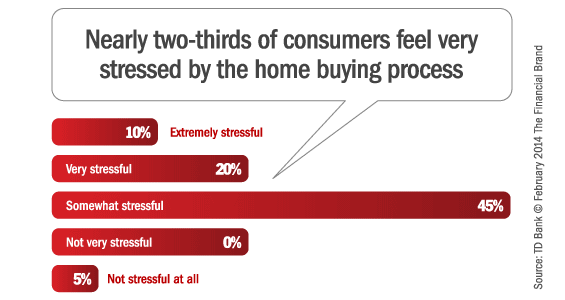

As compared with last year, more homebuyers reported the home buying experience as being “extremely” or “very” stressful (30% vs. 24% last year). Not surprisingly, home buyers reporting a good buying experience cited less stress in the purchase process. Among home buyers who had a good home buying experience overall, 85% reported a very good lender experience.

Read More: Room For Improvement In Home Loan Process, Study Shows

The Full Report Breaks Down Data by Region

The TD Bank Mortgage Service Index parses survey data by geographic region:

- There was a drop in optimism among Philadelphians, with only 36% of respondents feeling the housing market will improve this year, as compared to 47% who felt the same way this time last year.

- Both Philadelphians (57%) and Bostonians (50%) exceed the national average (45%) in obtaining their most recent mortgage through institutions where they do not have existing accounts.

- Seventy-one% of those in the Big Apple feel they had an “excellent” or “very good” mortgage and lender experience, as compared to 58% in 2013.

- New Yorkers (33%), up from 22% last year, are considering purchasing a new home in the next year