Millennials have reached adulthood, and know how they want to be engaged and serviced when it comes to their financial needs. But their order is a tall one. Gravitating toward technology, yet partial to the “artisanal” and genuine; eager consumers, yet wary of overspending; known for their blink-fast attention span, but willing to dig deep when an issue inspires; servicing millennials may feel like a gamble.

Failing to crack their code could be fatal to your future lending opportunities. Millennials have already changed the way business is run across nearly every sector, leaving traditional brick-and-mortar standbys scrambling to catch up and reinvent their sales model – often too late.

Not to mention, they could be your largest market of potential borrowers… ever.

What is a Millennial, Anyway?

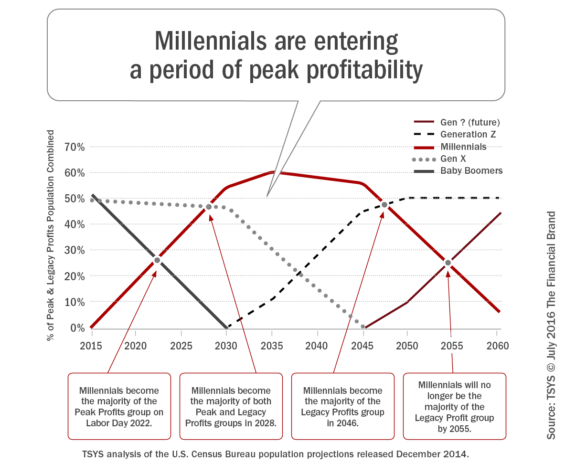

As described in 63-page Digital Banking Report, The Millennial Mind, Millennials represent a major force in today’s mortgage market. Born roughly between 1982 and 2004, they encompass an estimated 86 million potential customers whose lives as active consumers will extend well into the next quarter century.

They’re diverse, including a large immigrant population, and they don’t consider marriage or a family to be prerequisites for home ownership, with single female home-buyers far outpacing their male counterparts.

A Place of Their Own

Now in their late 20’s and early 30’s, many Millennials have already hit “home-buying age”. Data from the Census Bureau indicates that nearly 17 million millennials may buy a home in the next decade.

Unfortunately, the number of young adults still living with their parents due to finances has grown as well, revealing a major roadblock for many millennial borrowers … the burden of college debt. Fifty-three percent of this group cited student loans as the biggest obstacle toward saving for a down payment. Other challenges include a stagnant supply of affordable first homes and restrictive lending standards that make it difficult for new homebuyers with lower credit scores.

That’s not to say the idea of home ownership isn’t appealing. The 2016 NAR Home Buyer and Seller Generational Trends survey found that millennials who desire to own a home of their own as the primary reason for their purchase is up to 48% from 39% only a year before.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Digital Generation

Millennials may remember dial-up Internet, but most have grown accustomed to instant online gratification. Fast access to the web is a “must have,” and smartphones and social media a part of their everyday lives. As most banks and credit unions now offer a broad range of services online, today’s younger customers and members prefer doing their banking from a mobile app over visiting a brick-and-mortar branch.

On the other hand, when it comes to applying for mortgages and other big-ticket, long-commitment financial products, younger customers still appreciate having a human element when paperwork and terminology get more complicated. Many financial institutions offer a hybrid approach – the convenience of online applications, with the option to personally meet with a loan officer to go over completed paperwork.

While an all-automated loan origination process is certainly doable – even preferable for some personalities – flexibility in customer service is what cuts through the competition and opens the door for future lending opportunities.

Factoring in Financing

In the 2015 Home Buyer report from the National Association of REALTORS®, 22% of Millennials reported having a difficult time saving for a down payment. Again, the specter of student loan debt looms, as well as those from credit cards and car loans.With these lingering debts, saving for the future is an uphill battle.

Millennials intending to purchase a home do understand that some sacrifices have to be made, however, and are willing to cut spending on non-essentials like entertainment or clothing. And despite a somewhat jaded view of the economy, 84% of buyers under age 34 believe purchasing their home was a good investment.

Proving Your Worth

For most Millennials, the first touch point when considering a purchase, from shoes to vacations, is the Internet. The “personal recommendation” has expanded from word of mouth to “earned media” sources, such as social platforms and online review sites like Yelp. These sites allow prospective buyers to vet the experience of other consumers. A bad customer experience can spread like wildfire – but so can a good one.

The banking and lending industry has taken notice, resulting in a veritable online financial district of “virtual banks” and web-based mortgage lending sites. New concepts such as peer-to-peer lending and “marketplace” lenders have made inroads as well, increasing the competition.

Millennials look at lenders like any other business: they want round-the-clock convenience, fast results, and mobility, coupled with exceptional customer service, throughout the entire lifecycle of their loan. Consistently creating such an experience is key to earning positive feedback and landing new business opportunities.

The Start of a Beautiful Relationship

Today’s young adults may have unique expectations, but in many ways, they’re no different from past borrowers. Whether urbanites or suburbanites, Millennials still dream of “a place to call their own,” and they still have questions that only a live, talking loan officer can adequately address.

Despite disrupteos like online-based mortgages, savvy local lenders have an opportunity to build their mortgage business to levels not seen in decades, thanks to a burgeoning population of likely homebuyers and an improving economy. By buffering well-chosen online outreach with the unique ability to provide truly personal and community-based service, local and regional financial institutions can develop a strong and loyal base of new borrowers who appreciate next-gen convenience and a vested partnership.