As banks, credit unions and other lenders continue to vie for new borrowers, markets and opportunities, many have discovered conventional means of credit scoring and risk don’t necessarily hold up.

Hence, most lenders looking to grow their lending business are embracing so-called “alternative credit data” to approve up-and-coming borrowers. These alternative data represent factors generally not included or weighted heavily in national credit reporting agencies (NCRA) formulas. That could include a potential customer’s income and employment information, inquiries and payment records to ‘specialty’ lenders like payday lenders, utility and mobile payment history, rental payments, peer-to-peer lending history and social media profiles.

Kevin King, vice president, credit risk and marketing at LexisNexis Risk Solutions, is seeing a fast uptick in the use of Fair Credit Reporting Act (FCRA) — actionable alternative credit data — which meet regulatory standards for inclusion in credit assessments but aren’t currently included in traditional credit rating solutions such as FICO or VantageScore.

“This year, financial institutions are pulling approximately 800 million to 900 million alternative credit consumer reports in the U.S. for underwriting purposes, excluding marketing and account servicing use cases,” says King. “Banks represent the most significant users of this data, although fintech lenders and BNPL users also heavily utilize it.”

Credit unions have adopted the use of alternative credit data to a lesser extent, “often perceiving the analytic and technological barriers to access as too high, but usage is growing there,” King says. The data in use comprise a mix of public record data and credit-seeking data including inquiry data not currently captured in the bureaus’ core credit reports, rental data, utility data and subprime lending data, King adds.

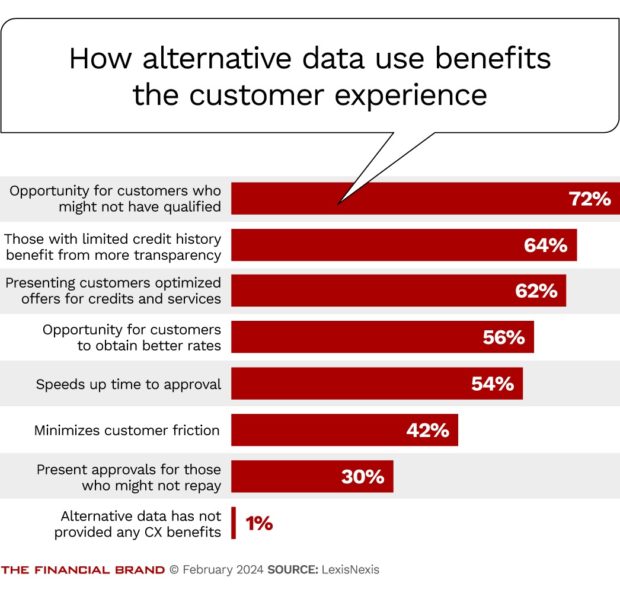

Indeed, according to a 2023 LexisNexis Risk Solutions study that surveyed 225 senior U.S. financial institution decision makers for marketing, lending and credit risk, 65% of respondents use alternative credit data on anywhere from 50% up to almost 100% of all new applicants. As a result, more than half reported lending revenue increased by 15% and higher.

U.S. Bancorp is reportedly using alternative data to develop a holistic banking platform for small-business clients that organizes all customers’ accounts and compiles income and asset statements for use in one dashboard. Similarly, Citigroup, in early 2023, launched its own Project Roundtable for Economic Access and Change (REACh) pilot program, to issue credit cards to borrowers without credit scores and make it easier for small businesses owned by minorities, women and veterans to borrow funds.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

As of mid-2023, JPMorgan Chase and U.S. Bank were reportedly participating in a government-supported pilot program to help expand access to credit cards for consumers lacking credit history by sharing bank deposit information with the credit bureaus — making it easier for issuers to be able to consider customers’ deposit data and cash flow when weighing applications. “This is about opportunity,” Trish Wexler, spokesperson for JPMorgan Chase, said in a release last year. “This will give millions of Americans the opportunity to access credit that’s essential to building wealth, buying a home, starting a business or financing education.”

Roughly 55 million U.S. consumers have “thin files or no files” at the National Consumer Reporting Agencies (NCRAs), according to King. And as NCRAs are increasingly unable to report back with a thorough credit risk finding, lenders are increasingly looking to alternative data, King adds. “The fastest-growing use case involves pairing alternative data and traditional data to refine pricing on every applicant,” King says. In this instance, alternative credit data may be integrated directly into a primary credit score or held out in a secondary score, used to identify under and overestimated applicants within a primary credit score range.

Dig deeper: 4 Ways to Use Alternative Data to Boost Loan & Account Growth

Historically alternative data meant everything outside the three bureaus, from data from bill payments to rent, payroll, and the like, according to Stephen Greer, advisory industry consultant for Financial Services for SAS. “Alt data attributes are usually categorized under ‘ability to repay,’ while traditional scores like FICO are ‘willingness to repay.’ However, these data aren’t really alternative anymore, since the bureaus have incorporated them into their scoring methodology… like Experian Boost.”

The procurement of alternative data follows a fairly standard process, according to King. Lenders task providers with scoring a historical dataset of applicants and their credit performance to evaluate the potential value the alt data points may illuminate. “If value is identified, the lender proceeds with accessing the alternative data,” King says. “The most critical step is a fair-lending governance review, where every attribute in the model — or in the attribute package — undergoes thorough scrutiny for adherence to regulation and lender policy.”

History of Alternative Credit Data

To be sure, the use of alternative credit data is not new. Indeed, for many lenders, alt data has been increasingly used to evaluate credit risk for half a dozen years or more. In the summer of 2020, the Office of the Comptroller of the Currency initially launched the Project REACh (which is being independently implemented by banks including Citigroup) to explore alternative credit assessment methods for potential borrowers with weak or nonexistent credit scores, including racial or ethnic minorities.

In more recent months, credit rating companies are increasingly turning to new technologies to gauge credit risk. For example, Moody’s Analytics announced an AI-powered end-to-end commercial loan origination system in cooperation with Numerated last month.

According to Greer from SAS, “there are more extreme alternative data sources, like social media data for example, but most of the efforts to make that data useful have failed.” Ant Financial took this approach years ago in China, “and it flopped,” Greer said. “More extreme attributes also cause issues for fair lending requirements, where a bank might awkwardly have to explain that a consumer was denied a loan because of their friend group. So, if anything not traditionally captured in a FICO score is alternative, then a lot of larger lenders use alternative data for scoring models — but it’s usually always alongside bureau data.”

Naeem Siddiqi, a SAS executive and author of two books on credit risk, Intelligent Credit Scoring: Building and Implementing Better Credit Risk Scorecards and Credit Risk Scorecards: Developing and Implementing Intelligent Credit Scoring, says that “globally, there are many fintech and micro lenders actively using alternative data to lend to the unbanked and underbanked.”

Typically, he says, these are small-ticket ($10-$200), short-term (weeks) and high-priced loans – analogous to payday loans. Meanwhile, Siddiqi sees traditional lenders “treading more carefully – and rightfully so. The quality of alternative data varies considerably, from the better to the potentially problematic.”

Even King, who has seen lenders embrace alternative credit data for more than a decade experiencing “significant growth and evolution during that time,” points out that RiskView, the LexisNexis suite of data analysis tools for non-traditional data, “frequently diverges from a traditional credit assessment, often reclassifying upwards of 5% of consumers within a 20-point traditional credit score band to new credit classes.” In other words, the use of alternative credit data may create dissension in creditworthiness.

“Banks and lenders are increasingly incorporating a diverse range of alternative data, with products like point of sale BNPL, into their decision-making processes to supplement traditional credit information,” says David Donovan, executive vice president of financial services at digital consultancy Publicis Sapient.

“There are more extreme alternative data sources, like social media data for example, but most of the efforts to make that data useful have failed.”

— Stephen Greer

“While credit scores provide historical credit behavior, alternative data offers a more real-time and holistic view of an individual’s financial habits,” Donovan says. “Lenders aim to weigh alternative data alongside traditional metrics to provide a nuanced understanding of creditworthiness, particularly for individuals with limited credit history.” Another key area where alternative data can make a substantial impact is providing greater access to credit in underbanked or unbanked communities, he adds. “It has the potential to transform and expand the lending market,” Donovan says, “within the financial services sector in several ways.”

As Devon Kinkead, CEO of Micronotes.AI, which offers cloud-based solutions for financial institutions, points out: ‘the purpose of data and analytics in loan decisioning is to assess the probability of borrower default and make corresponding pricing and lending decisions.’

“Alternative forms of data — which I would define as data that has not historically been used in underwriting — should be considered if it provides better information in making the default prediction, which can be assessed using commonly available data science tools like an attribute selection algorithm,” says Kinkead.

“The challenge, however, is in commercial implementation because any vendor conversation that starts with, ‘we have a better way for you to make your lending decisions using big data and analytics,’ the inner workings of which are difficult to explain, is likely to meet resistance.” Early adopters are embracing AI-based decisioning solutions, Kinkead says. Longer term, “it’s the information value of the data and the performance of the predictive model in making the default prediction that will prevail,” he adds.

Learn more:

- Rising Numbers of Stressed Consumers Seek Alternatives to Credit Cards

- Improving Customer Experiences With Alternative Data

The Impact of Alternative Credit Data

When assessing a current or former customer, “nearly all lenders use some internal data to inform their decision-making process, although the extent often depends on the sophistication of a lender’s analytics and master data management capabilities,” according to King. Internal credit signals such as repayment behaviors, cash flow data from checking accounts and the ownership of property or vehicles can all be highly predictive factors in evaluating creditworthiness, he says. Although income and employment data are not typically categorized as alternative credit data and are not included in the aforementioned 800-900 million metric, these signals can still fall under the definition and be obtained through a combination of external and internal sources.

“When considering the weighting of internal versus externally sourced credit data, there is no universally accepted best practice,” King says. Instead, the influence of these data sources on lending decisions is usually determined based on their individual merits.

Lenders’ data science and risk management teams conduct testing to establish the optimal weighting that leads to the most predictive assessment of a consumer’s ability to repay debt. While there is no standard answer regarding weighting, it is now common for alternative data to carry significant weight, especially in situations where it provides additional insights into certain consumers’ creditworthiness or supports the expansion of financial inclusion programs.

Siddiqi points out that in recent years, there is a particular focus on rental payments as a determinant of credit risk, which can be submitted to the three bureaus. “This is nothing new; landlords have been sending negative rental payments data to the bureau for many years,” he says. “Now tenants can opt to send positive payment data, although less than 5% of American renters have opted to do so currently.” Reporting rental payments should be encouraged in the U.S., as it has the potential to help millions of renters improve their credit scores, Siddiqi believes.

The next set of alternative credit data that can be very useful is utilities payments, Siddiqi says. “At the moment, I believe Experian is the only bureau that gives customers the option of including this information in their score,” he says. “Like landlords, [some] utilities have been reporting delinquencies to the bureaus for many years.” However, the level of reporting positive data is still very low —around 5% for telecommunications, 0% for cable.

“At the moment, I believe Experian is the only bureau that gives customers the option of including this information in their score.”

— Naeem Siddiqi

King says that when evaluating the impact of alternative credit data on the booking rates of specific credit products, the short answer is that it “can elevate booking rates by over 10% in numerous portfolios.” However, lenders’ objectives often involve more “nuanced considerations.”

“While some seek to increase booking rates while simultaneously reducing loss rates, resulting in a balanced strategy that doesn’t solely prioritize booking gains, others may prioritize fine-tuning product selection and pricing over boosting booking rates, potentially resulting in a booking rate increase below 10%,” he says. “It is more common for lenders to conduct offline tests such as theoretical tests on historical applications versus decision-making on data in production, to ensure that unproven data sources do not bias actual lending decisions.” Once the offline test has been completed, they can implement the proven strategy into production across the entire population they intend to impact against a small subset.

Donovan says that some financial institutions find alternative data more indicative of real-world risks and repayment abilities, especially for individuals with limited credit history. “It is often used in conjunction with traditional credit scores to provide a more comprehensive risk assessment,” he says. “Real-world examples include fintech startups pioneering alternative data use, microfinance institutions in developing countries, and mainstream banks beginning to incorporate alternative data into credit assessments.”

KE Hoffman has been writing about the financial industry — and fintech specifically — for more than three decades.