Can regulatory agencies effectively reduce the cost of alternative financial services to consumers? Banking industry skepticism aside, recent data suggests the answer may be yes.

To be sure, old habits die hard: When the Biden administration recently placed a cap on credit card fees, the industry warned that the move would ultimately force borrowers to pay more. But financial services companies now have some compelling data to consider that tells a different story: It shows that recent regulatory policy guidance – along with technology advances – helped lower financing costs for small-dollar short-term loans by more than 90%.

The research, in a report by non-profit design and consulting firm ideas42, comes three years after regulatory agencies, led by the Federal Deposit Insurance Corporation (FDIC), released guidance concerning responsible approaches to small-dollar lending.

The ideas42 study, “The Promise of Small-Dollar Loans for Banks and Consumers,” was underwritten in part by Pew Charitable Trusts, and is based on interviews with banks, regulators, researchers, advocates, and borrowers.

The impact of small-dollar loans is far-reaching, according to the report: Six of the country’s eight biggest banks as well as a growing number of credit unions now offer such products.

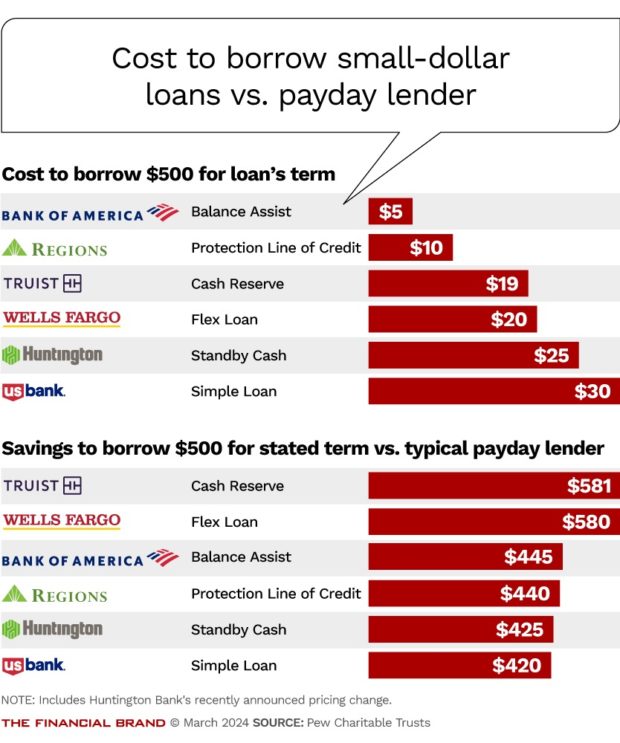

And the impact of their fees is likewise meaningful, said Alex Horowitz, a Project Director at Pew who has conducted extensive research on consumer finance. While a typical four-month payday loan for $500 would generate $450 in fees, banks and credit unions are now offering the same loan for around $30 in fees.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

“We are looking at, in all likelihood, millions of borrowers saving billions of dollars,” Horowitz said, in an interview with The Financial Brand. “These are low and moderate-income households [that are] gaining access to this credit that’s priced about 15 times less than what they’re paying in the high-cost loan market for payday and similar loans.”

Once they are launched, these loans tend to grow fast. Bank of America, according to the report, has disbursed over $500 million and made more than 1.1 million loans via its Balance Assist product, which launched in December 2020 and provides loans of up to $500. Wells Fargo issued over 100,000 Flex loans five months after introducing the product, the report said. Credit unions, meanwhile, originated more than $271 million in small-dollar loans in 2023, a record amount and an increase of 19% over the prior year, according to data from the National Credit Union Association.

According to the study, these loans matter to a significant portion of American households, pointing to Federal Reserve research showing that 20% of adults would struggle to pay an unexpected $100 expense with their savings alone. Pew notes that this financing will especially help those with no credit history or who are of Black, Hispanic or immigrant backgrounds, or under age 30 – because these demographics make disproportionate use of high-cost, nonbank financial services.

The Role of Technology

Payday loans emerged in the early 1990s and largely remained the territory of small institutions offering high-cost credit, in most cases for clients with checking accounts. Back then, the manual processing of small loans for applicants with low or invisible credit scores made deposit-advance products bad business for large financial institutions. Banks began to see reputational liability in these products after the Office of the Comptroller of the Currency in 2013 said they “pose significant safety and soundness and consumer protection risks.” The FDIC around the same time pressured banks to refuse service to payday lenders as part of an effort known as Operation Choke Point, according to documents that emerged in a lawsuit by a group of payday lenders against the FDIC. (The agency settled the suit in 2019.)

Policy shifted with the release of the 2020 Interagency Lending Principles, signed by the FDIC and four other financial regulators, which said that financial institutions “can play an important role in providing small-dollar loans safely and responsibly.” Short-term loans have since then moved into the mainstream, helped by cash flow underwriting automation that speeds the process from loan origination to underwriting.

The post-2020 period became the time frame that ideas42 analyzed. Repayment rates proved considerably higher than expected, with one provider hitting 95%, according to the report. The six large banks involved – U.S. Bank, Bank of America, Huntington Bank, Regions, Truist and Wells Fargo – charge fee-inclusive rates of 36% or lower, about one-fifteenth of typical payday loan pricing, the report said.

“Providers mentioned the value borrowers place on maintaining access to the product in anticipation of future emergencies as one reason for healthy repayment behavior – a theme that was echoed by the borrowers we interviewed,” ideas42 wrote.

Read more:

- Should Banks Beware Credit Score ‘Grade Inflation’?

- 7 Keys to De-risking Commercial Real Estate Lending

Spreading Out Payments

Loans are generally repaid in three or four equal monthly payments. This contrasts with the typical two-week payday loan repayment periods that frequently result in high-cost rollovers. Borrowers who spoke to ideas42 said they found repayment manageable due to the affordability and structure of loans.

A separate consumer survey by Pew, published in 2023, found that 82% of respondents thought it was fair for a bank to charge a $30 fee for a three-month, $500 loan, while another survey, conducted in 2015 found that 68% of Americans thought it was unfair for banks to charge a $35 overdraft fee.

“Small-dollar loans were also seen as a tool to enhance longer-term customer engagement and grow opportunities to serve customers with other bank products,” the ideas42 report said. Customers, the report said, felt “they were getting more service from their banks in return for their customer deposits and were more appreciative of their banks after taking out a loan.”

It is not immediately evident how the traditional payday loan industry will react to the entrance of more large banks into this market, something that data like the ideas42 study is likely to spark. InFIN, an alliance of consumer financial firms including providers of small-dollar loans, did not respond to a message seeking comment on the research and the impact of large banks’ involvement in small-dollar loans. Banking industry experts say there is plenty of demand, and there will always be a need for accessible services for the estimated 6 million unbanked and 19 million underbanked American households.

Meanwhile, ideas42 believes both banks and consumers will benefit from greater availability of lower-cost short-term loans.

“Millions more families could benefit from access to small-dollar loans delivered by the mainstream institutions where they already hold their savings and deposit their paychecks,” the report said. “Banks have the opportunity to leverage this demand for small-dollar loans to reach a large market of viable customers, serve their communities, and do so sustainably.”

Brian Ellsworth is a Washington-based journalist and communications advisor. He is a former Reuters correspondent who covered Latin America and the Caribbean for 20 years.