In one of the most detailed consumer attitudinal surveys of its kind, the Fannie Mae National Housing Survey polls 1,000 consumers every month. The research provides a window into the opinions of Americans about home buying and the mortgage market.

Results from Fannie Mae’s October 2014 National Housing Survey show Americans’ optimism about the housing market continued its gradual climb amid greater confidence in household income and personal finances.

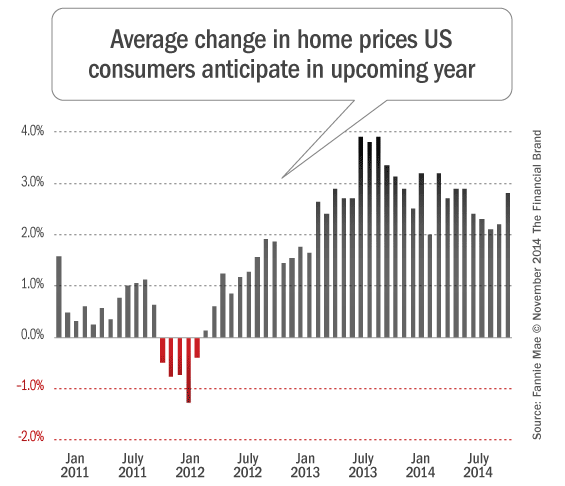

Consumers expect home prices to increase an average of 2.8% over the next year. 44% say home prices will go up in the next 12 months, while only 7% say home prices will go down.

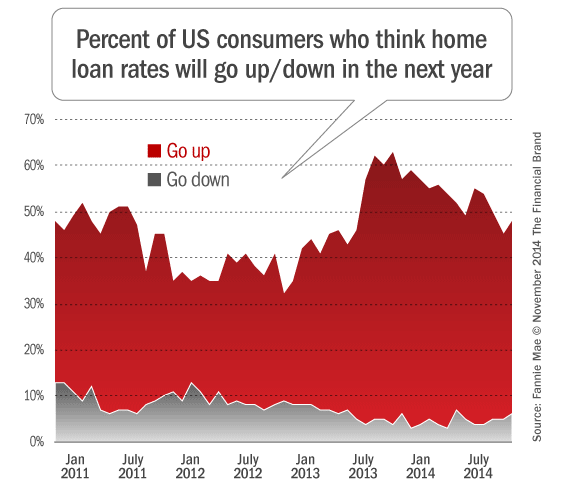

The share of respondents who say mortgage rates will go up in the next 12 months rose by three percentage points to 48%. 38% think mortgage rates will stay about the same, and only 6% say rates will go down.

Exactly half (50%) of all US consumers think it would be difficult to get a home mortgage today. That’s down from a high of 57% back in March 2011. Generally, however, consumers feel that the hurdles in the home loan credit market are easing.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

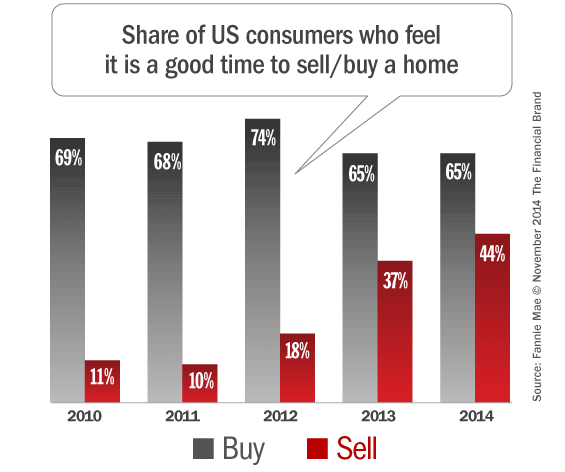

Those who say it is a good time to buy a house fell to 65%, down from a high of 74% back in July 2013 — a nine percentage point drop in only 15 months. Meanwhile, those who say it is a good time to sell increased to 44% — a new all-time high for the survey.

The share who say they would buy if they were going to move fell to 65%, while the share who would rent increased slightly to 30% (up from 27% a year ago).

For consumers who rent, Americans foresee a 3.7% increase in rental prices in 2015.

Doug Duncan, SVP/Chief Economist at Fannie Mae, says that overall, the research suggests the tumultuous mortgage market may be returning to something seems a little more normal and familiar.

“The narrowing gap between home buying and home selling sentiment may foreshadow increased housing inventory levels and a better balance of housing supply and demand,” says Duncan. “These results may help drive a healthier housing market in 2015.”

The share of consumers who expect their personal finances to get better is near its highest level since the Fannie Mae first launched the survey, while those expecting their finances to get worse reached a survey low. The share of respondents who say they expect their personal financial situation to improve during the next 12 months climbed to 45% – seven points higher compared to one year ago – while the share expecting their financial situation to worsen decreased to 10% last month. Although consumer attitudes about the direction of the economy remain subdued, with only 40% of survey respondents saying the economy is on the right track.

Will Millennials Ever Move Out?

At some point, the Millennial generation should bust the mortgage market wide open. In the meantime, a third of Gen Y continues to live at home, according to another study from Fannie Mae. The percent of young adults (ages 18 to 34) who are living with their parents has increased from an average of 27% in 2006 to 31% in 2013. Today this represents a total of roughly 22 people. Because young adults — especially the older ones — traditionally represent a substantial share of first-time homebuyers, their delayed decision to form a household has contributed to a depressed rate of household formation and housing demand. Young adults also have been experiencing higher rates of unemployment and delayed marriages.

A difference in financial situation attitudes among parents with younger adult children (ages 18-22) compared to older adult children (ages 23-34) living at home. 52% of parents with older adult children expect their kids to move out in less than two years. Parents with younger adult children were almost evenly split: 38% said less than two years while 34% said two to five years. For both age groups, the majority of kids living with their parents said they expect that they will more likely rent than buy a home when they move out.

How Are Lenders Feeling?

In a separate study by Fannie Mae found that most mortgage lenders are still struggling to find their footing in the wake of the subprime apocalypse. 72% of lenders overall say that recent regulations have had “significant” impact on their business. Smaller and mid-sized lenders are much more likely to say that new regulations have hurt them.

A majority of lenders (72%) believe that their compliance costs have increased from 2013 to 2014, reporting a median increase of 29% in compliance spending. Small and mid-sized lenders reported the largest increase (50%).

Larger lenders are more concerned with operational risk while smaller lenders are more concerned with credit risk and interest rate risk. As a result of increased regulations and associated costs, post-closing quality control review and servicing are being outsourced by more and more lenders. Mid-sized lenders are more likely to outsource compliance functions. Compliance risk is reported as the top area of focus for most lenders this

year.