Competition for Auto Loans is Fast & Furious

The auto loan market today resembles one of those third-world crowded outdoor markets or bazaars like you see in today’s action movies, with vendors crammed close together while sellers hawk their wares to busy shoppers who scurry around for the best deal. It’s as if everyone has weaseled their way into the auto financing business, with a seemingly infinite number of companies fighting for consumers’ auto loan business. It’s become such a highly competitive market that is largely rate driven.

The key to success in today’s fiercely competitive auto loan market is to identify and assume a leadership position in a particular market niche — to forge a competitive advantage. A good example is the auto loan refinance market, also known as the recapture market. Having a leadership position demands that you have a superior sales message delivered to an extremely receptive, highly targeted audience.

The key to success in today’s fiercely competitive auto loan market is to identify and assume a leadership position in a particular market niche — to forge a competitive advantage. A good example is the auto loan refinance market, also known as the recapture market. Having a leadership position demands that you have a superior sales message delivered to an extremely receptive, highly targeted audience.

Market Overview

Experian Automotive reports that during the fourth quarter of 2010, banks’ share of auto financing jumped to 36.6%, up from 32.8% a year earlier. And fortunately, data indicates the demand for auto loans is increasing in 2011. Several sources forecast total US sales of new cars and trucks to top 13 million by the end of the year.

While auto and truck sales are increasing, there’s at least one change in consumer behavior that is impacting the auto financing market. An automotive research group found that “consumers are holding onto new cars for a record 63.9 months, up 4.5 months from a year ago and 14% since the end of 2008.” When used cars are included in the calculation, the average length of car ownership has hit a record 52.2 months.

Bottom Line: The length of time between when consumers pay off one loan and take out another is increasing .

This is where the refinance/recapture market comes in. The key to success in the auto recapture market is reaching these borrowers at the right time — hitting them right when they’ve had the time to give thought to their current monthly payment amount — with a personalized offer, using the most cost-effective marketing channel.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Right Marketing Channel

With direct lending, personalized direct mail is the most cost-effective marketing channel for reaching qualified prospects. This applies to both banks and credit unions, whether they are focused on originating purchase loans or refinancing existing loans.

Today, the availability of sophisticated software, experienced programmers, computer modeling, immediate access to huge credit files, and unlimited desktop computing capabilities all come together, enabling direct response marketing vendors to identify and pre-approve prospects most likely to respond to your personalized loan offers.

The result of all these prospect identification tools is a list of highly-qualified loan prospects — those most likely to respond to your offer. This helps ensure that every dime of your marketing money is spent identifying and delivering your personalized offer to only the most responsive prospects – those prospects with a high probability of responding.

Your Personalized Offer

Let’s assume for a moment that you, as a consumer, are currently making payments on an existing vehicle. In other words, you are a prime candidate for a bank or credit union looking to lend you money to finance another new or used vehicle or refinance your existing car or truck loan in order to lower your monthly payments – again, known by bankers as the recapture market.

It’s your lucky day. On Tuesday, you receive in the mail three different auto loan offers from two local banks and one credit union. Here are their offers:

1. Rates as low as 3.75% APR when you refinance or get an auto loan from AB Bank

2. You’re pre-qualified for up to $25,000

3. Thanks to your good credit, you’re already pre-approved to refinance your auto loan at AC Credit Union. Look how much you can save:

– Monthly payment with current lender $520

– Monthly payment at AC Credit Union $365

– Your Monthly Savings $155

Remember, you could save a similar amount every month for the life of your new loan.

Which of these three offers appeals most to you? Hands down, it’s the third offer for a lower monthly payment. Any experienced consumer lending expert will quickly tell you that the amount of the monthly payment is the most critical deciding factor for potential borrowers. It all boils down to the age old question in car buying: “Can I afford the monthly payment?” In the third offer, the big competitive advantage is the promise of a lower payment.

Your Prospect List

Here’s one of the best pieces of marketing advice you’ll receive. When you’re working on a direct mail program, when in doubt, spend more time developing the absolute best possible mailing list. The greatest opportunity for dramatically improving response rates to your auto loan marketing program lies in the list.

The ultimate goal when creating your list is to allow you to mail fewer pieces while achieving the highest response rate. There’s always a point with direct mail where additional quantity brings you very few, if anymore, customers. A top-notch list delivers the greatest number of responses with the fewest number of pieces mailed, thereby allowing you to spread your direct mail costs over a larger number of new customer relationships.

Therefore, if your bank or credit union is interested in launching an auto loan marketing campaign directed at the recapture market, make sure your prospect list consists only of those vehicle owners most likely to respond to your lower payment offer. Typically, the creation of a great DM list requires expertise in consumer lending criteria, credit bureau data and operations, computer modeling, and experience list processing software. That’s why building such a list usually requires a direct response marketing company who can work with your financial institution’s credit underwriting managers to draw from data using one or more of the three national credit reporting agencies (Equifax, TransUnion, Experian).

For example, with auto loan marketing, the mailing list professional begins with his or her best practices input on what is already working best for other mailers. He then sits down with your credit manager to review your existing underwriting criteria in order to develop the criteria that will be used at the credit bureau. Additional decisions are made concerning your offer.

The next step is to interface with the appropriate credit reporting agency to extract all the data required to begin the prospect selection process. What happens next determines the success or failure of your auto loan marketing effort.

Using proprietary software programs developed exclusively for auto loan marketing and customized for your bank or credit union, your marketing partner’s list professionals will process the accumulated data to identify only those vehicle owners with the highest probability of responding to your lower payment offer. Frequently referred to as a black box by those unfamiliar with today’s sophisticated, proprietary software programs, such a list generation process delivers superior results. The few vendors successfully using such proprietary list generation programs can provide you with the test results of their lists tested against other types of direct mail lists – not to mention the results achieved by current clients.

With a superior offer and a highly qualified, responsive prospect list, your bank or credit union will have a distinct competitive advantage when it comes to sourcing new auto loan customers in the recapture market.

In today’s fiercely competitive auto loan market, having a competitive advantage isn’t an option, it’s a necessity.

The Proof is in the Results

Most likely your bank or credit union is already making auto loans in the purchase market –either via direct loans, indirect loans, or both. It’s much less likely that you are also pursuing the recapture market. Yet, the recapture market provides you with the greatest opportunity today due to much less competition.

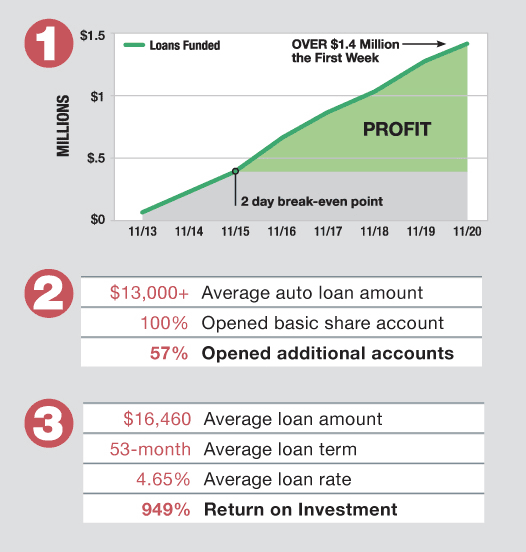

Take a look at these results and compare them to what you’re doing today.

If you are ready to take your auto loan marketing program to the next level, your next step should be to find a direct response marketing partner with expertise in both direct mail and auto loan marketing.